Introduction

Medicaid, Title XIX of the Social Safety Act, is a joint federal-state program that funds well being care to the poor.[1] When it was first signed into regulation, Medicaid eligibility was restricted to low-income kids, pregnant ladies, mother and father of dependent kids, the aged, and other people with disabilities. Within the sixty years because the program was enacted, nonetheless, it has strayed from its mission of offering healthcare for probably the most weak and has grow to be a steppingstone towards common government-run medical insurance.

This explainer will define how Medicaid capabilities, this system’s prices, its affect on healthcare in america, and the way the proposed coverage modifications in 2025 may reshape this system.

How Does Medicaid Work?

Medicaid is split into two teams: conventional Medicaid and the Medicaid Enlargement group. Earlier than discussing the variations between the 2, it’s vital to grasp that there are strings connected. For a state to take part in Medicaid (both conventional or enlargement), the federal authorities requires that state to offer Medicaid protection for sure eligibility teams, together with[2]:

Sure low-income households, together with mother and father, that meet the monetary necessities of the previous Assist to Households with Dependent Kids (AFDC) money help program;

Pregnant ladies with annual earnings at or under 133% of the Federal Poverty Degree (FPL);

Kids with household earnings at or under 133% of FP;

Aged, blind, or disabled people who obtain money help below the Supplemental Safety Earnings (SSI) program;

Kids receiving foster care, adoption help, or kinship guardianship help below the Social Safety Act (SSA) Title IV–E;

Sure former foster care youth;

People eligible for the Certified Medicare Beneficiary program; and

Sure teams of authorized everlasting resident immigrants.

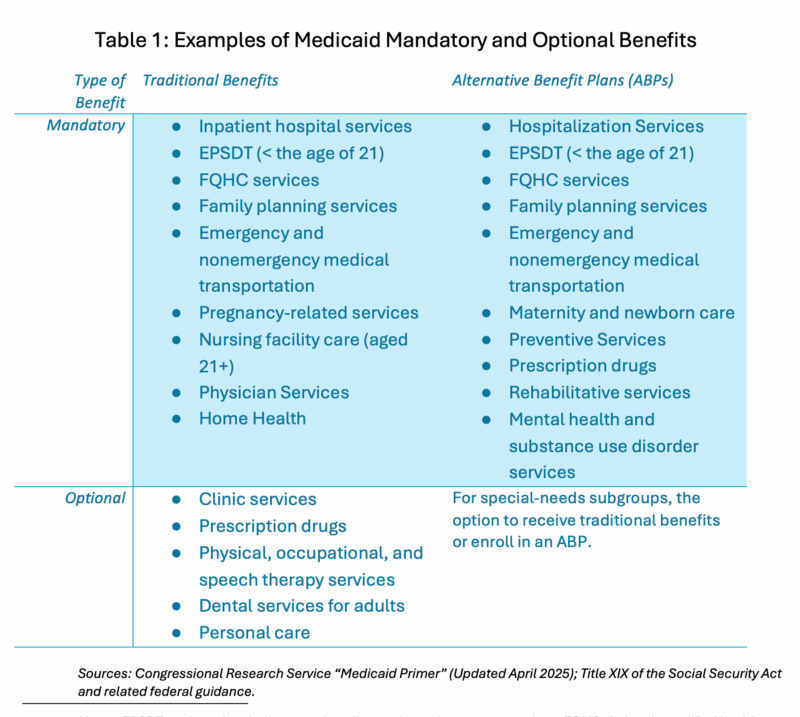

Federal regulation offers two major profit packages for state Medicaid applications: conventional advantages and different profit plans (ABPs). These profit classes (taken from the Congressional Analysis Service) are recreated in Desk 1. States even have some flexibility by means of Medicaid program waivers, which permit them to be exempt from sure federal necessities. These embrace analysis and demonstration tasks (Part 1115), managed care/freedom of selection applications (Part 1915(b)), and residential and community-based companies (Part 1915(c)). To obtain a waiver, a state should meet federal financing necessities corresponding to funds neutrality, cost-effectiveness, or cost-neutrality.[3]

It’s also vital to notice that Medicaid spending is usually lumped in with the Kids’s Well being Insurance coverage Program (CHIP) and related federal subsidies created below the Affected person Safety and Inexpensive Care Act (Inexpensive Care Act or ACA). The CHIP program offers well being protection to eligible kids in households with incomes above the Medicaid threshold, both by means of Medicaid or separate state applications. The federal subsidies created below the ACA embrace premium tax credit (which subsidize the price of an insurance coverage premium) and cost-sharing reductions (lowering out-of-pocket prices corresponding to deductibles, copays, and coinsurance) for many who buy medical insurance by means of a government-created healthcare market.

Conventional Medicaid

Conventional Medicaid covers each major and acute care in addition to long-term companies and helps (corresponding to look after disabled adults and people with power diseases). Eligibility is proscribed to low-income kids, pregnant ladies, mother and father of dependent kids, the aged, and other people with disabilities. On this program, states are assured federal matching {dollars} with out a cap for certified companies, based mostly on a method that matches at the least 50 p.c of state spending. The portion of the federal authorities’s share of most Medicaid expenditures is called the Federal Medical Help Share (FMAP). This matching fee will increase as state per-capita earnings decreases.

Underneath conventional Medicaid, states outline the particular options of every coated profit inside 4 broad federal pointers:

Every service have to be enough in quantity, period, and scope to moderately obtain its goal. States could place applicable limits on a service based mostly on such standards as medical necessity.

Inside a state, companies obtainable to the varied inhabitants teams have to be equal in quantity, period, and scope (the comparability rule).

With sure exceptions, the quantity, period, and scope of advantages have to be the identical statewide (the statewideness rule).

With sure exceptions, enrollees will need to have freedom of selection amongst well being care suppliers.[4]

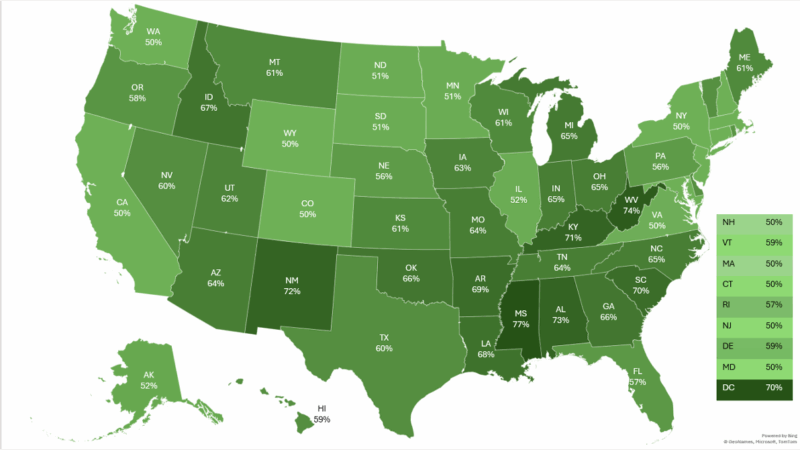

Waiting for FY 2026 (October 1, 2025 – September 30, 2026), the federal matching charges for state funds are anticipated to vary from 50 p.c (the necessary minimal matching fee) to just about 77 p.c.[5] Determine 1 reveals the federal Medicaid FMAP matching fee for every state.

Determine 1: Federal FMAP Percentages, FY 2026

Sources: KFF estimates of elevated FY 2026 FMAPs based mostly on Federal Register, November 29, 2024 (Vol 89, No. 230), pp 94742-94746.

Be aware: Estimates are rounded to the closest complete quantity.

The Medicaid Enlargement Group

Underneath the Inexpensive Care Act (ACA), states had the choice to increase Medicaid to non-elderly adults with earnings as much as 133 p.c of the Federal Poverty Degree. When states had been initially allowed to increase Medicaid beginning January 1, 2014, the federal authorities promised to cowl 100% of Medicaid enlargement prices to encourage states to take part. With this promise of a “free lunch,” many states rushed to increase Medicaid, sharply rising enrollment. By 2020, nonetheless, the federal match fee for the enlargement program was lowered to 90 p.c. Consequently, states needed to improve their very own Medicaid spending, on common, $26.7 billion from 2017 to 2022 from their very own sources.

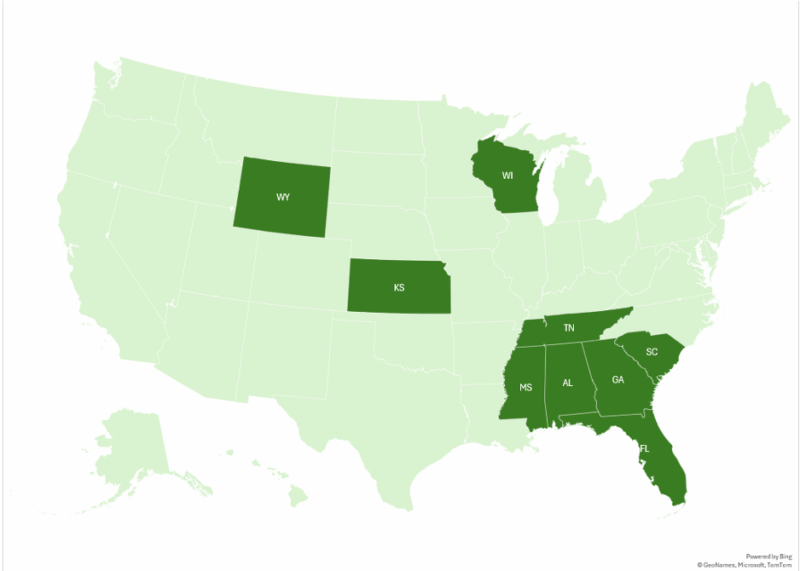

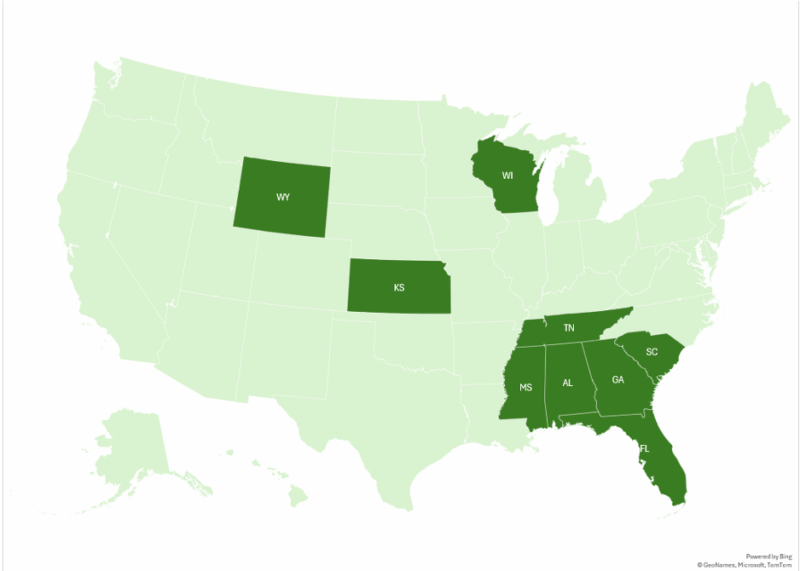

As of 2025, all however 10 states have expanded Medicaid.[6] These states are proven in Determine 2.

Determine 2: States that Have Not Expanded Medicaid as of 2025

Sources: KFF monitoring and evaluation of state actions associated to adoption of the ACA Medicaid enlargement and Searing, Adam. “Federal Funding Cuts to Medicaid Might Set off Computerized Lack of Well being Protection for Thousands and thousands of Residents of Sure States.” Say Ahhh! Georgetown Heart for Kids and Households, November 27, 2024

How A lot Does Medicaid Value? Who Pays?

Provided that Medicaid is a joint federal and state program, it is very important look at the prices of Medicaid on the federal and state ranges. On the federal stage, Medicaid, the Kids’s Well being Insurance coverage Program (CHIP), and different healthcare market subsidies enacted by the ACA value $759 billion in FY 2024. Put one other approach, for each greenback the federal authorities spent, eleven cents of that greenback went to Medicaid, CHIP, and the ACA subsidies.[7]

On the state stage, Medicaid accounts for about 30 p.c of complete state spending (capital inclusive) and is the only largest expenditure in all state budgets. For each greenback the typical state spends, thirty cents go to Medicaid—solely ten cents come from state income whereas the remaining 20 cents come from federal transfers.[8]

Though Medicaid was designed to be a “joint” funding program, state policymakers have discovered methods to get the federal authorities to cowl the lion’s share of Medicaid spending. This displays the incentives elected officers face: utilizing accounting gimmicks to supply extra beneficiant Medicaid spending whereas passing the price to federal taxpayers may help them win reelection.

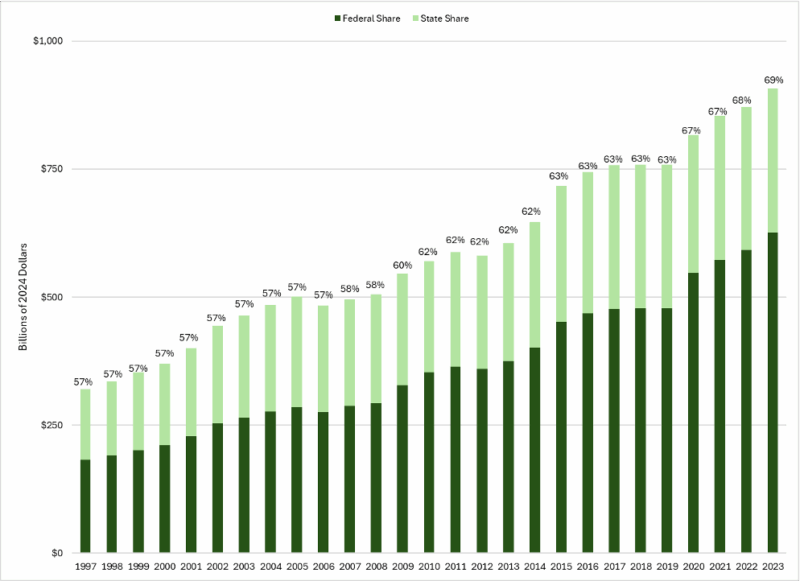

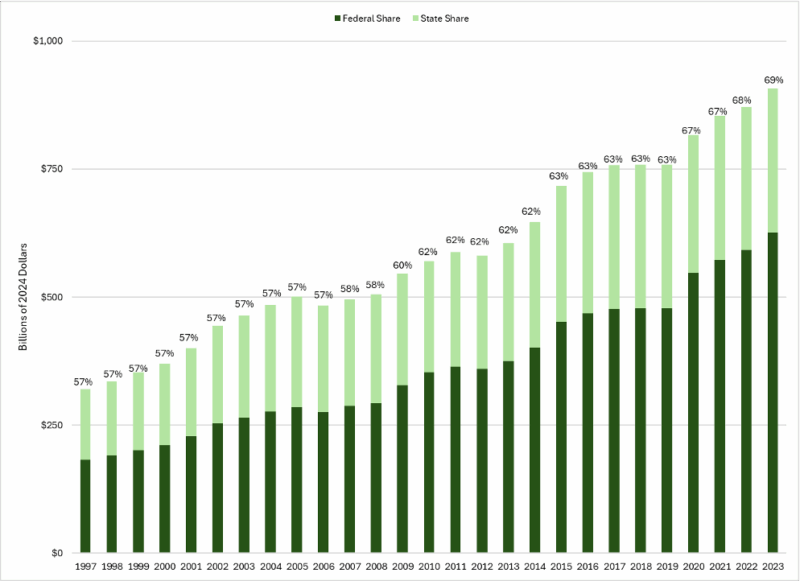

This drawback was exacerbated by Medicaid enlargement below the ACA. Determine 3 (recreated from the CRS report) reveals the breakdown of federal and state Medicaid spending. The chances atop every column point out the federal share of complete Medicaid spending.

Determine 3: Federal and State Shares of Medicaid Spending

Sources: Congressional Analysis Service “R43357: Medicaid: An Overview,” Determine 6: Federal and State Precise Medicaid expenditures CMS, Kind CMS-64 Knowledge as reported by states to the Medicaid Price range and Expenditure System, as of Might 29, 2024, at https://www.medicaid.gov/medicaid/financial-management/state-expenditure-reporting-for-medicaid-chip/expenditure-reports-mbescbes. CPI-U inflation information collected from US Bureau of Labor Statistics

Notes: CMS, Kind CMS-64 Knowledge as reported by states to the Medicaid Price range and Expenditure System, as of Might 29, 2024, at https://www.medicaid.gov/medicaid/financial-management/state-expenditure-reporting-for-medicaid-chip/expenditure-reports-mbescbes.

Ultimately, federal taxpayers are footing the invoice for Medicaid. Nonetheless, because the nationwide debt continues to pressure the federal funds and crowd out different priorities, policymakers in DC are determined to chop prices. One doubtless space is federal Medicaid spending. If the federal authorities had been to vary the matching charges of both conventional Medicaid or Medicaid enlargement, state spending on Medicaid would quickly improve and crowd out different spending. In additional fiscally distressed states, this might spur a fiscal disaster.

How Does Medicaid Influence Healthcare?

The dimensions of Medicaid signifies that it shapes virtually each nook of the American healthcare system, from hospital and acute care to long-term care to medical analysis. This system covers one in 5 People and funds 19 p.c of all well being spending in america. Listed below are a few of the outcomes of that affect.[9]

Growing Protection with Little to Present for Well being Entry or Outcomes

Medicaid will increase healthcare protection. Because of the Medicaid Enlargement below the ACA and extra beneficiant federal matching applications created in the course of the COVID-19 period and thru the Biden administration’s stimulus packages, enrollment in Medicaid dramatically elevated and the share of uninsured People decreased, reaching an all-time low in 2022.[10]

Moreover, whereas use of healthcare companies elevated, different detrimental outcomes emerged that decreased entry to care, particularly for these in conventional Medicaid. Cannon (2022a) notes that the Medicaid Enlargement below the ACA creates an incentive for state policymakers to prioritize Medicaid enlargement group recipients over conventional Medicaid recipients.[11] Blase and Gonshorowski (2025) confirmed these findings, noting that Medicaid enlargement decreased entry to care, crowded out personal choices, and shifted funds away from the poorest Medicaid recipients.[12]

In a overview of the literature, Sigaud (2025) additionally finds miserable outcomes[13] States that expanded Medicaid noticed longer wait instances and lowered entry to look after conventional Medicaid enrollees. Moreover, he notes that signs of melancholy elevated amongst near-elderly adults on Medicaid earlier than and after enlargement, particularly amongst rural residents with extraordinarily restricted entry to psychological well being suppliers. He additionally notes slower ambulance response instances and better delays within the emergency room.

Cementing the Relationship Between Employment and Healthcare

Medicaid enlargement below the Inexpensive Care Act additional entrenched employer-sponsored insurance coverage (ESI) because the spine of American healthcare. The ACA saved the ESI tax construction in place, basically creating what Cannon (2022b) calls “an implicit penalty on staff who don’t (a) give up management of a large portion of their earnings to an employer; (b) enroll in a well being plan that their employers select, management, and revoke upon separation; and (c) pay the stability of the premium immediately.”[14]

In an excellent world, People wouldn’t want to go away their jobs to vary healthcare supplier networks. Sadly, if People need a totally different medical insurance package deal, they have to “hearth” their employer, pay a big tax penalty for selecting an employer-sponsored plan, or be caught with an inferior, public choice.

Growing the Value of Healthcare

Medicaid prices for healthcare are a lot better than the prices of healthcare within the personal sector. In my AIER paper “The Work vs Welfare Tradeoff Revisited,” I discovered that Medicaid paid extra per full-year equal enrollee than the typical annual single premium for an employer-sponsored plan in 43 states.[15] Regardless of the upper funds, well being outcomes for Medicaid recipients should not higher than these of People with personal insurance coverage.

The explanation why Medicaid is so expensive comes from the incentives created below the joint federal-state funding relationship, as mentioned within the earlier part. Cannon (2022a) elaborates, “Spending $1 on police buys $1 of police safety. Spending $1 on Medicaid, nonetheless, buys $2 to $10 of medical or long-term care. Medicaid rewards states for spending the marginal greenback on medical and long-term care even when spending it on police, training, or transportation would offer better profit.”[16]State officers have an incentive to maximise Medicaid whereas chopping primary public companies. The open-ended federal matching system permits states to maximise federal matching {dollars} (particularly for enlargement populations) by means of gimmicks corresponding to supplier tax loopholes.[17]As spending on the enlargement inhabitants will increase, conventional Medicaid enrollees are pushed apart, resulting in much less entry to care and worsening well being outcomes.

The Authorities Accountability Workplace (GAO) recurrently lists Medicaid (and its relative Medicare) among the many “Excessive-Threat” checklist for improper funds. The GAO notes that Medicaid program integrity have to be strengthened by means of each laws and “coordinated effort throughout a number of entities.”[18] Moreover, America is likely one of the most charitable nations on the earth. In closing, Mueller opines,

In different phrases, Medicaid is rife with waste, fraud, and abuse, and fixing it’s no small process.

Elevated Regulatory Complexity

Medicaid additionally has a major affect on the character and form of healthcare rules. Federal guidelines dictating how states form their Medicaid insurance policies discourage innovation, analysis, and suppleness as a result of state policymakers need to maximize these federal matching {dollars}. Moreover, states will form their very own healthcare rules to make sure compliance with federal Medicaid pointers and maximize federal Medicaid funding. This leads to states limiting entry to new therapies to manage prices.

What Do the 2025 Coverage Modifications Imply for Medicaid?

In 2025, two main coverage modifications have impacted Medicaid: proposed modifications below the “One Massive Stunning Invoice” (H.R. 1) and a Facilities for Medicare and Medicaid Providers proposed rule to shut a supplier tax loophole. These modifications have the potential to offer quick fixes to Medicaid, however a lot deeper reforms are wanted.

The biggest change comes from the legislative and CMS rule modifications towards Medicaid supplier taxes. The modifications in H.R. 1 part the Medicaid supplier tax fee from 6 p.c to three.5 p.c and freeze any new supplier taxes created[19] It could additionally mandate waiver resubmissions and droop current approvals in noncompliant states. These reforms would guarantee Medicaid financing aligns with federal intent, helps scale back wasteful spending, and prevents states from misusing federal Medicaid funds for different normal fund applications.[20] It could additionally mandate waiver resubmissions and droop current approvals in noncompliant states. These reforms would guarantee Medicaid financing aligns with federal intent, helps scale back wasteful spending, and prevents states from misusing federal Medicaid funds for different normal fund applications.

Moreover, H.R. 1 additionally strengthens work necessities and eligibility checks, guaranteeing that verification requirements are improved and states are allowed to take away ineligible enrollees from Medicaid.

These reforms, sadly, solely scratch the floor. Deeper modifications to Medicaid (in addition to healthcare broadly) are wanted. One such change is obtainable by economist David Rose. Rose writes,

“To place it merely, get rid of Obamacare, Medicare, and Medicaid and exchange them with a nationwide healthcare voucher system. This transformative change for American healthcare may very well be restricted to the extent paid for with a nationwide gross sales tax, and our unfunded legal responsibility issues would merely disappear. Whereas, for sensible causes, this is able to doubtless have to begin on the nationwide stage, the aim may very well be to then spin it off to the states.”[21]

There isn’t a scarcity of concepts obtainable for healthcare reform. The issue lies in altering the incentives that tens of millions within the healthcare sector face (each in authorities and the personal sector) that preserve them sustaining the established order.

Conclusion

Medicaid was designed to offer a security internet for probably the most weak People. After sixty years, trillions spent, and tens of millions of People enrolled, this system has little to point out for it. It has strayed from its mission of serving to the poor as a result of policymakers prioritize maximizing federal matching charges. Medicaid spends extra but fails to offer higher well being care entry or well being outcomes, will increase prices, and discourages selection and innovation in healthcare.

America—the wealthiest nation in historical past—and its folks deserve well being care that delivers entry, worthwhile well being outcomes, affordability, and selection. Market-driven options can present such a system.

[1] Social Safety Administration. Medicaid. In Annual Statistical Complement to the Social Safety Bulletin, 2015. https://www.ssa.gov/coverage/docs/statcomps/complement/2015/medicaid.html.

[2] Congressional Analysis Service. Medicaid: An Overview. R43357. Washington, DC: Library of Congress, 2023. https://www.congress.gov/crs-product/R43357.

[3] Ibid.

[4] Ibid.

[5] KFF. “Federal Matching Charge and Multiplier.” KFF State Well being Information. Accessed July 9, 2025. https://www.kff.org/medicaid/state-indicator/federal-matching-rate-and-multiplier.

[6] KFF. “Standing of State Medicaid Enlargement Choices.” KFF. Accessed July 9, 2025. https://www.kff.org/status-of-state-medicaid-expansion-decisions.

[7]

[8]

[9] Workplace of the Assistant Secretary for Planning and Analysis. The Advantages of Increasing Medicaid Eligibility to Low-Earnings Adults: Proof from State Expansions. U.S. Division of Well being and Human Providers, March 28, 2022. https://aspe.hhs.gov/reviews/benefits-expanding-medicaid-eligibility.

[10] Workplace of the Assistant Secretary for Planning and Analysis. 2022 Uninsurance Charge at an All-Time Low: New Estimates Spotlight the Position of the ACA and Medicaid Enlargement. U.S. Division of Well being and Human Providers, September 2022. https://aspe.hhs.gov/reviews/2022-uninsurance-at-all-time-low.

[11] Cannon, Michael F. Cato Institute. “Medicaid and the Kids’s Well being Insurance coverage Program.” In Cato Handbook for Policymakers, Ninth ed., 2022. https://www.cato.org/cato-handbook-policymakers/cato-handbook-policymakers-Ninth-edition-2022/medicaid-childrens-health-insurance-program#perverse-incentives.

[12] Blase, Brian and Gonshorowski, Drew. “Resisting the Wave of Medicaid Enlargement: Why Florida Is Proper.” Paragon Institute. Might 1, 2024. https://paragoninstitute.org/medicaid/resisting-the-wave-of-medicaid-expansion-why-florida-is-right.

[13] Sigaud, Liam. “Shedding Focus: How the ACA’s Medicaid Enlargement Left Conventional Enrollees Behind.” Paragon Prognosis, February 10, 2025. https://paragoninstitute.org/paragon-prognosis/losing-focus-how-the-acas-medicaid-expansion-left-traditional-enrollees-behind/#:~:textual content=Apercent202021percent20analysispercent20inpercent20Health,adversepercent20outcomespercent2Cpercent20includingpercent20higherpercent20mortality.e.

[14] Cannon, Michael F. Cato Institute. “The Tax Therapy of Well being Care.” In Cato Handbook for Policymakers, Ninth ed., 2022. https://www.cato.org/cato-handbook-policymakers/cato-handbook-policymakers-Ninth-edition-2022/tax-treatment-health-care#the-tax-exclusion-for-employer-sponsored-health-insurance.

[15] Savidge, Thomas. “The Work vs. Welfare Tradeoff Revisited.” American Institute for Financial Analysis, June 17, 2022. https://aier.org/article/the-work-vs-welfare-tradeoff-revisited/#medicaid.

[16] Cannon (2022a). supra be aware 11.

[17] Blase, Brian. Medicaid Supplier Taxes: A Gimmick that Exposes the Flaws in Medicaid’s Financing. Arlington, VA: Mercatus Heart at George Mason College, June 20, 2023. https://www.mercatus.org/analysis/research-papers/medicaid-provider-taxes-gimmick-exposes-flaws-medicaids-financing.

[18] U.S. Authorities Accountability Workplace. Medicaid Financing: Actions Wanted to Guarantee Supplier Taxes Do Not Undermine Federal Oversight. GAO-25-107743, Might 2025. https://www.gao.gov/merchandise/gao-25-107743.

[19] U.S. Congress. H.R. 1: “One Massive Stunning Reconciliation Act of 2025,” 119th Cong., 1st sess., § 71115, “Supplier Taxes” (2025). https://www.congress.gov/invoice/119th-congress/house-bill/1/textual content

[20] Facilities for Medicare & Medicaid Providers. Preserving Medicaid Funding for Susceptible Populations by Closing Well being Care-Associated Tax Loophole: Proposed Rule. Truth Sheet. Washington, DC: U.S. Division of Well being and Human Providers, Might 2, 2024. https://www.cms.gov/newsroom/fact-sheets/preserving-medicaid-funding-vulnerable-populations-closing-health-care-related-tax-loophole-proposed#_ftn2.

[21] Rose, David C. “Need to Repair Medicaid? Look to Milton Friedman.” The Each day Economic system, June 6, 2025. https://thedailyeconomy.org/article/want-to-fix-medicaid-look-to-milton-friedman.