Key Takeaways

Bitcoin reveals stronger correlation with tech shares fairly than gold.

Bitcoin’s correlation with the Nasdaq has reached as excessive as 0.7 prior to now three years.

Share this text

Bitcoin reveals a stronger correlation with tech shares than gold, in accordance with Franklin Templeton Digital Property’ new report, “When Gold Zigged, Bitcoin Moonwalked,” which discusses the widespread narrative that Bitcoin is “digital gold.”

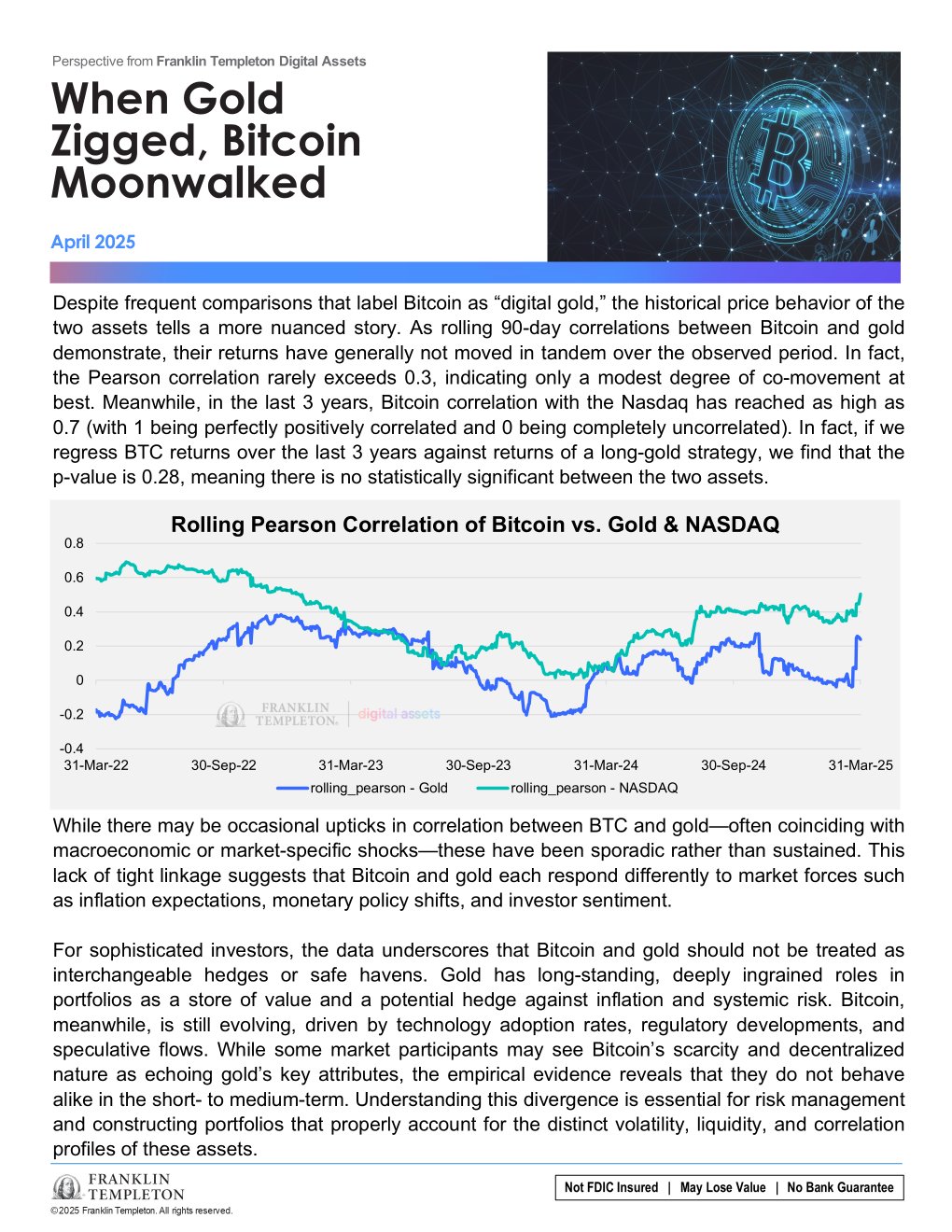

Franklin’s digital asset group analyzed three years of knowledge and located that the value correlation between Bitcoin and gold is weak. Analysis reveals that Bitcoin’s correlation with gold hardly ever exceeds 0.3 over rolling 90-day intervals, that means the 2 property typically transfer independently.

Whereas they may sometimes present some co-movement, they don’t persistently behave in tandem.

As an alternative, Bitcoin has proven a a lot stronger and rising correlation with the Nasdaq inventory index, reaching as excessive as 0.7 prior to now three years. This implies Bitcoin’s habits extra carefully tracks tech equities than conventional secure havens.

“The truth is, if we regress BTC returns during the last 3 years in opposition to returns of a long-gold technique, we discover that the p-value is 0.28, that means there isn’t any statistically important between the 2 property,” the report says.

In line with Franklin Templeton Digital Property, a number of key elements are behind the divergence. Gold has a long-standing institutional adoption, deep liquidity, and a sturdy market construction developed over centuries.

Bitcoin, however, has solely not too long ago entered institutional portfolios and stays influenced by rising dynamics corresponding to regulatory adjustments, technological innovation, and speculative flows.

Whereas there have been transient intervals the place Bitcoin and gold moved in tandem, often throughout macroeconomic shocks, these episodes have been extra the exception than the rule.

The report argues that Bitcoin’s inherently risky and tech-driven nature limits its usefulness as a gold substitute in diversified portfolios.

“The disparity in maturity, mixed with Bitcoin’s inherently extra risky and tech-driven nature, continues to restrict its correlation with gold, making the case that the “digital gold” moniker could also be extra aspirational than reflective of precise market habits—not less than for now,” the report notes.

Gold costs soar to contemporary highs as US-China commerce tensions escalate

Bitcoin soared previous $83,000 early Friday as US Producer Worth Index (PPI) knowledge reported decrease than anticipated at 2.7% in opposition to a forecast of three.3%, in accordance with TradingView knowledge.

The lower in PPI, together with a drop within the US greenback index under the important thing 100 degree, has fueled optimism amongst crypto merchants about potential bullish market situations for Bitcoin.

Nevertheless, regardless of these ostensibly constructive inflation numbers, main US inventory indexes just like the S&P 500 and Nasdaq confirmed minimal change, reflecting ongoing considerations in regards to the US commerce struggle.

Bitcoin has skilled elevated volatility over the previous week, largely in response to President Trump’s sweeping tariff announcement, which rattled world fairness markets.

Regardless of early indicators of decoupling, Bitcoin continues to commerce consistent with tech shares. After briefly falling under $80,000 on Thursday because the US-China commerce battle intensified, the crypto asset rebounded above $83,000 right now on PPI knowledge.

On the time of publication, Bitcoin modified fingers at round $82,600, up almost 4% within the final 24 hours.

Gold surged to new document highs on Friday as traders flocked to safe-haven property amid rising US-China commerce tensions. Spot gold climbed over 1% to $3,207 per ounce, whereas futures reached $3,236.

The valuable steel is now up roughly 20% for the yr, outperforming most main asset courses.

Share this text