In January 2024, The College of Chicago Harris Faculty of Public Coverage and the Related Press-NORC Heart for Public Affairs Analysis printed a survey that discovered two-thirds of Individuals believed their taxes had been too excessive and they lacked confidence in how the federal authorities spends their tax {dollars}.[1] These sentiments will not be unfounded. This Explainer will cowl the place the federal government takes income from, the way it spends these {dollars}, the way it prioritizes spending, and what’s projected for the longer term.

The place Does the Cash Come From? The place Does the Cash Go?

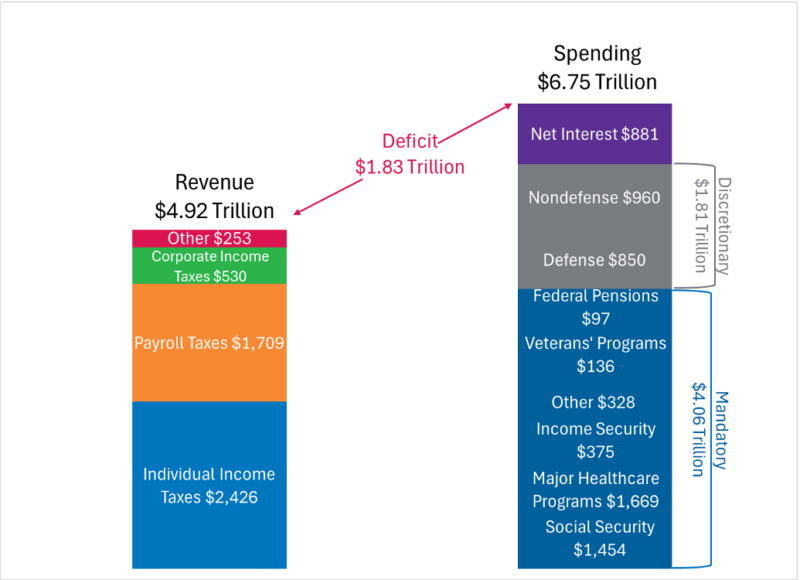

Over the course of Fiscal 12 months (FY) 2024 (October 1, 2023-September 30, 2024), the federal authorities took in $4.92 trillion in tax income and spent $6.75 trillion. Determine 1 exhibits the recreation of “Federal Income vs Spending” full breakdown of federal revenues and expenditures by supply for FY 2024.[2]

As Determine 1 exhibits, 84 % of that income comes proper out of your paycheck between particular person revenue taxes and payroll taxes (akin to funding for Social Safety and Medicare). One other 10 % comes from taxes on enterprise revenue. The remaining 5 % “Different” class consists of excise taxes, remittances from the Federal Reserve, customs duties, property and present taxes, and miscellaneous fines and charges.[3]

When observing the spending column, discover three distinct classes: Obligatory Spending, Discretionary Spending, and Web Curiosity Spending. Right here is how the federal authorities distinguishes these classes:

Obligatory Spending: That is spending that’s mandated by current legal guidelines. This class contains entitlements akin to Social Safety, the main well being care applications (Medicare, Medicaid, CHIP, and the “Reasonably priced Care Act Tax Credit & Associated Subsidies”). It additionally contains revenue safety applications such because the Non permanent Help for Needy Households (TANF) and the Supplemental Diet Help Program (SNAP). The Different class contains spending on increased schooling, agriculture, deposit insurance coverage, the Division of Protection, Fannie Mae and Freddie Mac, the Pension Profit Warranty Company, and the Training Stabilization Fund.[4]

Discretionary Spending: That is spending that’s formally accredited by Congress and the President throughout the appropriations course of (when Congress designates and approves spending for the fiscal 12 months) every year. Discretionary spending is broadly divided into protection and nondefense spending for federal businesses and applications throughout the appropriations course of. Through the fiscal 12 months, the federal authorities may also difficulty supplemental appropriations in the identical method. The latest notable examples of this are the huge spending payments the federal authorities issued in 2020 in response to the COVID-19 financial downturn.[5]

Web Curiosity: That is the curiosity prices on the nationwide debt minus curiosity revenue that the federal government receives on loans (akin to pupil loans) in addition to money balances and earnings of the Nationwide Railroad Retirement Funding Belief.[6]

Obligatory spending makes up most federal expenditures, accounting for $4.06 trillion (over 60 %) of all federal spending in FY 2024. The three largest necessary spending applications are Social Safety totaling $1.454 trillion (36 % of necessary spending and 21 % of whole spending), Medicare with $1.09 trillion (28 % of necessary spending) and Medicaid and CHIP at $575 billion (15 % of necessary spending). It is usually necessary to notice that spending on web curiosity ($870 billion) now exceeds each Medicaid and CHIP spending and whole protection spending ($850 billion). In response to CBO estimates, the one classes that exceed web curiosity spending are Social Safety, the main well being care applications (Medicare, Medicaid, CHIP, and ACA Tax Credit & Associated Subsidies), and discretionary nondefense spending.

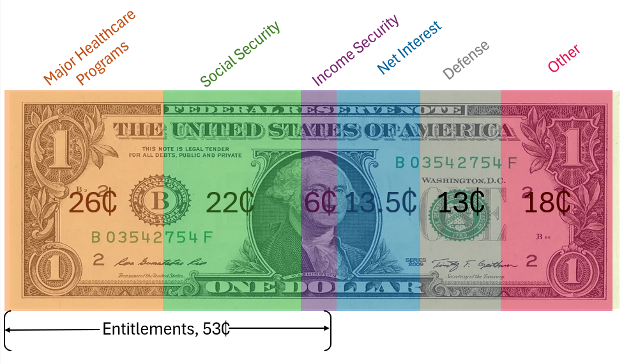

Determine 2 frames the problem in another way by displaying how every tax greenback is spent. For every greenback the federal authorities spends, greater than half of that greenback goes towards entitlement spending. This dispels the parable that important cuts to protection spending could possibly be used to fund entitlements. As of FY 2024, web curiosity funds on the nationwide debt exceed nationwide protection spending. Web curiosity funds additionally eclipsed spending on all main well being care applications besides Medicare.

Underlying all of that is the truth that the federal authorities is spending greater than the income it’s bringing in, resulting in massively rising debt. The issues with rising debt are mentioned extensively within the AIER Explainer Understanding Public Debt.[7] In essence, as traders lose confidence within the federal authorities’s means to pay its money owed, they’ll ask for increased rates of interest (a better worth of borrowing). As this continues, spending on web curiosity will proceed to crowd out different spending classes. This implies the typical American will see increased taxes, a weaker greenback, lowered entry to credit score (because the US authorities diverts capital out of the non-public sector to finance deficits), and fewer public companies.

How Authorities Prioritizes Spending

To know how the federal government allocates funds, you will need to first take into account the incentives (rewards and punishments that encourage habits) of presidency officers. Concerning elected officers, economist Thomas Sowell famously famous that their two most necessary priorities are getting elected and getting reelected. Any subsequent objectives are much less necessary than the primary two.[8] As for unelected authorities officers, economist William Niskanen famous that their success is measured by the variety of folks working beneath them and the dimensions of their discretionary finances.[9]

It is usually necessary to look at the constraints authorities actors face. To ensure that any cash to get spent, Congress and the President must conform to spend it. This leads to logrolling, the place these elected officers are keen to supply concessions to the opposite facet in trade for a desired coverage in return.[10] Nobody will get every thing they need, however everybody will get one thing. It is usually necessary to notice that bureaucratic funding is zero-sum, which means that funds not allotted to at least one company are being spent on a special company. This constraint on unelected officers incentivizes them to ask for spending will increase and encourages “mission creep,” the place bureaucrats broaden their company’s function past its meant scope to justify elevated funding.

Logrolling, nevertheless, can lead to voter confusion. If voters discover their consultant partaking in logrolling usually sufficient, the elected official could come off as unprincipled, which may end in her or him shedding reelection. Sadly, the extra authorities will increase its scope of authority, the extra logrolling will happen, leading to better voter confusion.

These elected officers, nevertheless, is not going to simply cater to any voters. They are going to take heed to the voters who might help sway the election of their favor. These are typically smaller teams with a shared curiosity. These teams can both be within the non-public sector or bureaucrats within the public sector. These small teams have a better stake in getting the coverage outcomes they need in comparison with the broader public whose pursuits are extra extensively distributed. Their measurement additionally permits them to politically manage, mobilize, and simply police free using. This permits these teams to pay attention advantages for themselves and disperse the prices among the many wider populace. [11]

In conclusion, elected officers will concentrate on the events that present up and might influence their electoral prospects. This will result in spending priorities that favor these teams no matter whether or not these priorities are the very best use of taxpayer {dollars}.

Future Projections

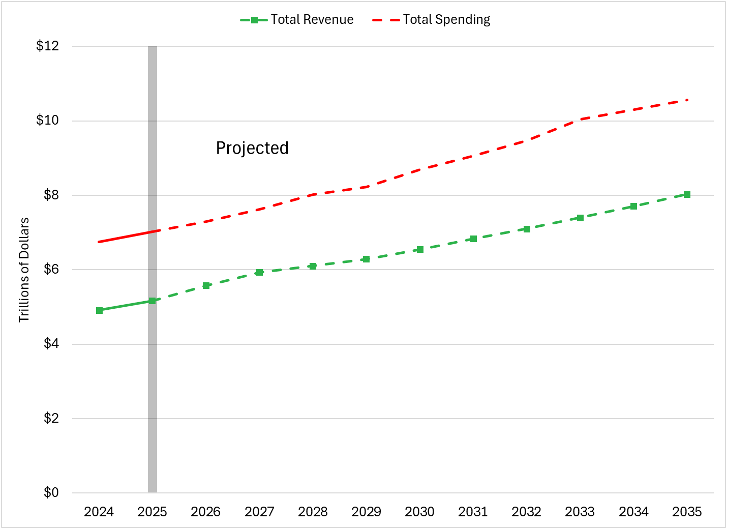

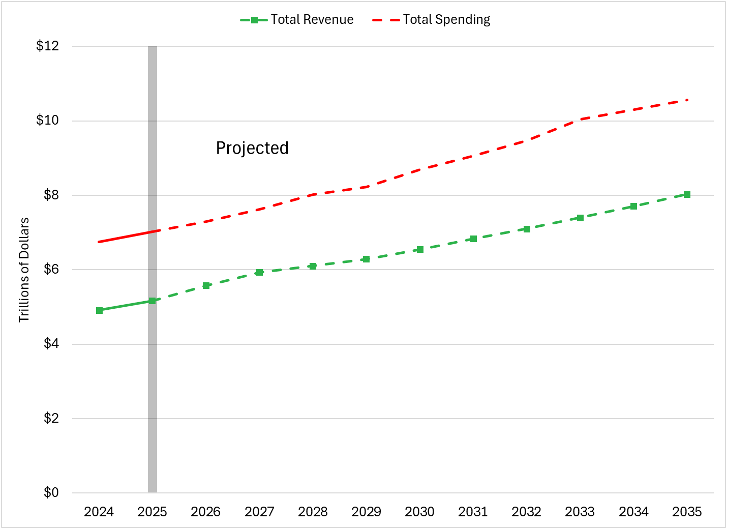

Sadly, the degrees of spending and incentive issues don’t bode nicely for Individuals. Determine 3 exhibits the CBO’s projections, which present that (assuming all else stays equal) spending will proceed to quickly outpace revenues over the subsequent decade.

To sort out this difficulty, policymakers will want a mixture of fiscal and regulatory reforms. This can restrict how a lot cash the federal government can take in addition to restrict what it could possibly go alongside to residents as unfunded mandates. As my colleague Dave Hebert and I wrote,

“We should always not simply search to starve the beast of sources. We have to starve the beast of duty. Somewhat than flip to authorities, as residents are more and more wont to do, we have to perceive that personal markets are rather more highly effective at fixing society’s ills than they’re generally understood to be.”[12]

In 2025, bond traders proceed to demand increased premiums for US authorities debt. Which means that policymakers in Washington should prioritize spending cuts or else endure the implications of crippling public debt.

References and Sources for Additional Info

[1] AP-NORC Heart for Public Affairs Analysis. (January 2024). “Majorities view native, state, and federal taxes as too excessive and delivering too little worth for folks like them” https://apnorc.org/majorities-view-local-state-and-federal-taxes-as-too-high-and-delivering-too-little-value-for-people-like-them

[2] “Federal Income vs Spending (For Fiscal 12 months 2023, in Billions).” Federal Funds in Photos from The Heritage Basis. Created July 24, 2024. Accessed July 29, 2024. https://www.federalbudgetinpictures.com/federal-revenue-vs-spending/

[3] “The Funds and Financial Outlook: 2024 to 2034.” Congressional Funds Workplace. February 7, 2024. Accessed July 24, 2024. https://www.cbo.gov/publication/59710

[4] Ibid.

[5] “How a lot has the U.S. authorities spent this 12 months?” America’s Finance Information from FiscalData. U.S. Division of the Treasury. https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/

[6] “Web Curiosity” in A Glossary of Phrases Used within the Federal Funds Course of. Congressional Funds Workplace. Accessed July 24, 2024. https://www.cbo.gov/publication/42904

[7] Savidge, Thomas and Yonk, Ryan M. Understanding Public Debt. American Institute for Financial Analysis. 15 Aug 2024. Accessed 1 Jan 2025. https://aier.org/article/understanding-public-debt/

[8] Sowell, Thomas. “Politicians remedy their issues, not yours.” The East Bay Occasions. 25 November 2009. Accessed July 24, 2024. https://www.eastbaytimes.com/2009/11/25/thomas-sowell-politicians-solve-their-problems-not-yours/

[9] Niskanen, William A. “The Peculiar Economics of Paperwork.” American Financial Evaluation. Vol 58, No 2 (Might 1968). p. 293-305. Accessed July 24, 2024. https://www.jstor.org/steady/1831817

[10] Buchanan, James M. and Tullock, Gordon. The Calculus of Consent: The Logical Foundations of Constitutional Liberty. Indianapolis: Liberty Fund. Accessed July 24, 2024. https://www.econlib.org/library/Buchanan/buchCv3.html?chapter_num=11#book-reader

[11] Shugert, William F. “Public Selection.” Econlib Concise Encyclopedia of Economics. Accessed July 24, 2024. https://www.econlib.org/library/Enc/PublicChoice.html

[12] Hebert, David and Savidge, Thomas. “Studying Fiscal Self-discipline: Colorado’s Success, Shortcomings, and Regulatory Ruse.” The Each day Economic system by the American Institute for Financial Analysis. 17 Dec 2024. Accessed 21 Jan 2025. https://thedailyeconomy.org/article/learning-fiscal-discipline-colorados-success-shortcomings-and-regulatory-ruse/