After reaching an all-time excessive of $125 on February 18, Palantir (NASDAQ:) shares dropped over 28% in just some classes, falling to $90.68 by February 25. As of this writing, the inventory is down 30% in simply 5 classes—a pointy drop, particularly for current patrons caught up available in the market euphoria.

The spark got here from information that the Pentagon plans to chop US navy spending by 8% within the coming years. Since authorities contracts made up about 40% of Palantir’s 2024 income, traders grew involved concerning the influence of a smaller protection finances.

The massive query now—ought to traders steer clear, given the danger of catching a falling knife, or is there an opportunity for a rebound?

How you can Defend Your Portfolio from Sudden Promote-Offs

Judging a inventory solely by its current efficiency is dangerous. Nobody can predict whether or not it’ll plunge additional or stage a comeback.

Nevertheless, sure key indicators ought to at all times be thought of earlier than investing. Ignoring them and leaping in simply due to market hype isn’t any totally different from playing.

With InvestingPro’s ProTips, figuring out these essential components turns into a lot simpler. Listed here are a couple of to bear in mind.

Understanding the Worth/Earnings Ratio and What It Alerts

Supply: InvestingPro

As an example, a excessive price-to-earnings (P/E) ratio means traders are paying a premium for every greenback of firm earnings. Usually, a excessive P/E is seen as a bearish sign, suggesting the inventory is perhaps overvalued and weak to a correction.

In Palantir’s case, even after its current decline, the P/E ratio stands at 460x. By comparability, Tesla—usually thought of overinflated—has a P/E under 150x, whereas Nvidia’s sits at simply 50x.

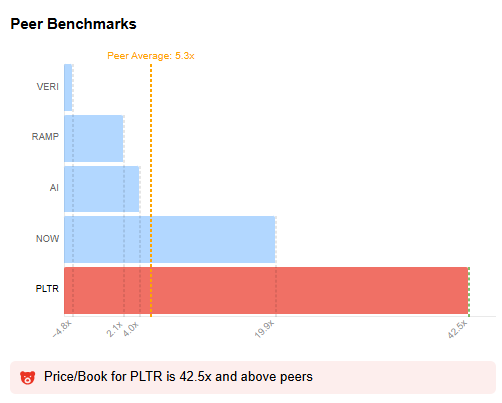

Understanding the P/B Ratio

One other pink flag is the inventory’s excessive worth relative to its e-book worth, mirrored in an elevated Worth-to-Ebook (P/B) ratio.

Supply: InvestingPro

Supply: InvestingPro

In Palantir’s case, the P/B ratio stands at 42.5x, in comparison with 5.3x for its opponents.

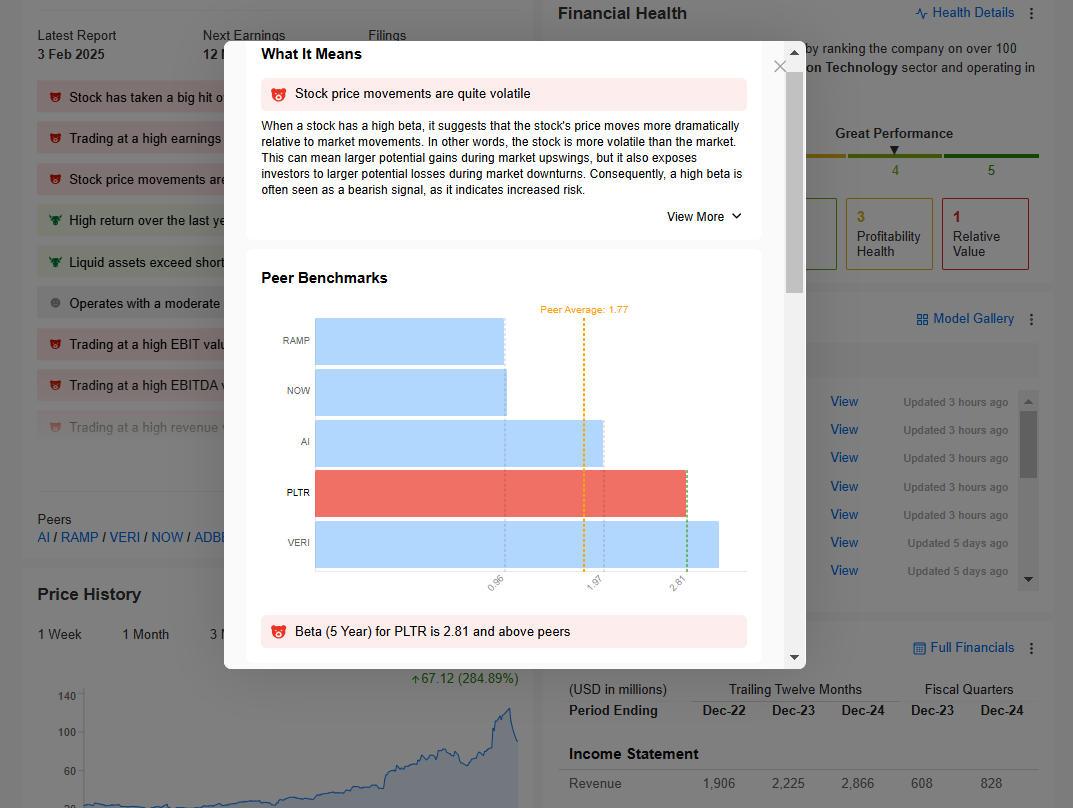

Measuring Volatility

To evaluate the danger of investing in a inventory, you will need to contemplate its beta. A excessive beta means the inventory strikes extra dramatically than the market, resulting in better potential positive factors in uptrends but in addition larger losses throughout downturns. This heightened volatility indicators elevated funding danger.

Supply: InvestingPro

Supply: InvestingPro

Palantir’s common beta is 2.81, considerably larger than its opponents’ common of 1.77. This means that Palantir’s inventory is extra risky, making it riskier but in addition doubtlessly extra rewarding throughout market upswings.

What’s Subsequent for Palantir Shares?

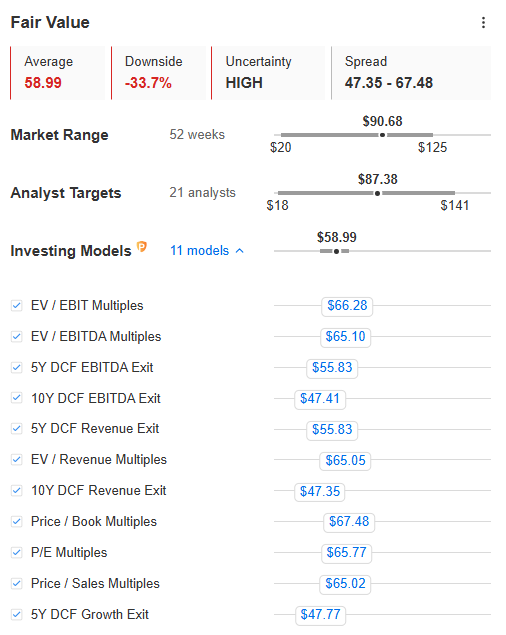

All of this knowledge (which InvestingPro customers can entry right here) means that Palantir stays overvalued. Probably the most easy indicator to examine is Truthful Worth, calculated by InvestingPro utilizing 11 acknowledged monetary fashions tailor-made to the inventory.

Palantir Truthful Worth | Supply: InvestingPro

Palantir Truthful Worth | Supply: InvestingPro

As proven within the chart above, Palantir’s intrinsic worth is $58.99 per share, which is 33.7% decrease than its February 24 closing worth. Moreover, the 21 analysts overlaying the inventory undertaking additional draw back over the following 12 months, with a goal worth of $87.38.

Time to Maintain or Head for the Exits?

The chart above highlights the excessive stage of uncertainty surrounding Palantir. The longer term stays unpredictable, however the warning indicators are clear. Coming into now comes with important danger—there’s a likelihood of a rebound and strong positive factors, however the correction may proceed. It’s also price noting that regardless of the current drop, the inventory continues to be up 280% over the previous yr.

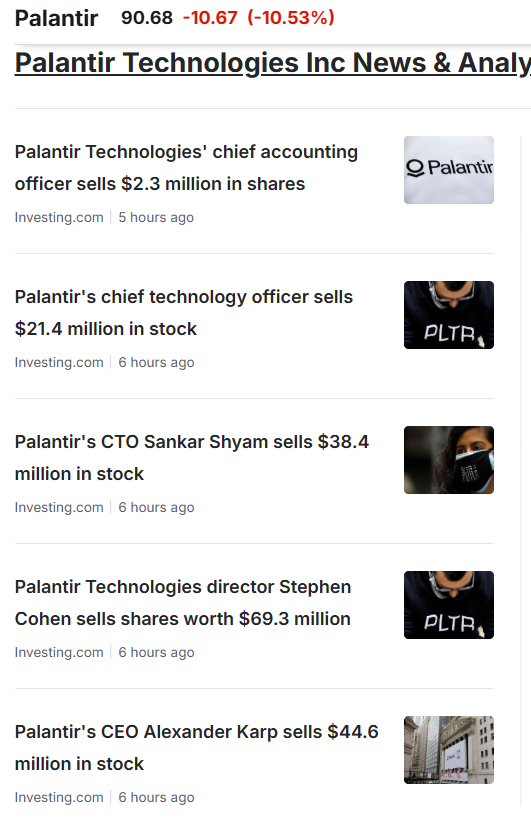

For risk-averse traders, staying on the sidelines is perhaps the wiser selection. Many shareholders appear to share this sentiment, as evidenced by profit-taking in current classes, as reported by Investing.com. Nevertheless, after Palantir’s exceptional 2024 rally, a 30% drop is probably not trigger for a lot remorse.

Supply: InvestingPro

Supply: InvestingPro

The Significance of Diversifying

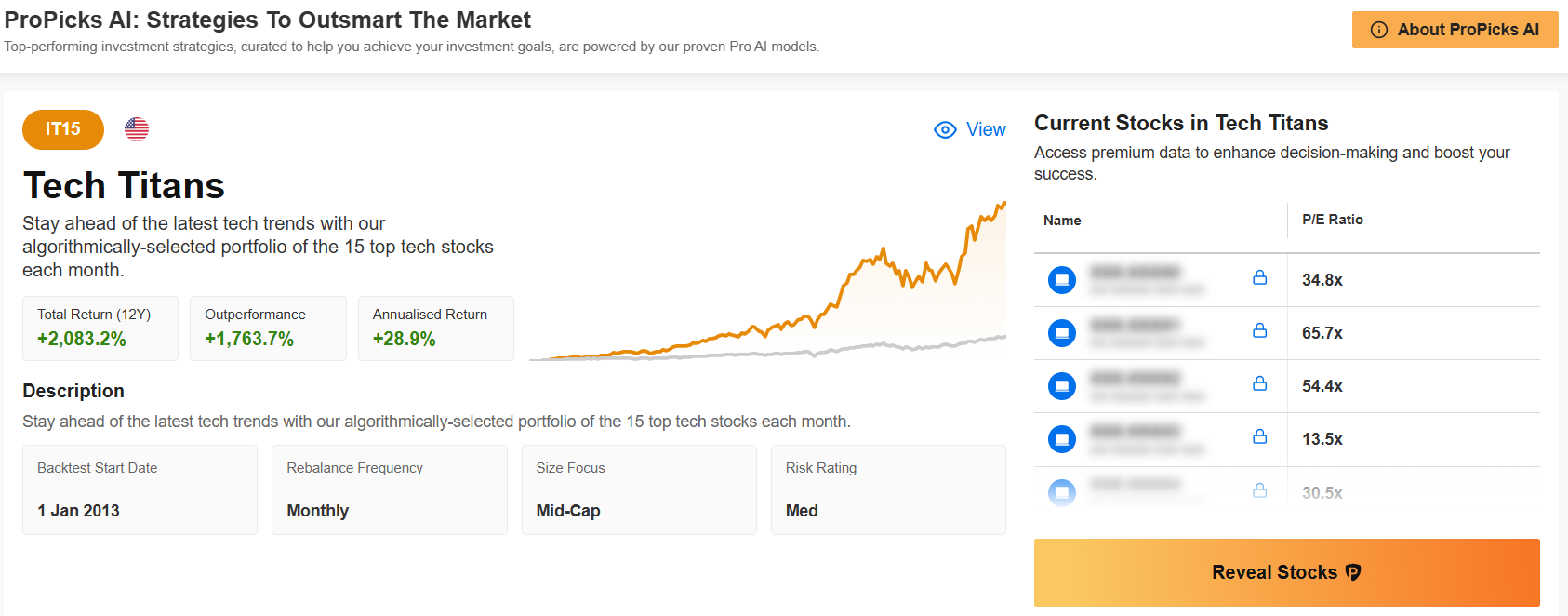

The very best method for traders is at all times diversification. For these seeking to spend money on high US tech firms, InvestingPro’s ProPicks AI Tech Giants technique presents a sensible various. This technique delivered a 42.7% return in 2024, outperforming the 23.3%. By updating its listing of 15 shares each month, it helps handle danger on high-beta shares, figuring out the perfect buys and those to keep away from.

Need a device that can assist you choose the perfect shares to purchase and promote when volatility rises? Attempt InvestingPro. Between superior inventory screeners, Truthful Worth and Propicks AI, the AI-driven methods for beating the markets, InvestingPro is the device for you.

Attempt it now, CLICK HERE and begin investing like a PRO!****

DISCLAIMER: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to speculate as such it isn’t meant to incentivize the acquisition of belongings in any manner. As a reminder, any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding choice and the related danger stays with the investor