Amid widespread financial weakening, due in no small measure to damaging Trump insurance policies similar to slashing and burning of Federal companies that present necessary public and business-boosting companies, and supply-chain-cracking and inflation inducing tariff will increase, it ought to hardly be a shock that shopper and enterprise confidence is sagging, as are Trump coverage approval rankings. As we’ll overview posthaste, a brand new naysayer, albeit in economese, is the Fed.

Donald Trump’s approval rankings are underwater throughout the board.

Individuals do not assist how he’s dealing with the financial system, the federal work drive, international coverage, or commerce.

Which, is principally all the things a President does. pic.twitter.com/tKzqcAIUIJ

— Jessica Tarlov (@JessicaTarlov) March 13, 2025

BREAKING: In a shocking announcement, CNN Senior Knowledge Analyst Harry Enten simply introduced Donald Trump has the bottom approval ranking on dealing with the financial system at this level in his Presidency. That is big.pic.twitter.com/UrLUMjFmjj

— Democratic Wins Media (@DemocraticWins) March 19, 2025

The lead story within the Wall Road Journal is Fed Projections See an Financial system Dramatically Reset by Trump’s Election. The corresponding headline on the Monetary Occasions is extra direct, Federal Reserve cuts US development forecast as Trump’s insurance policies weigh on outlook, however the Wall Road Journal does a by means of job of unpacking the central financial institution’s, erm, reservations.

Nonetheless, there’s an enormous failing on the coronary heart of the Journal story, which isn’t even mentioning what the precise forecasts have been. For that, we have now to go to the Monetary Occasions, which appropriately places them within the second paragraph:

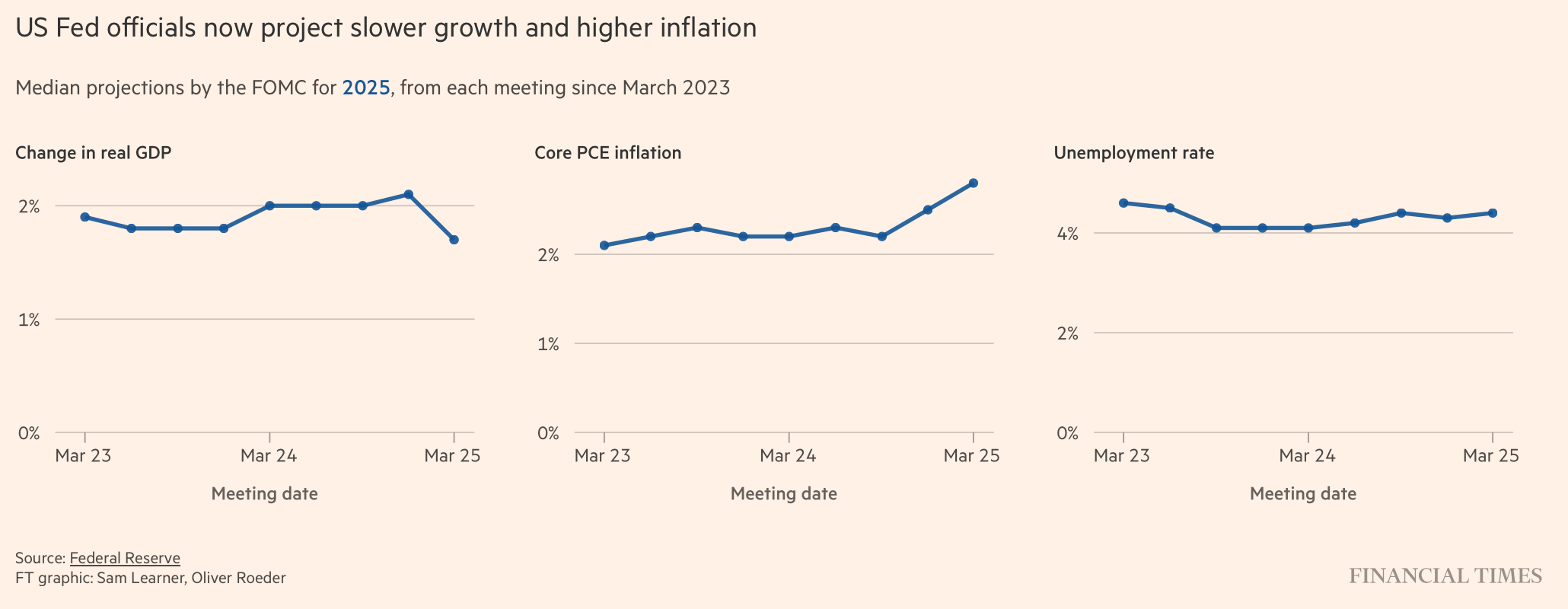

The Fed’s newest projections confirmed officers anticipated GDP to broaden by 1.7 per cent this yr, with costs forecast to rise by 2.7 per cent. Policymakers saved the central financial institution’s major rate of interest on maintain on the finish of a two-day assembly on Wednesday.

Bloomberg gave a its TL;DR model:

The Federal Reserve left rates of interest unchanged, shopping for time to evaluate how President Donald Trump’s insurance policies impression an financial system dealing with each lingering inflationary pressures and mounting development issues https://t.co/Sp5efWSkin pic.twitter.com/56OPsGnOnt

— Bloomberg TV (@BloombergTV) March 19, 2025

Michael Shedlock offered the related knowledge desk:

The Journal describes a sudden, arduous Trump financial gear-shift, to the diploma that loads of weak vacationers have gotten whiplash:

The Federal Reserve’s first set of projections since Donald Trump’s inauguration underscored—within the central financial institution’s understated and technocratic trend—simply how a lot the president’s plans to press forward with widespread tariffs have turned the financial outlook on its head.

The story continues by discussing how the smooth touchdown state of affairs is out the window as tariffs will increase costs whereas whacking funding, the Confidence Fairy, and groaf. Furthermore, the dangers all look to be on the draw back.

The Fed Chair simply stated what each credible economist, each economics textbook, and each empirical examine exhibits: Tariffs scale back output and lift costs.

That is fairly uncontroversial stuff, of us. (Additionally, miserable.) pic.twitter.com/h0dj05STMQ

— Justin Wolfers (@JustinWolfers) March 19, 2025

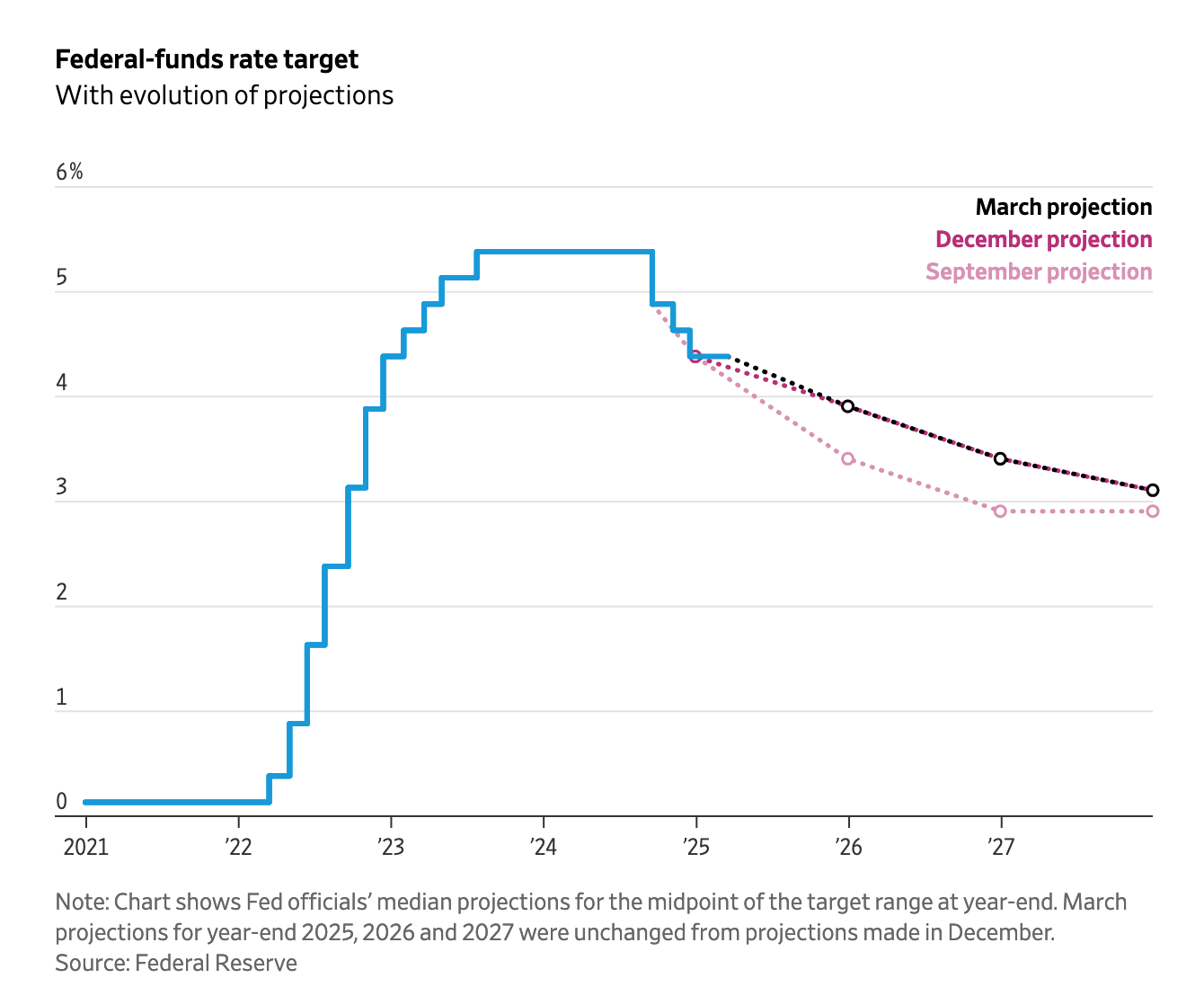

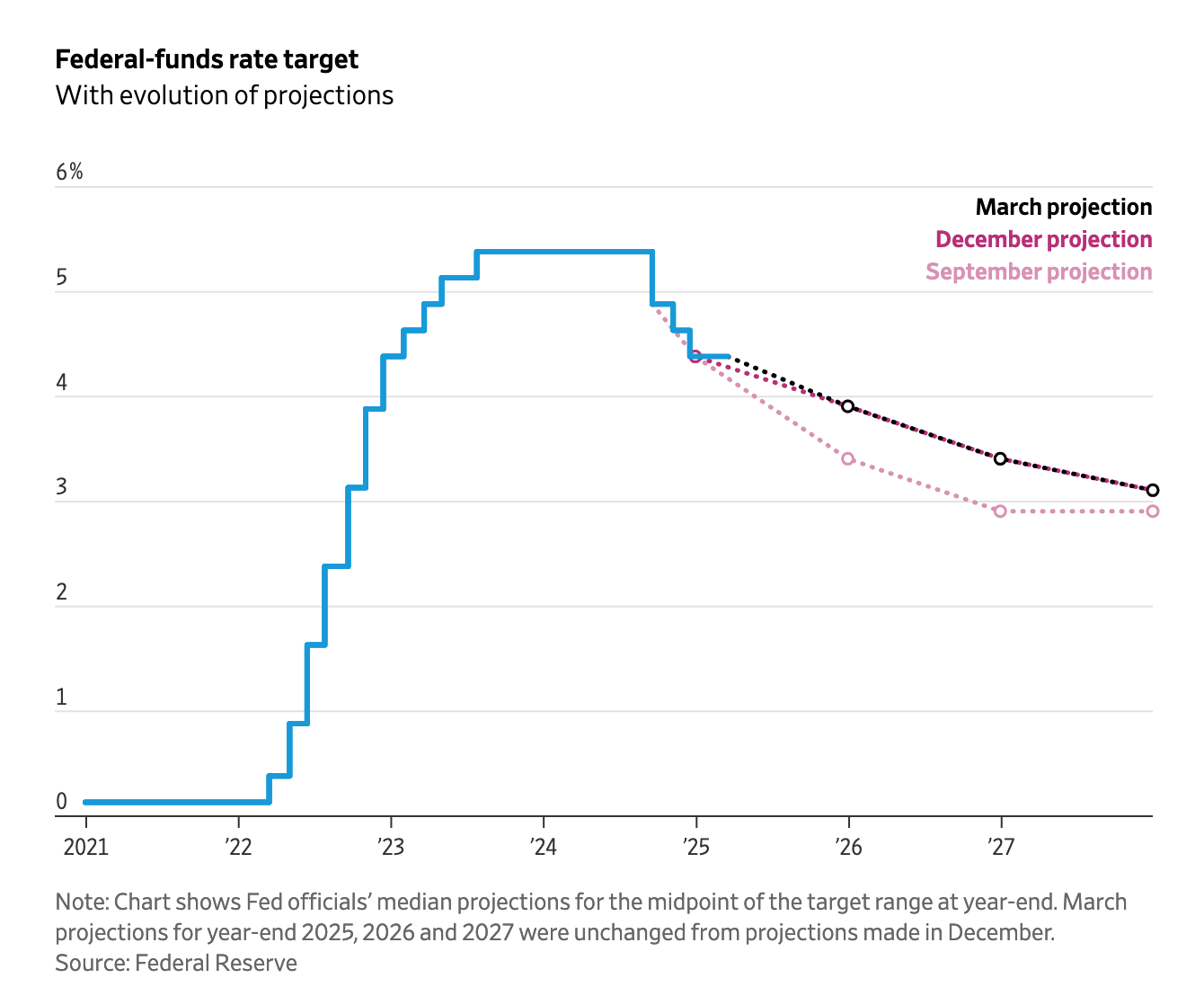

Regardless of all that, the central financial institution caught with anticipating two fee cuts this yr, which led to a little bit of a inventory market bounce. That got here regardless of Fed chair Powell declaring that there was a “degree of inertia” amongst traders concerning the odds that their hoped-for fee cuts may come up brief.

Nonetheless, the “inertia” comment is greater than a little bit of projection. The Fed takes the view that any tariff-induced worth will increase are a short lived shock after which costs will stabilize. However the central financial institution’s time frames are totally different from these of shoppers and one imagines, many companies. Even after the costs of eggs has stabilized at an controversial new regular, patrons nonetheless remembered effectively after they had been cheaper, even when costs had not risen additional in, say, the final six months. Preserve additional in thoughts that this phenomenon means that how the Fed thinks about inflation expectations (as mirrored in bond market yields) are based mostly on investor conduct, not shopper conduct, and thus might critically misinterpret actual financial system reactions.

The Journal describes that Fed officers do acknowledge that their regular approaches may fail given the tariffs shock:

Officers might be hard-pressed to declare worth will increase from tariffs as momentary in the event that they set in movement a reordering of worldwide manufacturing processes that takes years to play out.

On high of that, Fed officers are nervous that the postpandemic inflation might need given companies and shoppers extra acceptance of upper inflation. Policymakers pay shut consideration to expectations of future inflation as a result of they suppose these expectations could be self-fulfilling.

The Journal did use the dreaded phrase “stagflation” however depicted that as a risk versus a given, and additional argued that even when it occurred, it could not be as dangerous because the Seventies model.

Now to the pink paper, which offered a extra pressing take:

The Federal Reserve has slashed its US development forecast and lifted its inflation outlook, underscoring issues that Donald Trump’s tariffs will knock the world’s largest financial system….

Progress on inflation was “in all probability delayed in the meanwhile”, Powell stated. The Fed has been battling to push inflation again to its 2 per cent objective and halt essentially the most extreme bout of worth pressures in a long time.

The Fed additionally introduced that it was slowing down the tempo of its quantitative tightening programme, reducing the quantity of US Treasury debt it permits to roll off its stability sheet every month from $25bn to $5bn starting in April.

With Trump a chaos generator, the prospects are a lot in flux that one may as effectively throw darts….apart from shortly rising alarm and widespread indicators of degradation. Readers have reported massive falloffs in site visitors in native shops. The Journal reported on belt-tightening at each degree of the earnings scale. These aren’t portents for completely satisfied residents or a wholesome financial system.