Chartered Market Technician (CMT) Tony “The Bull” Severino argues that Bitcoin’s most reliable macro inform—the copper-to-gold ratio—has damaged character on the very second the market sometimes enters a parabolic part, leaving the post-halving script in disarray and altcoins with out their standard rotation.

Why The Copper/Gold Ratio Is Essential For Bitcoin

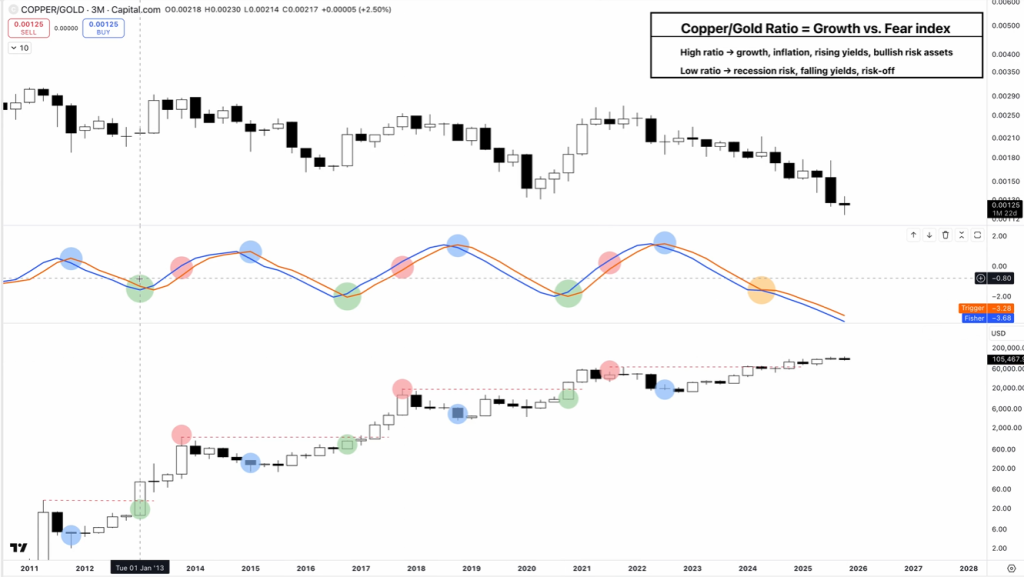

In a 16-minute video evaluation revealed on November 10, Severino frames the copper/gold ratio as a “progress versus worry index,” the place copper power indicators enlargement, rising yields and urge for food for threat, whereas gold outperformance maps to recession threat, falling yields and risk-off conduct.

“When gold is performing higher than copper, it sometimes means financial slowdown [and] common recession fears,” he mentioned, including that copper’s industrial demand anchors the ratio to the enterprise cycle. The punchline: the ratio’s cyclical flip that traditionally coincides with Bitcoin’s vertical part merely by no means arrived. “They are saying essentially the most harmful factor to say in investing is that this time is totally different. Nicely, this time is totally different,” Severino mentioned. “The enterprise cycle primarily based on the copper versus gold ratio didn’t flip again up.”

Severino contends that the four-year halving lore is at finest incomplete and at worst misattributed. He overlays prior halving dates with a Fisher Remodel sign on the copper/gold ratio and observes that the true inflection has traditionally been macro, not supply-driven. “I by no means actually thought it was the halving,” he mentioned. “The identical halving date began a bull run within the Nasdaq […] the halving in Bitcoin would probably not have any impact on tech shares.” In his development, the halving has coincided with, slightly than brought on, the ratio’s upswing and a risk-on impulse that sometimes propels Bitcoin past prior highs right into a closing, parabolic leg.

Associated Studying

This cycle diverged. After briefly producing a “larger excessive” within the ratio—the primary since roughly 2010—copper/gold failed to determine a better low and as an alternative printed “one other decrease low,” marking, in Severino’s phrases, the bottom studying in about 15 years on his chart—“since just about because the Nice Recession.”

The Fisher Remodel that had traditionally flipped as much as affirm the risk-on window by no means delivered the total follow-through. “It was purported to ship Bitcoin into the ultimate stage of its parabolic rally […] we didn’t go parabolic after going above all-time excessive. We’re simply type of meandering sideways.”

Is The Bitcoin Cycle High In?

Timing-wise, that failure issues. Severino measures roughly a yr between the ratio’s go-signal and Bitcoin’s cycle prime in prior episodes. By that yardstick, “we actually ought to have topped” already or, if anchored to the March breakout above the 2021 excessive, would at the very least be coming into a risk-off window. However with out the definitive risk-on impulse, the cycle landmarks blur. “As a result of we didn’t get the total threat on, I don’t know the place the danger off sign is,” he mentioned.

Associated Studying

The implications lengthen to altcoins and Bitcoin dominance. Traditionally, the ratio’s inexperienced “risk-on” part lined up with “alt season,” however this time the setup by no means materialized. “You usually get your alt season at these inexperienced factors […] We didn’t get it right here,” Severino mentioned, noting Bitcoin dominance is holding key assist on higher-timeframe views. He additionally highlights an “extraordinarily sturdy detrimental correlation” between Bitcoin and the copper/gold ratio at current; in previous cycles, correlation drifting towards zero tended to coincide with altseason. “Not one of the circumstances for altcoin season appear to be right here primarily based on previous financial indicators,” he added.

Severino stops wanting a deterministic name. The ratio’s development construction is ambiguous—one failed breakout from a protracted downtrend doesn’t make an uptrend—and the Fisher sign may nonetheless flip. However till it does, he argues, macro says warning.

“We’re nonetheless within the worry type of aspect of this ratio. We have to nonetheless be defensive and we must be threat off. When this begins to show again up, we will think about being bullish threat belongings once more.” That ambiguity, he suggests, is exactly why Bitcoin’s post-ATH drift has defied the well-worn four-year narrative: “It simply didn’t do the identical factor because it did up to now […] We’re totally different. It’s genuinely totally different this time.”

At press time, BTC traded at $104,486.

Featured picture created with DALL.E, chart from TradingView.com