Up to date on July ninth, 2025 by Nathan Parsh

An organization will need to have an extended observe report of producing regular dividend development, even throughout recessions, to change into a dividend king. That is removed from a simple activity, which makes it all of the extra spectacular.

It needs to be no shock that we contemplate the Dividend Kings to be among the many highest-quality dividend shares in the whole inventory market.

With this in thoughts, we created a full listing of all 55 Dividend Kings, together with essential monetary metrics equivalent to dividend yields, payout ratios, and price-to-earnings ratios. You possibly can obtain the complete listing by clicking on the hyperlink under:

Real Components Firm (GPC) has elevated its dividend for 69 consecutive years, giving it one of many longest streaks of annual dividend raises in the whole inventory market. It has achieved this development with a prime model in an business that has seen constant development over a few years. A transparent path stays forward for continued development, significantly as automobiles age.

Real Components inventory seems barely undervalued at current, providing a yield above the market common and a excessive chance of continued dividend hikes for a few years, along with a sturdy development forecast.

Enterprise Overview

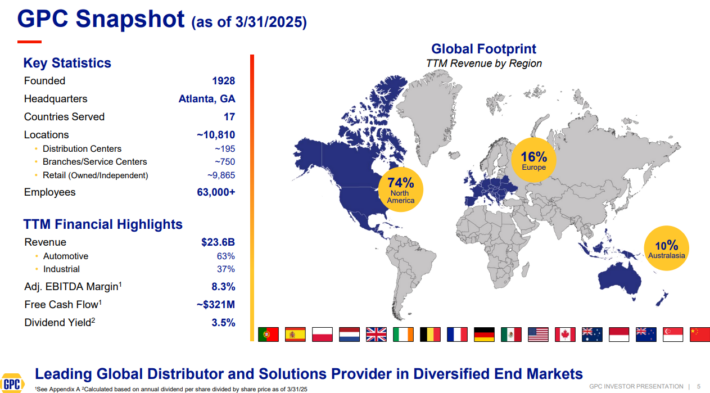

Real Components traces its roots again to 1928, when Carlyle Fraser bought Motor Components Depot for $40,000. He renamed it, Real Components Firm. The unique Real Components retailer had annual gross sales of simply $75,000 and employed solely six folks.

At the moment, Real Components has the world’s largest world auto elements community, with greater than 10,800 places worldwide. As a significant distributor of automotive and industrial elements, Real Components generates annual income of practically $24 billion.

Supply: Investor Presentation

It operates two segments: automotive (which incorporates the NAPA model) and the commercial elements group, which sells industrial alternative elements to MRO (upkeep, restore, and operations) and OEM (unique gear producer) prospects. Prospects are derived from a variety of segments, together with meals and beverage, metals and mining, oil and gasoline, and well being care.

On April 22, 2025, the corporate reported its first-quarter 2025 outcomes, with gross sales reaching $5.9 billion, a 1.7% improve from the identical interval within the earlier 12 months. Nevertheless, web revenue fell to $194 million, or $1.40 per diluted share, down from $249 million, or $1.78 per diluted share, in Q1 2023. Adjusted diluted earnings per share (EPS) additionally decreased to $1.75 in comparison with $2.22 final 12 months. Restructuring prices and the continued integration of acquired impartial automotive shops drove this decline.

Development Prospects

Real Components is primed for fulfillment, because the atmosphere for auto alternative elements is extremely supportive of development. Customers are holding onto their automobiles longer and are more and more making minor repairs to maintain their automobiles on the highway for longer, quite than shopping for new automobiles.

As the common value of auto restore will increase with a automotive’s age, this instantly advantages Real Components. As newer automobiles change into more and more costly, prospects usually tend to maintain older automobiles for longer.

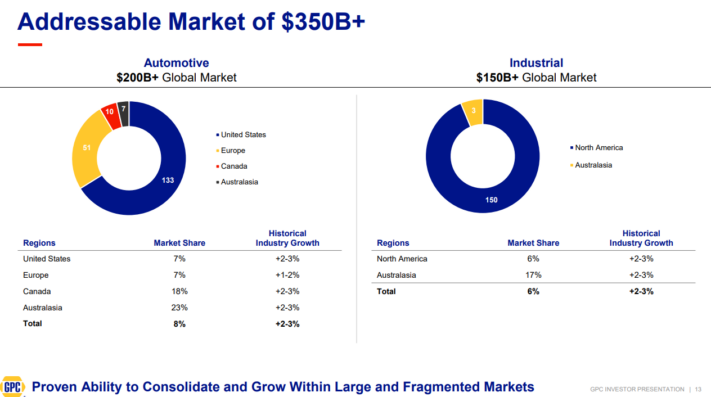

In line with Real Components, automobiles aged six years or older now characterize the vast majority of automobiles on the highway, which bodes very nicely for Real Components. As well as, the whole addressable marketplace for automotive aftermarket services, in addition to business merchandise, is big and fragmented, leaving loads of alternative for enlargement.

Supply: Investor Presentation

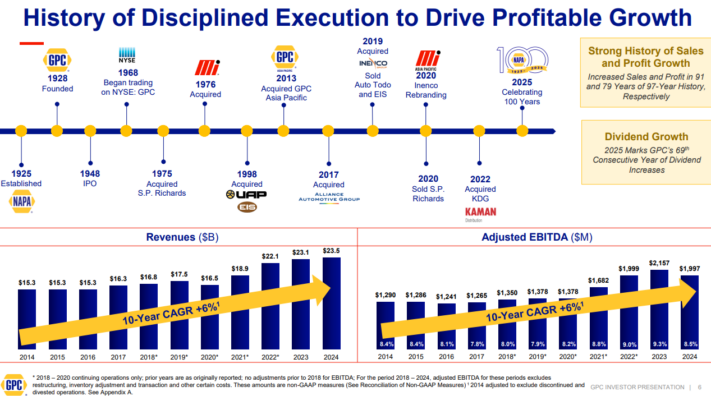

Supply: Investor Presentation

Real Components has a large portion of the $200 billion and rising automotive aftermarket enterprise. One particular means Real Components has captured market share on this area has traditionally been by way of acquisitions.

Real Components regularly acquires smaller firms within the U.S. and worldwide markets to spice up market share in present classes or develop into new areas. All through its historical past, Real Components has made a number of acquisitions.

Supply: Investor Presentation

These acquisitions have helped result in earnings development in every of the final 10 years. For instance, Real Components acquired Alliance Automotive Group for $2 billion. Alliance is a European distributor of auto elements, instruments, and workshop gear.

This was a horny acquisition, as Alliance Automotive holds a prime 3 market share place in Europe’s largest automotive aftermarkets: the U.Ok., France, and Germany. The deal added $1.7 billion of annual income to Real Components, together with extra earnings development potential from value synergies.

In 2018, Real Components agreed to purchase Hennig Fahrzeugteile, a Germany-based provider of elements for gentle and industrial automobiles. The acquisition expanded Real Components’ attain in Europe and in addition gave it additional publicity to the industrial market. Real Components expects the acquired firm to spice up its annual gross sales by $190 million.

Extra lately, Real Components has made a number of acquisitions which might be anticipated to strengthen the corporate’s management place in varied markets. In 2019, Real Components accomplished its acquisition of PartsPoint, a number one distributor of automotive aftermarket elements and equipment primarily based within the Netherlands.

The corporate accomplished its buy of main industrial distributor Inenco in 2019. Inenco has operations in Australia, New Zealand, and Indonesia. Later that month, Real Components introduced it was including Todd Group, a pacesetter within the heavy-duty aftermarket phase in France.

In 2022, the corporate accomplished its $1.3 billion acquisition of Kaman Distribution Group, increasing its portfolio of alternative elements.

Real Components divested its S.P. Richards US operations and its Security Zone and Influence Merchandise operations in 2020. It continues to optimize its portfolio, specializing in its core automotive and industrial elements companies.

Total, Real Components’ a number of acquisitions have clearly contributed to the corporate’s long-term development. The outcomes of Real Components’ development technique communicate for themselves. We anticipate Real Components to generate 8% annual earnings-per-share development over the following 5 years.

Aggressive Benefits & Recession Efficiency

The largest problem dealing with the economic system continues to be provide chain points stemming from the pandemic; nevertheless, because the economic system recovers, Real Components’ outcomes are additionally bettering. So far, Real Components seems to not have been closely impacted by these points.

The opposite risk to bodily retailers is e-commerce competitors, however automotive elements retailers equivalent to NAPA will not be uncovered to this danger. Automotive repairs are sometimes complicated, difficult duties. NAPA is a number one model, thanks partly to its repute for high quality merchandise and repair. It’s precious for purchasers to have the ability to ask inquiries to certified employees, which provides Real Components a aggressive benefit.

Real Components has a management place throughout its companies. All of its working segments characterize the #1 or #2 model in its respective class. This results in a robust model and regular demand from prospects.

Real Components’ earnings-per-share throughout the Nice Recession are under:

2007 earnings-per-share of $2.98

2008 earnings-per-share of $2.92 (2.0% decline)

2009 earnings-per-share of $2.50 (14% decline)

2010 earnings-per-share of $3.00 (20% improve)

Earnings per share declined considerably in 2009, which ought to come as no shock. Customers are inclined to tighten their belts when the economic system enters a downturn.

That mentioned, Real Components remained extremely worthwhile all through the recession and returned to development in 2010 and past. The corporate additionally generated money move throughout the coronavirus pandemic, which allowed it to lift its dividend in 2020.

Given their consumable nature, there has at all times been a sure stage of demand for automotive elements, which provides Real Components’ earnings a excessive ground.

Valuation & Anticipated Returns

Primarily based on our anticipated earnings per share of $7.75 for 2025, Real Components has a price-to-earnings ratio of 16.4. Our honest worth estimate for Real Components is a price-to-earnings ratio of 15.0. Consequently, Real Components seems overvalued these days. A number of contractions may scale back annual returns by 1.8% per 12 months over the following 5 years.

Luckily, Real Components’ complete returns may even embrace earnings development and dividends.

We anticipate Real Components to develop its earnings per share by 8% yearly over the following 5 years. The inventory has a 3.2% present yield, which is considerably increased than the common yield of the S&P 500 Index. Moreover, Real Components raises its dividend every year, together with a 3% improve in 2025. Real Components Firm’s dividend development streak now stands at 69 consecutive years.

Real Components has a extremely sustainable dividend. The corporate has paid a dividend yearly since its preliminary public providing in 1948. The dividend is prone to proceed rising for a few years to come back. That mentioned, buyers also needs to contemplate the affect of valuation relating to a inventory’s complete returns.

In complete, Real Components is predicted to ship an annual complete return of 8.9% by way of 2030.

Ultimate Ideas

Real Components has an extended historical past of regular development, benefiting from the rising demand for automotive elements. The ageing automobile fleet within the U.S. is predicted to proceed rising shifting ahead. Within the meantime, shareholders ought to obtain annual dividend will increase as has been the case for practically seven a long time.

We discover the inventory to be barely overvalued in the present day, that means that now will not be the perfect time to purchase Real Components. Whereas the dividend yield stays strong and the corporate has an extended historical past of dividend development, we charge shares of Real Components as a maintain on account of projected returns.

Further Studying

The next databases of shares include shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.