Yves right here. The article under explains how each superior and rising economies can treatment their seemingly intractible downside of excessive public debt ranges and low development: by correctly focusing spending on productiveness/output rising areas, equivalent to infrastructure and well being, and rising effectivity of govenment operations. Word that this evaluation immplicity assumes that the nations on this repair are, like Eurozone member states, not monetarily sovereign. However even these which can be usually need to take care of the objections of price range hawks.

Even Larry Summers, a mainstream economist of solely a mildly Keynesian persuasion, confused that infrastructure spending greater than paid for itself (when you’ve as a lot backlog and deferred upkeep because the US does), producing GDP development of as a lot as 3x the expenditure.

But many superior economies have purchased the neoliberal fairy story that personal improvement and possession of pubic companies equivalent to infrastructre might be extra environment friendly. The charges related to advanced authorized strucuting and fundraising for these offers alone makes the concept they are going to be cheaper (ex delivering a really inferior product) doubtful. A easy proof: within the US, each newly-built public toll highway has gone bankrupt. As we wrote in 2021:

One apparent type of grifting is toll roads. A 2014 article on privatizations, describing the economics of latest toll highway tasks, explains how they at all times go bust. I’ve seen no proof that the construction or phrases of those offers have modified to favor customers and taxpayers. From Considering Highways:

Starting with the contracting stage, the proof suggests toll working public non-public partnerships are transportation shell corporations for worldwide financiers and contractors who blueprint future bankruptcies. As a result of Uncle Sam usually ensures the bonds – by far the most important chunk of “non-public” cash – if and when the non-public toll highway or tunnel companion goes bankrupt, taxpayers are pressured to repay the bonds whereas absorbing all loans the state and federal governments gave the non-public shell firm and any amassed depreciation. But the shell firm’s mother or father companies get to maintain years of precise toll earnings, on prime of thousands and thousands in design-build price overruns….

In fact, no govt comes ahead and says, “We’re planning to go bankrupt,” however an evaluation of the info is stunning. There don’t seem like any American non-public toll companies nonetheless in operation below the identical administration 15 years after building closed. The unique toll companies appear constantly to have gone bankrupt or “zeroed their belongings” and walked away, leaving taxpayers a freeway now needing restore and having to repay the bonds and take in the loans and the depreciation.

The listing of bankrupt companies is staggering, from Virginia’s Pocahontas Parkway to Presidio Parkway in San Francisco to Canada’s “Sea to Sky Freeway” to Orange County’s Riverside Freeway to Detroit’s Windsor Tunnel to Brisbane, Australia’s Airport Hyperlink to South Carolina’s Connector 2000 to San Diego’s South Bay Expressway to Austin’s Cintra SH 130 to a few dozen different toll services.

We can not discover any American non-public toll corporations, moreover, assembly their pre-construction visitors projections. Even these shell corporations not in chapter court docket often produce half the earnings they projected to bondholders and federal and state officers previous to building.

Placing apart apparent public burdens like bankruptices, non-public possession of infrastructure is inherently a nasty deal for residents. Financiers “sweat the asset” by jacking up prices, like touchdown charges for airports, and skimping on upkeep.

US healtcare, with its excessive prices and poor outcomes, is the poster youngster of what occurs with revenue incentives in all of the fallacious locations. And now now we have the EU and US set to bulk up on equally overpriced arms spending.

So even when coverage makers take proposals like these to coronary heart, they’ve to beat a whole lot of mental seize and corruption to get them applied. And all of the indicators are that inertia and horrible management will assure that circumstances will worsen, save for these on the prime.

PS: Earlier than you pooh pooh this text as a result of its authors work for the IMF, understand that there has lengthy been a cut up between the analysis facet of home, which has lengthy advocated progressive (within the older sense fo the phrase) reforms, and the “program” facet, which is a hard-nosed neoliberal enforcer.

By Period Dabla-Norris, Deputy Director, Fiscal Affairs Division Worldwide Financial Fund, Davide Furceri, Division Chief, Fiscal Affairs Division Worldwide Financial Fund. Zsuzsa Munkacsi, Economist Worldwide Financial Fund, and Galen Sher, Economist, Worldwide Financial Fund. Initially printed at VoxEU

With excessive public debt and weak medium-term development, finance ministries search to do extra with much less. This column argues that effectivity gaps in public spending stand at about 30-40% globally and are pronounced in infrastructure funding and R&D spending. Utilizing empirical and model-based evaluation, it reveals that reallocating spending to infrastructure, schooling, well being, and R&D and shutting effectivity gaps can elevate GDP by 11% in rising market and creating economies and 4% in superior economies, over the long run, and crucially with out will increase in whole spending.

Public debt is ready to surpass 100% of GDP within the subsequent 4 years globally, in accordance with the newest IMF projections. Greater rates of interest, and stress to spend extra on defence, ageing societies, and improvement create a constrained setting the place each greenback of public cash has to work tougher in delivering higher outcomes. Compounding this problem, medium-term development prospects have remained persistently subdued because the COVID-19 pandemic.

The IMF’s October 2025 Fiscal Monitor finds that nations have substantial scope to reallocate public spending to assist financial development, and so they might achieve round one third extra worth for cash by adopting the practices of greatest performers (IMF 2025). Furthermore, the report finds that spending smarter – via improved composition and elevated effectivity – can elevate GDP by 11% in rising market and creating economies and 4% in superior economies, over the long run.

Scope for Reforms

Public spending as a share of GDP has doubled in superior and rising market economies because the Nineteen Sixties; nonetheless, the allocation has not been pro-growth. Globally, public funding as a share of whole expenditure has declined by two share factors, whereas spending on public schooling has stagnated at about 11% of whole expenditure – lower than half of public wage payments.

Critically, our new estimates for 174 nations counsel that just about all have substantial room to enhance the effectivity of public spending. Constructing on a wealthy literature (e.g. Apeti et al. 2023, Herrera et al. 2025), we measure the gap of nations from a manufacturing potentialities frontier, which represents the absolute best outcomes in infrastructure, well being, schooling, and analysis and improvement spending. Importantly, our estimates are the primary to fluctuate over time whereas additionally permitting for structural variations throughout nations, statistical noise, and uncertainty over the selection of final result variables.

The dataset reveals that effectivity gaps stand at about 30-40% globally at this time and are pronounced in infrastructure funding and analysis and improvement spending (Determine 1). These gaps have narrowed significantly over the previous 4 many years, reflecting worldwide will increase in life expectancy, technological developments, and expanded entry to primary infrastructure in low-income creating nations.

Determine 1 Public spending effectivity gaps (p.c)

Notes: The determine reveals effectivity gaps, that are distances to the spending effectivity frontier. Effectivity gaps vary from 0 (absolutely environment friendly) to 100 (absolutely inefficient). The determine reveals averages from 1980 to 2023. The containers point out medians and interquartile ranges (twenty fifth –seventy fifth percentiles), and the whiskers delineate the minimal and most values. AEs = superior economies, EMs = rising market economies, LIDCs = low-income creating nations.

Output Positive aspects from Reforms

An enormous literature examines how the allocation and effectivity of public spending contribute to development. In normal development fashions, public funding in bodily and human capital will increase the financial system’s productive capability, and public R&D spending provides to the information base that companies use to innovate (Barro and Sala-i-Martin 2004). Extra environment friendly public funding provides extra to the capital inventory (Gupta et al. 2014, Presbitero et al. 2016).

We contribute to this literature in two key dimensions. First, we analyse – via each empirical and model-based evaluation – how the composition of public spending impacts financial exercise, assuming whole spending stays fixed. Second, we assess how the financial results fluctuate throughout nations and over time, based mostly on the brand new estimates of effectivity.

Empirical proof – utilizing native projection and artificial management strategies – from about 700 episodes of huge reallocations in public spending in 155 nations means that output will increase considerably within the quick to medium time period. A significant reallocation to public funding is adopted by a rise in output of about 4% ten years later. Reallocations to public well being and R&D spending are adopted by 3% will increase in output over ten years. These positive factors begin to emerge even within the first 5 years and improve over time.

Certainly, simulations of an endogenous development mannequin clearly illustrate the potential long-term positive factors and the financial mechanism. Public infrastructure provides to output alongside non-public capital and labour (as in Traum and Yang 2015), whereas public funding in human capital enhances the productiveness of time spent in schooling, accelerating ability accumulation. Public R&D spending expands the inventory of improvements out there for companies to undertake, with know-how diffusion occurring regularly as companies put money into adoption (as in Anzoategui et al. 2019). The mannequin explicitly incorporates inefficiencies in public funding, human capital, and R&D, by permitting some public spending to be wasted as a substitute of contributing to the shares of capital and information (as in Berg et al. 2019).

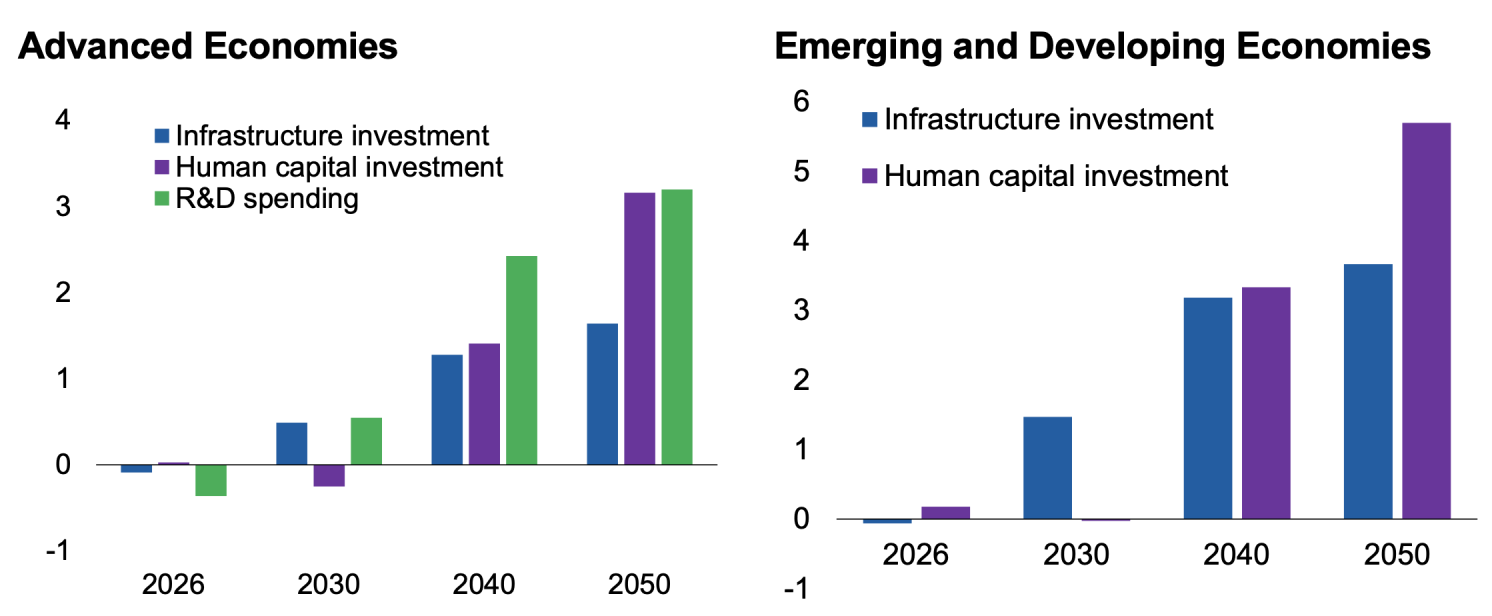

Determine 2 Lengthy-term output positive factors from reallocating spending (p.c)

Notes: The bars present long-term output positive factors as a consequence of a everlasting improve, within the expenditure classes listed within the legend, of 1% of GDP in 2025, funded by a reduce in public consumption.

The outcomes present that reallocating 1% of GDP from authorities consumption (equivalent to administrative overhead) to public funding in human capital – equivalent to updating nationwide curricula and equipping faculties – can improve output by 3% in superior economies and 6% in rising market and creating economies over the long run (Determine 2). The bigger positive factors for rising market and creating economies replicate their decrease preliminary ranges of human capital, which suggests a better marginal return on funding. These findings are echoed by de La Maisonneuve et al. (2024), who spotlight that boosting participation in early childhood schooling and rising schooling spending among the many lowest-spending nations might generate giant positive factors in long-run productiveness. The output positive factors emerge solely after about 15 years, when the following era enters the labour pressure.

Comparable reallocations to infrastructure funding yield long-term output positive factors of 1.5% in superior economies and three.5% in rising market and creating economies. In superior economies, reallocating public spending towards R&D by 1% of GDP might increase output by 3% over the long run.

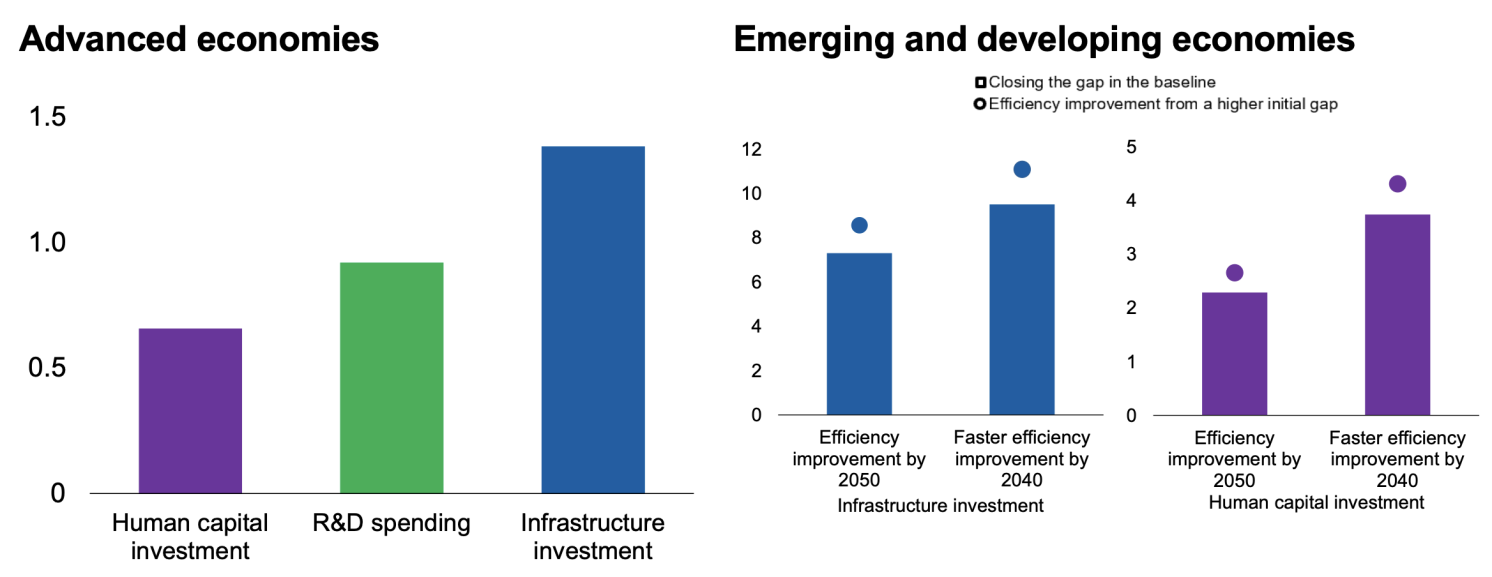

Crucially, closing gaps in spending effectivity can additional improve the output influence by 1.5% in superior economies and a couple of.5-7.5% in rising market and creating economies, as extra of the out there public spending interprets into productive types of capital and scientific information (Determine 3). The output positive factors could be as much as 2% bigger if spending effectivity is improved sooner.

Complementary insurance policies can additional increase these positive factors. In superior economies, combining investments in human capital and R&D yields larger advantages than focusing solely on one space, as innovation and abilities complement one another. For rising market and creating economies, pairing infrastructure and human capital investments capitalises on each short-term and long-term positive factors.

Determine 3 Lengthy-term output positive factors from enhancing spending effectivity (p.c)

Notes: The bars present the long-term output positive factors when gaps in spending effectivity are regularly closed, by 2050 within the left panel, and in the best panel, by 2040 or 2050 as indicated on the horizontal axis. In the best panel, the circles present the bigger achieve that’s achievable for nations ranging from a better preliminary effectivity hole.

See authentic submit for references

![[+96% Profit in 10 Months] 100% Automated NAS100 Strategy ‘ACRON Supply Demand EA’ – Trading Systems – 15 November 2025 [+96% Profit in 10 Months] 100% Automated NAS100 Strategy ‘ACRON Supply Demand EA’ – Trading Systems – 15 November 2025](https://i0.wp.com/c.mql5.com/i/og/mql5-blogs.png?w=120&resize=120,86&ssl=1)