Revealed on October twenty first, 2025 by Bob Ciura

The common dividend yield within the S&P 500 Index stays low at simply 1.2%. Because of this, earnings traders ought to deal with higher-yielding securities.

Excessive dividend shares can contribute a good portion of a inventory’s whole return.

With this in thoughts, we compiled a listing of excessive dividend shares with dividend yields above 5%. You’ll be able to obtain your free copy of the excessive dividend shares record by clicking on the hyperlink beneath:

In the meantime, excessive dividend shares may very well be even greater bargains, when buying and selling at all-time low costs.

The next 10 excessive dividend shares have yields above 5%, and are buying and selling inside 10% of their 52-week lows. The record is sorted by present dividend yield, in ascending order.

Desk of Contents

You’ll be able to immediately soar to any particular part of the article through the use of the hyperlinks beneath:

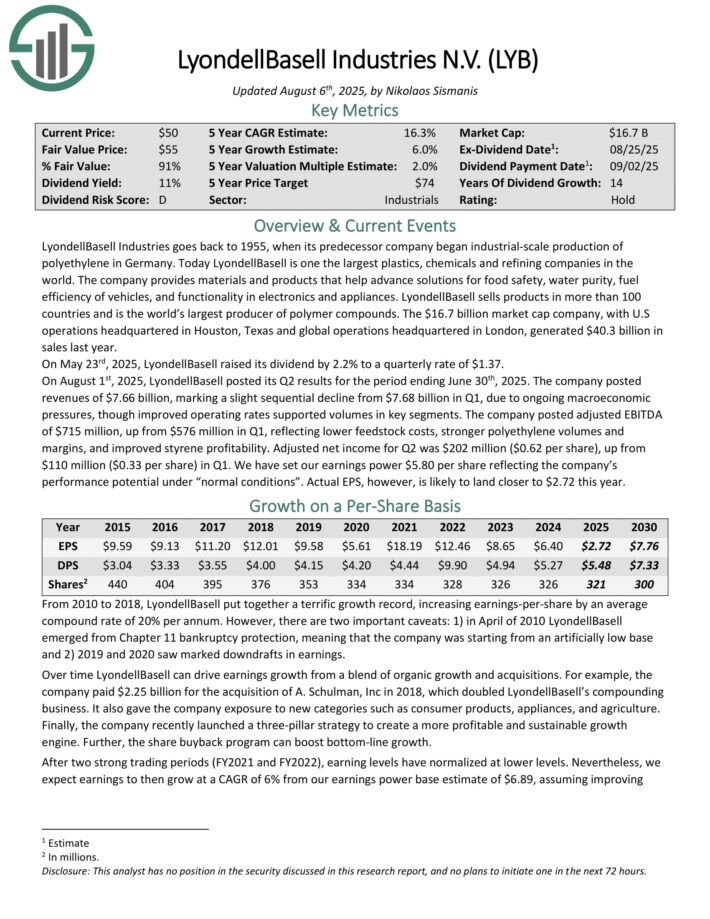

Crushed Down Excessive Yielder #10: LyondellBasell Industries N.V. (LYB)

LyondellBasell is one the biggest plastics, chemical compounds and refining firms on the earth. The corporate gives supplies and merchandise that assist advance options for meals security, water purity, gasoline effectivity of automobiles, and performance in electronics and home equipment.

LyondellBasell sells merchandise in additional than 100 international locations and is the world’s largest producer of polymer compounds. The corporate, with U.S operations headquartered in Houston, Texas and world operations headquartered in London, generated $40.3 billion in gross sales final 12 months.

On August 1st, 2025, LyondellBasell posted its Q2 outcomes. The corporate posted revenues of $7.66 billion, marking a slight sequential decline from $7.68 billion in Q1, on account of ongoing macroeconomic pressures, although improved working charges supported volumes in key segments.

The corporate posted adjusted EBITDA of $715 million, up from $576 million in Q1, reflecting decrease feedstock prices, stronger polyethylene volumes and margins, and improved styrene profitability.

Adjusted internet earnings for Q2 was $202 million ($0.62 per share), up from $110 million ($0.33 per share) in Q1.

Click on right here to obtain our most up-to-date Positive Evaluation report on LYB (preview of web page 1 of three proven beneath):

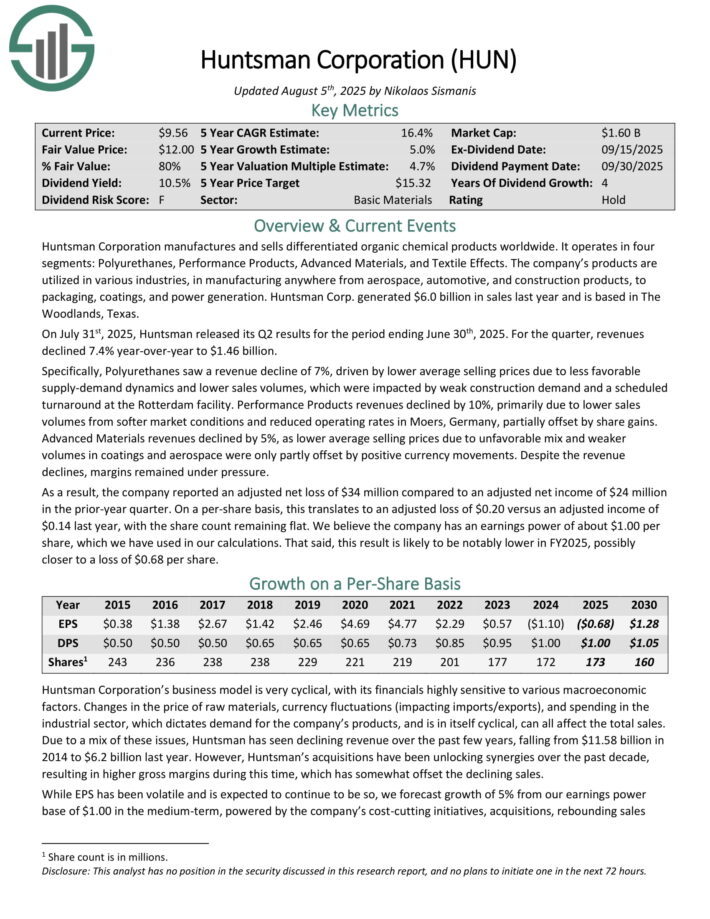

Crushed Down Excessive Yielder #9: Huntsman Company (HUN)

Huntsman Company manufactures and sells differentiated natural chemical merchandise worldwide. It operates in 4 segments: Polyurethanes, Efficiency Merchandise, Superior Supplies, and Textile Results.

The corporate’s merchandise are utilized in varied industries, in manufacturing anyplace from aerospace, automotive, and development merchandise, to packaging, coatings, and energy era. Huntsman Corp. generated $6.0 billion in gross sales final 12 months and relies in The Woodlands, Texas.

On July thirty first, 2025, Huntsman launched its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, revenues declined 7.4% year-over-year to $1.46 billion. Particularly, Polyurethanes noticed a income decline of seven%, pushed by decrease common promoting costs on account of much less favorable supply-demand dynamics and decrease gross sales volumes.

Efficiency Merchandise revenues declined by 10%, primarily on account of decrease gross sales volumes from softer market situations and diminished working charges in Moers, Germany, partially offset by share features.

Superior Supplies revenues declined by 5%, as decrease common promoting costs on account of unfavorable combine and weaker volumes in coatings and aerospace have been solely partly offset by optimistic forex actions. Regardless of the income declines, margins remained beneath strain.

Because of this, the corporate reported an adjusted internet lack of $34 million in comparison with an adjusted internet earnings of $24 million within the prior-year quarter. On a per-share foundation, this interprets to an adjusted lack of $0.20 versus an adjusted earnings of $0.14 final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on HUN (preview of web page 1 of three proven beneath):

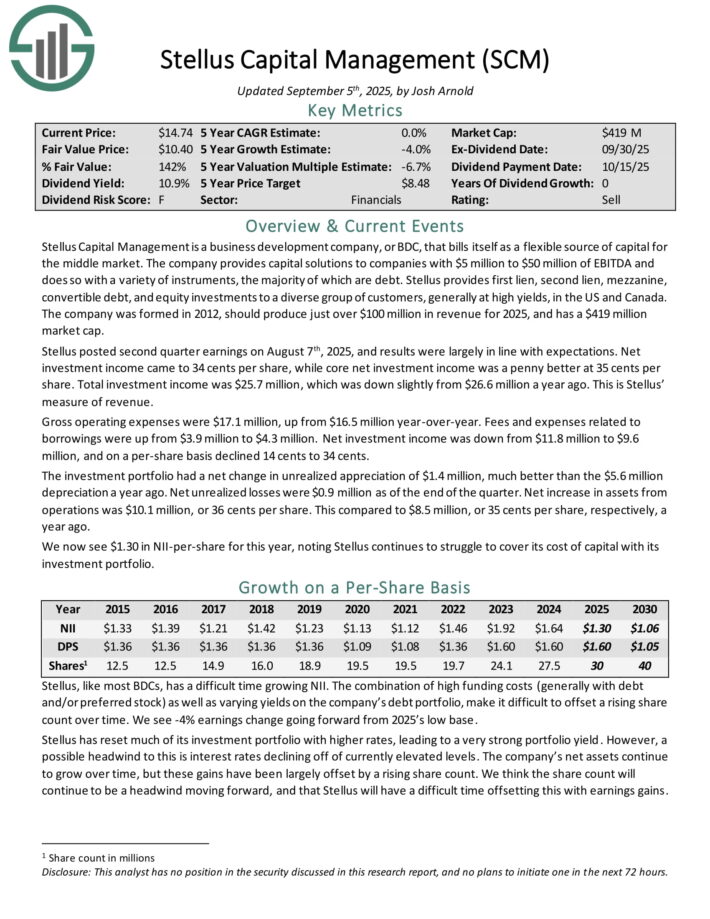

Crushed Down Excessive Yielder #8: Stellus Capital (SCM)

Stellus Capital Administration gives capital options to firms with $5 million to $50 million of EBITDA and does so with quite a lot of devices, nearly all of that are debt.

Stellus gives first lien, second lien, mezzanine, convertible debt, and fairness investments to a various group of consumers, usually at excessive yields, within the US and Canada.

Stellus posted second quarter earnings on August seventh, 2025, and outcomes have been largely according to expectations. Web funding earnings got here to 34 cents per share, whereas core internet funding earnings was a penny higher at 35 cents per share.

Complete funding earnings was $25.7 million, which was down barely from $26.6 million a 12 months in the past. That is Stellus’ measure of income.

Gross working bills have been $17.1 million, up from $16.5 million year-over-year. Charges and bills associated to borrowings have been up from $3.9 million to $4.3 million. Web funding earnings was down from $11.8 million to $9.6 million, and on a per-share foundation declined 14 cents to 34 cents.

The funding portfolio had a internet change in unrealized appreciation of $1.4 million, a lot better than the $5.6 million depreciation a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCM (preview of web page 1 of three proven beneath):

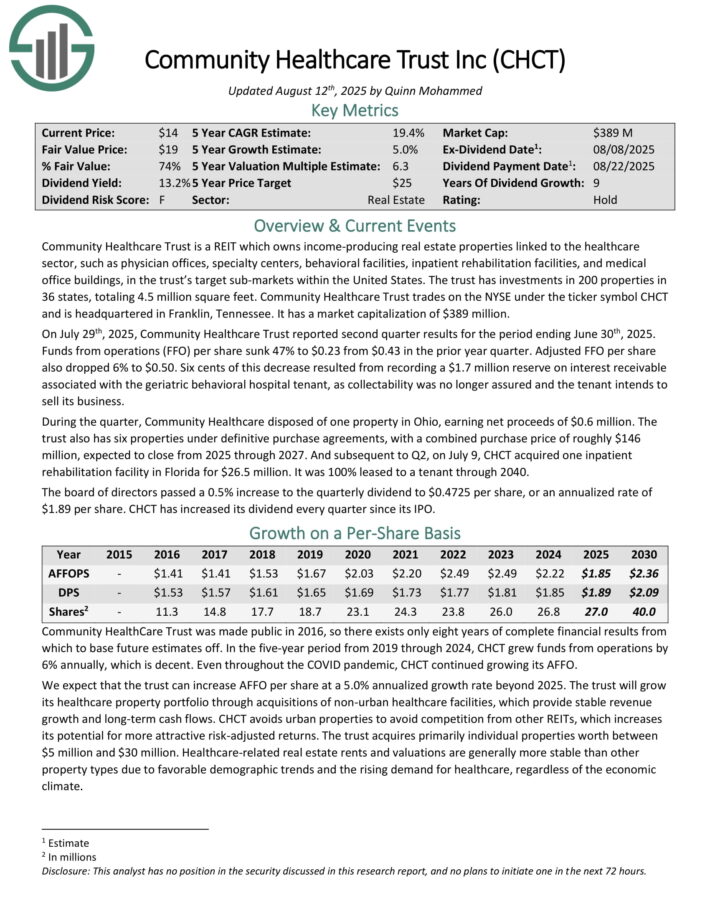

Crushed Down Excessive Yielder #7: Neighborhood Healthcare Belief (CHCT)

Neighborhood Healthcare Belief owns income-producing actual property properties linked to the healthcare sector, equivalent to doctor places of work, specialty facilities, behavioral amenities, inpatient rehabilitation amenities, and medical workplace buildings, within the belief’s goal sub-markets inside the US.

The belief has investments in 200 properties in 36 states, totaling 4.5 million sq. ft.

On July twenty ninth, 2025, Neighborhood Healthcare Belief reported second quarter outcomes for the interval ending June thirtieth, 2025.

Funds from operations per share sank 47% to $0.23 from $0.43 within the prior 12 months quarter. Adjusted FFO per share additionally dropped 6% to $0.50.

Six cents of this lower resulted from recording a $1.7 million reserve on curiosity receivable related to the geriatric behavioral hospital tenant, as collectability was now not assured and the tenant intends to promote its enterprise.

Through the quarter, Neighborhood Healthcare disposed of 1 property in Ohio, incomes internet proceeds of $0.6 million. The belief additionally has six properties beneath definitive buy agreements, with a mixed buy value of roughly $146 million, anticipated to shut from 2025 via 2027.

And subsequent to Q2, on July 9, CHCT acquired one inpatient rehabilitation facility in Florida for $26.5 million. It was 100% leased to a tenant via 2040.

Click on right here to obtain our most up-to-date Positive Evaluation report on CHCT (preview of web page 1 of three proven beneath):

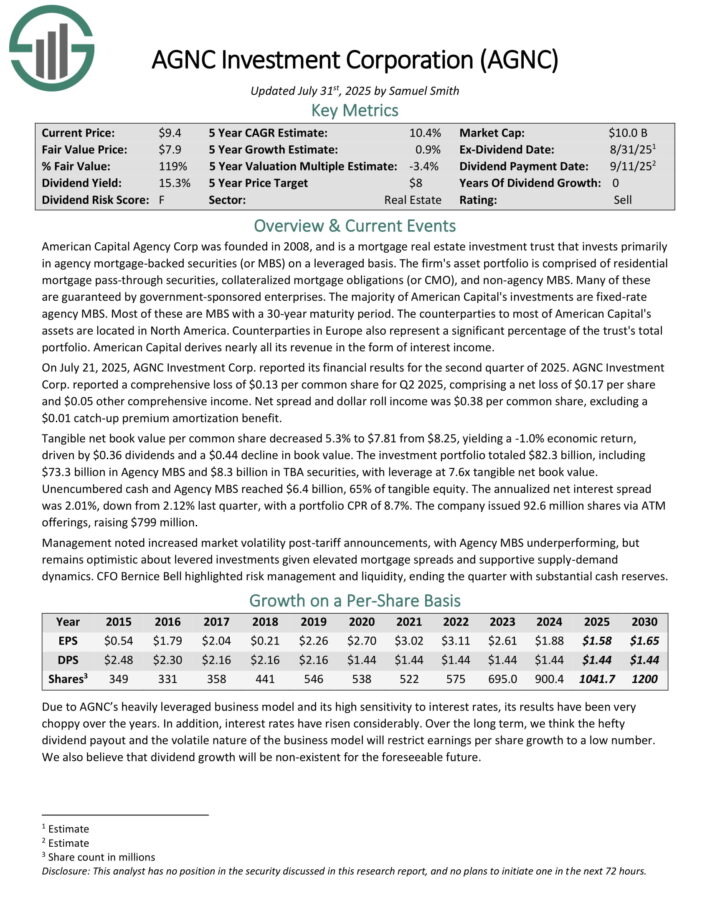

Crushed Down Excessive Yielder #6: AGNC Funding Company (AGNC)

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage cross–via securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

On July 21, 2025, AGNC Funding Corp. reported its monetary outcomes for the second quarter of 2025. AGNC Funding Corp. reported a complete lack of $0.13 per widespread share for Q2 2025, comprising a internet lack of $0.17 per share and $0.05 different complete earnings.

Web unfold and greenback roll earnings was $0.38 per widespread share, excluding a $0.01 catch-up premium amortization profit.

Tangible internet e book worth per widespread share decreased 5.3% to $7.81 from $8.25, yielding a -1.0% financial return, pushed by $0.36 dividends and a $0.44 decline in e book worth. The funding portfolio totaled $82.3 billion, together with $73.3 billion in Company MBS and $8.3 billion in TBA securities, with leverage at 7.6x tangible internet e book worth.

Unencumbered money and Company MBS reached $6.4 billion, 65% of tangible fairness. The annualized internet curiosity unfold was 2.01%, down from 2.12% final quarter, with a portfolio CPR of 8.7%. The corporate issued 92.6 million shares through ATM choices, elevating $799 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven beneath):

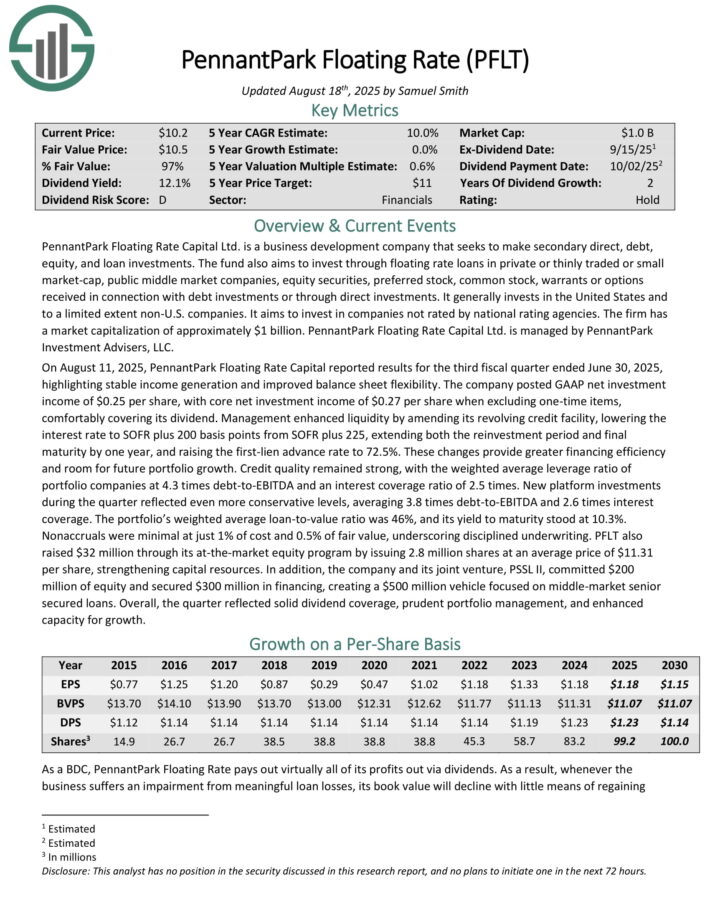

Crushed Down Excessive Yielder #5: PennantPark Floating Price Capital (PFLT)

PennantPark Floating Price Capital Ltd. is a enterprise growth firm that seeks to make secondary direct, debt, fairness, and mortgage investments.

The fund additionally goals to take a position via floating charge loans in personal or thinly traded or small market-cap, public center market firms, fairness securities, most popular inventory, widespread inventory, warrants or choices obtained in reference to debt investments or via direct investments.

On August 11, 2025, PennantPark Floating Price Capital reported outcomes for the third fiscal quarter ended June 30, 2025, highlighting steady earnings era and improved steadiness sheet flexibility.

The corporate posted GAAP internet funding earnings of $0.25 per share, with core internet funding earnings of $0.27 per share when excluding one-time gadgets, comfortably protecting its dividend.

Administration enhanced liquidity by amending its revolving credit score facility, decreasing the rate of interest to SOFR plus 200 foundation factors from SOFR plus 225, extending each the reinvestment interval and closing maturity by one 12 months, and elevating the first-lien advance charge to 72.5%.

These adjustments present larger financing effectivity and room for future portfolio development. Credit score high quality remained sturdy, with the weighted common leverage ratio of portfolio firms at 4.3 instances debt-to-EBITDA and an curiosity protection ratio of two.5 instances.

New platform investments in the course of the quarter mirrored much more conservative ranges, averaging 3.8 instances debt-to-EBITDA and a pair of.6 instances curiosity protection. The portfolio’s weighted common loan-to-value ratio was 46%, and its yield to maturity stood at 10.3%.

Nonaccruals have been minimal at simply 1% of value and 0.5% of honest worth, underscoring disciplined underwriting. PFLT additionally raised $32 million via its at-the-market fairness program by issuing 2.8 million shares at a median value of $11.31 per share, strengthening capital assets.

As well as, the corporate and its three way partnership, PSSL II, dedicated $200 million of fairness and secured $300 million in financing, making a $500 million car centered on middle-market senior secured loans.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFLT (preview of web page 1 of three proven beneath):

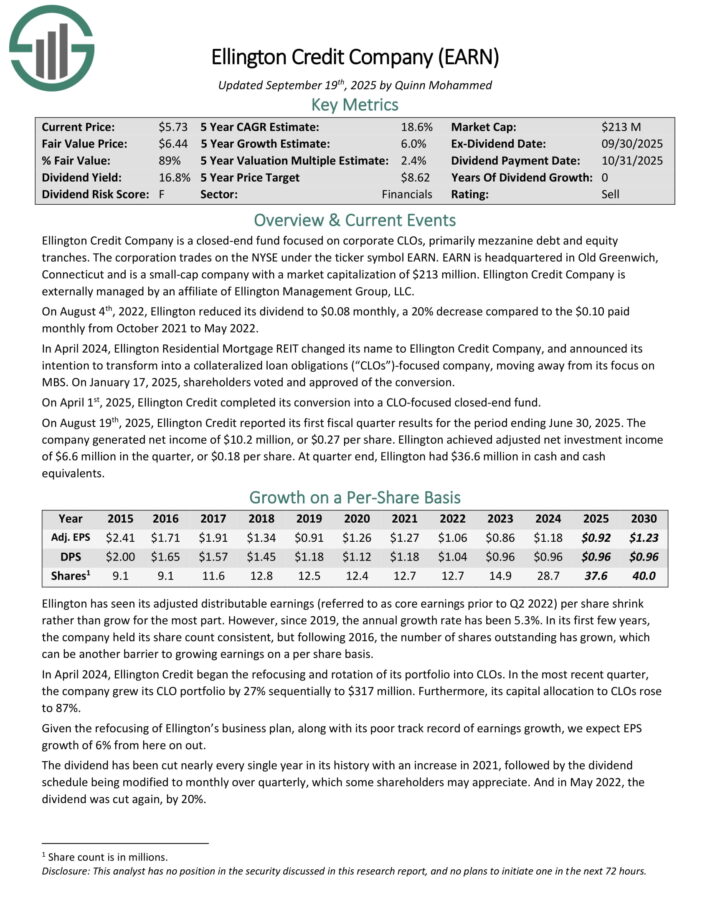

Crushed Down Excessive Yielder #4: Ellington Credit score Co. (EARN)

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On August nineteenth, 2025, Ellington Credit score reported its first fiscal quarter outcomes for the interval ending June 30, 2025. The corporate generated internet earnings of $10.2 million, or $0.27 per share.

Ellington achieved adjusted internet funding earnings of $6.6 million within the quarter, or $0.18 per share. At quarter finish, Ellington had $36.6 million in money and money equivalents.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven beneath):

Crushed Down Excessive Yielder #3: Orchid Island Capital (ORC)

Orchid Island Capital, Inc. is an mREIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money circulate primarily based on residential loans equivalent to mortgages, subprime, and home-equity loans.

On July 24, 2025, Orchid Island Capital, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate recorded a internet lack of $33.6 million, or $0.29 per widespread share, pushed by internet curiosity earnings of $23.2 million, whole bills of $5.0 million, and internet realized and unrealized losses of $51.7 million on RMBS and derivatives.

Dividends declared and paid have been $0.36 per widespread share, with e book worth per share at $7.21 by June 30, 2025, reflecting a complete return of (4.66)%.

Liquidity remained sturdy at $492.5 million, comprising money and unpledged securities, representing 54% of stockholders’ fairness, with borrowing capability exceeding $6.7 billion throughout 24 lenders.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven beneath):

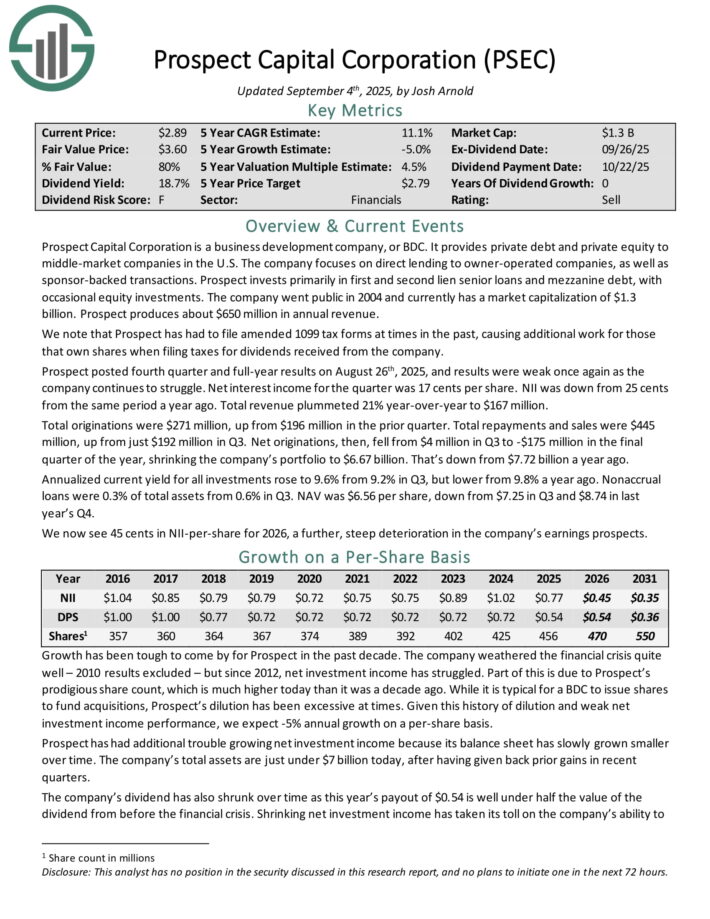

Crushed Down Excessive Yielder #2: Prospect Capital (PSEC)

Prospect Capital Company is a Enterprise Growth Firm, or BDC, that gives personal debt and personal fairness to center–market firms within the U.S.

The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Prospect posted fourth quarter and full-year outcomes on August twenty sixth, 2025, and outcomes have been weak as soon as once more as the corporate continues to battle. Web curiosity earnings for the quarter was 17 cents per share. NII was down from 25 cents from the identical interval a 12 months in the past. Complete income plummeted 21% year-over-year to $167 million.

Complete originations have been $271 million, up from $196 million within the prior quarter. Complete repayments and gross sales have been $445 million, up from simply $192 million in Q3. Web originations, then, fell from $4 million in Q3 to -$175 million within the closing quarter of the 12 months, shrinking the corporate’s portfolio to $6.67 billion. That’s down from $7.72 billion a 12 months in the past.

Annualized present yield for all investments rose to 9.6% from 9.2% in Q3, however decrease from 9.8% a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven beneath):

Crushed Down Excessive Yielder #1: Horizon Expertise Finance (HRZN)

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the expertise, life sciences, and healthcare–IT sectors.

The corporate has generated enticing danger–adjusted returns via instantly originated senior secured loans and extra capital appreciation via warrants.

On August seventh, 2025, Horizon introduced its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, whole funding earnings fell 4.5% year-over-year to $24.5 million, primarily on account of decrease curiosity earnings on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in Q2 of 2025 and Q2 of 2024 was 15.8% and 15.9%, respectively.

Web funding earnings per share (IIS) fell to $0.28, down from $0.36 in comparison with Q2-2024. Web asset worth (NAV) per share landed at $6.75, down from $9.12 year-over-year and $8.43 sequentially.

After paying its month-to-month distributions, Horizon’s undistributed spillover earnings as of the top of the quarter was $0.94 per share, indicating a substantial money cushion.

Administration assured traders of the dividend’s stability by declaring three ahead month-to-month dividends at a charge of $0.11.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven beneath):

Further Studying

In case you are inquisitive about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.