Printed on August nineteenth, 2025 by Bob Ciura

Traders within the US shouldn’t overlook Canadian shares, a lot of which have excessive dividend yields than their U.S. counterparts.

There are a lot of Canadian dividend shares which have considerably larger yields and decrease valuations than comparable U.S. friends.

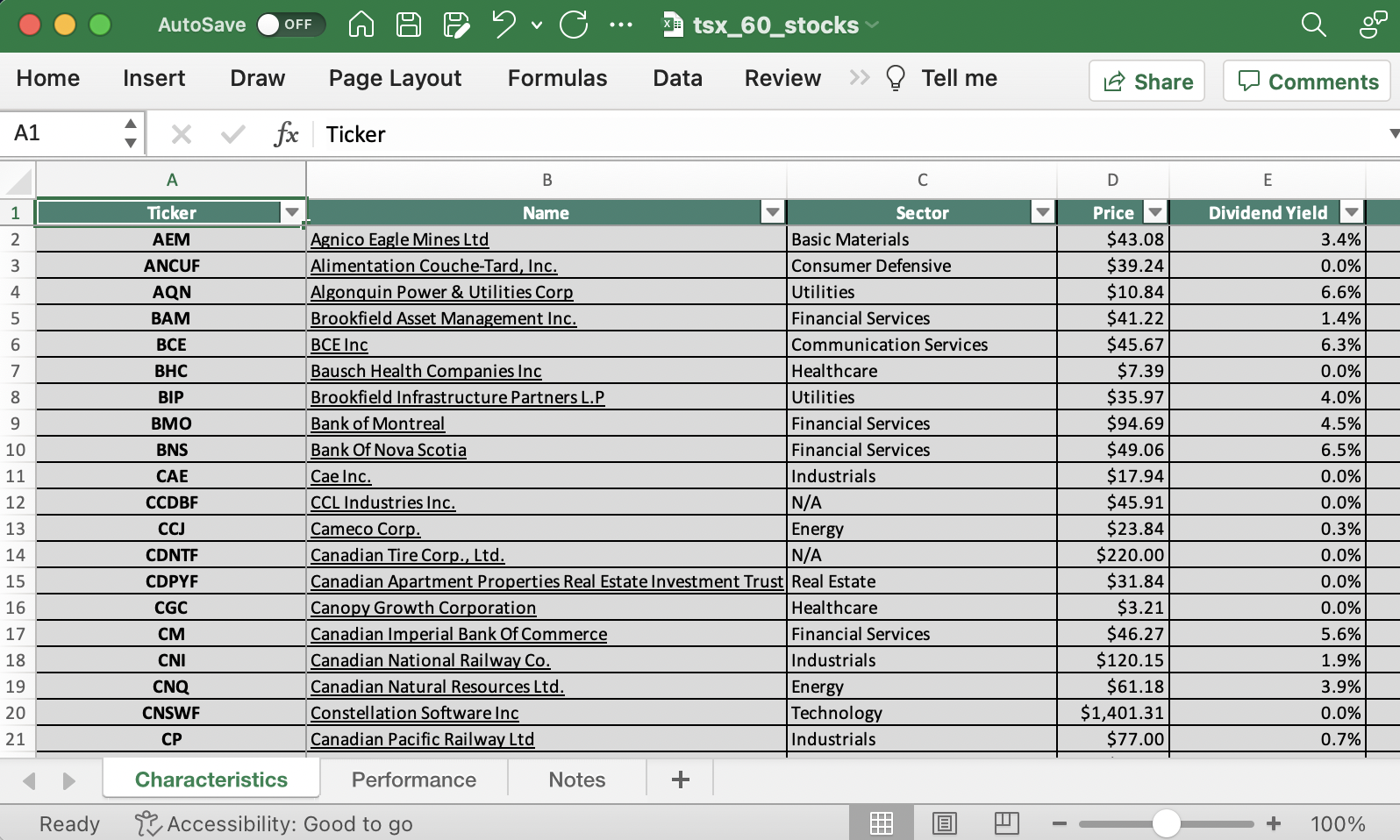

The TSX 60 Index is a inventory market index of the 60 largest firms that commerce on the Toronto Inventory Alternate.

As a result of the Canadian inventory market is closely weighted in the direction of massive monetary establishments and power firms, the TSX is an inexpensive benchmark for Canadian equities efficiency. It’s also an awesome place to search for funding concepts.

You may obtain a database of the businesses throughout the TSX 60 (together with related monetary metrics corresponding to dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

The TSX 60 Shares Record accessible for obtain above incorporates the next data for each safety throughout the index:

Inventory Worth

Dividend Yield

Market Capitalization

Worth-to-Earnings Ratio

All the monetary information within the database are listed in Canadian {dollars}.

Word: Canada imposes a 15% dividend withholding tax on U.S. traders. In lots of instances, investing in Canadian shares by a U.S. retirement account waives the dividend withholding tax from Canada, however test together with your tax preparer or accountant for extra on this challenge.

This text will rank the highest 10 Canadian dividend shares within the Certain Evaluation Analysis Database, ranked by their annual anticipated returns over the following 5 years.

Desk of Contents

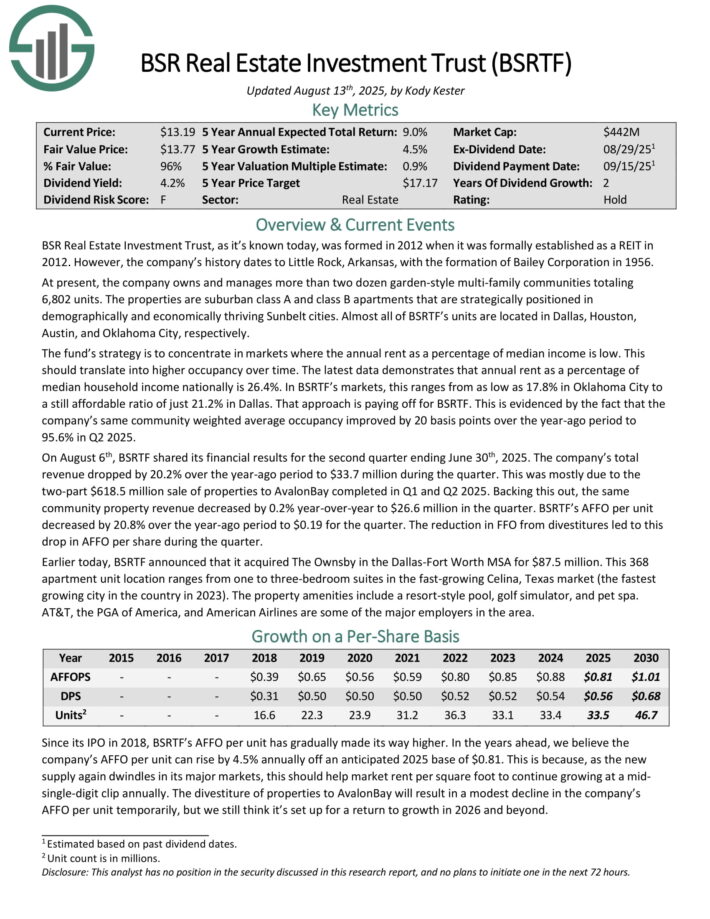

Greatest Canadian Dividend Inventory #10: BSR Actual Property Funding Belief (BSRTF)

Annual Anticipated Returns: 10.6%

BSR Actual Property Funding Belief, because it’s recognized at present, was fashioned in 2012 when it was formally established as a REIT in 2012. At current, the corporate owns and manages greater than two dozen garden-style multi-family communities totaling 6,802 models.

The properties are suburban class A and sophistication B flats which are strategically positioned in demographically and economically thriving Sunbelt cities. Nearly all of BSRTF’s models are situated in Dallas, Houston, Austin, and Oklahoma Metropolis, respectively.

On August sixth, BSRTF shared its monetary outcomes for the second quarter ending June thirtieth, 2025. The corporate’s whole income dropped by 20.2% over the year-ago interval to $33.7 million through the quarter. This was largely because of the two-part $618.5 million sale of properties to AvalonBay accomplished in Q1 and Q2 2025.

Backing this out, the identical group property income decreased by 0.2% year-over-year to $26.6 million within the quarter. BSRTF’s AFFO per unit decreased by 20.8% over the year-ago interval to $0.19 for the quarter. The discount in FFO from divestitures led to this drop in AFFO per share through the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on BSRTF (preview of web page 1 of three proven beneath):

Greatest Canadian Dividend Inventory #9: Solar Life Monetary (SLF)

Annual Anticipated Returns: 10.6%

Solar Life Monetary is a monetary companies firm that provides insurances, wealth administration, group advantages and retirement companies. Solar Life Monetary has divisions that function within the US, in Canada, and in Asia. Solar Life Monetary was based in 1865, is headquartered in Toronto, Canada.

Solar Life Monetary reported its first quarter earnings leads to Could. Solar Life insurance coverage gross sales between the Group and Particular person franchises grew by 13% in comparison with one yr earlier, with particular person gross sales rising by 15% whereas group gross sales rose by 10%. Solar Life Monetary’s property below administration grew by 6% in comparison with one yr earlier.

Solar Life Monetary generated underlying web income of CAD$1.82 on a per-share foundation through the first quarter, which equates to $1.33 as soon as translated to USD. This earnings-per-share outcome was up by double-digits in comparison with the prior yr’s outcome.

Solar Life Monetary managed to generate an underlying return on fairness of 18% (annualized) through the quarter, which was up barely in comparison with the earlier quarter. Solar Life Monetary generated earnings-per-share progress of 5% in Canadian {Dollars} in fiscal 2024 (much less in US {Dollars}).

Click on right here to obtain our most up-to-date Certain Evaluation report on SLF (preview of web page 1 of three proven beneath):

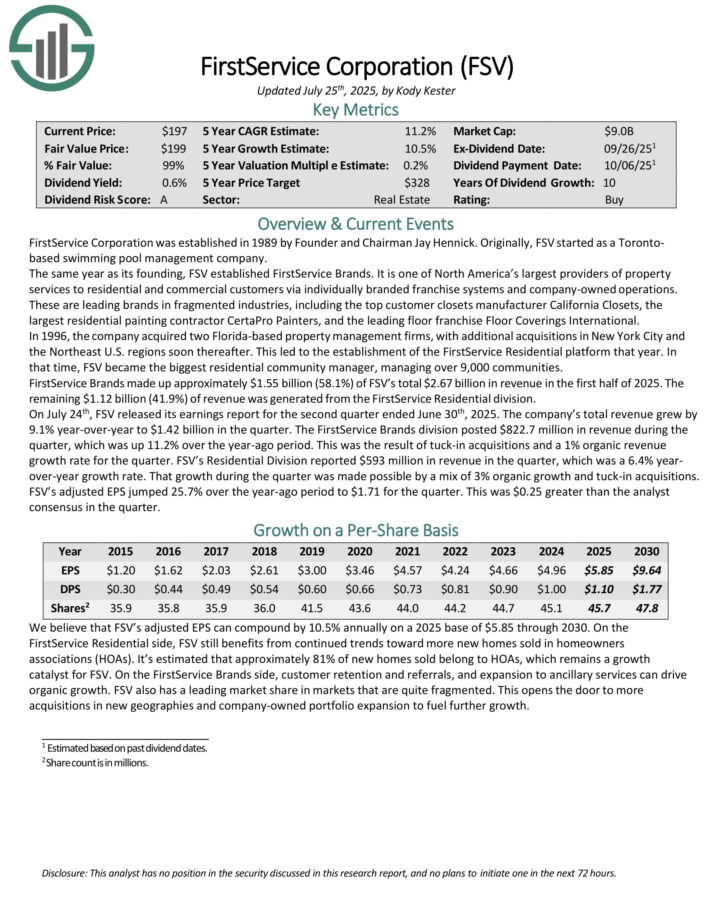

Greatest Canadian Dividend Inventory #8: FirstService Corp. (FSV)

Annual Anticipated Returns: 11.1%

FirstService Company is considered one of North America’s largest suppliers of property companies to residential and business clients by way of individually branded franchise methods and company-owned operations.

These are main manufacturers in fragmented industries, together with the highest buyer closets producer California Closets, the biggest residential portray contractor CertaPro Painters, and the main ground franchise Flooring Coverings Worldwide.

FirstService Manufacturers made up roughly $1.55 billion (58.1%) of FSV’s whole $2.67 billion in income within the first half of 2025. The remaining $1.12 billion (41.9%) of income was generated from the FirstService Residential division.

On July twenty fourth, FSV launched its earnings report for the second quarter ended June thirtieth, 2025. The corporate’s whole income grew by 9.1% year-over-year to $1.42 billion within the quarter. The FirstService Manufacturers division posted $822.7 million in income through the quarter, which was up 11.2% over the year-ago interval.

This was the results of tuck-in acquisitions and a 1% natural income progress charge for the quarter. FSV’s Residential Division reported $593 million in income within the quarter, which was a 6.4% year-over-year progress charge.

That progress through the quarter was made doable by a mixture of 3% natural progress and tuck-in acquisitions. FSV’s adjusted EPS jumped 25.7% over the year-ago interval to $1.71 for the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on FSV (preview of web page 1 of three proven beneath):

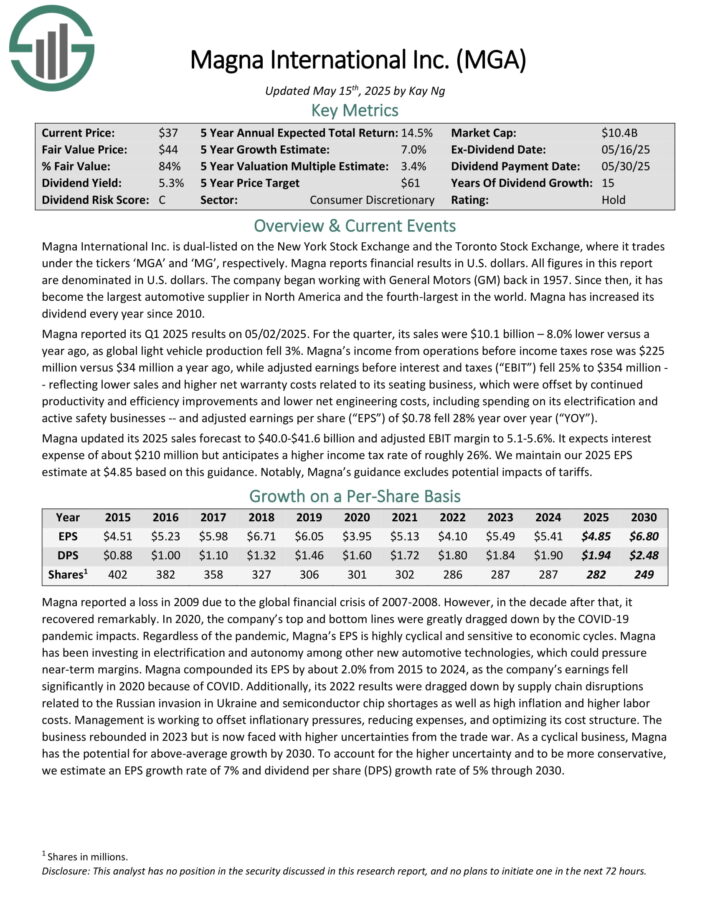

Greatest Canadian Dividend Inventory #7: Magna Worldwide Inc. (MGA)

Annual Anticipated Returns: 11.5%

Magna Worldwide Inc. is dual-listed on the New York Inventory Alternate and the Toronto Inventory Alternate, the place it trades below the tickers ‘MGA’ and ‘MG’, respectively.

It has develop into the biggest automotive provider in North America and the fourth-largest on this planet. Magna has elevated its dividend yearly since 2010.

Magna reported its Q1 2025 outcomes on 05/02/2025. For the quarter, its gross sales have been $10.1 billion – 8.0% decrease versus a yr in the past, as international mild car manufacturing fell 3%. Magna’s revenue from operations earlier than revenue taxes rose was $225 million versus $34 million a yr in the past.

Adjusted earnings earlier than curiosity and taxes (“EBIT”) fell 25% to $354 million — reflecting decrease gross sales and better web guarantee prices associated to its seating enterprise, which have been offset by continued productiveness and effectivity enhancements and decrease web engineering prices, together with spending on its electrification and lively security companies.

Adjusted earnings per share of $0.78 fell 28% year-over-year. Magna up to date its 2025 gross sales forecast to $40.0-$41.6 billion and adjusted EBIT margin to five.1-5.6%.

Click on right here to obtain our most up-to-date Certain Evaluation report on MGA (preview of web page 1 of three proven beneath):

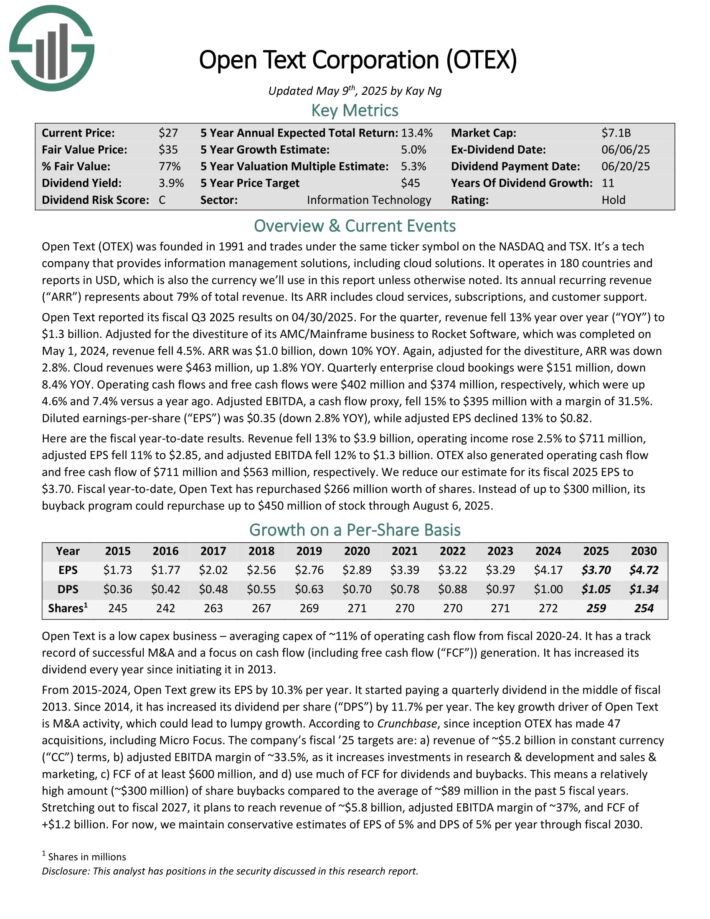

Greatest Canadian Dividend Inventory #6: Open Textual content Corp. (OTEX)

Annual Anticipated Returns: 11.5%

Open Textual content was based in 1991. It gives data administration options, together with cloud options. It operates in 180 nations and its annual recurring income (“ARR”) represents about 79% of whole income.

Its ARR contains cloud companies, subscriptions, and buyer help. Open Textual content reported its fiscal Q3 2025 outcomes on 04/30/2025. For the quarter, income fell 13% year-over-year to $1.3 billion. Adjusted for the divestiture of its AMC/Mainframe enterprise to Rocket Software program, which was accomplished on Could 1, 2024, income fell 4.5%.

ARR was $1.0 billion, down 10% year-over-year. Once more, adjusted for the divestiture, ARR was down 2.8%. Cloud revenues have been $463 million, up 1.8% year-over-year.

Working money flows and free money flows have been $402 million and $374 million, respectively, which have been up 4.6% and seven.4% versus a yr in the past. Adjusted EBITDA, a money circulation proxy, fell 15% to $395 million with a margin of 31.5%.

OTEX additionally generated working money circulation and free money circulation of $711 million and $563 million, respectively.

Click on right here to obtain our most up-to-date Certain Evaluation report on OTEX (preview of web page 1 of three proven beneath):

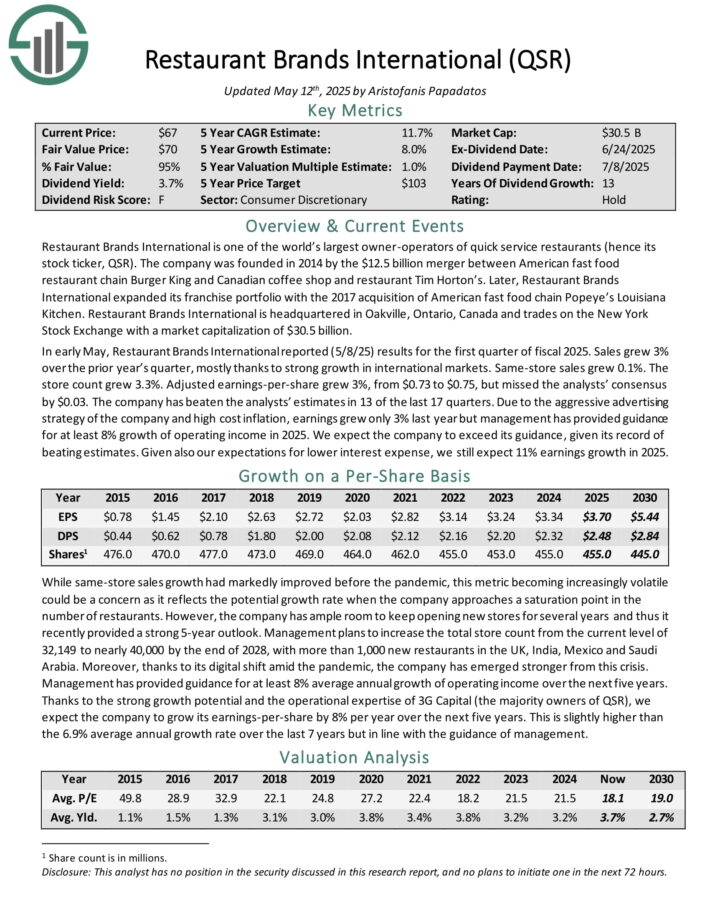

Greatest Canadian Dividend Inventory #5: Restaurant Manufacturers Worldwide (QSR)

Annual Anticipated Returns: 12.1%

Restaurant Manufacturers Worldwide is likely one of the world’s largest owner-operators of fast service eating places. The corporate was based in 2014 by the $12.5 billion merger between American quick meals restaurant chain Burger King and Canadian espresso store and restaurant Tim Horton’s.

Later, Restaurant Manufacturers Worldwide expanded its franchise portfolio with the 2017 acquisition of American quick meals chain Popeye’s Louisiana Kitchen.

In early Could, Restaurant Manufacturers Worldwide reported (5/8/25) outcomes for the primary quarter of fiscal 2025. Gross sales grew 3% over the prior yr’s quarter, largely due to robust progress in worldwide markets. Similar-store gross sales grew 0.1%.

The shop depend grew 3.3%. Adjusted earnings-per-share grew 3%, from $0.73 to $0.75, however missed the analysts’ consensus by $0.03. The corporate has overwhelmed the analysts’ estimates in 13 of the final 17 quarters.

As a result of aggressive promoting technique of the corporate and excessive value inflation, earnings grew solely 3% final yr however administration has offered steering for at the very least 8% progress of working revenue in 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on QSR (preview of web page 1 of three proven beneath):

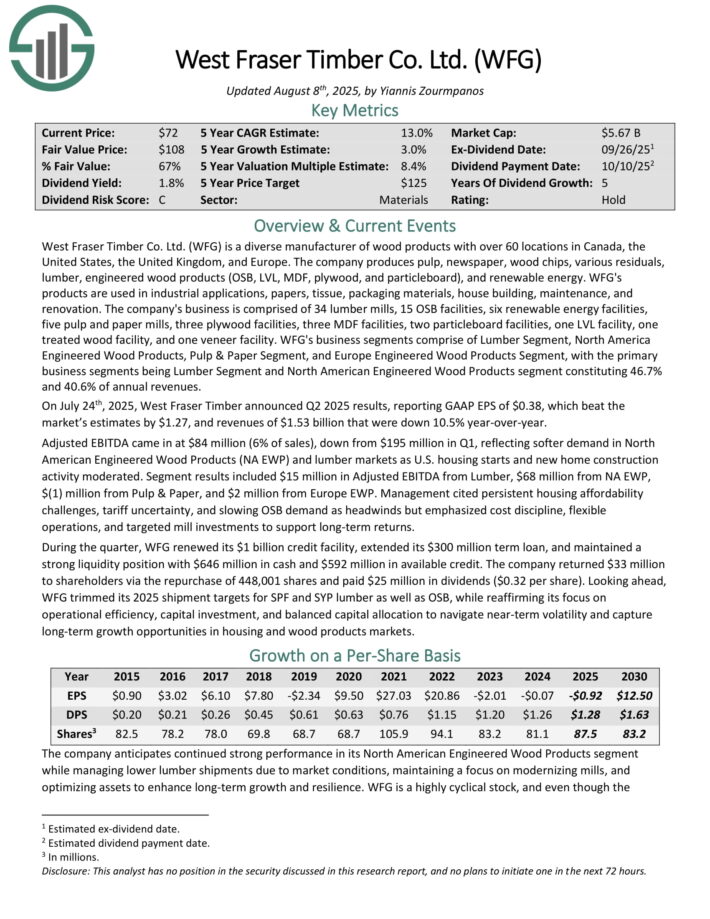

Greatest Canadian Dividend Inventory #4: West Fraser Timber Co. (WFG)

Annual Anticipated Returns: 12.5%

West Fraser Timber is a various producer of wooden merchandise with over 60 areas in Canada, the USA, the UK, and Europe. The corporate produces pulp, newspaper, wooden chips, varied residuals, lumber, engineered wooden merchandise (OSB, LVL, MDF, plywood, and particleboard), and renewable power.

WFG’s merchandise are utilized in industrial purposes, papers, tissue, packaging supplies, home constructing, upkeep, and renovation.

WFG’s enterprise segments comprise of Lumber Phase, North America Engineered Wooden Merchandise, Pulp & Paper Phase, and Europe Engineered Wooden Merchandise Phase, with the first enterprise segments being Lumber Phase and North American Engineered Wooden Merchandise phase constituting 46.7% and 40.6% of annual revenues.

On July twenty fourth, 2025, West Fraser Timber introduced Q2 2025 outcomes, reporting GAAP EPS of $0.38, which beat the market’s estimates by $1.27, and revenues of $1.53 billion that have been down 10.5% year-over-year.

Adjusted EBITDA got here in at $84 million (6% of gross sales), down from $195 million in Q1, reflecting softer demand in North American Engineered Wooden Merchandise (NA EWP) and lumber markets as U.S. housing begins and new residence building exercise moderated.

Click on right here to obtain our most up-to-date Certain Evaluation report on WFG (preview of web page 1 of three proven beneath):

Greatest Canadian Dividend Inventory #3: TFI Worldwide Inc. (TFII)

Annual Anticipated Returns: 14.9%

TFI Worldwide Inc. is a number one North American transportation and logistics firm. The Canada-based firm’s 95-plus working firms and over 26,000 staff present a wide range of transportation and logistics companies to clients.

TFII’s clients function largely within the retail, manufactured items, automotive, constructing supplies, meals and beverage, metals and mining, and companies industries.

Roughly two-thirds of the corporate’s income is generated within the U.S., with the remaining third of income being derived in Canada.

TFII is organized into the next three working segments. The Much less-Than-Truckload phase gives over-the-road and asset-light intermodal LTL companies. Via the primary half of 2025, LTL accounted for the plurality (~41%) of the corporate’s $3.5 billion in whole income earlier than gasoline surcharges.

The Truckload phase provides flatbed, tank, and container companies to clients. The phase additionally carries full masses from the shopper to the vacation spot utilizing a closed van or specialised gear.

Lastly, the Logistics phase gives asset-light logistics companies, corresponding to freight forwarding, transportation administration, and small bundle parcel supply.

On July twenty eighth, TFII shared its earnings report for the second quarter ended June thirtieth, 2025. The corporate’s whole income decreased by 10% over the year-ago interval to $2.04 billion within the quarter. This was as a consequence of diminished volumes stemming from weaker end-market demand through the quarter.

TFII’s adjusted diluted EPS dropped by 21.6% year-over-year to $1.34 for the quarter. That beat the analyst consensus by $0.11 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on TFII (preview of web page 1 of three proven beneath):

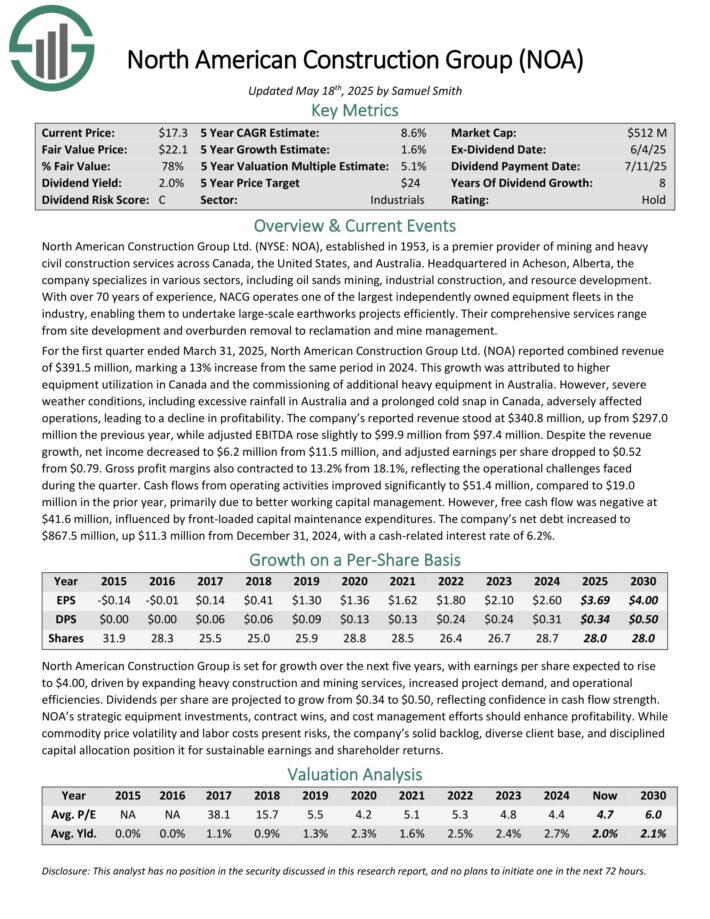

Greatest Canadian Dividend Inventory #2: North American Development Group (NOA)

Annual Anticipated Returns: 15.8%

North American Development Group, established in 1953, is a premier supplier of mining and heavy civil building companies throughout Canada, the USA, and Australia. Headquartered in Acheson, Alberta, the corporate makes a speciality of varied sectors, together with oil sands mining, industrial building, and useful resource improvement.

For the primary quarter ended March 31, 2025, North American Development Group reported mixed income of $391.5 million, marking a 13% enhance from the identical interval in 2024. This progress was attributed to larger gear utilization in Canada and the commissioning of further heavy gear in Australia.

The corporate’s reported income stood at $340.8 million, up from $297.0 million the earlier yr, whereas adjusted EBITDA rose barely to $99.9 million from $97.4 million. Regardless of the income progress, web revenue decreased to $6.2 million from $11.5 million, and adjusted earnings per share dropped to $0.52 from $0.79.

Gross revenue margins additionally contracted to 13.2% from 18.1%, reflecting the operational challenges confronted through the quarter. Money flows from working actions improved considerably to $51.4 million, in comparison with $19.0 million within the prior yr, primarily as a consequence of higher working capital administration.

Click on right here to obtain our most up-to-date Certain Evaluation report on NOA (preview of web page 1 of three proven beneath):

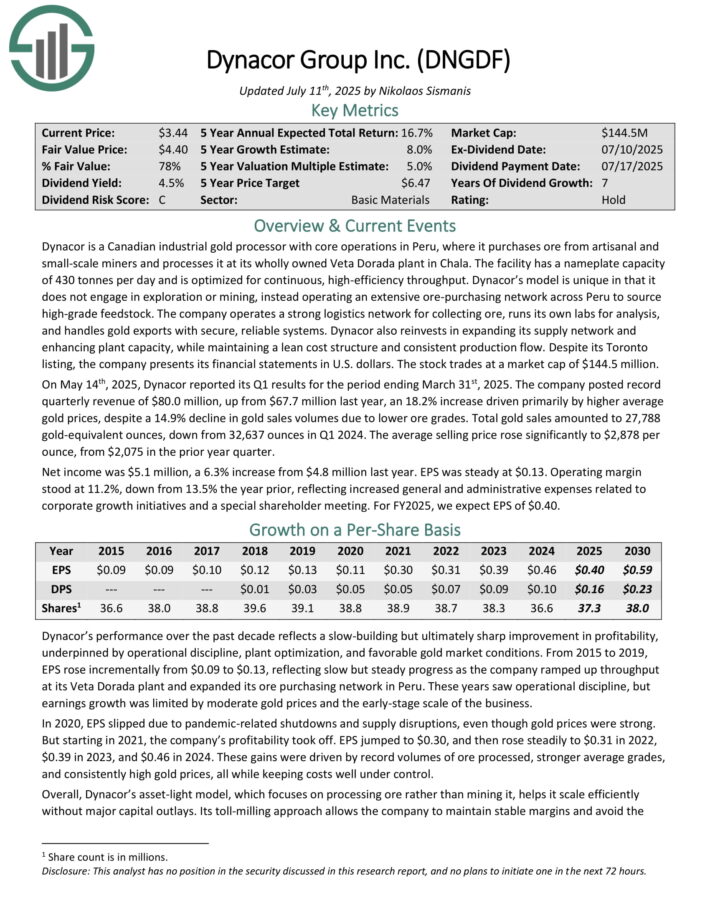

Greatest Canadian Dividend Inventory #1: Dynacor Group Inc. (DNGDF)

Annual Anticipated Returns: 16.6%

Dynacor is a Canadian industrial gold processor with core operations in Peru, the place it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The ability has a nameplate capability of 430 tonnes per day and is optimized for steady, high-efficiency throughput.

Dynacor’s mannequin is exclusive in that it doesn’t interact in exploration or mining, as a substitute working an intensive ore buying community throughout Peru to supply high-grade feedstock.

The corporate operates a robust logistics community for gathering ore, runs its personal labs for evaluation, and handles gold exports with safe, dependable methods.

Dynacor additionally reinvests in increasing its provide community and enhancing plant capability, whereas sustaining a lean value construction and constant manufacturing circulation. Regardless of its Toronto itemizing, the corporate presents its monetary statements in U.S. {dollars}.

On Could 14th, 2025, Dynacor reported its Q1 outcomes for the interval ending March thirty first, 2025. The corporate posted file quarterly income of $80.0 million, up from $67.7 million final yr, an 18.2% enhance pushed primarily by larger common gold costs, regardless of a 14.9% decline in gold gross sales volumes as a consequence of decrease ore grades.

Complete gold gross sales amounted to 27,788 gold-equivalent ounces, down from 32,637 ounces in Q1 2024. The common promoting worth rose considerably to $2,878 per ounce, from $2,075 within the prior yr quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on DNGDF (preview of web page 1 of three proven beneath):

Further Studying

In case you are considering discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources will probably be helpful:

Canadian Dividend Shares

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.