Printed on November eleventh, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which are considerably greater than the market common. For instance, the S&P 500’s present yield is barely ~1.2%.

Excessive-yield shares will be notably useful in supplementing earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Gladstone Business Company (GOOD) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Positive Evaluation Analysis Database.

We have now created a spreadsheet of shares (and carefully associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full checklist of all securities with 5%+ yields (together with essential monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our checklist of high-dividend shares to assessment is Gladstone Business Company (GOOD).

Enterprise Overview

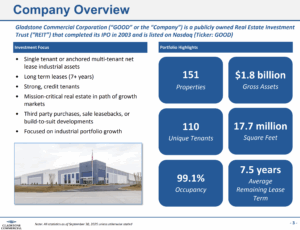

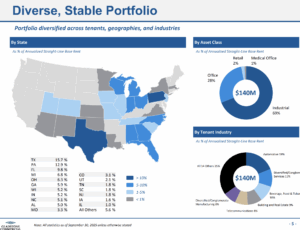

Gladstone Business Company (NASDAQ: GOOD) is an actual property funding belief (REIT) that focuses on buying, proudly owning, and managing single-tenant and anchored multi-tenant net-leased workplace and industrial properties throughout the USA. Based in 2003, the corporate’s portfolio consists of 151 properties in 27 states, totaling roughly 17 million sq. ft and leased to over 100 tenants. Its technique emphasizes long-term leases with creditworthy tenants, focusing on steady earnings and diversification throughout industries and geographies.

The corporate is understood for delivering constant earnings to shareholders by means of month-to-month money distributions and sustaining excessive occupancy ranges, which stood at 99.1% as of mid-2025. Gladstone Business is more and more specializing in industrial property, which now account for about 67% of its annualized hire, reflecting a strategic shift away from non-core workplace properties. This focus positions the REIT for regular rental earnings and modest, dependable development, interesting primarily to income-oriented buyers searching for stability.

Supply: Investor Relations

Gladstone Business Company reported third-quarter 2025 outcomes with whole working income of $40.8 million, up 3.3% from the prior quarter. Internet earnings accessible to frequent stockholders was $1.0 million, or $0.02 per share, down 32.5%, whereas Core FFO rose 1.8% to $16.4 million, or $0.35 per share, pushed by acquisitions and leasing exercise.

In the course of the quarter, the corporate collected 100% of rents, acquired a six-property, 693,236-square-foot portfolio for $54.8 million, bought a non-core industrial property for $3.0 million, and accomplished leasing on 734,464 sq. ft throughout 14 properties. It additionally raised $23.0 million by means of its at-the-market inventory program and continued month-to-month money distributions to shareholders.

After the quarter, Gladstone expanded its credit score facility to $600 million, prolonged mortgage maturities, repaid $3.1 million of mortgage debt, and maintained full hire assortment. These actions reinforce the corporate’s give attention to steady earnings, disciplined capital administration, and strategic portfolio development.

Supply: Investor Relations

Progress Prospects

Gladstone Business is positioned for regular development by means of its strategic give attention to industrial properties, which now make up about 67% of its annualized hire. By buying absolutely leased, long-term industrial property and disposing of non-core workplace properties, the corporate is bettering portfolio high quality and money movement stability.

Excessive occupancy ranges, close to 98–99%, and lengthy common lease phrases assist constant hire assortment and scale back emptiness threat.

Progress is predicted to be modest however steady. Core FFO rose 1.8% in Q3 2025 to $16.4 million ($0.35 per share), reflecting contributions from acquisitions and leasing, although per-share development is tempered by fairness issuance and rising prices.

Key dangers embrace greater rates of interest and challenges within the workplace sector. For buyers, Gladstone’s enchantment lies in dependable earnings and incremental portfolio development slightly than fast growth.

Aggressive Benefits & Recession Efficiency

Gladstone Business’s aggressive benefits stem from its give attention to high-quality, net-leased industrial and workplace properties with creditworthy tenants and long-term leases. This technique ensures predictable money movement and reduces tenant turnover, whereas its disciplined acquisition strategy targets absolutely leased properties in development markets.

The corporate additionally maintains a diversified portfolio throughout industries and geographies, mitigating focus threat and offering stability in various market situations.

The corporate has traditionally demonstrated resilience throughout financial downturns as a result of its sturdy tenant base, lengthy lease phrases, and internet lease construction, which shifts most property bills to tenants.

Occupancy has remained constantly excessive—close to 98–99%—even in slower financial intervals, permitting Gladstone to maintain money distributions and Core FFO. This mixture of steady earnings, diversified holdings, and conservative monetary administration helps the REIT climate recessions higher than many friends.

Supply: Investor Relations

Dividend Evaluation

The corporate’s annual dividend is $1.20 per share. At its current share value, the inventory has a excessive yield of 10.9%.

Given the corporate’s 2025 earnings outlook, FFO is predicted to be $1.45 per share. In consequence, the corporate is predicted to pay out roughly 83% of its FFO to shareholders in dividends.

Closing Ideas

We mission whole annual returns of 13% for Gladstone Business going ahead. With a present yield of 10.9%, the inventory seems undervalued. We view the corporate’s sturdy recession resilience and constant FFO per share positively, although we assign a promote score as a result of lack of current dividend will increase.

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

![[ +105% Profit / 10% Drawdown ] GBPAUD H1 Automated Strategy ‘ACRON Supply Demand EA’ [61049] – Trading Systems – 26 November 2025 [ +105% Profit / 10% Drawdown ] GBPAUD H1 Automated Strategy ‘ACRON Supply Demand EA’ [61049] – Trading Systems – 26 November 2025](https://i0.wp.com/c.mql5.com/i/og/mql5-blogs.png?w=120&resize=120,86&ssl=1)