The North American Free Commerce Settlement (NAFTA) between the US, Mexico, and Canada harkens again to a not-so-distant previous when Congress took its constitutional function “to manage Commerce with overseas Nations” significantly.

In his remaining weeks in workplace, Republican President George H. W. Bush signed the settlement on December 17, 1992. The Home and Senate permitted NAFTA lower than a yr later in a bipartisan vogue with Democrat President Invoice Clinton signing the Implementation Act in December 1993.

Simply over 31 years since, NAFTA and its up to date USMCA have confirmed a boon to the American financial system.

The settlement slashed many tariffs instantly upon enactment in 1994. By 2008, almost all import duties between the three nations had disappeared. Central to the settlement was manufacturing freedom. However NAFTA additionally eliminated unfair commerce obstacles positioned on service industries — together with banking, insurance coverage, and telecommunications. Guaranteeing honest remedy for overseas traders additionally spurred cross-border funding. This included defending their property from expropriation and offering worldwide arbitration in lieu of oft-biased native courts. Patents, copyrights, and logos additionally acquired safety from piracy and counterfeits to an extent unprecedented in commerce offers. Cross-border commerce quickly soared. The US, Canada, and Mexico benefited drastically from decrease prices, extra funding, and streamlined commerce.

As NAFTA pried open markets by limiting quotas and different non-tariff obstacles, commerce reworked and blossomed. Since 1994, American exports have almost tripled, even after you alter for inflation. American items exported exceeded $2 trillion final yr. Exports from the US to Mexico jumped from about $40 billion a yr to an all-time excessive of $334 billion in 2024. Our exports to Canada greater than tripled, rising from $100 billion to a close to all-time excessive of $349 billion final yr. Each of America’s NAFTA companions import greater than twice as a lot from the US as China — quantity three on the record.

No settlement is ideal, after all. Some sectors, notably dairy, acquired cronyist carveouts. However opposite to common perception, American exporters loved a producing renaissance.

The US agricultural sector noticed a significant enhance from NAFTA. With tariffs on many farm items eradicated, exports to Canada and Mexico soared. Corn exports to Mexico jumped from negligible ranges to billions of {dollars} yearly, whereas soybean, pork, and beef shipments additionally climbed. In 2023, Mexico and Canada accounted for greater than 32 p.c of US agricultural exports — over $55 billion a yr in gross sales. Farmers in Iowa, Ohio, Nebraska, and Texas actually reap the rewards of this expanded market entry.

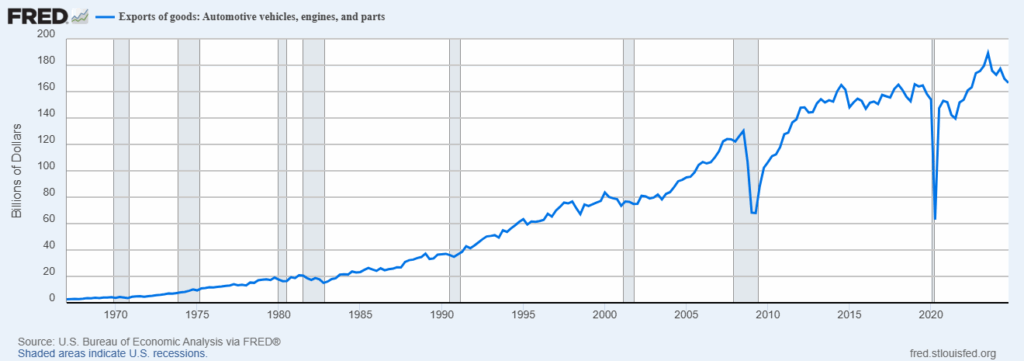

The auto sector thrived underneath NAFTA’s built-in provide chains. Tariffs on autos and components dropped to zero, letting corporations like Ford, GM, and Chrysler supply elements from Mexico and Canada at decrease prices. This saved US-made automobiles aggressive globally — exports of autos to Mexico alone grew from underneath $1 billion in 1993 to just about $29 billion in 2024. Crops in Michigan, Ohio, and the Midwest benefited from this cross-border effectivity, whilst some meeting shifted south. The American automotive sector exports greater than $160 billion yearly, almost doubling in inflation-adjusted phrases since 1994. Throughout the nation, American factories churn out vehicles for export — together with BMW’s South Carolina plant which employs 11,000 Individuals. Motor autos are among the many prime three exports in 14 states, together with Missouri, Michigan, Ohio, and Tennessee.

Past autos, manufacturing broadly gained from cheaper inputs and greater markets. Equipment, electronics, and chemical compounds noticed export booms — US equipment exports to NAFTA companions tripled in worth post-1994. Companies in industrial hubs like Illinois and Pennsylvania discovered new clients, whereas lower-cost Mexican imports (like metal or plastic elements) trimmed manufacturing prices, serving to producers keep lean in a world race. America’s aerospace trade now exports almost $100 billion a yr.

The vitality sector, significantly oil and gasoline, benefited as effectively. A lot of the document ranges of US-produced oil is shipped to Canada for refining earlier than returning to gas our autos. In the meantime, Canada turned the US’s prime provider of some kinds of crude oil wants. Though the US produces extra oil on web than we devour, petroleum sorts and makes use of differ. For that reason, we imported almost 4 million barrels a day from Canada in 2023 representing 97 p.c of their oil exports. Mexico sends refined merchandise north to us as effectively. The growth in American pure gasoline manufacturing helps provide the vitality wants of all three nations — all with out tariff taxation. Greater than half of our pure gasoline exports circulate to Canada and Mexico, 8 p.c of our complete manufacturing. This retains vitality costs secure, immediately helps extraction and pipeline jobs in Texas, North Dakota, and elsewhere. Industrial electrical energy costs — important to aggressive manufacturing — profit as effectively.

Retailers and shopper items corporations — like Walmart or meals processors — profit from cheaper imports and a bigger export market. American households take pleasure in Mexican vegatables and fruits — in the midst of winter — at reasonably priced costs. American manufacturers like Coca-Cola, Kraft, and John Deere revenue by extra gross sales in Mexico.

Deeper ties with Canada and Mexico drove effectivity, created jobs, and elevated output. In fact — some industries like textiles and furnishings confronted robust competitors. It’s a misnomer to say manufacturing has been “hollowed out.” In reality, the US is a much bigger manufacturing powerhouse at present than 30 years in the past. Industrial output elevated by greater than half since 1994 — and is close to all-time excessive at present.

On the similar time, fewer persons are employed in manufacturing regardless of the elevated output as a result of effectivity has surged. Our financial system has shifted to a lot higher-paying, superior providers. In reality, we now export way more of those providers than we import. In different phrases, free commerce has allowed us to buy low-cost merchandise from abroad, specializing in these new high-paying sectors the place we take pleasure in a comparative benefit.

The providers sector — together with finance, logistics, and tech — expanded underneath NAFTA. US banks and insurers gained simpler entry to Canadian and Mexican markets, whereas cross-border trucking and transport grew to deal with booming bodily commerce. American service exports to NAFTA companions topped $128 billion in 2023, boosting well-paying white-collar jobs.

In fact, protectionists bemoan the truth that our imports from our companions grew by much more. However a commerce deficit is an identical to our capital surplus that flows again to the US typically within the type of overseas direct funding (FDI) in companies right here. Since NAFTA’s enactment, FDI exploded greater than 500 p.c to greater than $330 billion yearly. This helped spur a doubling in general employee productiveness previously 40 years. Competitors forces producers to innovate. As effectivity grew, GDP throughout all three nations grew.

It’s not simply traders or managers who profit from rising productiveness. Employees share on this abundance of reasonably priced, obtainable, and numerous items. American households are much better off. Thanks largely to the innovation and efficiencies from free commerce, thousands and thousands of Individuals take pleasure in new alternatives in well-paying professions. Center-class actual annual household earnings elevated greater than $28,000 since 1994. By Nineteen Eighties earnings requirements, middle-class shrank as a share of the inhabitants solely as a result of thousands and thousands of those households at the moment are incomes what would have been higher middle-class incomes. Sure, that’s in actual, inflation-adjusted phrases. In the meantime, a higher proportion of prime-working age adults are employed at present than pre-NAFTA.

NAFTA reveals how broadly shared abundance materializes when governments meddle much less and let markets work. Commerce obstacles — tariffs, quotas, and restrictions on funding — distort costs, prop up inefficient producers, and rob customers of alternative.

Tearing down these obstacles between the US, Canada, and Mexico generated widespread abundance. Free commerce definitely means decrease costs for companies and households. Who needs to pay a Canadian lumber tariff when constructing a house — or a Mexican tequila tax? However, simply as importantly, free commerce means the freedom to purchase and promote with out searching for the approval of or paying off the central planners in Washington, DC.