Do you wrestle to foretell foreign exchange market actions? Many merchants do. The foreign exchange market’s ups and downs can change shortly, taking income away. However, there’s a technique to deal with these adjustments.

Studying to identify developments and reversals may also help. This information will train you to make use of key foreign exchange market evaluation instruments. You’ll study to search out reversals and comply with worthwhile developments.

Key Takeaways

Retracements usually happen after important value actions.

Worth retracements usually align with Fibonacci ranges.

Breaking main development traces can sign attainable reversals.

ADX readings above 25 present robust developments.

A number of assessments of help traces could sign weakening developments.

Corrections are short-term and occur in overbought/oversold situations.

Decrease highs in uptrends will be bearish reversal indicators.

Understanding Market Dynamics in Foreign exchange Buying and selling

The foreign exchange market is complicated and full of things. It trades over $6 trillion day by day. It’s key to know what makes currencies transfer.

What Drives Foreign money Market Actions

Many issues drive the foreign exchange market. The energy of an financial system is essential. Sturdy economies get extra investments, making their currencies extra wanted.

For instance, Australia’s greater rates of interest from 2009 to 2012 made the Australian greenback extra fashionable.

The Position of Worth Motion Evaluation

Worth motion is important in foreign currency trading. Merchants take a look at charts and candlesticks to grasp the market. Uptrends have greater highs and lows, whereas downtrends have decrease highs and lows.

In 2020, the AUD/USD pair went up, even with some ups and downs.

Influence of Market Psychology

Market psychology performs a giant function in buying and selling. Concern, greed, and following the gang can change costs. The Relative Energy Index (RSI) exhibits how the market feels.

An RSI of 90 would possibly imply it’s time to promote in a downtrend. An RSI of 10 might imply it’s time to purchase in an uptrend.

Issue

Influence on the Foreign exchange Market

Financial Energy

A robust financial system results in foreign money appreciation

Curiosity Charges

Increased charges appeal to overseas funding, strengthening foreign money

Market Sentiment

Constructive sentiment drives costs up, destructive sentiment down

Easy methods to Spot Foreign exchange Market Reversals and Developments

Recognizing market reversals and developments is vital for foreign currency trading success. Merchants use some ways to get forward, like chart evaluation and technical indicators. They search for developments and reversals to make sensible trades.

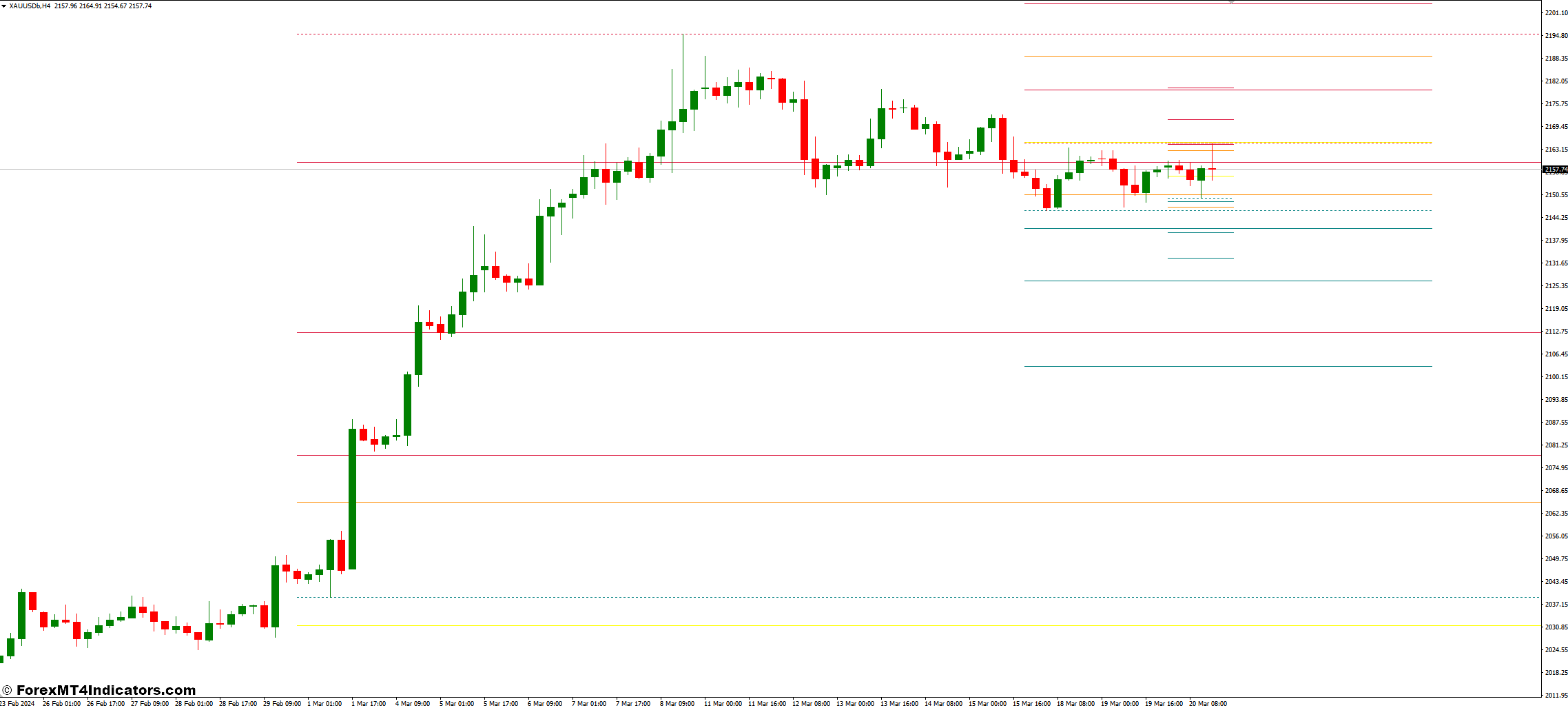

Foreign exchange chart evaluation is necessary. It helps spot candlestick patterns. Huge bearish candles after an uptrend imply a downtrend reversal. Huge bullish candles after a downtrend present an uptrend reversal.

Assist and resistance ranges are additionally vital. Assist ranges are the place costs cease falling and begin rising. Resistance ranges are the place costs cease rising and begin falling. Breaking long-term trendlines can sign large reversals.

Reversal Sign

Indication

RSI above 70

Overbought, attainable downward reversal

RSI beneath 30

The oversold, attainable upward reversal

Excessive quantity at help/resistance

Sturdy shopping for/promoting strain

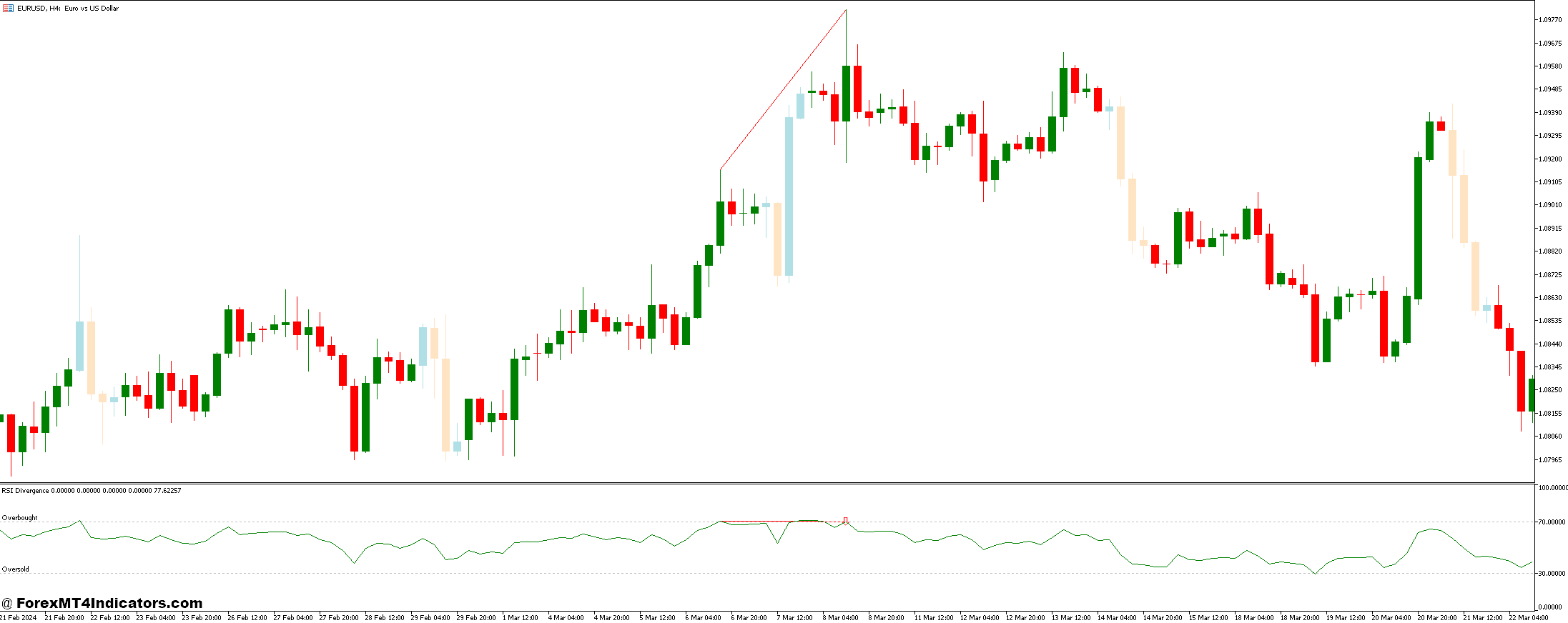

Technical indicators just like the Relative Energy Index (RSI) give extra indicators. An RSI above 70 means costs are too excessive. Beneath 30 means costs are too low. When the worth and indicator don’t match, it may be time for a change.

Through the use of these strategies, merchants could make higher decisions within the fast-paced foreign exchange market.

Key Variations Between Retracements and Reversals

In foreign currency trading, understanding the distinction between retracements and true reversals is vital. It helps you make higher buying and selling decisions. Study these variations to enhance your buying and selling expertise.

Traits of Retracements

Foreign exchange retracements are short-term value strikes towards the development. They will final from minutes to hours. More often than not, they return to the unique development.

Research present that 60-70% of retracements return to the unique development. That is necessary for merchants to know.

Figuring out True Reversals

True reversals imply a development change. They last more than retracements, usually over 5 buying and selling days. To identify a real reversal, search for indicators from a number of indicators.

This method boosts prediction accuracy by 20-30%. It’s a wise technique to commerce.

Period and Magnitude Evaluation

The size and dimension of value strikes assist inform retracements from reversals. Retracements keep inside sure Fibonacci ranges. Reversals transcend these ranges.

Right here’s a fast comparability:

Side

Retracements

Reversals

Period

Minutes to hours

Days to weeks

Magnitude

23.6% to 61.8% of prior transfer

Exceeds 61.8% of the prior transfer

Quantity

Usually decreases

Normally will increase

Market Construction

Maintains greater lows/decrease highs

Kinds new development construction

Understanding these ideas helps merchants take care of market ups and downs. It results in extra worthwhile buying and selling selections.

Utilizing Fibonacci Retracement Instruments

Fibonacci retracement evaluation is a key software in foreign currency trading. It makes use of Fibonacci ranges to search out help and resistance areas. The primary ranges are 0%, 23.6%, 38.2%, 50%, and 61.8%.

Merchants take a look at these ranges to see if developments will maintain going or change. A bounce off a Fibonacci degree usually means the development will proceed. For instance, a bounce from the 50% degree in an uptrend could possibly be time to purchase.

Fibonacci ranges are additionally necessary for managing threat. Merchants use them to set stop-loss and take-profit ranges. This helps management threat within the unstable foreign exchange markets.

To make buying and selling methods higher, use Fibonacci retracement with different instruments. Shifting averages or RSI may also help affirm trades. All the time watch value motion close to Fibonacci ranges and alter your trades as wanted.

Fibonacci Stage

Significance

Buying and selling Motion

0%

Begin of retracement

Potential development reversal

23.6%

Shallow retracement

Look ahead to development continuation

38.2%

Average retracement

Think about entry factors

50%

Mid-point retracement

The important thing degree for development affirmation

61.8%

Deep retracement

Sturdy reversal attainable

Studying to make use of Fibonacci retracement instruments helps merchants spot market adjustments. This ability makes buying and selling selections extra knowledgeable within the fast-paced world of foreign money change.

Pivot Factors as Reversal Indicators

Pivot level evaluation is vital in foreign currency trading. It helps merchants discover help and resistance ranges. Through the use of pivot factors, merchants can spot market reversals and make sensible decisions.

Assist and Resistance Ranges

Pivot factors arrange help and resistance ranges. The central pivot level (P) is discovered utilizing yesterday’s excessive, low, and shut. This provides merchants further ranges:

Stage

Formulation

Resistance 1 (R1)

(P × 2) – Low

Resistance 2 (R2)

P + (Excessive – Low)

Assist 1 (S1)

(P × 2) – Excessive

Assist 2 (S2)

P – (Excessive – Low)

Buying and selling with Pivot Factors

In uptrends, merchants take a look at decrease help factors (S1, S2) for breaks. In downtrends, they watch greater resistance factors (R1, R2). This helps discover commerce entry and exit factors.

Affirmation Methods

Merchants usually use pivot factors with different instruments for higher outcomes. For instance, a 200-period easy shifting common can filter developments. When the worth goes above this common, it would present a bullish pivot level sign.

Pivot level evaluation is nice for recognizing market adjustments in foreign currency trading. It’s simple to make use of however works finest with a strong buying and selling plan.

Pattern Line Evaluation Methods

Pattern line drawing is a key ability in foreign exchange chart evaluation. It helps merchants discover when the market would possibly change or maintain going. To attract development line, you want two factors. For an uptrend, join the highs. For a downtrend, join the lows.

Pattern traces are necessary for help and resistance. When costs get shut, merchants look ahead to breakouts or bounces. Bear in mind, false breakouts occur, so be affected person.

Managing threat is important when utilizing development traces. Set stop-loss orders simply past the development line. This will shield your cash if the market goes towards you. Regulate your commerce dimension primarily based on how shut the development line is to the present value.

To get higher at foreign exchange chart evaluation, use development traces with different instruments. For instance, Fibonacci ranges may also help discover reversal factors extra precisely. totally different time frames may assist affirm developments and indicators, making your buying and selling higher.

Pattern Line Sort

Description

Buying and selling Implication

Uptrend Line

Connects rising lows

Potential purchase alternatives on bounces

Downtrend Line

Connects lowering highs

Potential promote alternatives on rallies

Damaged Pattern Line

Worth breaks by the established development line

Attainable development reversal or acceleration

The Sushi Roll Reversal Sample

The sushi roll sample is a particular sign in foreign currency trading. It helps merchants discover when the market would possibly change. This sample exhibits up in ten buying and selling bars, making it a robust software for recognizing development adjustments.

Sample Recognition

To discover a sushi roll sample, search for 5 small-range candlesticks adopted by 5 big-range ones. The second set of bars should cowl the primary set utterly. This implies power builds up after which breaks out, exhibiting a attainable change in development.

Implementation Technique

Timing is vital when buying and selling the sushi roll sample. Enter the market when it kinds at key help or resistance ranges. Place cease losses past the widest level of the second vary to manage threat. For further affirmation, use foreign exchange reversal indicators like quantity or momentum indicators.

Success Charge Evaluation

The sushi roll sample is promising in foreign currency trading. It occurs in about 30% of foreign money pairs throughout large developments. Trades primarily based on this sample have a 65% success price, beating many different indicators. For the perfect outcomes, purpose for a risk-to-reward ratio of a minimum of 1:2 with this technique.

Side

Particulars

Sample Period

10 bars (5 slim + 5 huge)

Incidence Charge

30% of foreign money pairs

Success Charge

65%

Advisable Danger-Reward

1:2 or higher

Studying the sushi roll sample may also help merchants spot market reversals higher. This results in extra knowledgeable buying and selling selections.

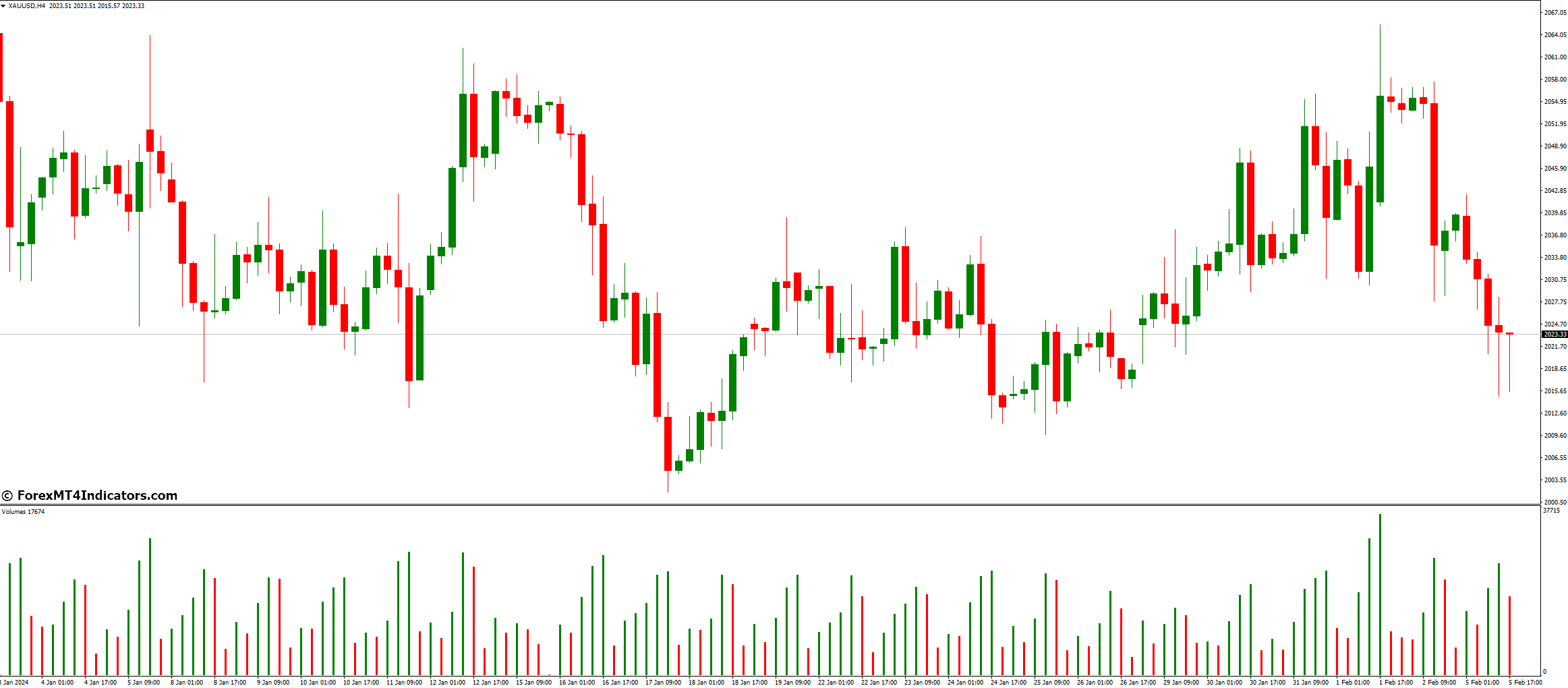

Shifting Common Methods for Pattern Identification

Shifting averages are key instruments for recognizing developments within the foreign exchange market. They assist easy out value adjustments, making developments simpler to see. Merchants decide totally different intervals to search out quick, medium, and long-term developments.

Quick-term merchants usually use 10 or 20-day shifting averages. The 50-day common is nice for medium-term developments. Lengthy-term buyers take a look at the 200-day common. If the worth is above these traces, it’s an uptrend. Beneath, it’s a downtrend.

Merchants look ahead to crossovers to make selections. A “Golden Cross” means a short-term common goes above a long-term one, exhibiting a bullish development. A “Dying Cross” means bearish momentum. These methods assist with timing trades.

However, shifting averages are gradual to react. They use previous knowledge, which might trigger delays. To repair this, some use exponential shifting averages (EMAs). These give extra weight to current costs.

Shifting Common Sort

Interval

Pattern Indication

Quick-term

10-20 days

Fast market reactions

Medium-term

50 days

Intermediate development shifts

Lengthy-term

200 days

Main market route

By mixing these shifting common strategies with different instruments, merchants can construct robust programs for analyzing developments within the foreign exchange market.

Quantity Evaluation in Pattern Affirmation

Foreign exchange quantity evaluation is vital in confirming developments. It helps merchants perceive market sentiment and future value strikes. This manner, they make higher selections and discover good buying and selling probabilities.

Quantity Indicators

Many indicators assist with foreign exchange quantity evaluation. The On-Stability Quantity (OBV) exhibits shopping for and promoting strain over time. Chaikin Cash Circulate goes from -100 to +100, exhibiting if cash is coming in or going out. These instruments assist merchants see when the market would possibly change route.

Worth-Quantity Relationships

It’s necessary to understand how value and quantity relate. Excessive quantity in uptrends means robust help. However, if quantity goes down, the development may be weakening. In downtrends, a giant quantity spike can imply a development reversal is coming.

Merchants use these patterns to time their trades higher.

Quantity Sample Recognition

Recognizing particular quantity patterns can sign development adjustments. A giant quantity spike usually means a development is ending and would possibly reverse. If quantity stays regular in patterns like flags or pennants, the development is more likely to maintain going. Breakouts with excessive quantity are normally extra dependable, exhibiting the transfer is actual.

Quantity Sample

Interpretation

Buying and selling Implication

Excessive quantity throughout an uptrend

Sturdy shopping for curiosity

Pattern more likely to proceed

Reducing quantity in an uptrend

Waning momentum

Potential reversal

Quantity spike at resistance

Sturdy breakout potential

Think about lengthy positions

Low quantity throughout breakout

Weak market curiosity

Increased threat of a false breakout

Utilizing quantity evaluation in buying and selling may also help merchants affirm developments and spot reversals. This makes their market evaluation higher and helps them make smarter buying and selling decisions.

Technical Indicators for Reversal Detection

Foreign exchange technical indicators are key for recognizing development adjustments. They assist merchants discover when to purchase or promote. Let’s take a look at some necessary indicators for market reversals.

ADX Indicator Utilization

The Common Directional Index (ADX) exhibits development energy. If ADX goes over 25, it means a robust development. When ADX falls beneath 20, it would sign a development weakening, resulting in a reversal. Merchants usually use ADX with different instruments for higher reversal detection.

RSI Divergence Indicators

Relative Energy Index (RSI) divergence is nice for locating reversals. If the worth goes up however RSI goes down, it’s a bearish signal. However, if the worth goes down however RSI goes up, it’s bullish. These indicators usually imply a development change is coming.

Ichimoku Cloud Evaluation

The Ichimoku Cloud exhibits development route and attainable reversals. If the worth goes from beneath to above the cloud, it’s bullish. Going from above to beneath the cloud is bearish. The cloud’s width additionally tells us about development energy.

Bear in mind, utilizing these indicators collectively is finest. Mixing them makes your buying and selling indicators stronger. All the time handle your dangers when buying and selling reversals.

Danger Administration Throughout Pattern Transitions

Foreign exchange threat administration is vital throughout development adjustments. Merchants want to regulate their plans to maintain income and lower losses. Place sizing is a giant a part of this.

Danger solely 1-2% of your account per commerce. This secure methodology guards your cash in shaky markets.

Buying and selling psychology is important throughout development shifts. It’s simple to get swept up in pleasure or worry. Use technical indicators to again up your ideas.

The RSI (Relative Energy Index) is useful. It exhibits if a market is overbought (above 70) or oversold (beneath 30).

Setting stop-losses can be key. Place them at 1.5-2 instances the common true vary (ATR). This protects your commerce from large losses.

Use Fibonacci retracement ranges to identify attainable reversals.

Watch buying and selling quantity to see if developments are altering.

Halve your place dimension when volatility is excessive.

Preserve complete open threat (portfolio warmth) below 6%.

Through the use of these threat administration ideas, you possibly can deal with development adjustments higher. Bear in mind, good buying and selling isn’t just about guessing the market. It’s additionally about protecting your capital secure once you’re fallacious.

Conclusion

Mastering foreign currency trading wants each technical expertise and market perception. Merchants who use totally different evaluation strategies usually do higher. The stochastic oscillator, for instance, helps spot development adjustments when used with different instruments.

The foreign exchange market is large, with $7.5 trillion traded day by day in 2022. Staying up to date is vital. Merchants have to learn about financial information, basic evaluation, and technical indicators.

Success in foreign currency trading is greater than guessing market strikes. It’s about managing dangers, adjusting to new conditions, and enhancing methods. By studying extra and making use of what you recognize, you may get higher at buying and selling currencies.