In the present day we’re going to make use of a easy technique to (legally!) beat the tax man. The hot button is a (too) often-ignored group of funds whose dividends are past the attain of the IRS.

The low-risk property behind this revenue stream actually ought to be a part of any revenue investor’s portfolio. And the three funds we’ll talk about beneath, which yield as much as 7.3%, are an awesome place to begin. Due to their tax-free standing, their “actual” yields will seemingly be significantly extra for us.

Enter “Boring However Lovely” Municipal-Bond Funds

Right here’s the reality on taxes: In case you’re an American and also you obtain any sort of revenue, you’re going to get taxed. This can be a fixed of life. However there may be one exception: municipal bonds, the revenue from which is tax-free for many People.

That tax-exempt standing drives loads of buyers to muni bonds, making them a secret weapon for state and native governments and American trade, as these bonds fund many infrastructure and different public works tasks across the nation.

It provides as much as a giant difference-maker for a lot of of us. A municipal, or “muni,” bond yielding 4% may not appear spectacular at first look, however for somebody within the prime federal tax bracket, this 4% tax-free yield is equal to a taxable yield of 6.6%.

And naturally, the upper our “headline” muni-bond yields get, the larger the taxable-equivalent yield: for that very same taxpayer within the prime federal bracket, for instance, 5% yields flip into 8.3% on a taxable-equivalent foundation.

Creating Your Personal “Tax-Free Revenue Machine”

One of the best ways to purchase municipal bonds is thru closed-end funds (CEFs), which give us three key benefits:

Lively administration: The world of municipal bonds is difficult for people to entry, so we wish execs from well-established companies like BlackRock (NYSE:), Nuveen and others “working” our muni-bond portfolio for us.

Excessive yields: Loads of muni-bond CEFs pay 4%, 5%, and extra, which, as we simply noticed, interprets into an even bigger yield on a taxable-equivalent foundation. Reductions to web asset worth (NAV): As a result of CEFs have roughly mounted share counts for his or her whole lives, they will, and infrequently do, commerce at completely different ranges than the per-share worth of their portfolios, and often at reductions. That lets us purchase our “munis” for 90, 85 and generally even fewer cents per greenback of property, as we’ll see in a second.

With all that in thoughts, let’s go forward and create a tax-free revenue portfolio with simply three CEFs, all of that are diversified throughout municipalities, tasks and credit score rankings.

Muni Decide #1: BlackRock MuniYield High quality Fund (MQY)

BlackRock MuniYield High quality Fund (NYSE:) is notable for its constant efficiency and talent to supply tax-free revenue for a very long time, making it an awesome long-term maintain.

MQY’s Lengthy Historical past of Earnings

MQY at present trades at a 7% low cost to NAV, so we’re paying 93 cents for each greenback of property with this one. Low cost! Furthermore, like all muni-bond funds, MQY dropped in 2022, as rates of interest rose. However now, with charges having come down a bit, and prone to transfer decrease over time, the fund is properly positioned to grind increased, along with handing us a pleasant long-term (and naturally tax-free) revenue stream.

The kicker right here is that MQY’s 5.9% yield—already engaging by itself—“converts” to a 9.8% taxable-equivalent yield for prime revenue earners.

Muni Decide #2: Nuveen AMT-Free High quality Municipal Revenue Fund (NEA)

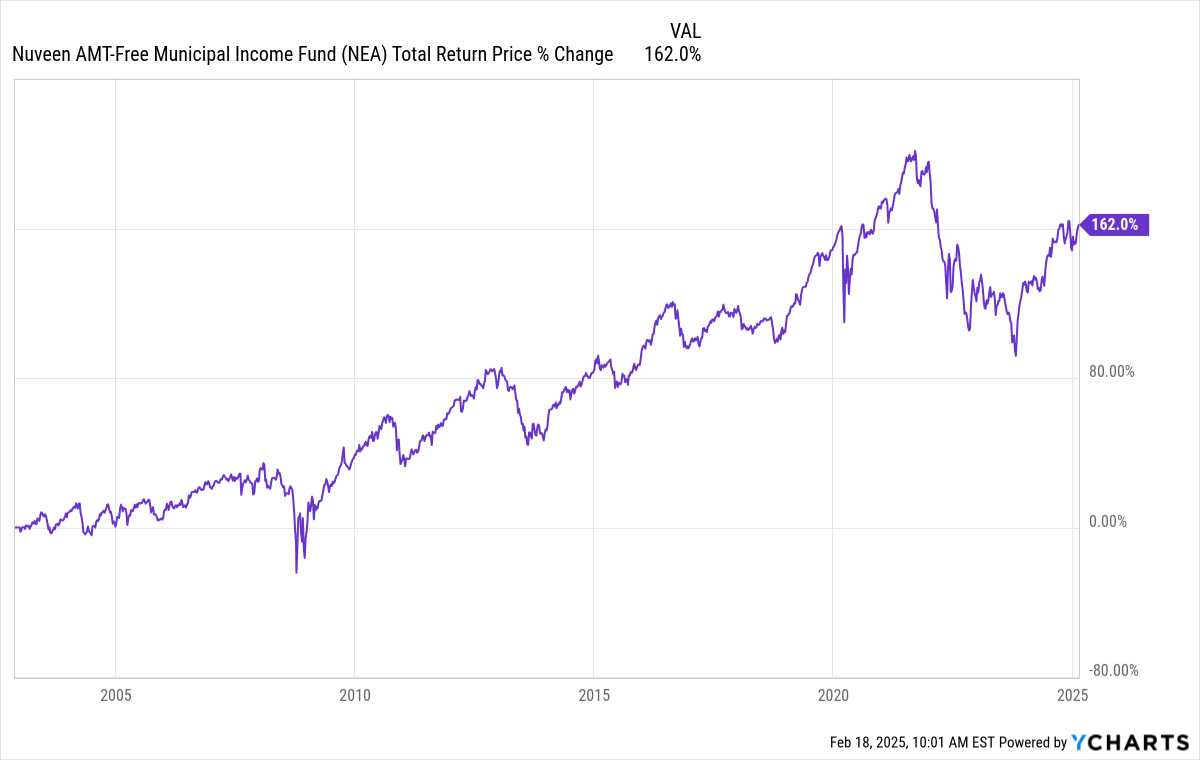

Let’s keep it up with Nuveen AMT-Free Municipal IF (NYSE:), identified for its robust administration crew (Nuveen will get entry to high-quality municipal-bond issuances early, which is feasible because of the corporate’s deep contacts within the muni-bond world and the truth that the muni market is small).

Like MQY, NEA trades at a reduction (4.9% on this case) however its yield clocks in at a large 7.6%, thanks in no small half to increased yields the fund has been capable of lock in as rates of interest rose and stayed elevated.

And like MQY, this fund has a protracted monitor document of wholesome whole returns, particularly for a secure asset class like munis.

NEA Retains Delivering Revenue and Good points

Keep in mind, too, that because of NEA’s excessive yield, a lot of that return has come within the type of dividend money.

Muni Decide #3: RiverNorth Managed Period Municipal Revenue Fund II (RMMZ)

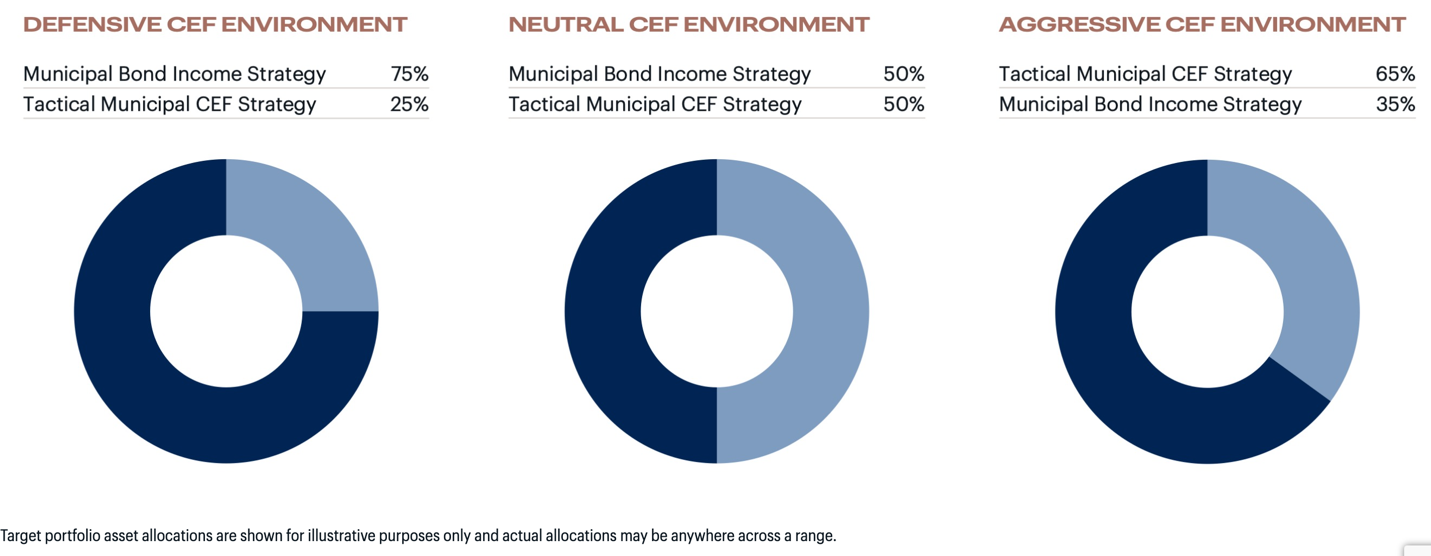

Lastly, for additional diversification within the muni-bond fund area, contemplate RiverNorth Managed Period Municipal Revenue Fund II (NYSE:), which has an fascinating methodology of managing period and credit score danger: It buys extra particular person municipal bonds when the muni market is sizzling, then leans extra into shopping for different muni-bond CEFs when the market is chilly and CEF reductions are unusually huge.

RMMZ’s Intelligent Method to Sustaining Revenue

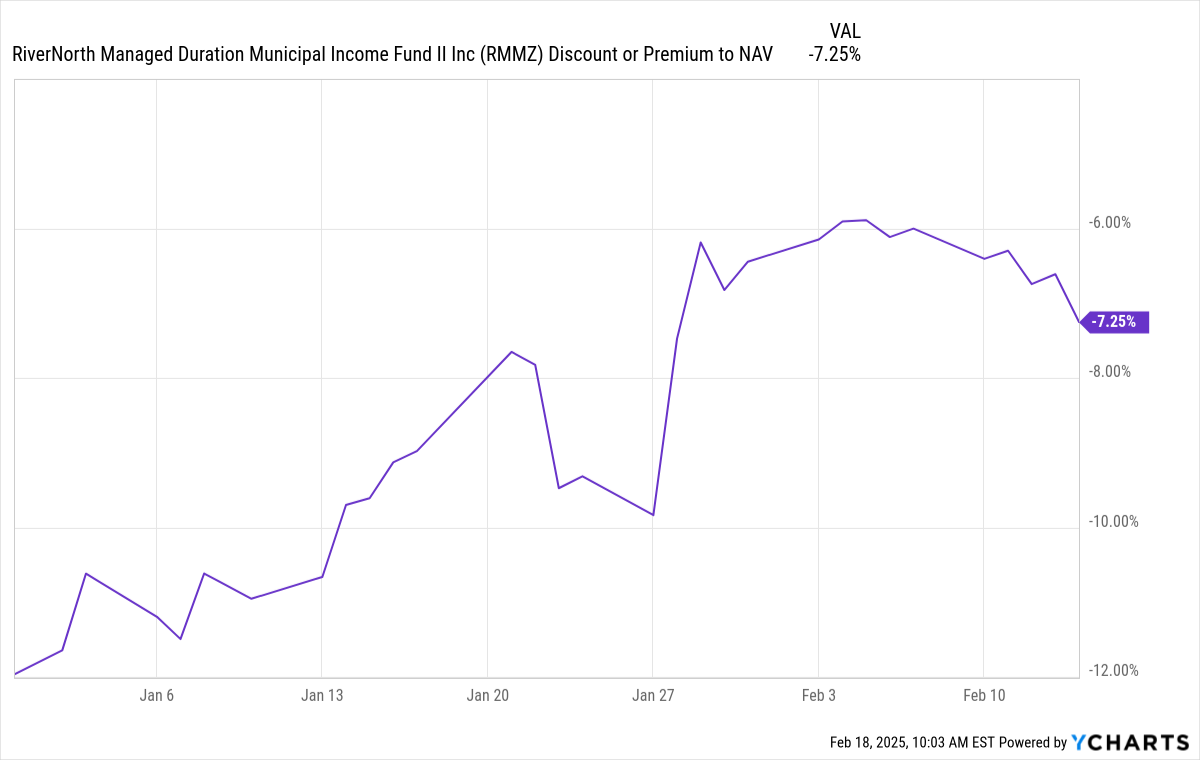

This fund additionally trades at a large low cost to NAV—7.4% at the moment—which is but once more a pleasant bonus for a high-yielding fund. However the actual standout stat is RMMZ’s yield: 7.2%. On a taxable-equivalent yield foundation, that’s 12%. Plus, RMMZ’s low cost to NAV has been eroding, giving buyers who purchase at a reduction the potential to promote at a revenue because the low cost shrinks.

RMMZ’s Low cost Is Evaporating

RMMZ is way from excellent: its payouts have been lower at the beginning of 2025 by two-tenths of a penny, and if that have been to occur once more, its present yield would “fall” to round 7%, with little impact on that 12% taxable-equivalent yield for our prime revenue earner!

I don’t learn about you, however that’s a fairly cheap “draw back” to me. The upside is that these funds all have diversified portfolios in municipal bonds, which sport only a 0.1% default charge throughout the asset class.

The underside line: In case you want a tax break (and who doesn’t?), these are three funds value critical consideration.

Disclosure: Brett Owens and Michael Foster are contrarian revenue buyers who search for undervalued shares/funds throughout the U.S. markets. Click on right here to learn to revenue from their methods within the newest report, “7 Nice Dividend Development Shares for a Safe Retirement.”