Printed on February twenty seventh, 2025 by Bob Ciura

Passive earnings shares make it easier to construct rising earnings for retirement and/or monetary freedom. Passive earnings shares are supposed to be bought as soon as and by no means bought.

The fantastic thing about incomes passive earnings is that it permits traders to generate earnings for doing virtually nothing.

The typical dividend yield within the S&P 500 Index stays low at simply 1.3%. Because of this, earnings traders ought to deal with higher-yielding securities, if they need extra earnings from their inventory portfolios.

With this in thoughts, we compiled a listing of excessive dividend shares with dividend yields above 5%. You may obtain your free copy of the excessive dividend shares record by clicking on the hyperlink under:

This text will focus on 10 passive earnings shares with present yields over 6%.

Importantly, these 10 shares have sturdy aggressive benefits and powerful underlying earnings, which help their dividends.

These 10 passive earnings shares even have dividend payout ratios at or under 70%, which signifies a sustainable dividend proper now.

The ten passive earnings shares are listed under by present dividend yield, in ascending order.

Desk of Contents

You may immediately soar to any particular part of the article through the use of the hyperlinks under:

Passive Revenue Inventory #10: Newtek One Inc. (NEWT)

Newtek One offers monetary and enterprise companies to the small- and medium-sized enterprise market in the US.

What makes NewTek a singular firm is {that a} good portion of its earnings is derived from subsidiaries that present a big selection of enterprise companies to its giant shopper base.

The corporate additionally will get a big quantity of its earnings from being an issuer of SBA (Small Enterprise Administration loans), which solely only a few BDCs are licensed to do. This isn’t your typical BDC that solely generates earnings from rate of interest spreads, but additionally from a a lot wider vary of small enterprise companies.

On November sixth, 2024, Newtek reported its Q3 outcomes for the interval ending September thirtieth, 2024. This was the third quarter of the second 12 months of Newtek reporting as a monetary holding firm following its completion of the Nationwide Financial institution of New York Metropolis acquisition.

For the quarter, the corporate produced a internet earnings of $11.9 million, or $0.45 per share. This compares to internet earnings of $10.9 million, or $0.43 per share, for the prior-year interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on NEWT (preview of web page 1 of three proven under):

Passive Revenue Inventory #9: Verizon Communications (VZ)

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is among the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a few quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On January twenty fourth, 2025, Verizon introduced fourth quarter and full 12 months outcomes. For the quarter, income grew 1.7% to $35.7 billion, which beat estimates by $360 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $1.10 in contrast favorably to $1.08 within the prior 12 months and was in-line with expectations. For the 12 months, grew 0.6% to $134.8 billion whereas adjusted earnings-per-share $4.59 in comparison with $4.71 in 2023.

For the quarter, Verizon had postpaid cellphone internet additions of 568K, which was higher than the 449K internet additions the corporate had in the identical interval final 12 months. Retail postpaid internet additions totaled 426K.

Wi-fi retail postpaid cellphone churn fee stays low at 0.89%. Wi-fi income grew 3.1% to $20.0 billion whereas the Client section elevated 2.2% to $27.6 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven under):

Passive Revenue Inventory #8: Edison Worldwide (EIX)

Edison Worldwide is a renewable power firm that’s lively in power technology and distribution. It additionally operates an power companies and a applied sciences enterprise. The corporate was based in 1987 and is headquartered in Rosemead, CA.

On October 29, 2024, Edison Worldwide reported its monetary outcomes for the third quarter ended September 30, 2024.

The corporate delivered a GAAP internet earnings of $516 million, or $1.33 per diluted share, marking a considerable improve from $155 million, or $0.40 per diluted share, in the identical quarter final 12 months.

On an adjusted foundation, Edison achieved core earnings of $582 million, or $1.51 per diluted share, up from $531 million, or $1.38 per diluted share, in Q3 2023.

Income for the quarter was $5.20 billion, reflecting a ten.61% year-over-year development and surpassing expectations by $192.39 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on Edison Worldwide (EIX) (preview of web page 1 of three proven under):

Passive Revenue Inventory #7: Ford Motor Co. (F)

Ford Motor Firm was first integrated in 1903 and prior to now 120 years, it has grow to be one of many world’s largest automakers. It operates a big financing enterprise in addition to its core manufacturing division, which produces a well-liked assortment of vehicles, vehicles, and SUVs.

Ford posted fourth quarter and full-year earnings on February fifth, 2025, and outcomes have been higher than anticipated. Adjusted earnings-per-share got here to 39 cents, which was seven cents forward of estimates.

Income was up virtually 5% year-over-year for the quarter to $48.2 billion, which additionally beat estimates by $5.37 billion. The fourth quarter was the very best income complete the corporate has ever produced.

Ford Blue elevated 4.2% to $27.3 billion in income for the fourth quarter, beating estimates of $25.9 billion. Mannequin e income was down 13% year-over-year to $1.4 billion, $400 million lower than anticipated.

Ford Professional income was up 5.3% to $16.2 billion, beating estimates for $15.6 billion.

For this 12 months, Ford expects full-year adjusted EBIT of $7 to $8.5 billion, and for adjusted free money movement of $3.5 billion to $4.5 billion, with capex of $8 to $9.5 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on Ford (preview of web page 1 of three proven under):

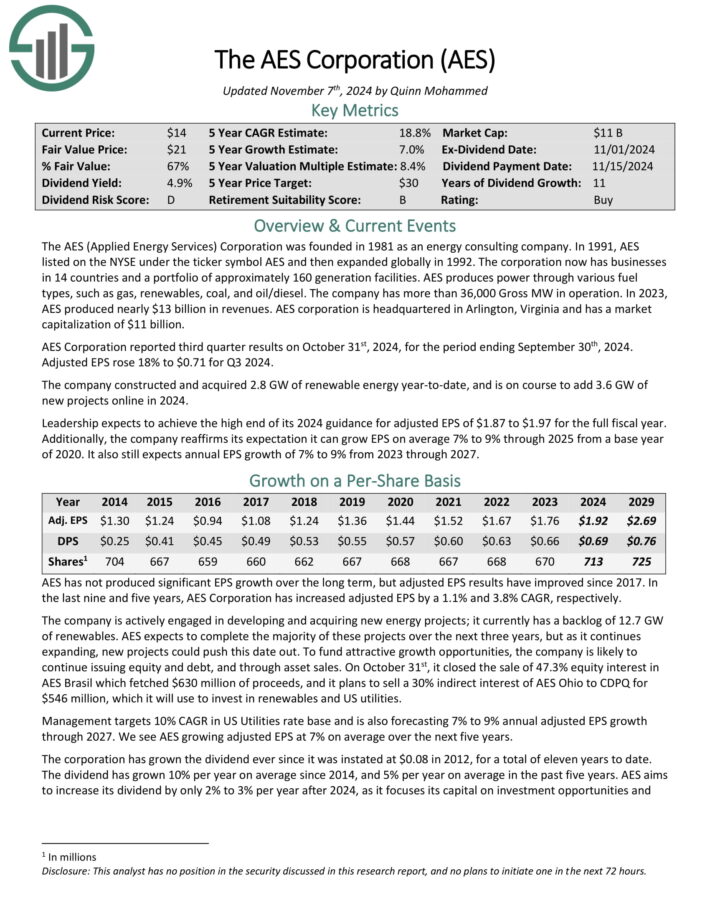

Passive Revenue Inventory #6: AES Corp. (AES)

The AES (Utilized Vitality Companies) Company was based in 1981 as an power consulting firm. It now has companies in 14 international locations and a portfolio of roughly 160 technology services.

AES produces energy by means of numerous gas sorts, reminiscent of gasoline, renewables, coal, and oil/diesel. The corporate has greater than 36,000 Gross MW in operation.

AES Company reported third quarter outcomes on October thirty first, 2024, for the interval ending September thirtieth, 2024. Adjusted EPS rose 18% to $0.71 for Q3 2024.

The corporate constructed and purchased 2.8 GW of renewable power year-to-date, and is on track so as to add 3.6 GW of latest initiatives on-line in 2024.

Supply: Investor Presentation

Management expects to attain the excessive finish of its 2024 steerage for adjusted EPS of $1.87 to $1.97 for the total fiscal 12 months. Moreover, the corporate reaffirms it additionally nonetheless expects annual EPS development of seven% to 9% from 2023 by means of 2027.

The corporate is actively engaged in growing and buying new power initiatives.

It presently has a backlog of 12.7 GW of renewables. AES expects to finish the vast majority of these initiatives by means of 2027.

Click on right here to obtain our most up-to-date Certain Evaluation report on AES (preview of web page 1 of three proven under):

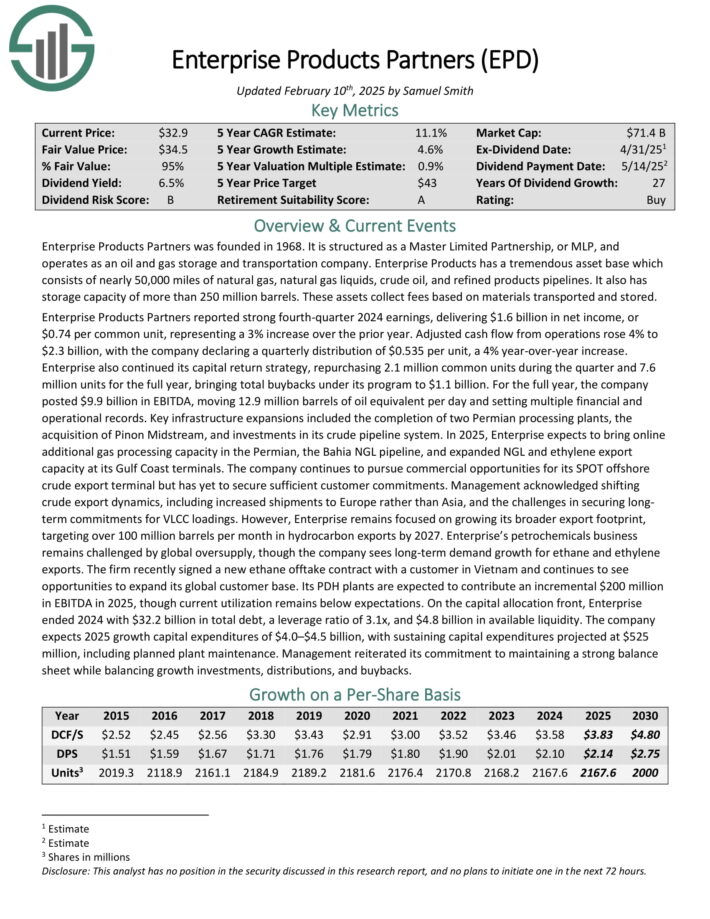

Passive Revenue Inventory #5: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These property acquire charges primarily based on volumes of supplies transported and saved.

Supply: Investor Presentation

Enterprise Merchandise Companions reported robust fourth-quarter 2024 earnings, delivering $1.6 billion in internet earnings, or $0.74 per frequent unit, representing a 3% improve over the prior 12 months.

Adjusted money movement from operations rose 4% to $2.3 billion, with the corporate declaring a quarterly distribution of $0.535 per unit, a 4% year-over-year improve.

Enterprise additionally continued its capital return technique, repurchasing 2.1 million frequent models throughout the quarter and seven.6 million models for the total 12 months, bringing complete buybacks underneath its program to $1.1 billion.

For the total 12 months, the corporate posted $9.9 billion in EBITDA, shifting 12.9 million barrels of oil equal per day.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPD (preview of web page 1 of three proven under):

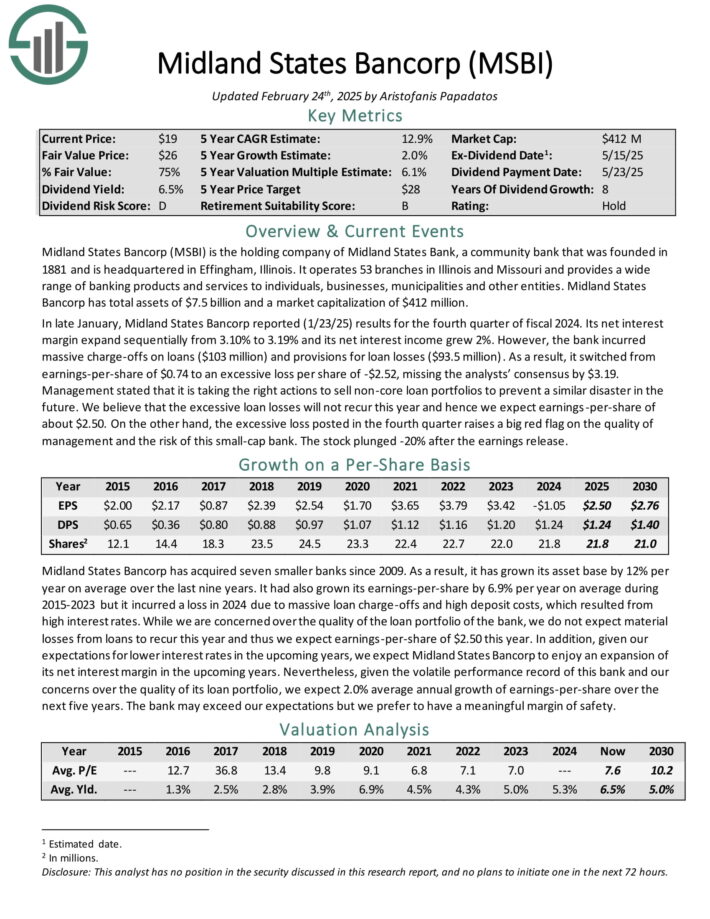

Passive Revenue Inventory #4: Midland States Bancorp (MSBI)

Midland States Bancorp (MSBI) is the holding firm of Midland States Financial institution, a neighborhood financial institution that was based in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and offers a variety of banking services and products to people, companies, municipalities and different entities. Midland States Bancorp has complete property of $7.5 billion.

In late January, Midland States Bancorp reported (1/23/25) outcomes for the fourth quarter of fiscal 2024. Its internet curiosity margin broaden sequentially from 3.10% to three.19% and its internet curiosity earnings grew 2%.

Nevertheless, the financial institution incurred large charge-offs on loans ($103 million) and provisions for mortgage losses ($93.5 million).

Because of this, it switched from earnings-per-share of $0.74 to an extreme loss per share of -$2.52, lacking the analysts’ consensus by $3.19.

Midland States Bancorp has acquired seven smaller banks since 2009. Because of this, it grew its asset base by 12% per 12 months on common over the past 9 years.

It had additionally grown its earnings-per-share by 6.9% per 12 months on common throughout 2015-2023 but it surely incurred a loss in 2024 resulting from large mortgage charge-offs and excessive deposit prices, which resulted from excessive rates of interest.

Click on right here to obtain our most up-to-date Certain Evaluation report on MSBI (preview of web page 1 of three proven under):

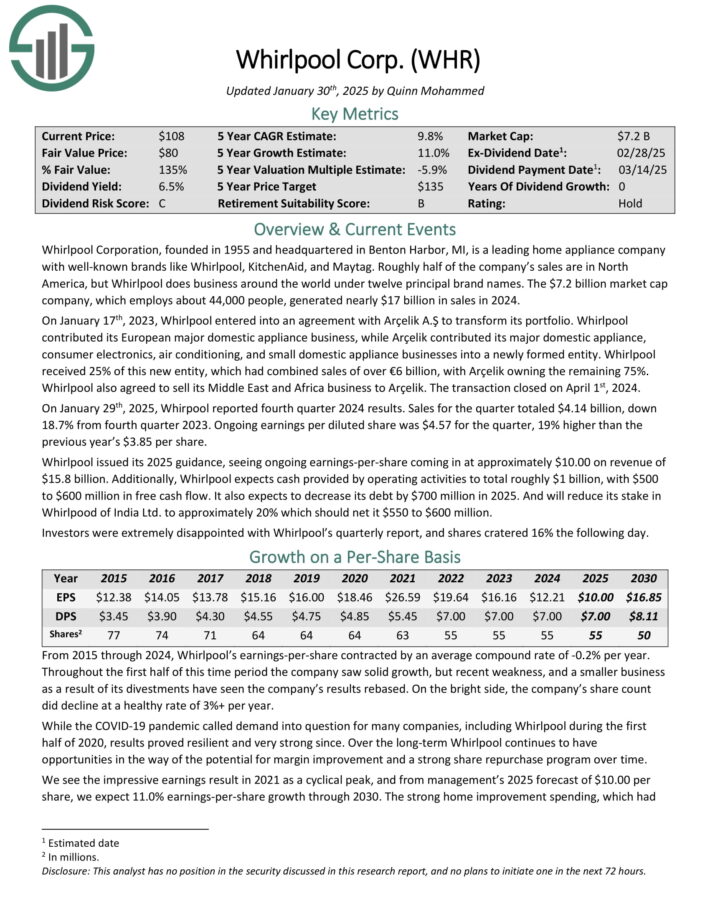

Passive Revenue Inventory #3: Whirlpool Corp. (WHR)

Whirlpool Company, based in 1955 and headquartered in Benton Harbor, MI, is a number one house equipment firm with high manufacturers Whirlpool, KitchenAid, and Maytag.

Roughly half of the corporate’s gross sales are in North America, however Whirlpool does enterprise all over the world underneath twelve principal model names. The corporate, which employs about 44,000 folks, generated almost $17 billion in gross sales in 2024.

Supply: Investor Presentation

On January twenty ninth, 2025, Whirpool reported fourth quarter 2024 outcomes. Gross sales for the quarter totaled $4.14 billion, down 18.7% from fourth quarter 2023.

Ongoing earnings per diluted share was $4.57 for the quarter, 19% larger than the earlier 12 months’s $3.85 per share.

Whirlpool issued its 2025 steerage, seeing ongoing earnings-per-share coming in at roughly $10.00 on income of $15.8 billion.

Moreover, Whirlpool expects money supplied by working actions to complete roughly $1 billion, with $500 to $600 million in free money movement.

Click on right here to obtain our most up-to-date Certain Evaluation report on WHR (preview of web page 1 of three proven under):

Passive Revenue Inventory #2: MPLX LP (MPLX)

MPLX LP is a Grasp Restricted Partnership that was shaped by the Marathon Petroleum Company (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The enterprise operates in two segments:

Logistics and Storage, which pertains to crude oil and refined petroleum merchandise

Gathering and Processing, which pertains to pure gasoline and pure gasoline liquids (NGLs)

In early February, MPLX reported (2/4/25) monetary outcomes for the fourth quarter of fiscal 2024. Adjusted EBITDA and distributable money movement (DCF) per share grew 9% and seven%, respectively, primarily due to larger tariff charges and elevated volumes of liquids and gasoline.

MPLX maintained a wholesome consolidated debt to adjusted EBITDA ratio of three.1x and a stable distribution protection ratio of 1.5x.

Click on right here to obtain our most up-to-date Certain Evaluation report on MPLX (preview of web page 1 of three proven under):

Passive Revenue Inventory #1: Western Union Firm (WU)

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 international locations.

About 90% of brokers are exterior of the US. Western Union operates two enterprise segments, Client-to-Client (C2C) and Different (invoice funds within the US and Argentina).

Western Union reported combined This fall 2024 outcomes on February 4th, 2025. Income elevated 1% and diluted GAAP earnings per share elevated to $1.14 within the quarter, in comparison with $0.35 within the prior 12 months on larger income and a $0.75 tax profit on reorganizing the worldwide operations.

Income rose, regardless of challenges in Iraq on larger Banded Digital transactions and Client Companies volumes.

CMT income fell 4% year-over-year even with 3% larger transaction volumes. Branded Digital Cash Switch CMT revenues elevated 7% as transactions rose 13%. Digital income is now 25% of complete CMT income and 32% of transactions.

Client Companies income rose 56% on new merchandise and growth of retail international change choices. The agency launched a media community enterprise, expanded retail international change, and grew retail cash orders.

Click on right here to obtain our most up-to-date Certain Evaluation report on WU (preview of web page 1 of three proven under):

Last Ideas & Further Studying

If you’re concerned with discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.