Are markets too assured in a September ? Sure. However are central banks too nervous about one other inflation wave? Additionally, sure, argues James Smith. He’s obtained a bone to choose this week, because the group appears to be like forward to a data-fuelled week in monetary markets

Why Central Banks Are Improper About Inflation

Central banks – or a few of them no less than – appear more and more nervous about one other inflation wave. I’m simply not that satisfied – and let me clarify why.

For context, the most recent batch of Fed minutes revealed rising concern that tariffs – in idea, a one-off worth rise – might feed a a lot longer-lasting bout of inflation. Right here within the UK, the Financial institution of England’s Chief Economist, Huw Tablet, has warned that inflation has a behavior of changing into extra entrenched as soon as headline CPI rises near 4% – a degree that we’re not far-off from proper now.

Likewise, in its latest technique evaluate, the European Central Financial institution spoke of “upside non-linearities” in inflation, a complicated method of reminding us that issues snowballed after the 2022 vitality worth shock in a method that the fashions didn’t predict.

“Central banks are nonetheless haunted by the latest inflation spike”

That, in a nutshell, is the issue. Central banks are nonetheless haunted by the latest inflation spike, which economists all over the place – myself included – didn’t predict.

Officers typically stress that latest expertise has made companies extra prone to increase costs in response to a future value shock and in a extra versatile method than they may have finished prior to now. A change within the inflation mentality, when you like.

The actual lesson, although, of the post-Covid inflation spike (and the Nineteen Seventies for that matter) was that the broader financial context issues enormously. Having a catalyst for costs to rise is one factor. However inflation isn’t going to be long-lasting except companies have the facility to maintain passing on increased prices and staff have the facility to demand increased wages and shield their disposable incomes.

Pricing energy is admittedly fairly onerous to place your finger on. Nevertheless it relies upon rather a lot on the flexibility of shoppers to soak up increased costs. That potential was bolstered massively by governments again within the pandemic. Bear in mind all these US stimulus checks? And within the aftermath of the Ukraine warfare, authorities assist propped up shoppers right here in Europe.

As we speak, not a lot. Not within the US, anyway. President Trump’s tax invoice doesn’t characterize a serious fiscal stimulus, within the sense that the majority of the tax measures merely lengthen what’s already in place.

The roles market story has additionally modified rather a lot for the reason that final inflation wave. That surge coincided with an unprecedented scarcity of staff and a spike in job vacancies. That’s what enabled staff to drive up wage progress, limiting the draw back to their disposable incomes, but in addition prolonging the inflation wave.

As we speak, that job market warmth has solely disappeared. In Britain, actually, the backdrop is wanting grim. The scope for wage progress to amplify an externally pushed inflation shock has diminished significantly.

It’s all properly and good me saying this, after all, however it’s not what I feel that issues. In the meanwhile, central banks are genuinely involved in regards to the danger of inflation taking off once more, and I think buyers could also be underestimating that.

Take the Fed, the place markets are fairly assured the Fed will lower charges in September. For that to occur, the latest remarkably benign pattern in US inflation must proceed – one thing neither we nor the Fed, it appears, thinks we’ll see. Tariffs have been at all times going to hit costs with a lag. And we’re anticipating a spike in subsequent week’s knowledge, in addition to chunky rises by means of the summer time as these tariffs take their full impact on items costs.

That might be massive information for markets. My US colleagues anticipate the to spike as much as 4.75% this quarter, as renewed inflation fears couple with strain on debt issuance. Our FX group suppose the prospect of a September lower being priced out might take again in direction of 1.15 – even when solely quickly.

And short-term is the important thing phrase there. This inflation story needs to be a short-term factor, which suggests every little thing I mentioned earlier nonetheless holds.

A part of the issue proper now could be that companies inflation – the little bit of the inflation basket central banks care most about and tends to be probably the most slow-moving – remains to be fairly elevated. However that ought to begin to change.

UK companies inflation ought to come decrease in subsequent week’s launch, as an illustration. Within the US, weaker shopper demand coupled with falling rents ought to take the warmth out of service-sector inflation because the yr wears on. And when that occurs, the likes of the Fed and BoE needs to be far more assured in getting on with the job of slicing rates of interest.

That’s it for this week, however earlier than you go, why not be part of the 400 folks already signed up for subsequent Wednesday’s dwell webinar on all issues currencies – together with that all-important query: how far can the greenback fall? Join right here

Chart of the Week: US Inflation Has Been Remarkably Benign Regardless of Tariffs

Supply: Macrobond, ING

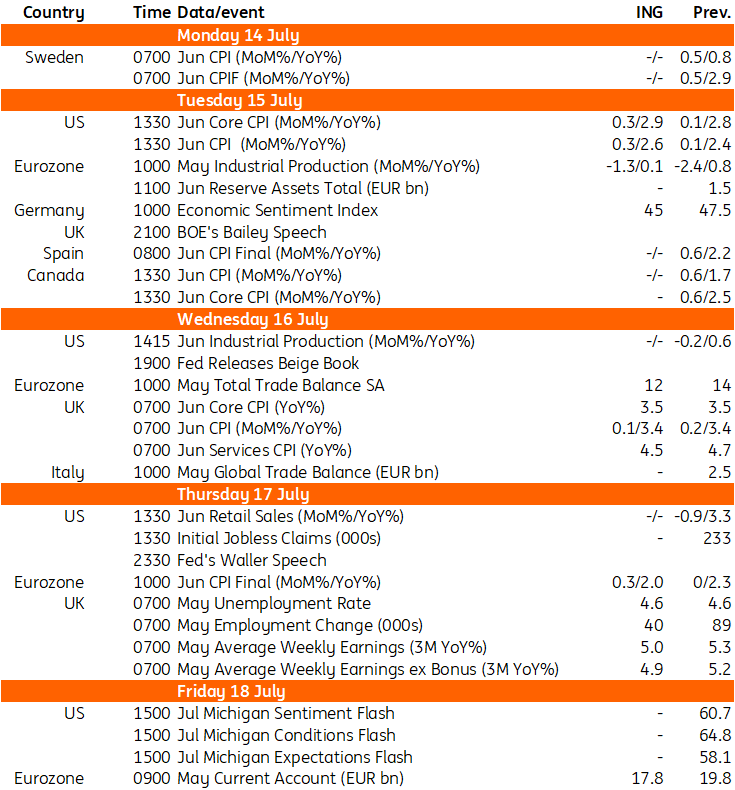

THINK Forward in Developed Markets

United States

Inflation (Tues): has been well-behaved in latest months, posting 0.1% and 0.2% month-on-month readings, however we at all times suspected it might take three months from April/Could earlier than the tariffs present up. Meaning the July, August and September stories are the place we are going to see the extra noticeable influence. We anticipate to speed up in Tuesday’s knowledge.

Eurozone:

Industrial manufacturing (Tue) and commerce of products (Wed): after robust US frontloading-driven progress for each manufacturing and exports within the first quarter, April already noticed declines once more as frontloading results light after “Liberation Day”. For industrial manufacturing, April nonetheless confirmed increased ranges, although, in comparison with the January numbers. Whereas new orders have proven some encouraging indicators of bottoming out, it does appear to be April nonetheless had a front-loading factor driving the extent of manufacturing increased. The large query is whether or not the tariff-pause has brought about one other spherical of frontloading or whether or not manufacturing and exports knowledge have normalised and even reversed on the again of the upper tariff setting in comparison with pre-April 2 ranges. Could knowledge will shed necessary mild on that, additionally as a result of it should give robust course on 2Q figures.

United Kingdom:

Inflation (Weds): Companies inflation is prone to fall again additional, and that ought to give the Financial institution of England the boldness to chop charges once more in August.

Jobs knowledge (Thurs): Unusually, the roles numbers look far more important for markets than inflation subsequent week. Payrolled worker numbers fell at their sharpest price on file (since 2014), outdoors of the pandemic, in Could. That knowledge could properly get revised up subsequent week. But when it doesn’t – and certainly have been June’s knowledge to be equally unhealthy – it might pile the strain on the Financial institution of England to speed up price cuts.

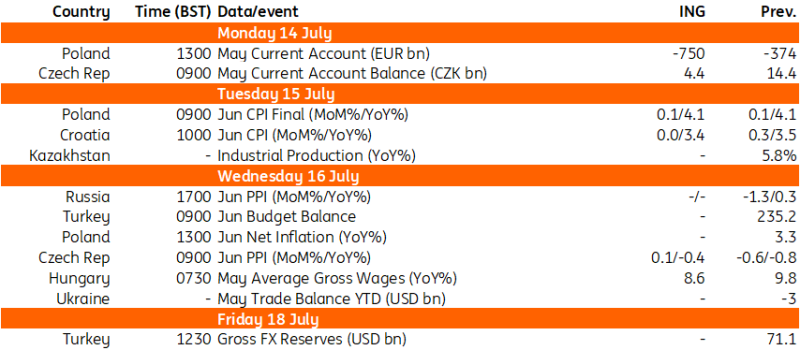

THINK Forward in Central and Jap Europe

Poland

Present account (Mon): Present account deterioration almost certainly slowed in Could. Each exports and imports, in annual phrases, have been negligible, and the commerce deficit was considerably decrease than in Could 2024, when it exceeded €1bn. Consequently, the 12-month rolling present account deficit most likely remained at 0.6% of GDP, broadly unchanged vs. the earlier month. The dimensions of exterior imbalances stays small regardless of weak exports.

CPI (Tue): The StatOffice ought to verify its flash estimate of June CPI inflation at 4.1percentYoY, however a slight upward revision can’t be dominated out as gas costs began rising in direction of the top of the earlier month. Nonetheless, the general inflation outlook stays optimistic and headline ought to average under 3percentYoY in July, giving the Nationwide Financial institution of Poland no different possibility than to proceed coverage price cuts. We see the following transfer in September (no coverage assembly in August) and don’t rule out a 50bps lower.

Czech Republic

Producer costs (Weds): PPI doubtless continued its annual decline in June, given demand from the principle European buying and selling companions stays tepid and competitors is conserving a lid on worth will increase. Nonetheless, the spike in the identical month made the decline much less potent, because it was solely partially compensated by a stronger koruna. The present account stability continued to deteriorate in Could however doubtless remained in a slight surplus.

Key Occasions in Developed Markets Subsequent Week

Supply: Refinitiv, ING

Key Occasions in EMEA Subsequent Week

Supply: Refinitiv, ING

Disclaimer: This publication has been ready by ING solely for data functions regardless of a specific consumer’s means, monetary state of affairs or funding aims. The data doesn’t represent funding suggestion, and neither is it funding, authorized or tax recommendation or a proposal or solicitation to buy or promote any monetary instrument. Learn extra

Unique Put up