Tariff disruption is fertile floor for innovation

Final week, we had Liberation Day, ushering in a interval of intense upheaval. The US imposed tariffs on markets and sectors the world over, earlier than quickly reversing some, whereas doubling down on others, significantly with China.

It doesn’t matter what your information or expertise, there’s nonetheless confusion about what’s subsequent. I mentioned this with a number of analysts and senior Consultants at Mintel, and after some preliminary shocked – one thing companies all over the place doubtless skilled – we regrouped. We reminded ourselves that serving to companies navigate uncertainty is what we do finest at Mintel, particularly after 15 years of back-to-back market disruptions.

Every of those crises has been very totally different. However from the monetary crash to COVID-19, Mintel has gained helpful insights from every interval of disruption. Our collective information and expertise, together with datasets that date again a long time, implies that we’re outfitted to understanding what’s subsequent. That is what defines Mintel.

So, what have we realized? Nicely, over the previous 15 years, we’ve seen a fair proportion of financial and political earthquakes: the tremors of the monetary crash, the unprecedented impression of COVID-19, the drawn-out saga of Brexit, and the continued cost-of-living disaster. Every occasion has been a lesson in adaptation, resilience, and has supplied a masterclass find alternative amidst the chaos. By means of all of it, one precept has remained steadfast: consistency. In occasions of uncertainty, manufacturers want to point out a trusted voice and be guided by a gentle hand on the tiller.

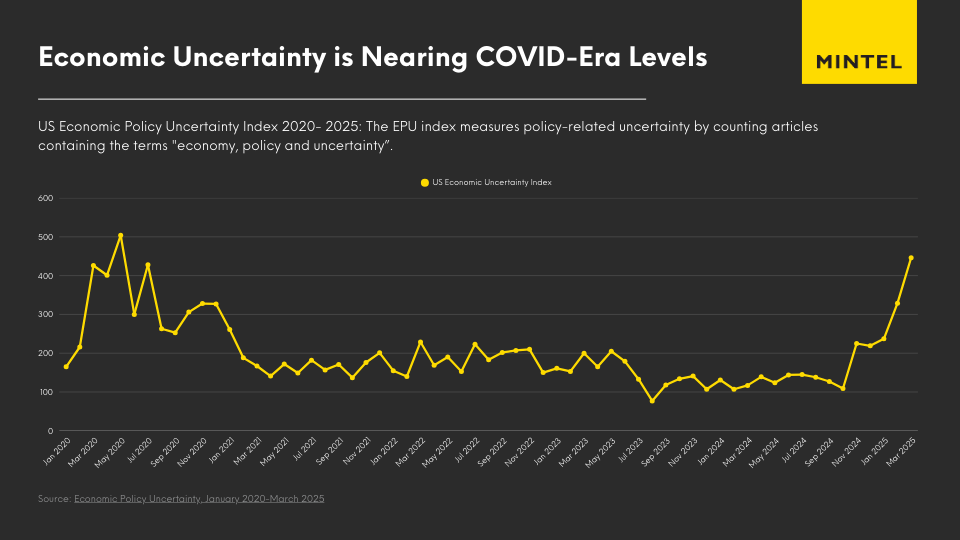

The problem now goes past the quick impression of the tariffs. They amplify much more uncertainty to an already unpredictable international scenario. And uncertainty has an inevitable impression on how each companies and customers behave.

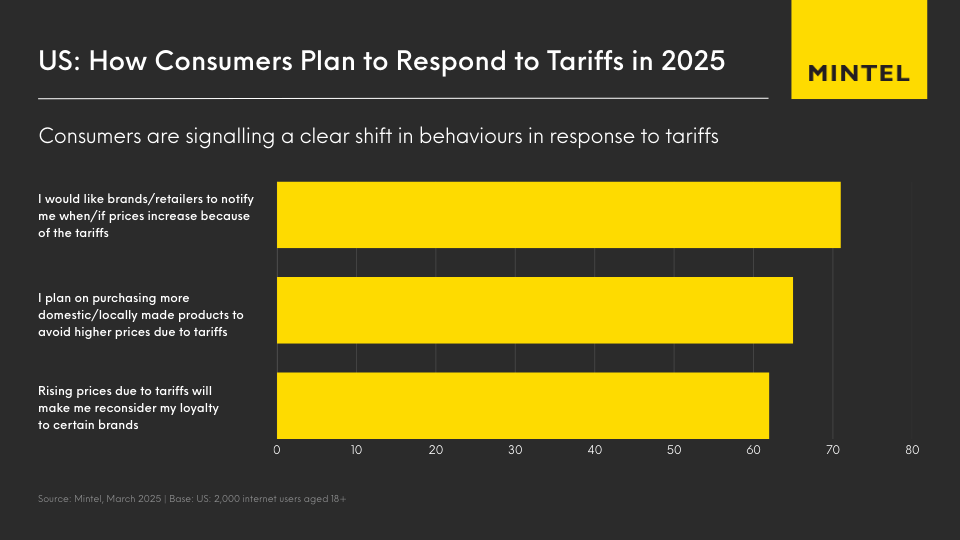

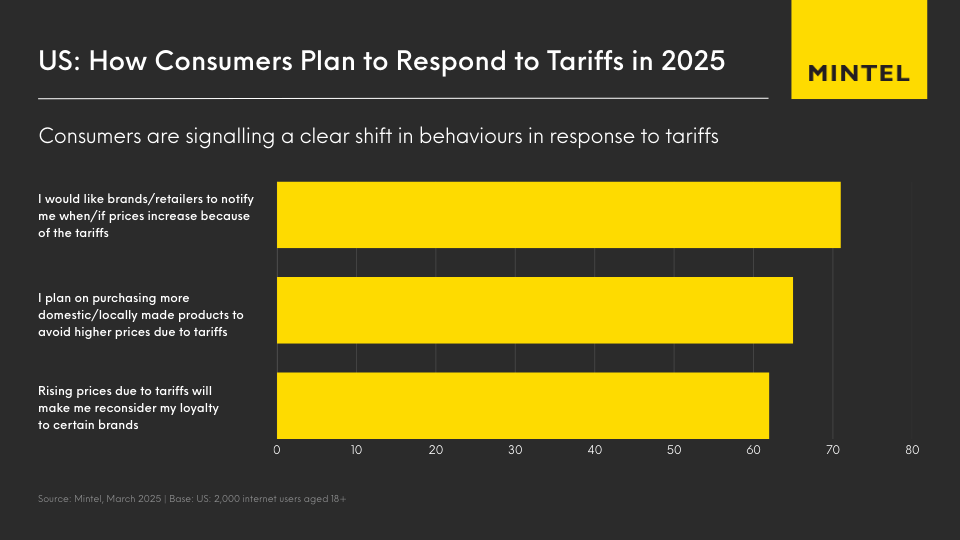

That is significantly difficult, provided that client confidence remains to be fragile. Solely a minority of individuals say their funds are wholesome, whereas many behaviours adopted in the course of the cost-of-living disaster are nonetheless in full impact. Manufacturers should adapt to this actuality with readability and objective.

40% of UK customers say they’re slicing again on luxuries, and 34% say they’re switching to lower-cost retailers.

Are manufacturers really doing sufficient to bolster their worth proposition, to remind customers why they’re price that little further, particularly when budgets are tighter than ever? Or are some merely hoping to experience out the storm, heads down, maybe assuming customers gained’t even discover their silence? That, in itself, is a raffle. As a result of in occasions of uncertainty, inaction may be simply as deafening as a misstep. However right here’s the thrilling half: this very disruption, this sense of being ‘caught,’ is fertile floor for innovation.

Historical past doesn’t repeat itself – but it surely typically rhymes

At Mintel, we’ve bought an immense useful resource of institutional information that we will draw on. We’ve been monitoring markets, customers and types for over 50 years. We’ve guided our shoppers by way of uncertainty earlier than, offering a transparent, actionable path ahead when it issues most.

And whereas every time, the trigger and form of the disaster has been totally different, once you monitor again by way of Mintel’s analysis and knowledge, there are frequent themes.

The larger the extent of uncertainty within the broader market, the extra that companies and customers attempt to take again management by reassessing their spending.

Typically, that includes decreasing spend. When uncertainty hits, it makes rational sense to attempt to create a margin of security. (“The paradox of thrift”: financial exercise drops, simply as an financial system wants essentially the most help.)

However specializing in spending additionally performs into our underlying want for management. None of us has any management over Donald Trump’s commerce insurance policies (or, in earlier crises, over vitality costs, or COVID-19, or international monetary stability), however we do have management over our personal spending.

5 ways in which client behaviour adjustments throughout occasions of financial uncertainty…

Whereas particular adjustments range by market and particular person, sure constant patterns are inclined to emerge.

Deal with worth and efficacy When each penny counts, each buy issues. We noticed this clearly within the family care sector in the course of the cost-of-living disaster. COVID-19 had already pushed efficacy up the agenda, however the cost-of-living disaster added one other layer. Shoppers needed to make sure that the purchases they made weren’t solely efficient for well being causes, but in addition supplied true worth for cash.

Buying and selling down…Lots of the commentary on client behaviour throughout powerful occasions revolves round methods persons are making an attempt to save cash. Some persons are pressured to commerce down, whereas others achieve this by alternative. In classes they’re not super-engaged in, or the place there’s a strategy to lower spend with out decreasing high quality, they’ll change to lower-cost alternate options.

… And buying and selling upBut customers’ behaviour is rather more refined than simply slicing again throughout the board. They’re additionally ready to spend extra in the event that they assume that’ll give them a greater return on their funding.

The monetary disaster, for instance, considerably accelerated the expansion of the UK’s premium prepared meal market. Retailers noticed a possibility to capitalise on customers who have been slicing again on eating out, and repositioned the prepared meal from a handy however uninspiring fallback to an indulgent however inexpensive luxurious.

This sample occurs throughout classes. Magnificence manufacturers know all in regards to the “lipstick impact”: individuals treating themselves to luxurious merchandise with the intention to elevate their temper. Mintel’s expertise exhibits that just about each class could have its personal equal of this pattern, whether or not that’s premium prepared meals, luxurious fragrances, or inexpensive upgrades to trip packages.

Market polarisationThe mixture of selective buying and selling down and buying and selling up means classes turn out to be extra polarised. The center floor turns into a troublesome place to be. It’s neither inexpensive sufficient to be a cut price, nor indulgent sufficient to be a deal with.

Branded merchandise are significantly weak to this impact, given the continued enchancment in non-public label alternate options, each on the higher and decrease finish of the market.

Flight to security Manufacturers can thrive by specializing in the tendency for customers to turn out to be extra risk-averse. In the event you can’t afford to waste cash, experimenting with new merchandise is dangerous. You may save a bit of cash by switching to a less expensive various, but when your youngsters don’t like that various, then the cash is wasted altogether.

…And why manufacturers can’t afford to sit down again and look ahead to circumstances to enhance

It’s not simply client behaviour that adjustments. In earlier financial slowdowns, our World New Merchandise Database (GNPD) has highlighted the best way innovation developments shift. We’ve seen a decline in brand-led innovation, with non-public labels taking a larger share of innovation.

Simply as with customers’ altering emphasis on decreasing prices, it’s a logical response to market uncertainty. Innovation is pricey and dangerous.

Nevertheless, inaction can also be dangerous, particularly given the risk posed by non-public label. When customers are below stress, their habits change. This creates alternatives in addition to challenges. It means they’re now not purchasing on autopilot, and that present loyalties are up for grabs. If manufacturers abandon the innovation battleground to non-public label, they danger completely shedding market share.

What’s subsequent?

Mintel has already revealed a number of articles inspecting the impression of the tariffs on client behaviour throughout a number of classes and markets, together with one on what it might imply for European foods and drinks markets (client-access solely), alongside perception items on how UK, US and Southeast Asian customers are prone to react.

Nevertheless, the implications gained’t solely differ throughout totally different classes and areas. They’ll even be dramatically totally different throughout manufacturers working in precisely the identical market. That’s the place our Mintel Consulting workforce may help. We will draw on Mintel’s heritage and our collective genius to create profitable methods tailor-made to your particular person goals.

We did this all through COVID-19 and the cost-of-living disaster, and we’ll do it once more. For instance, we’re already speaking to an iconic American model to assist them perceive whether or not latest occasions will have an effect on the best way international customers relate to their merchandise.

In the event you’re seeking to perceive how these adjustments have an effect on your individual model, your clients, and your innovation technique, then get in contact with Mintel Consulting to study extra about how we will use our strategies to assist drive your progress methods.

We may help you determine what’s already taking place in your sector, predict what’s coming subsequent, and perceive what it means for your enterprise’s technique.

Contact a Marketing consultant