The hospitality business faces mounting challenges with fragmented software program methods, rising operational prices, and chronic labor shortages that make scaling operations more and more tough. Disconnected entrance and back-office groups create inefficiencies that impression each visitor expertise and profitability. SuiteOp presents an all-in-one platform that consolidates important features right into a seamless ecosystem, from good gadget administration to visitor screening and activity administration. Precise operators created this platform after going through these challenges firsthand whereas managing a whole bunch of models. Their automation-first method delivers tangible outcomes, with clients reporting as much as 20% discount in operational bills and a 3.5x return on funding via enhanced income. AlleyWatch sat down with SuiteOp Co-founder and COO Simon Seroussi to be taught extra concerning the enterprise, its strategic enlargement plans, and up to date $3M seed spherical.

Who have been your buyers and the way a lot did you increase?

$3M Seed from ScopVc, Dream, and angel buyers together with Kunal Shah, and Sudeep Singh, and Tune Pak.

What impressed the beginning of SuiteOp and please inform us concerning the services or products that SuiteOp presents?

SuiteOp emerged from the real-world challenges confronted by our founding group whereas scaling Sosuite — a short-term rental model managing a whole bunch of models throughout Philadelphia. Within the wake of COVID-19, they grappled with skyrocketing operational prices, power labor shortages, and disjointed software program stacks that made scaling more durable. Fairly than settle for these inefficiencies, they got down to construct the automation-first working system they couldn’t discover out there.Whereas SuiteOp was born within the short-term rental area, it now powers a variety of lodging companies — from boutique inns to hybrid operators — going through the identical operational challenges.

How is SuiteOp completely different?

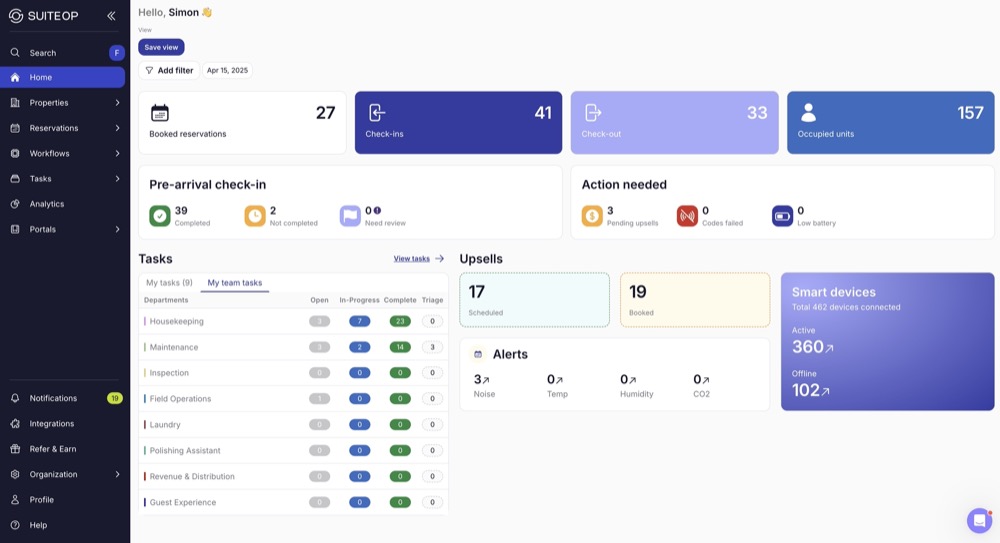

SuiteOp is the primary “Visitor Operations Platform” that connects hospitality groups, operations, and visitor expertise instruments in a single cohesive ecosystem, eliminating the necessity for fragmented software program stacks and a number of instruments.

It was created by precise operators (the founders of Sosuite) who confronted real-world challenges in managing a whole bunch of models, giving them sensible perception into business ache factors

SuiteOp is particularly designed with automation as its core focus, serving to hospitality operators run effectively regardless of labor shortages and excessive operational prices

IoT oversight and good automation

White-labeled visitor portals

Visitor screening

Activity administration

Analytics

It combines a number of key capabilities into one cohesive workflow:

Not like enterprise-level platforms constructed for large resort chains, SuiteOp is accessible to operators of all sizes – together with smaller, impartial companies – enabling them to ship high-end visitor experiences while not having in depth inner sources.

SuiteOp has spectacular market validation with zero p.c buyer churn regardless of business challenges, suggesting robust product-market match

SuiteOp additionally solves one of many business’s greatest ache factors: disconnection between front- and back-office groups. By integrating these workflows, it helps operators unlock a brand new stage of effectivity and repair high quality.

What market does SuiteOp goal and the way massive is it?

SuiteOp addresses the operational challenges throughout the fragmented $1.2T world lodging business, with strategic concentrate on the quickly rising short-term rental phase, trip rental properties, and impartial boutique inns.This market encompasses over 10 million professionally managed properties worldwide looking for expertise options to reinforce operational effectivity and income optimization in an more and more aggressive panorama.

What’s your small business mannequin?

SuiteOp employs a simple utilization-based pricing construction: a easy month-to-month price based mostly on the variety of energetic properties managed via our platform. Our dedication to transparency means you’ll by no means encounter hidden prices or shock costs that compromise your monetary planning.Not like opponents who depend on advanced transaction-based price constructions that may fluctuate unpredictably month-to-month, SuiteOp’s constant pricing mannequin permits property managers to forecast bills with confidence and maximize their operational effectivity with out monetary uncertainty.

How are you making ready for a possible financial slowdown?

SuiteOp permits property operators to thrive in any financial local weather by enhancing operational effectivity and producing ancillary income within the usually low-margin hospitality sector. It was partially developed in response to post-COVID challenges, and was created to assist operators preserve profitability throughout financial downturns.Our answer delivers tangible outcomes: a 3.5x common return on funding via income enhancement, whereas decreasing operational bills by as much as 20%. With that in thoughts, SuiteOp turns into an answer of selection throughout financial slowdowns, and we are literally seeing elevated adoption in these instances.

What was the funding course of like?

It unfolded organically. We weren’t actively looking for capital in December, having solely held preliminary conversations months earlier with out conviction about timing. As momentum constructed, the partnership with ScopVC emerged naturally. Their operator mindset and understanding of company-building fundamentals aligned completely with our imaginative and prescient, making the choice to proceed simple.

What are the most important challenges that you just confronted whereas elevating capital?

Discovering buyers who really understood our enterprise and have been prepared to commit on aligned phrases proved difficult. The method requires coordinating varied stakeholders – people and institutional funds – every with distinct priorities, funding thresholds, and decision-making timelines.Sustaining constant phrases whereas accommodating these variations required us to navigate this with a number of consideration and a number of care.

What elements about your small business led your buyers to jot down the test?

I feel they have been three compelling elements drove our funding success:

Trade experience that permits us to anticipate market wants relatively than merely react to them: deep area data permits us to leverage buyer suggestions as validation relatively than route, holding us forward of developments.

Technical background from our founding group, leading to speedy growth cycles and the power to iterate shortly based mostly on real-world implementation, considerably shortening our time-to-market for brand new options.

Distinctive product-market match evidenced by near-zero churn charges, which we imagine is essentially the most highly effective indicator that our answer delivers measurable worth and has grow to be important to our clients’ operations.

What are the milestones you intend to attain within the subsequent six months?

We’re focusing on aggressive however achievable progress on two fronts: rising our income via expanded market penetration whereas concurrently launching a next-generation automation suite.This new expertise will push past present business capabilities, introducing AI-driven operational instruments that cut back guide intervention by 70% throughout property administration workflows –one thing at the moment not possible with current options.

What recommendation are you able to provide corporations in New York that do not need a recent injection of capital within the financial institution?

Prioritize validation and income technology earlier than chasing enterprise funding. The New York ecosystem gives ample alternatives to check your idea via buyer pilots and strategic partnerships.Construct a sustainable enterprise mannequin that generates early money stream: even modest income gives each validation and runway. Keep in mind that VC funding is a software, not a vacation spot; many profitable corporations bootstrap to profitability by fixing actual buyer issues. If you do reveal market traction, you’ll negotiate from a place of energy relatively than necessity.

The place do you see the corporate going within the close to time period?

We’re at an inflection level in our progress trajectory. Till now, we’ve been primarily product-driven, permitting our answer’s capabilities to talk for themselves whereas rising organically via word-of-mouth.With our latest funding, we’re strategically accelerating on two fronts: ramping up our go-to-market initiatives to increase market penetration, whereas concurrently sustaining the speedy product growth tempo that has established us as an rising chief within the area.

What’s your favourite spring vacation spot in and across the metropolis?Too many to depend! Strolling from Pier 25 to Pier 97 on a spring day is at all times wonderful. Now we have an adventurous dachshund, Couscous, who’s an actual out of doors fella, and it’s at all times an unimaginable stroll because it warms up, stopping at varied institutions alongside the best way for a juice or just a little spritz.We’re all foodies, and have found a few new spots lately – Boni and Mott has phenomenal Mediterranean meals (and a burger to die for) that’s excellent on a spring day. And top-of-the-line rooster burgers within the metropolis is at Forefeather, who simply opened their Manhattan spot between Gramercy Park & Murray Hill. Spring in NYC simply hits completely different after winter!