Because the second half of the yr begins, a number of bullish setups are rising—every supported by seasonal patterns and historic knowledge.

is approaching multi-year highs following a powerful June, whereas technical indicators within the broader market and semiconductor sector level to continued momentum. In the meantime, latest coverage developments might have longer-term implications for retail investor participation.

On this article, we’ll discover three setups value watching in July—and the components that would assist their energy within the weeks forward.

1. Silver Set for July Bull Run?

Silver had a implausible month in June, rising nearly 10%—outpacing Wall Avenue—and is now approaching 13-year highs. There are two most important causes for this:

Whereas to not the identical extent as , silver additionally has safe-haven traits.

It has been undervalued for months, as mirrored by the gold/silver ratio, which signifies what number of ounces of silver are wanted to purchase one ounce of gold. To calculate it, merely divide the worth of gold by the worth of silver. When the ratio rises, it means silver is turning into cheaper relative to gold.

Demand can be rising attributable to its use in photo voltaic panels and its important function within the semiconductor trade, particularly as synthetic intelligence continues to growth.

Demand can be rising attributable to its use in photo voltaic panels and its important function within the semiconductor trade, particularly as synthetic intelligence continues to growth.

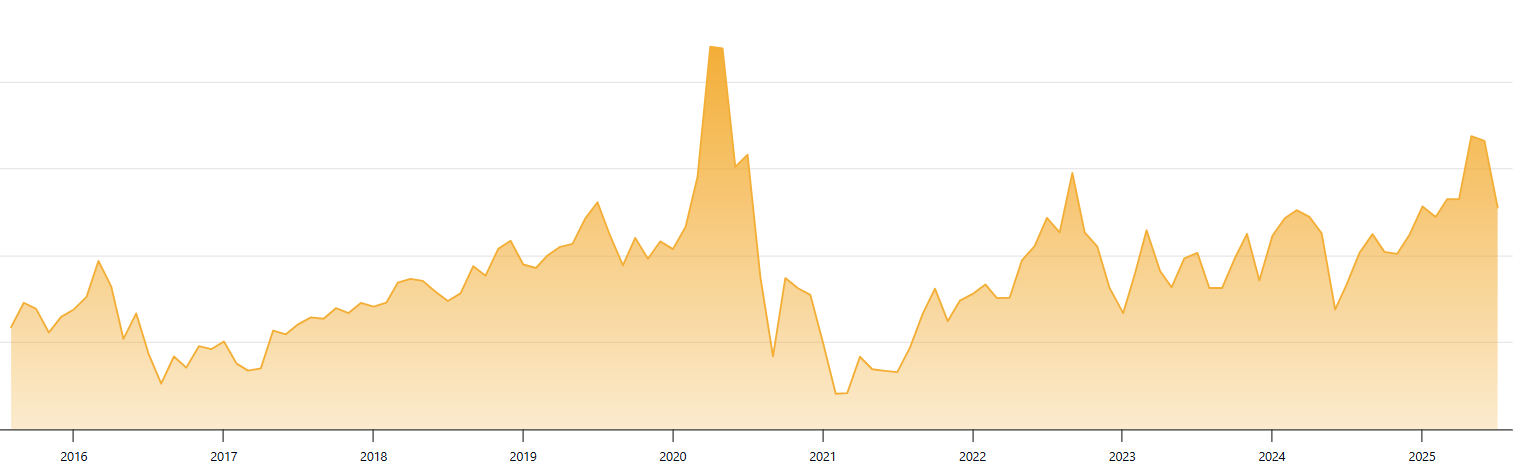

Curiously, if we take a look at the final 10 years of probably the most well-known ETF monitoring the bodily worth of silver—the iShares Silver Belief (NYSE:), which manages $17 billion—July emerges because the strongest month, with a median achieve of 4.5%, forward of the second-best month, December, which averages 2.7%.

This brings to thoughts a long-standing seasonal sample: silver tends to rise from the tip of 1 yr by means of the primary month and a half of the following. This sample has been noticed for over half a century—particularly, over the past 52–53 years. The timeframe in query spans from mid-December (particularly December 16) to mid-February (round February 20–21). Over this era, since 1968, silver has averaged a +7.20% achieve between December 16 and February 20–21.

Why? In line with Seasonax, the reason lies in industrial demand—orders for silver are usually positioned throughout this time, inflicting demand (and thus costs) to spike.

2. Golden Cross in S&P 500, Semiconductors Alerts July Features

Final week, the S&P 500 triggered the well-known bullish sign known as the “golden cross” or “golden crossover,” which happens when the 50-day transferring common crosses above the 200-day transferring common.

Conventional technical evaluation sees this as a purchase sign. Nevertheless, extra precisely, it’s a affirmation that the present uptrend stays in place and is prone to proceed. In different phrases, it indicators energy within the ongoing bullish pattern.

Conventional technical evaluation sees this as a purchase sign. Nevertheless, extra precisely, it’s a affirmation that the present uptrend stays in place and is prone to proceed. In different phrases, it indicators energy within the ongoing bullish pattern.

It’s been greater than two years for the reason that S&P 500 final triggered this sample—the earlier prevalence was on February 2, 2023. Since then, the index has gained 49%.

historical past, over the previous 97 years, the S&P 500 has risen a median of simply over 10% within the yr following a golden crossover. Focusing solely on the final 20 golden crossovers, the typical return is even greater—round 13%.

An identical crossover has additionally been triggered within the semiconductor sector index. The final time it occurred was in January 2023, and it resulted in a 140% achieve over the next yr and a half.

An identical crossover has additionally been triggered within the semiconductor sector index. The final time it occurred was in January 2023, and it resulted in a 140% achieve over the next yr and a half.

3. Trump’s “One Massive Lovely Invoice” Might Profit Robinhood

Trump’s “One Massive Lovely Invoice,” which handed the Senate final week, may show each attention-grabbing and helpful for Robinhood Markets Inc (NASDAQ:) inventory—maybe much more so than if the corporate had been included within the (which it in the end was not).

The invoice proposes the creation of tax-deferred funding accounts for new child American youngsters, together with a one-time authorities contribution of $1,000, with the choice for added personal contributions of as much as $5,000 per yr.

The invoice proposes the creation of tax-deferred funding accounts for new child American youngsters, together with a one-time authorities contribution of $1,000, with the choice for added personal contributions of as much as $5,000 per yr.

This initiative would give a complete technology the possibility to expertise the ability of long-term inventory market investing—mirroring the S&P 500—and the compounding magic of reinvested returns.

Robinhood at the moment has over 26 million clients aged 18 and older, and this measure may herald many extra. Contemplating that round 3.7 million infants are born within the U.S. every year—and every would arrive with $1,000 in a market-tracking account—the potential affect is substantial.

***

Subscribe now for as much as 50% off amid the summer season sale and immediately unlock entry to a number of market-beating options, together with:

InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for the perfect shares primarily based on a whole bunch of chosen filters, and standards.

Prime Concepts: See what shares billionaire traders equivalent to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of property in any means, nor does it represent a solicitation, provide, suggestion or suggestion to take a position. I want to remind you that each one property are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger belongs to the investor. We additionally don’t present any funding advisory companies.

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of property in any means, nor does it represent a solicitation, provide, suggestion or suggestion to take a position. I want to remind you that each one property are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger belongs to the investor. We additionally don’t present any funding advisory companies.