Up to date on April twenty fifth, 2025 by Bob Ciura

It isn’t shocking that we favor shares that pay dividends, as research have proven that proudly owning earnings producing securities is a wonderful solution to construct wealth whereas additionally defending to the draw back.

In bull markets, dividends can add to the beneficial properties from the inventory whereas additionally buying extra shares. When costs decline, dividends can cut back the losses whereas getting used to accumulate extra shares at a now lower cost.

With this in thoughts, we created a full record of the Dividend Kings, a gaggle of shares with over 50 consecutive years of dividend will increase.

You possibly can see the complete downloadable spreadsheet of all 55 Dividend Kings (together with essential monetary metrics corresponding to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

The Dividend Kings have rewarded shareholders with rising earnings for many years.

The next 10 shares signify Dividend Kings that may proceed to lift their dividends for many years to return.

The record consists of 10 Dividend Kings with our highest Dividend Danger Rating of ‘A’ within the Positive Evaluation Analysis Database, that even have payout ratios beneath 70% to make sure a sustainable dividend payout.

The shares are sorted by dividend payout ratio, from lowest to highest.

Desk of Contents

Dividend King To Maintain Ceaselessly: ABM Industries (ABM)

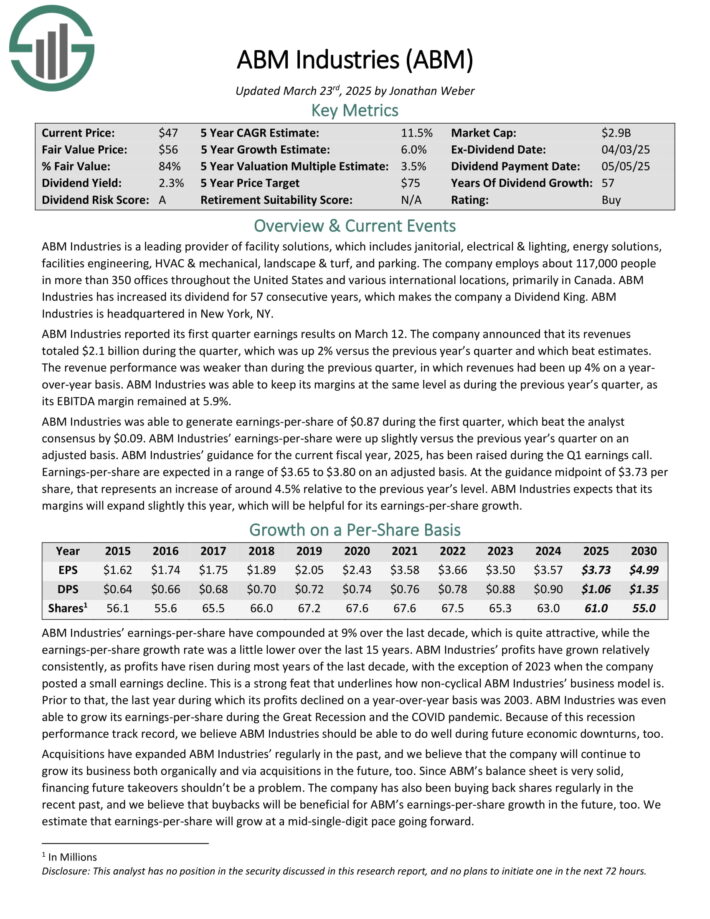

ABM Industries is a number one supplier of facility options, which incorporates janitorial, electrical & lighting, vitality options, services engineering, HVAC & mechanical, panorama & turf, and parking.

The corporate employs about 124,000 folks in additional than 350 places of work all through the USA and varied worldwide places, primarily in Canada.

Supply: Investor Presentation

ABM Industries reported its first quarter earnings outcomes on March 12. The corporate introduced that its revenues totaled $2.1 billion through the quarter, which was up 2% versus the earlier yr’s quarter and which beat estimates.

The income efficiency was weaker than through the earlier quarter, wherein revenues had been up 4% on a year-over-year foundation. ABM Industries was capable of preserve its margins on the similar degree as through the earlier yr’s quarter, as its EBITDA margin remained at 5.9%.

ABM Industries was capable of generate earnings-per-share of $0.87 through the first quarter, which beat the analyst consensus by $0.09. ABM Industries’ earnings-per-share have been up barely versus the earlier yr’s quarter on an adjusted foundation.

Click on right here to obtain our most up-to-date Positive Evaluation report on ABM (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: MSA Security Inc. (MSA)

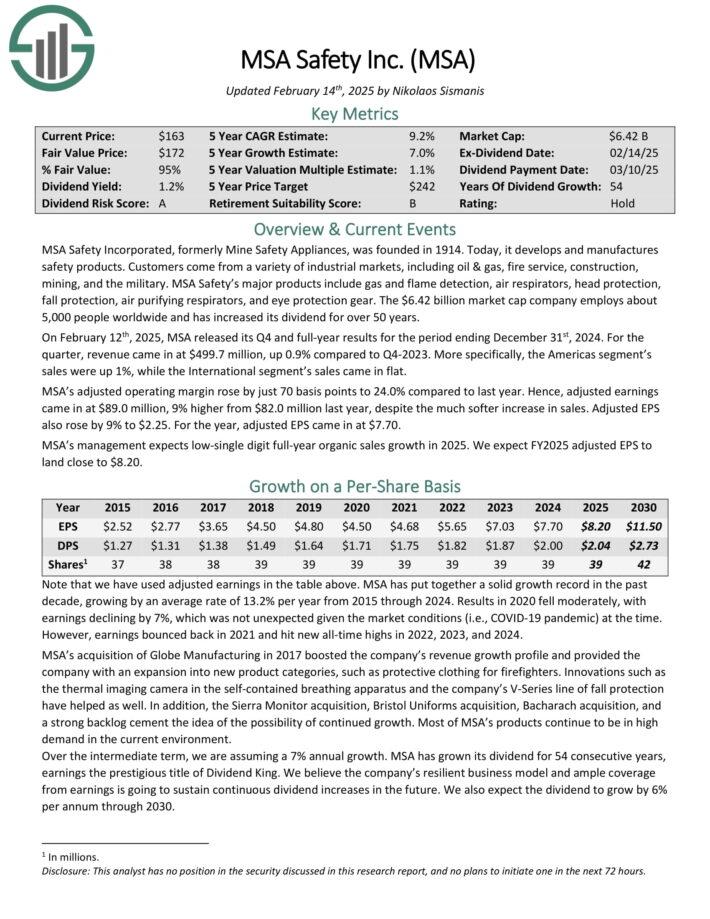

MSA Security Included, previously Mine Security Home equipment, was based in 1914. At this time, it develops and manufactures security merchandise.

Prospects come from a wide range of industrial markets, together with oil & gasoline, fireplace service, building, mining, and the army.

MSA Security’s main merchandise embody gasoline and flame detection, air respirators, head safety, fall safety, air purifying respirators, and eye safety gear.

On February twelfth, 2025, MSA launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, income got here in at $499.7 million, up 0.9% in comparison with This fall-2023. Extra particularly, the Americas phase’s gross sales have been up 1%, whereas the Worldwide phase’s gross sales got here in flat.

MSA’s adjusted working margin rose by simply 70 foundation factors to 24.0% in comparison with final yr. Therefore, adjusted earnings got here in at $89.0 million, 9% larger from $82.0 million final yr, regardless of the a lot softer enhance in gross sales. Adjusted EPS additionally rose by 9% to $2.25. For the yr, adjusted EPS got here in at $7.70.

MSA’s administration expects low-single digit full-year natural gross sales progress in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on MSA (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: Parker-Hannifin Corp. (PH)

Parker-Hannifin is a diversified industrial producer specializing in movement and management applied sciences. The corporate generates annual revenues of $16 billion.

Parker-Hannifin has paid a dividend for 72 years and has elevated the dividend for 67 consecutive years.

Supply: Investor Presentation

In late January, Parker-Hannifin reported (1/30/25) outcomes for the second quarter of 2025. Natural gross sales grew 1% over the prior yr’s quarter, as 14% progress in aerospace was nearly offset by declines in North American Enterprise and Worldwide Enterprise.

Adjusted earnings-per-share grew 6%, from $6.16 to $6.53, due to robust gross sales and a wider revenue margin in aerospace.

Parker-Hannifin exceeded the analysts’ consensus by $0.30. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 38 consecutive quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on Parker-Hannifin (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: H.B. Fuller Firm (FUL)

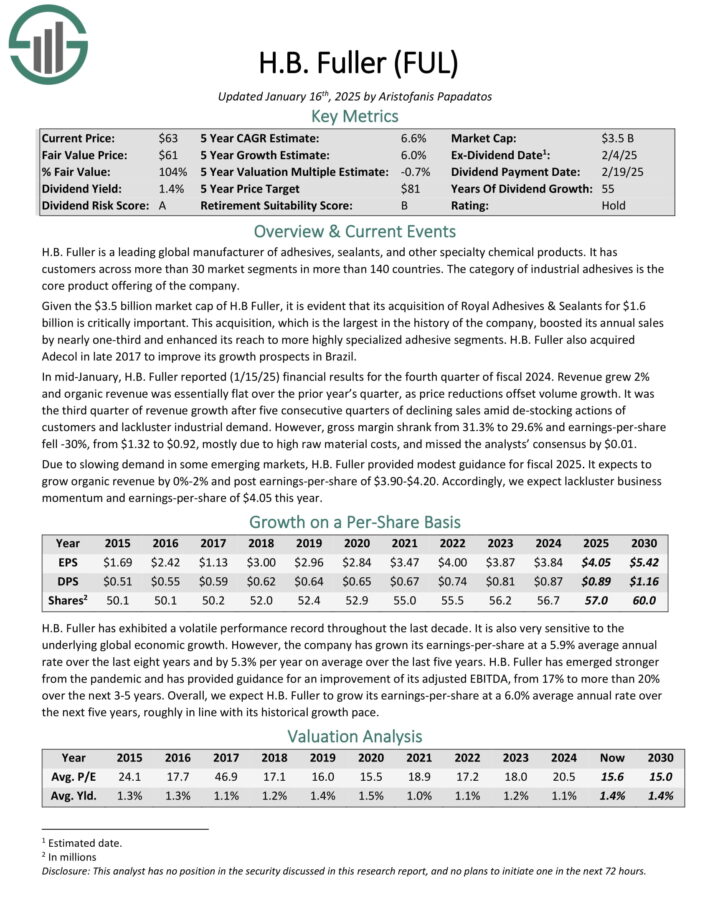

H.B. Fuller is a number one international producer of adhesives, sealants, and different specialty chemical merchandise.

It has prospects throughout greater than 30 market segments in additional than 140 international locations. The class of business adhesives is the core product providing.

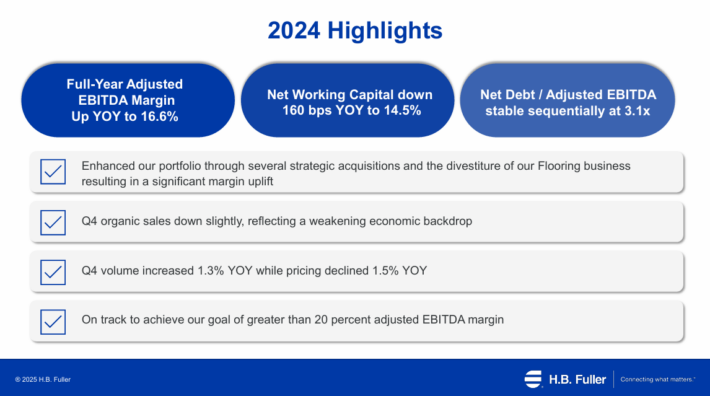

In mid-January, H.B. Fuller reported (1/15/25) monetary outcomes for the fourth quarter of fiscal 2024. Income grew 2% and natural income was basically flat year-over-year, as value reductions offset quantity progress.

Highlights for the complete yr will be seen within the picture beneath:

Supply: Investor Presentation

It was the third quarter of income progress after 5 consecutive quarters of declining gross sales amid de-stocking actions of consumers and lackluster industrial demand.

Nevertheless, gross margin shrank from 31.3% to 29.6% and earnings-per-share fell -30%, from $1.32 to $0.92, largely as a consequence of excessive uncooked materials prices, and missed the analysts’ consensus by $0.01.

Because of slowing demand in some rising markets, H.B. Fuller offered modest steerage for fiscal 2025. It expects to develop natural income by 0%-2% and publish earnings-per-share of $3.90-$4.20.

Click on right here to obtain our most up-to-date Positive Evaluation report on FUL (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: S&P World Inc. (SPGI)

S&P World is a worldwide supplier of monetary companies and enterprise data and income of over $13 billion.

By means of its varied segments, it gives credit score rankings, benchmarks and indices, analytics, and different knowledge to commodity market contributors, capital markets, and automotive markets.

S&P World has paid dividends constantly since 1937 and has elevated its payout for 51 consecutive years.

S&P posted fourth quarter and full-year earnings on February eleventh, 2025, and outcomes have been a lot better than anticipated on each the highest and backside traces.

Adjusted earnings-per-share got here to $3.77, which was a staggering 30 cents forward of estimates. Earnings rose from $3.13 a yr in the past.

Income was up 14% year-over-year to $3.59 billion, beating estimates by $90 million. The corporate posted income progress in all of its working segments, along with robust working margin growth.

Working bills rose barely from $2.26 billion to $2.33 billion year-over-year. That led to working revenue of $1.68 billion, sharply larger from $1.39 billion a yr in the past.

With dividend progress above 10%, SPGI is likely one of the rock strong dividend shares.

Click on right here to obtain our most up-to-date Positive Evaluation report on SPGI (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: Dover Corp. (DOV)

Dover Company is a diversified international industrial producer with annual revenues approaching $8 billion.

Dover consists of 5 reporting segments: Engineered Methods, Clear Power & Fueling, Pumps & Course of Options, Imaging & Identification, and Local weather & Sustainability Applied sciences.

On January thirtieth, 2025, Dover introduced fourth quarter and full yr outcomes the interval ending December thirty first, 2024. For the quarter, income grew 1% to $1.93 billion, although this was $20 million lower than anticipated.

Adjusted earnings-per-share of $2.20 in contrast unfavorably to $2.45 within the prior yr, however was $0.12 forward of estimates.

For the yr, income was larger by 1% to $7.75 billion whereas adjusted earnings-per-share of $8.29 in comparison with $8.80 in 2023.

For the quarter, natural income grew 0.3% year-over-year whereas bookings grew 7%. Engineered Merchandise had natural progress of two% as beneficial properties in car aftermarket and fluid meting out have been offset by cargo timings in aerospace and protection.

Click on right here to obtain our most up-to-date Positive Evaluation report on DOV (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: Tennant Co. (TNC)

Tennant Firm is a equipment firm that produces cleansing merchandise and that provides cleansing options to its prospects.

Within the US, the corporate holds the market management place in its business, however the firm additionally sells its merchandise in additional than 100 extra international locations across the globe.

Supply: Investor Presentation

Tennant Firm reported its fourth quarter earnings outcomes on February 19. Revenues of $328 million through the quarter elevated 6% year-over-year.

Tennant Firm generated adjusted earnings-per-share of $1.52 through the fourth quarter, which was lower than what the analyst group had forecasted, and which was down in comparison with the earlier yr.

Administration is forecasting that adjusted earnings-per-share will fall into a spread of $5.70 to $6.20 in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on TNC (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: W.W. Grainger Inc. (GWW)

W.W. Grainger, headquartered in Lake Forest, IL, is likely one of the world’s largest business-to-business distributors of upkeep, restore, and operations (“MRO”) provides.

Grainger has greater than 4.5 million energetic prospects, with greater than 30 million merchandise supplied globally.

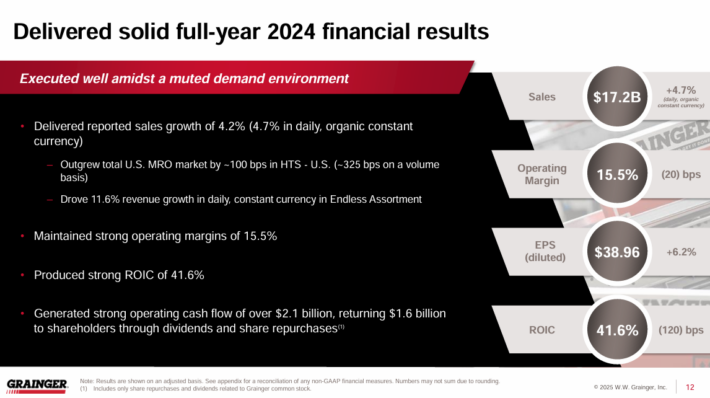

On January thirty first, 2025, W.W. Grainger posted its This fall and full-year outcomes. For the quarter, revenues have been $4.23 billion, up 5.9% on a reported foundation and up 4.7% on a each day, fixed forex foundation in comparison with final yr.

Outcomes have been pushed by strong efficiency throughout the board. The Excessive-Contact Options phase achieved gross sales progress of 4.0% as a consequence of quantity progress in all geographies.

Supply: Investor Presentation

Within the Countless Assortment phase, gross sales have been up 15.1%. Income progress for the phase was pushed by core B2B prospects throughout the phase in addition to enterprise buyer progress at MonotaRO.

Web earnings equaled $475 million, up 20.2% in comparison with This fall-2023. Web earnings was boosted by a 110 foundation level growth within the working margin to fifteen.0%.

Earnings-per-share got here in at $9.74, 22.8% larger year-over-year, and have been additional aided by inventory buybacks. For the yr, EPS reached a document $38.71.

Click on right here to obtain our most up-to-date Positive Evaluation report on GWW (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: RLI Corp. (RLI)

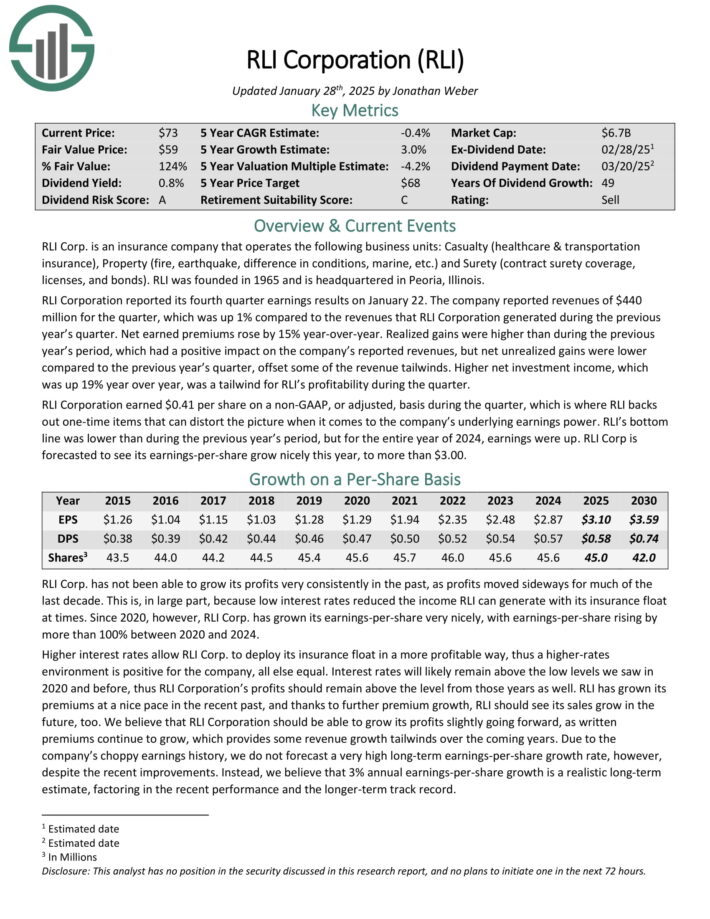

RLI Corp. is an insurance coverage firm that operates the next enterprise items: Casualty (healthcare & transportation insurance coverage), Property (fireplace, earthquake, distinction in circumstances, marine, and many others.) and Surety (contract surety protection, licenses, and bonds).

Supply: Investor Presentation

RLI Company reported its fourth quarter earnings outcomes on January 22. The corporate reported revenues of $440 million for the quarter, which was up 1% year-over-year. Web earned premiums rose by 15% year-over-year.

Realized beneficial properties have been larger than through the earlier yr’s interval, which had a constructive impression on the corporate’s reported revenues, however internet unrealized beneficial properties have been decrease in comparison with the earlier yr’s quarter, offset among the income tailwinds.

Increased internet funding earnings, which was up 19% yr over yr, was a tailwind for RLI’s profitability through the quarter.

RLI Company earned $0.41 per share on a non-GAAP, or adjusted, foundation through the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on RLI (preview of web page 1 of three proven beneath):

Dividend King To Maintain Ceaselessly: Farmers & Retailers Bancorp (FMCB)

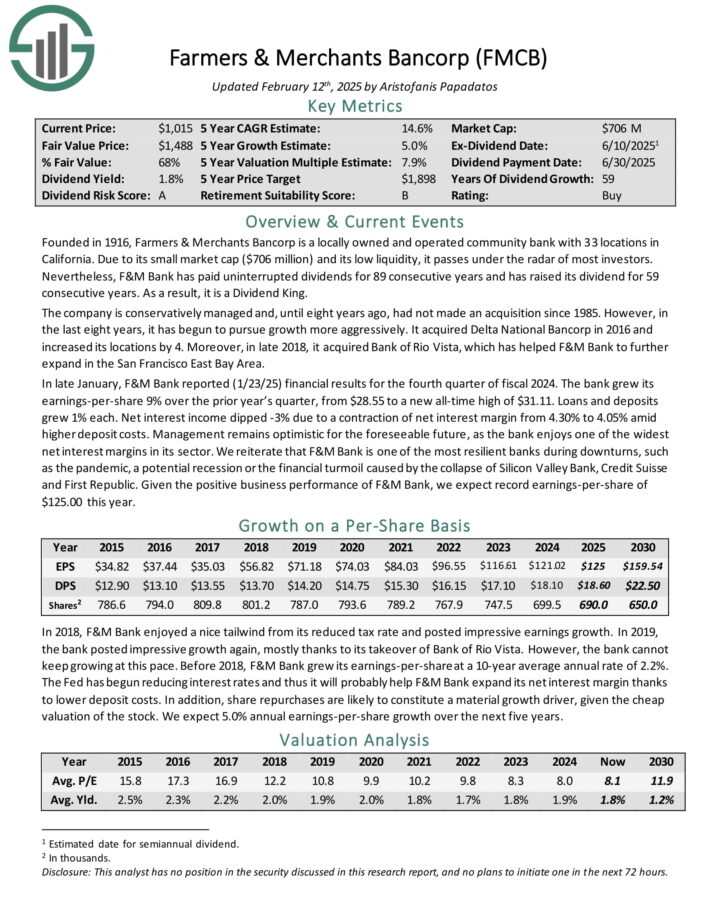

Farmers & Retailers Bancorp is a domestically owned and operated group financial institution with 32 places in California. Because of its small market cap and its low liquidity, it passes below the radar of most buyers.

F&M Financial institution has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In late January, F&M Financial institution reported (1/23/25) monetary outcomes for the fourth quarter of fiscal 2024. The financial institution grew its earnings-per-share 9% over the prior yr’s quarter, from $28.55 to a brand new all-time excessive of $31.11. Loans and deposits grew 1% every.

Web curiosity earnings dipped -3% as a consequence of a contraction of internet curiosity margin from 4.30% to 4.05% amid larger deposit prices. Administration stays optimistic for the foreseeable future, because the financial institution enjoys one of many widest internet curiosity margins in its sector.

We reiterate that F&M Financial institution is likely one of the most resilient banks throughout downturns, such because the pandemic, a possible recession or the monetary turmoil brought on by the collapse of Silicon Valley Financial institution, Credit score Suisse and First Republic.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMCB (preview of web page 1 of three proven beneath):

Remaining Ideas

Screening to search out one of the best Dividend Kings just isn’t the one solution to discover high-quality dividend progress shares to carry perpetually.

Positive Dividend maintains related databases on the next helpful universes of shares:

There’s nothing magical about investing within the Dividend Kings. They’re merely a gaggle of high-quality companies with shareholder-friendly administration groups which have robust aggressive benefits.

Buying companies with these traits–at honest or higher costs–and holding them perpetually, will doubtless lead to robust long-term funding efficiency.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.