Tariffs are supposed to reinvigorate US manufacturing, however there’s extra concern about what they imply for provide chains and the prospect of international retaliation proper now, amidst indicators of a cooling home economic system.

US Manufacturing Strikes Again into Contraction Territory

Right now’s US information are generally softer than hoped. The for March dropped to 49.0 from 50.3, decrease than the 49.5 consensus and again in contraction territory. That is broadly consistent with regional manufacturing indicators launched in current days. The main points present large drops in employment (44.7 from 47.6) and new orders (45.2 from 48.6) with manufacturing down at 48.3 versus 50.7. Bear in mind 50 is the break-even stage so something above is growth and the additional beneath 50 the deeper the downturn.

This implies that tariff fears (influence on provide chains and potential reciprocal motion from international buying and selling companions) are hurting the sector proper now. Observe too the massive rise in costs paid to 69.4 from 62.4, which suggests pre-emptive strikes forward of the imposition of tariffs with the specter of greater costs for customers trying very actual. Under is a chart of producing manufacturing development (YoY%) versus the ISM manufacturing index. This underscores how the stagnation within the sector over current years appears set to proceed regardless of tariffs supposedly being a software to reinvigorate manufacturing.

ISM Factors to Falling Manufacturing Output

Supply: Macrobond, ING

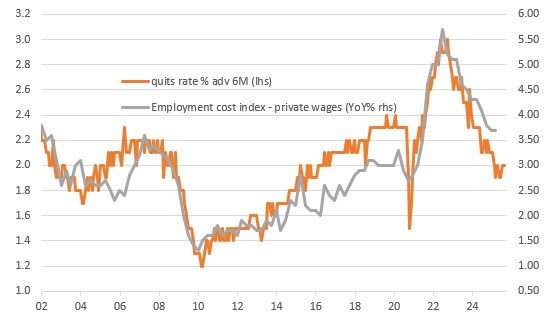

On the identical time, the information exhibits falling job openings (7568k versus 7762k in Jan and beneath the 7658k consensus) with the quits charge coming in at 2%. This in itself is at ranges traditionally in line with non-public sector wage development slowing to three% year-on-year. The chart exhibits the quits charge versus non-public wage development. The story right here is that the quits charge rises when there are many engaging, excessive paying jobs and falls when there are fewer jobs obtainable or they’re much less engaging. When employers see the quits charge fall there’s much less incentive for companies to supply their employees bumper pay awards as there’s much less concern about employees retention.

Quits Fee Factors to Slowing Wage Development

Supply: Macrobond, ING

With tariffs set to drive inflation above 3% within the second half of 2025 this squeeze on shopper spending energy is a key motive markets are nervous in regards to the US development outlook. A delicate on Friday would make issues even worse.

***

Disclaimer: This publication has been ready by ING solely for info functions no matter a specific consumer’s means, monetary scenario or funding targets. The data doesn’t represent funding suggestion, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Authentic Publish