The AIER On a regular basis Worth Index (EPI) rose 0.29 % to 297.6 in September 2025, marking its tenth consecutive month-to-month improve and bringing the year-to-date change to roughly 3.2 %. Out of the 24 parts, 15 classes posted value will increase, one was unchanged, and eight declined. The strongest positive factors got here from gardening and lawncare companies, motor gasoline, and intracity transportation, reflecting each seasonal and energy-related pressures. Offsetting these, essentially the most notable value declines occurred in nonprescription medication, admissions to motion pictures, theaters, and concert events, and housing fuels and utilities, indicating modest reduction in choose client necessities.

AIER On a regular basis Worth Index vs. US Client Worth Index (NSA, 1987 = 100)

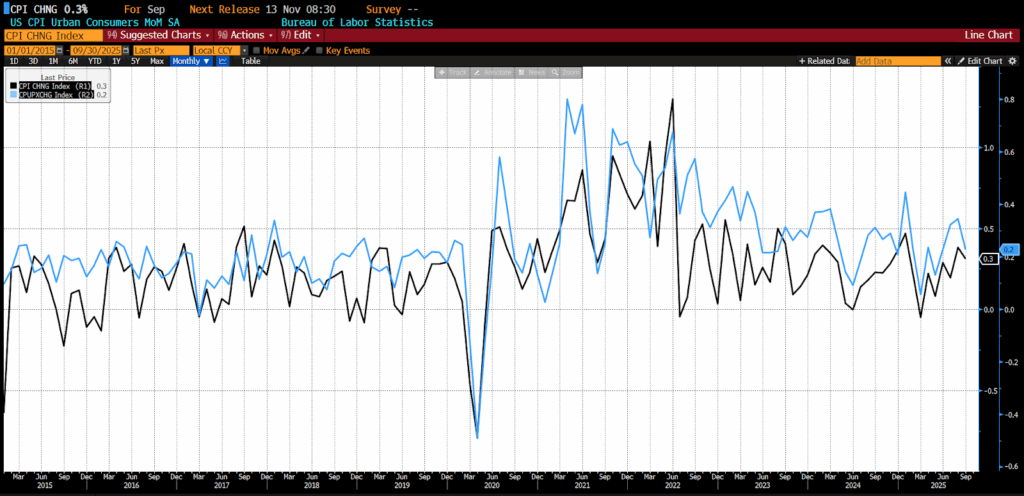

Additionally on October 24, 2025, the US Bureau of Labor Statistics (BLS) launched its September 2025 Client Worth Index (CPI) information. The month-to-month headline CPI rose 0.3 % whereas the core month-to-month CPI quantity elevated by 0.2 %, each of which had been decrease than forecasts by 0.1 %.

September 2025 US CPI headline and core month-over-month (2015 – current)

In September 2025, the meals index rose 0.2 % following a 0.5 % improve in August, with meals at dwelling costs climbing 0.3 % as 4 of six main grocery classes posted positive factors, together with different meals at dwelling (0.5 %), cereals and bakery merchandise (0.7 %), nonalcoholic drinks (0.7 %), and meats, poultry, fish, and eggs (0.3 %), whereas dairy merchandise declined 0.5 % and vegetables and fruit remained unchanged, and meals away from dwelling elevated a modest 0.1 %. Power prices surged 1.5 % in September, accelerating from August’s 0.7 % rise, pushed primarily by gasoline costs that jumped 4.1 %, whereas electrical energy fell 0.5 % and pure gasoline dropped 1.2 %.

Core inflation, excluding meals and power, moderated to 0.2 % in September from 0.3 % in every of the earlier two months, with shelter prices rising 0.2 % as homeowners’ equal hire posted its smallest month-to-month acquire (0.1 %) since January 2021.

Additionally within the core numbers, transportation prices had been blended, with airline fares rising 2.7 % and new autos rising 0.2 % as motorcar insurance coverage and used vehicles and vehicles each declined 0.4 %. Different notable modifications included recreation and family furnishings every rising 0.4 %, attire gaining 0.7 %, private care up 0.4 %, and communication falling 0.2 %. Medical care prices elevated 0.2 % general, with hospital companies and pharmaceuticals every rising 0.3 %, offsetting declines in dental companies (down 0.6 %), and physicians’ companies (down 0.1 %).

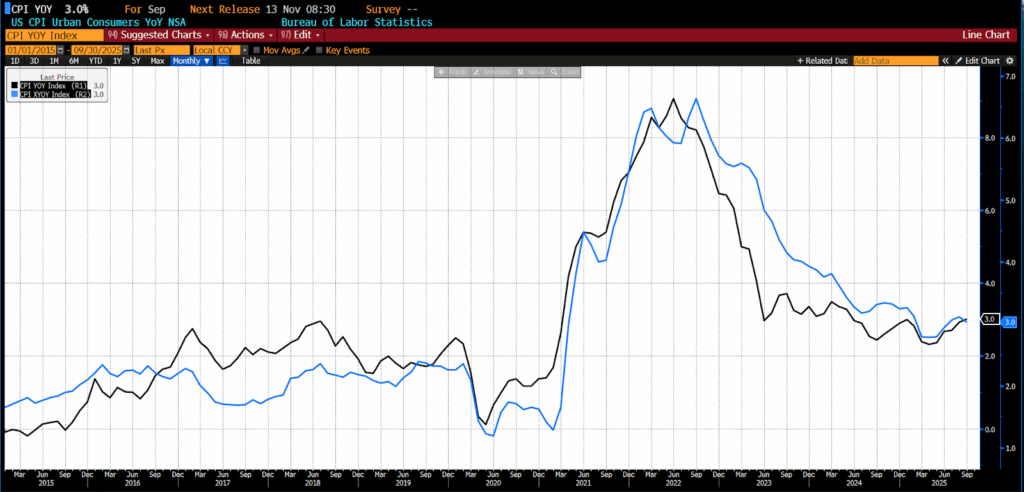

Monitoring modifications over the earlier 12 months, each the headline and core Client Worth Indices rose 3.1 %, barely increased than the three.0 % rise that was projected for each.

September 2025 US CPI headline and core year-over-year (2015 – current)

Over the 12 months ending in September, general meals costs elevated 2.7 %, with grocery costs holding regular from August whereas dining-out prices accelerated to a 3.7 % annual tempo. Inside meals classes, meats, poultry, fish, and eggs climbed 5.2 %, and nonalcoholic drinks rose 5.3 %, whereas “different meals at dwelling” superior 1.9 % and cereals and bakery items had been up 1.6 %. Power costs rose 2.8 % over the yr, led by steep positive factors in electrical energy (5.1 %) and pure gasoline (11.7 %), although gasoline edged 0.5 % decrease. Full-service restaurant meals rose 4.2 % in contrast with 3.2 % for limited-service meals, whereas vegetables and fruit gained 1.3 % and dairy costs had been up a modest 0.7 %.

Core CPI, which excludes meals and power, elevated 3.0 % year-over-year, pushed primarily by shelter prices, which superior 3.6 %. Different notable contributors included family furnishings and operations (4.1 %), used vehicles and vehicles (5.1 %), medical care (3.3 %), and recreation (3.0 %). These figures spotlight that whereas items inflation has moderated, companies and housing stay the important thing sources of upward value stress throughout the core index.

The September 2025’s Client Worth Index report delivered information of a welcome moderation in inflation, marking the slowest tempo of underlying value development in three months. Core CPI was restrained by a cooling in shelter prices — the smallest improve in homeowners’ equal hire since early 2021. Broader value actions had been equally tame: items inflation eased on cheaper used vehicles and slower positive factors in family furnishings, whereas companies inflation was capped by softening rents and airfare prices. Of observe, the information launch was delayed by the continuing federal shutdown and assembled primarily to make sure the Social Safety Administration may calculate its 2.8 % cost-of-living adjustment for subsequent yr.

For policymakers on the Federal Reserve, the report reinforces confidence that value pressures are persevering with to chill with out threatening broader financial stability. The slower tempo of inflation, notably throughout shelter and core companies, successfully seals the case for a 25-basis-point fee reduce on the late-October Federal Open Market Committee assembly and strengthens the probability of one other in December. The quick monetary market response mirrored that view: Treasury yields, and the greenback slipped, whereas inventory futures superior. Regardless of persistent tariff publicity — notably in classes like attire and family items — the general pass-through to customers stays modest. Estimates recommend corporations handed by roughly 26 cents of each greenback in new tariff prices, underscoring how aggressive pressures and slowing demand are muting inflation’s attain.

Nonetheless, the information paint a nuanced image beneath the headline calm. Measures of inflation breadth present that whereas fewer gadgets posted outsized will increase, almost half of core CPI parts proceed to rise at an annualized fee above 4 %, signaling lingering whereas narrowing stickiness. The first concern now will not be a lot inflation’s course however information continuity: with the federal government nonetheless shuttered, the Bureau of Labor Statistics has suspended most information assortment, casting doubt on the discharge and accuracy of upcoming CPI reviews. For the second, although, September’s figures supply reassurance that inflation is on a slower glide path — sufficient to justify the Fed’s easing bias however not but comfortable sufficient to rule out renewed vigilance if tariff or provide shocks reemerge over the subsequent a number of months.