Up to date on July eighth, 2025 by Nathan Parsh

The Dividend Kings comprise firms which have elevated their dividends for at the very least 50 consecutive years. On account of their unparalleled streak of annual dividend will increase, it is not uncommon to view the Dividend Kings as among the many greatest dividend development shares out there.

You may see the total checklist of all 55 Dividend Kings right here.

We additionally compiled a complete checklist of all Dividend Kings, together with related monetary statistics equivalent to dividend yields and price-to-earnings ratios. You may obtain the total checklist of Dividend Kings by clicking on the hyperlink beneath:

Consolidated Edison (ED) is among the newer additions to the Dividend Kings, having raised its dividend for 51 consecutive years.

Over time, utilities have grow to be relied upon for his or her regular dividend payouts, even throughout recessions. This text will analyze the corporate’s enterprise overview, future development prospects, aggressive benefits, and different key features.

Enterprise Overview

Consolidated Edison is a large-cap utility inventory. The corporate generates greater than $15 billion in annual income and has a market capitalization of roughly $36 billion.

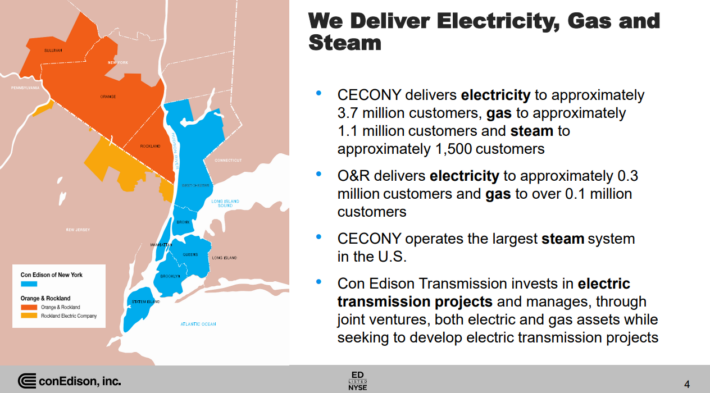

The corporate serves roughly 3.7 million electrical prospects and a further 1.1 million gasoline prospects in New York.

Supply: Investor Presentation

It operates electrical, gasoline, and steam transmission companies, with a steam system that’s the largest within the U.S.

On October 1st, 2022, Consolidated Edison introduced that it was promoting its curiosity in its renewable power enterprise to RWE Renewables Americas, LLC for $6.8 billion. The transaction closed in 2023. On account of this transaction, Consolidated Edison has not issued frequent inventory in every of the final two years. The corporate had sometimes issued shares for financing regularly prior to now.

On Could 2nd, 2025, Consolidated Edison introduced first-quarter outcomes for the interval ending March thirty first, 2025. Throughout the quarter, income elevated 12.1% to $4.8 billion, representing $346 million greater than anticipated.

Adjusted earnings of $792 million, or $2.26 per share, in contrast favorably to adjusted earnings of $742 million, or $2.15 per share, within the earlier yr. Adjusted earnings per share exceeded the analysts’ estimates by $0.07.

As with prior intervals, increased price bases for gasoline and electrical prospects had been the first contributors to leads to the CECONY enterprise, which accounts for the overwhelming majority of the corporate’s belongings.

Common price base balances are anticipated to develop at a median annual price of 8.2% between 2025 and 2029, up from 6.4% beforehand. Consolidated Edison expects capital investments of practically $38 billion through the interval 2025 to 2029.

On its newest convention name, Consolidated Edison reaffirmed its steering for 2025. The corporate expects adjusted earnings per share in a spread of $5.50 to $5.70 for the yr. On the midpoint, the steering implies 3.7% development over 2024.

Development Prospects

Earnings development throughout the utility trade sometimes mimics GDP development. Over the subsequent 5 years, we anticipate Consolidated Edison to develop its earnings per share by 6.0% yearly.

The corporate has guided for a median annual earnings per share development of 5% to 7% from 2025 ranges by 2029. We consider this development is achievable, on condition that share issuances seem to have stopped, coupled with the corporate’s steering in direction of higher-than-expected price balances. We notice that this anticipated earnings development price is above the long-term common price of three.2%.

ConEd ought to generate strong earnings development every year by a mixture of latest buyer acquisitions and price will increase, helped by the gradual enchancment of the U.S. economic system.

The expansion drivers for Consolidated Edison are new prospects and price will increase. One advantage of working in a regulated trade is that utilities are permitted to boost charges regularly, which nearly assures a gradual degree of development.

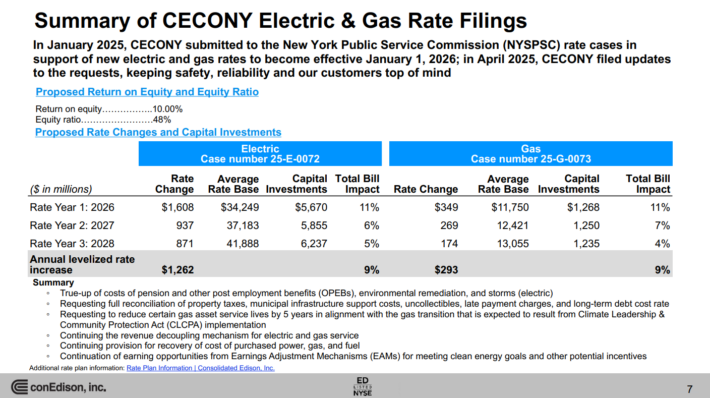

Supply: Investor Presentation

Consolidated Edison anticipates rising its price base by greater than 8% yearly on common by 2029. It is a pure approach for a utility to generate regular income and earnings development.

One potential risk to future development is excessive rates of interest, which may improve the price of capital for firms that make the most of debt, equivalent to utilities.

The Fed has largely maintained rates of interest the place they’re, following decreases, which implies firms with heavy debt hundreds are paying much less to finance their capital wants.

Decrease rates of interest assist firms that rely closely on debt financing, equivalent to utilities, so buyers don’t should be involved about Consolidated Edison in a falling-rate cycle.

Even when charges stay elevated, Consolidated Edison is in robust monetary situation. It has an investment-grade credit standing of A-, and a modest capital construction with balanced debt maturities over the subsequent a number of years.

A wholesome steadiness sheet and robust enterprise mannequin assist present safety for Consolidated Edison’s dividends.

Traders can fairly anticipate low single-digit dividend will increase every year, at a price just like the corporate’s annual adjusted earnings-per-share development.

Aggressive Benefits & Recession Efficiency

Consolidated Edison’s fundamental aggressive benefit is the excessive regulatory hurdles of the utility trade. Electrical energy and gasoline providers are essential and important to society.

Consequently, the trade is extremely regulated, making it nearly not possible for a brand new competitor to enter the market. This offers an excessive amount of certainty to Consolidated Edison.

As well as, the utility enterprise mannequin is extremely recession-resistant. Whereas many firms skilled vital earnings declines in 2008 and 2009, Consolidated Edison carried out comparatively nicely. Earnings per share through the Nice Recession are proven beneath:

2007 earnings-per-share of $3.48

2008 earnings-per-share of $3.36 (3% decline)

2009 earnings-per-share of $3.14 (7% decline)

2010 earnings-per-share of $3.47 (11% improve)

Consolidated Edison’s earnings fell in 2008 and 2009 however recovered in 2010. The corporate nonetheless generated wholesome earnings, even through the worst of the financial downturn.

This resilience allowed Consolidated Edison to proceed elevating its dividend every year.

The identical sample held up in 2020 when the U.S. economic system entered a recession because of the coronavirus pandemic. ConEd has remained extremely worthwhile, with file earnings per share in every of the final three years, which has enabled the corporate to boost its dividend yearly.

Valuation & Anticipated Returns

Utilizing the present share value of roughly $100 and the midpoint of 2025 steering, the inventory trades at a price-to-earnings ratio of 17.9. That is practically according to our truthful worth estimate of 18.0, which is beneath the long-term common P/E of 18.5.

Consequently, Consolidated Edison shares look like pretty valued. If the inventory valuation reaches our truthful worth estimate, the corresponding a number of enlargement would add 0.2 proportion factors to annual returns over the subsequent 5 years.

Luckily, the inventory can nonetheless present optimistic returns to shareholders by earnings development and dividend funds. We anticipate the corporate to develop its earnings per share by 6.0% yearly over the subsequent 5 years.

Moreover, the inventory boasts a present dividend yield of three.4%. Utilities like ConEd are prized for his or her steady dividends and secure payouts.

Placing all of it collectively, Consolidated Edison’s complete anticipated returns may attain 8.9% by 2029. It is a strong price of return, however not excessive sufficient to warrant a purchase advice in the meanwhile.

Earnings buyers might discover the yield enticing, as the present yield is meaningfully increased than the 1.25% yield of the S&P 500 Index and grows very persistently. The corporate has a projected payout ratio of 61%, which is among the lowest payout ratios for ConEd within the final decade, indicating a sustainable dividend. Nonetheless, dividend development has been on the low facet, averaging simply above 2% over each the lengthy and medium phrases.

Nonetheless, we price the inventory a maintain on the present projected price of return.

Ultimate Ideas

Consolidated Edison could be a invaluable holding for earnings buyers, equivalent to retirees, because of its 3.4% dividend yield. The inventory affords safe dividend earnings and can be a Dividend King, which means it’s anticipated to boost its dividend every year.

Subsequently, risk-averse buyers wanting primarily for earnings proper now–equivalent to retirees–may see larger worth in shopping for utility shares like Consolidated Edison. Nonetheless, we price the inventory as a maintain as a result of projected returns.

Further Studying

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.