Revealed on July twenty ninth, 2025 by Bob Ciura

Revenue traders keen to look outdoors the U.S. ought to take into account worldwide dividend shares.

Including worldwide dividend shares brings geographical diversification. As well as, many worldwide dividend shares are providing greater yields, and decrease valuations, than their U.S.-based friends.

After all, there are dangers to buying worldwide shares, similar to forex threat. Nonetheless, there are a lot of high quality worldwide shares which have elevated their dividends a few years.

We take into account shares which have elevated their dividends for over 10 consecutive years to be blue-chip shares.

You possibly can obtain our full checklist of over 500 blue-chip shares by clicking on the hyperlink beneath:

This text will talk about the highest 10 worldwide dividend shares. All of the shares on the checklist have elevated their dividends for a minimum of 10 years.

Moreover, they’ve Dividend Threat Scores of ‘C’ or higher within the Certain Evaluation Analysis Database, signifying they’ve safe payouts.

Because of this, these 10 worldwide dividend development shares may very well be engaging for dividend development traders, searching for worldwide diversification.

Desk of Contents

The desk of contents beneath permits for straightforward navigation. The shares are listed by 5-year annual anticipated returns, in ascending order.

Worldwide Dividend Inventory #10: Canadian Nationwide Railway (CNI)

Annual Anticipated Returns: 10.2%

Canadian Nationwide Railway is the biggest railway operator in Canada. The corporate has a community of roughly 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico.

It handles over $200 billion value of products yearly and carries over 300 million tons of cargo.

On Could 1st, 2025, Canadian Nationwide Railway reported first quarter outcomes. For the quarter, income grew 2.3% to $3.18 billion, which was $25 million greater than anticipated.

Adjusted earnings-per share of $1.40 in contrast favorably to $1.26 within the prior 12 months and was $0.12 above estimates.

For the quarter, Canadian Nationwide Railway’s working ratio improved 20 foundation factors to 63.4%. Income ton miles improved 1% from the prior 12 months whereas carloads declined 2.2%.

Income outcomes had been blended for many of the firm’s particular person product classes. Utilizing fixed forex, Coal (+9%), Grain and Fertilizers (+7%), and Petroleum and Chemical compounds (+3%) had been all greater for the interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on CNI (preview of web page 1 of three proven beneath):

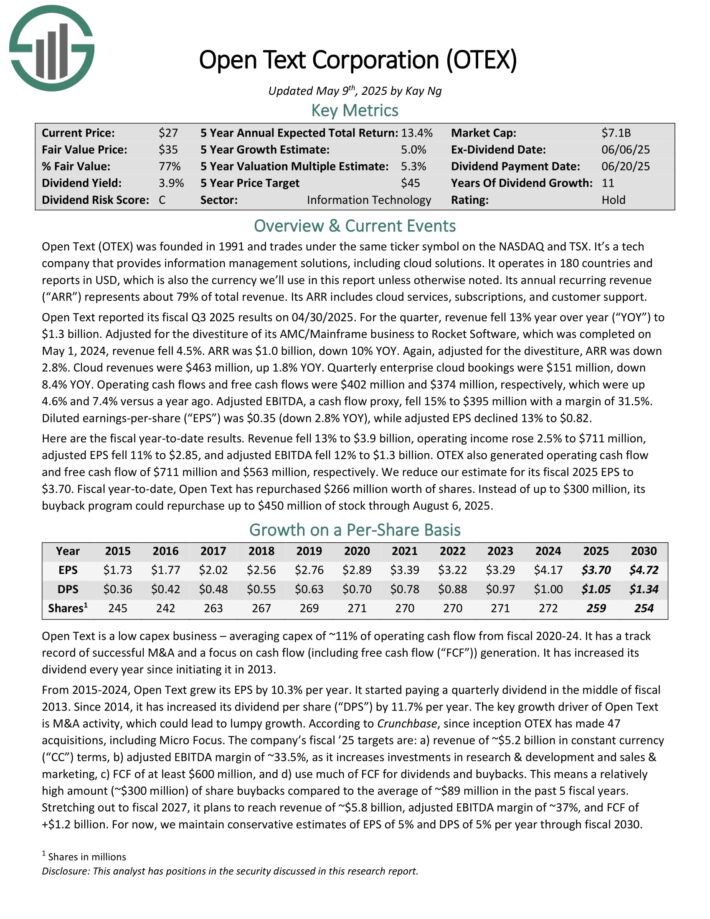

Worldwide Dividend Inventory #9: Open Textual content Corp. (OTEX)

Annual Anticipated Returns: 11.0%

Open Textual content was based in 1991. It supplies info administration options, together with cloud options. It operates in 180 nations and its annual recurring income (“ARR”) represents about 79% of complete income.

Its ARR consists of cloud companies, subscriptions, and buyer help. Open Textual content reported its fiscal Q3 2025 outcomes on 04/30/2025. For the quarter, income fell 13% year-over-year to $1.3 billion. Adjusted for the divestiture of its AMC/Mainframe enterprise to Rocket Software program, which was accomplished on Could 1, 2024, income fell 4.5%.

ARR was $1.0 billion, down 10% year-over-year. Once more, adjusted for the divestiture, ARR was down 2.8%. Cloud revenues had been $463 million, up 1.8% year-over-year.

Working money flows and free money flows had been $402 million and $374 million, respectively, which had been up 4.6% and seven.4% versus a 12 months in the past. Adjusted EBITDA, a money circulation proxy, fell 15% to $395 million with a margin of 31.5%.

OTEX additionally generated working money circulation and free money circulation of $711 million and $563 million, respectively.

Click on right here to obtain our most up-to-date Certain Evaluation report on OTEX (preview of web page 1 of three proven beneath):

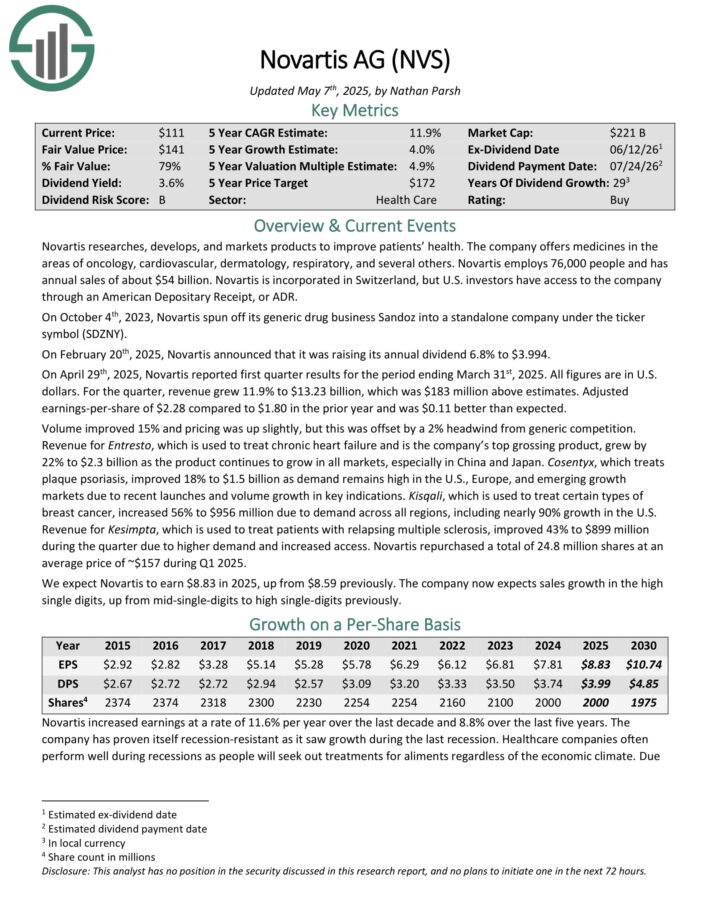

Worldwide Dividend Inventory #8: Novartis AG (NVS)

Annual Anticipated Returns: 11.3%

Novartis researches, develops, and markets merchandise to enhance sufferers’ well being. The corporate affords medicines within the areas of oncology, cardiovascular, dermatology, respiratory, and several other others. Novartis employs 76,000 folks and has annual gross sales of about $54 billion.

Novartis is included in Switzerland, however U.S. traders have entry to the corporate by way of an American Depositary Receipt, or ADR.

On April twenty ninth, 2025, Novartis reported first quarter outcomes. All figures are in U.S. {dollars}. For the quarter, income grew 11.9% to $13.23 billion, which was $183 million above estimates. Adjusted earnings-per-share of $2.28 in comparison with $1.80 within the prior 12 months and was $0.11 higher than anticipated.

Quantity improved 15% and pricing was up barely, however this was offset by a 2% headwind from generic competitors. Income for Entresto, which is used to deal with continual coronary heart failure and is the corporate’s high grossing product, grew by 22% to $2.3 billion because the product continues to develop in all markets, particularly in China and Japan.

Cosentyx, which treats plaque psoriasis, improved 18% to $1.5 billion as demand stays excessive within the U.S., Europe, and rising development markets because of latest launches and quantity development in key indications.

Click on right here to obtain our most up-to-date Certain Evaluation report on NVS (preview of web page 1 of three proven beneath):

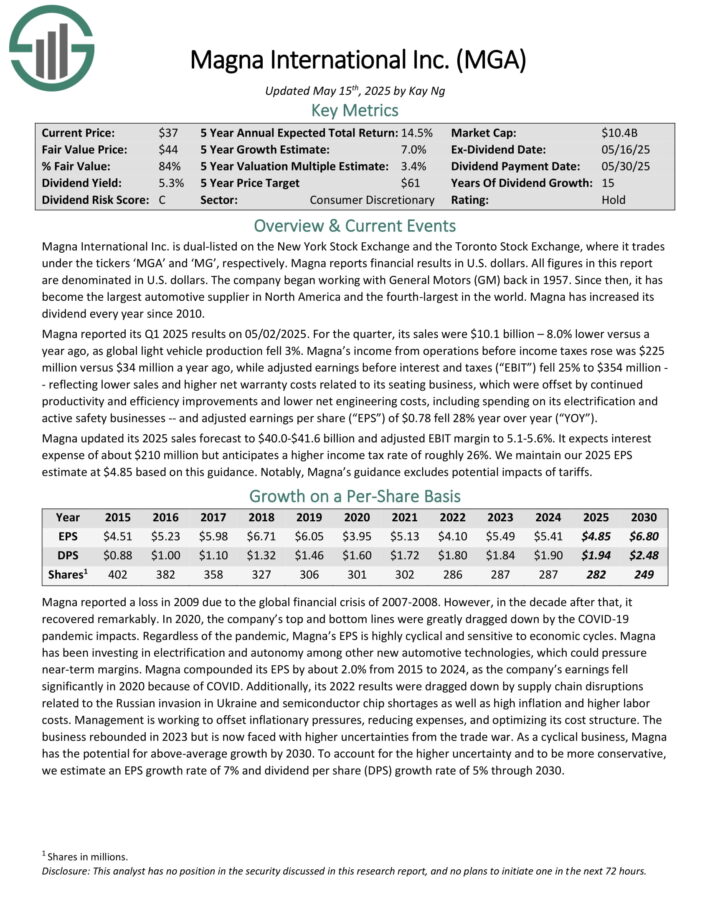

Worldwide Dividend Inventory #7: Magna Worldwide (MGA)

Annual Anticipated Returns: 11.4%

Magna Worldwide Inc. is dual-listed on the New York Inventory Change and the Toronto Inventory Change, the place it trades beneath the tickers ‘MGA’ and ‘MG’, respectively.

It has turn out to be the biggest automotive provider in North America and the fourth-largest on the earth. Magna has elevated its dividend yearly since 2010.

Magna reported its Q1 2025 outcomes on 05/02/2025. For the quarter, its gross sales had been $10.1 billion – 8.0% decrease versus a 12 months in the past, as international gentle automobile manufacturing fell 3%. Magna’s earnings from operations earlier than earnings taxes rose was $225 million versus $34 million a 12 months in the past.

Adjusted earnings earlier than curiosity and taxes (“EBIT”) fell 25% to $354 million — reflecting decrease gross sales and better web guarantee prices associated to its seating enterprise, which had been offset by continued productiveness and effectivity enhancements and decrease web engineering prices, together with spending on its electrification and lively security companies.

Adjusted earnings per share of $0.78 fell 28% year-over-year. Magna up to date its 2025 gross sales forecast to $40.0-$41.6 billion and adjusted EBIT margin to five.1-5.6%.

Click on right here to obtain our most up-to-date Certain Evaluation report on MGA (preview of web page 1 of three proven beneath):

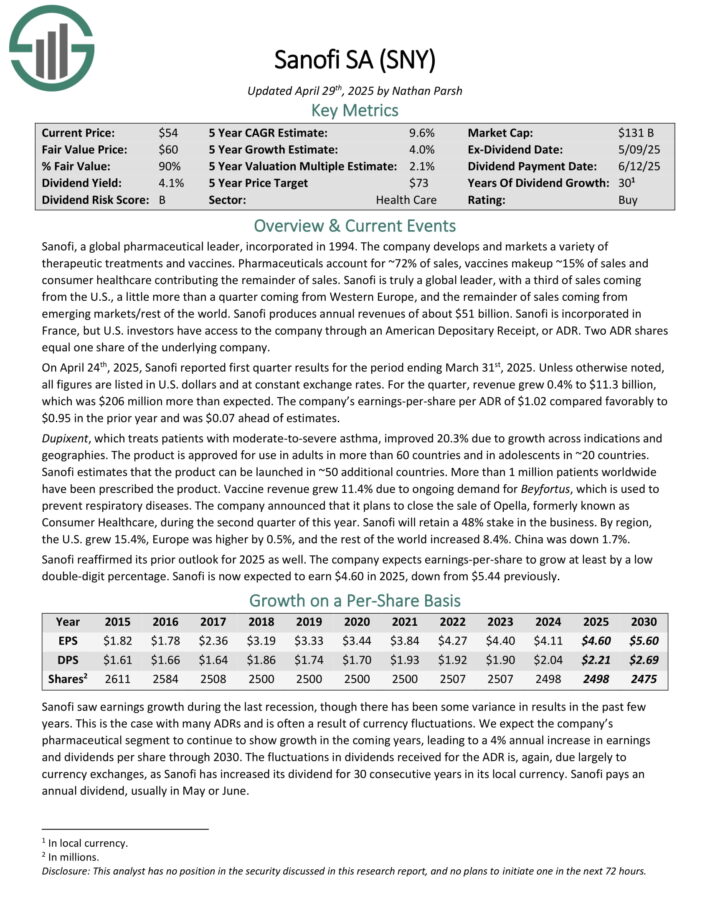

Worldwide Dividend Inventory #6: Sanofi (SNY)

Annual Anticipated Returns: 11.6%

Sanofi is a worldwide pharmaceutical firm that develops and markets a wide range of therapeutic therapies and vaccines. Prescribed drugs account for ~72% of gross sales, vaccines make-up ~15% of gross sales and client healthcare contributing the rest of gross sales.

Sanofi produces annual revenues of about $51 billion. It’s included in France, however U.S. traders have entry to the corporate by way of an American Depositary Receipt, or ADR. Two ADR shares equal one share of the underlying firm.

On April twenty fourth, 2025, Sanofi reported first quarter outcomes for the interval ending March thirty first, 2025. Until in any other case famous, all figures are listed in U.S. {dollars} and at fixed change charges.

For the quarter, income grew 0.4% to $11.3 billion, which was $206 million greater than anticipated. The corporate’s earnings-per-share per ADR of $1.02 in contrast favorably to $0.95 within the prior 12 months and was $0.07 forward of estimates.

Dupixent, which treats sufferers with moderate-to-severe bronchial asthma, improved 20.3% because of development throughout indications and geographies. The product is authorised to be used in adults in additional than 60 nations and in adolescents in ~20 nations. Sanofi estimates that the product will be launched in ~50 extra nations.

Vaccine income grew 11.4% because of ongoing demand for Beyfortus, which is used to stop respiratory illnesses.

Click on right here to obtain our most up-to-date Certain Evaluation report on SNY (preview of web page 1 of three proven beneath):

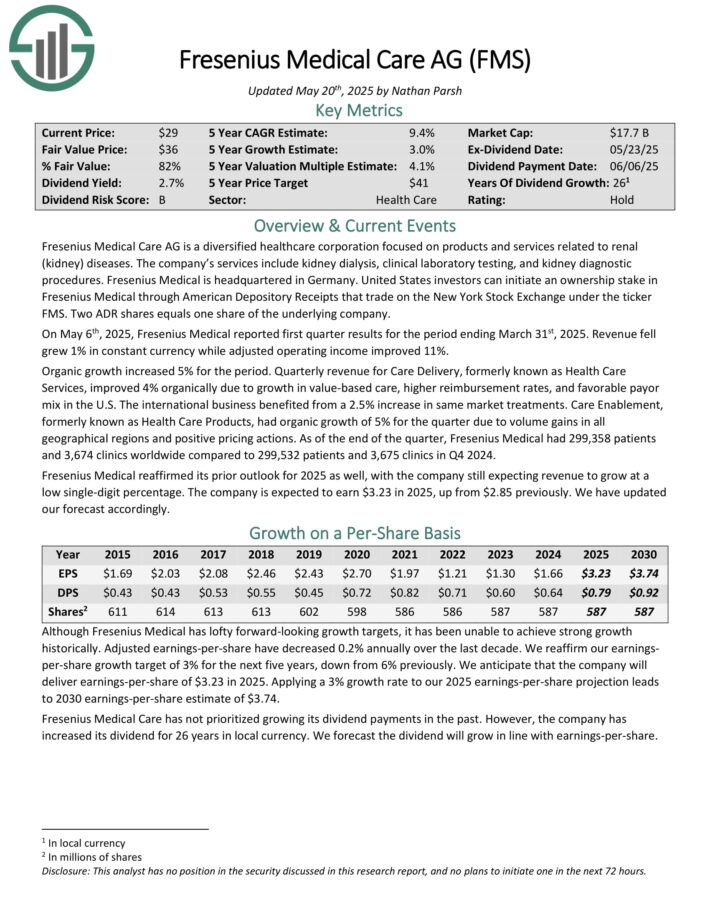

Worldwide Dividend Inventory #5: Fresenius-Medical Care AG (FMS)

Annual Anticipated Returns: 12.3%

Fresenius Medical Care AG is a diversified healthcare company centered on services and products associated to renal (kidney) illnesses.

The corporate’s companies embody kidney dialysis, scientific laboratory testing, and kidney diagnostic procedures. Fresenius Medical is headquartered in Germany.

On Could sixth, 2025, Fresenius Medical reported first quarter outcomes for the interval ending March thirty first, 2025. Income fell grew 1% in fixed forex whereas adjusted working earnings improved 11%.

Natural development elevated 5% for the interval. Quarterly income for Care Supply, previously often called Well being Care Providers, improved 4% organically because of development in value-based care, greater reimbursement charges, and favorable payor combine within the U.S. The worldwide enterprise benefited from a 2.5% improve in similar market therapies.

Care Enablement, previously often called Well being Care Merchandise, had natural development of 5% for the quarter because of quantity positive factors in all geographical areas and constructive pricing actions.

Fresenius Medical reaffirmed its prior outlook for 2025 as properly, with the corporate nonetheless anticipating income to develop at a low single-digit share. The corporate is predicted to earn $3.23 in 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on FMS (preview of web page 1 of three proven beneath):

Worldwide Dividend Inventory #4: TFI Worldwide (TFII)

Annual Anticipated Returns: 12.6%

TFI Worldwide Inc. is a number one North American transportation and logistics firm. The Canada-based firm’s 95-plus working corporations and over 26,000 staff present a wide range of transportation and logistics companies to clients.

TFII’s clients function largely within the retail, manufactured items, automotive, constructing supplies, meals and beverage, metals and mining, and companies industries.

Roughly two-thirds of the corporate’s income is generated within the U.S., with the remaining third of income being derived in Canada.

TFII is organized into the next three working segments. The Much less-Than-Truckload section supplies over-the-road and asset-light intermodal LTL companies. By way of the primary half of 2025, LTL accounted for the plurality (~41%) of the corporate’s $3.5 billion in complete income earlier than gas surcharges.

The Truckload section affords flatbed, tank, and container companies to clients. The section additionally carries full hundreds from the shopper to the vacation spot utilizing a closed van or specialised gear.

Lastly, the Logistics section supplies asset-light logistics companies, similar to freight forwarding, transportation administration, and small package deal parcel supply.

On July twenty eighth, TFII shared its earnings report for the second quarter ended June thirtieth, 2025. The corporate’s complete income decreased by 10% over the year-ago interval to $2.04 billion within the quarter. This was because of lowered volumes stemming from weaker end-market demand in the course of the quarter.

TFII’s adjusted diluted EPS dropped by 21.6% year-over-year to $1.34 for the quarter. That beat the analyst consensus by $0.11 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on TFII (preview of web page 1 of three proven beneath):

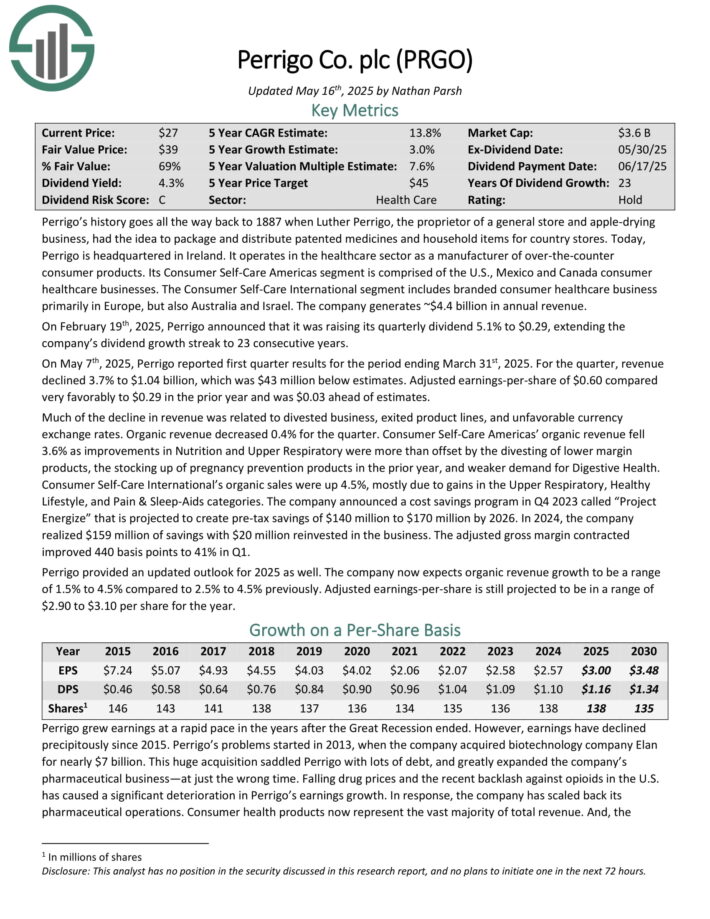

Worldwide Dividend Inventory #3: Perrigo Firm plc (PRGO)

Annual Anticipated Returns: 12.9%

Perrigo operates within the healthcare sector as a producer of over-the-counter client merchandise. Its Client Self-Care Americas section is comprised of the U.S., Mexico and Canada client healthcare companies.

The Client Self-Care Worldwide section consists of branded client healthcare enterprise primarily in Europe, but in addition Australia and Israel. The corporate generates ~$4.4 billion in annual income.

On Could seventh, 2025, Perrigo reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income declined 3.7% to $1.04 billion, which was $43 million beneath estimates. Adjusted earnings-per-share of $0.60 in contrast very favorably to $0.29 within the prior 12 months and was $0.03 forward of estimates.

A lot of the decline in income was associated to divested enterprise, exited product strains, and unfavorable forex change charges. Natural income decreased 0.4% for the quarter.

Client Self-Care Americas’ natural income fell 3.6% as enhancements in Vitamin and Higher Respiratory had been greater than offset by the divesting of decrease margin merchandise, the stocking up of being pregnant prevention merchandise within the prior 12 months, and weaker demand for Digestive Well being.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRGO (preview of web page 1 of three proven beneath):

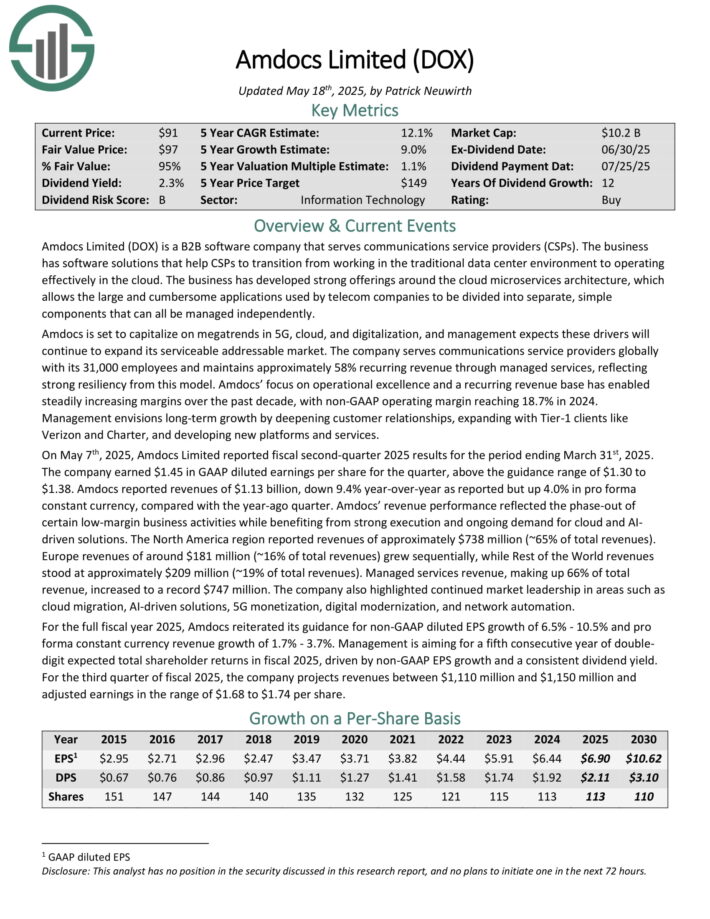

Worldwide Dividend Inventory #2: Amdocs Ltd. (DOX)

Annual Anticipated Returns: 13.3%

Amdocs Restricted is a B2B software program firm that serves communications service suppliers (CSPs). Its software program options that assist CSPs to transition from working within the conventional knowledge heart surroundings to working successfully within the cloud.

The enterprise has developed robust choices across the cloud microservices structure, which permits the big and cumbersome purposes utilized by telecom corporations to be divided into separate, easy parts that may all be managed independently.

Amdocs is about to capitalize on megatrends in 5G, cloud, and digitalization, and administration expects these drivers will proceed to increase its serviceable addressable market.

The corporate serves communications service suppliers globally with its 31,000 staff and maintains roughly 58% recurring income by way of managed companies.

Administration envisions long-term development by deepening buyer relationships, increasing with Tier-1 shoppers like Verizon and Constitution, and growing new platforms and companies.

On Could seventh, 2025, Amdocs Restricted reported fiscal second-quarter 2025 outcomes for the interval ending March thirty first, 2025.

The corporate earned $1.45 in GAAP diluted earnings per share for the quarter, above the steering vary of $1.30 to $1.38. Amdocs reported revenues of $1.13 billion, down 9.4% year-over-year as reported however up 4.0% in professional forma fixed forex, in contrast with the year-ago quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOX (preview of web page 1 of three proven beneath):

Worldwide Dividend Inventory #1: Novo Nordisk (NVO)

Annual Anticipated Returns: 18.4%

Novo Nordisk A/S ADR is a big international pharmaceutical firm headquartered in Denmark. The corporate focuses on two core enterprise segments: Diabetes & Weight problems Care and Uncommon Illnesses.

The Diabetes & Weight problems Care section manufactures insulin, associated supply techniques, oral anti-diabetic merchandise, and merchandise to deal with weight problems. The Uncommon Illnesses section manufactures merchandise for hemophilia and different continual illnesses. Novo Nordisk derives ~92% of income from diabetes and weight problems.

Novo Nordisk reported wonderful Q1 2025 outcomes on Could seventh, 2025. Firm-wide gross sales had been up 19% in Danish kroner to and diluted earnings per share (“EPS”) rose 15% on a year-over-year foundation.

Diabetes & Weight problems gross sales elevated 21% pushed by will increase in Ozempic and Rybelsus (GLP-1), Wegovy (weight problems), long-acting insulin, and fast-acting insulin, offset by decrease gross sales for premix insulin, Saxenda (weight problems), Victoza (GLP-1), and flat human insulin.

The Uncommon Illness section gross sales rose 5% brought on by rising uncommon blood and endocrine problems medicine. The agency is increasing its blockbuster GLP-1 and weight problems medicine to different indications and dosing sizes.

The corporate lowered its outlook to 13 – 21% gross sales development and 16%- 24% working revenue development in 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on NVO (preview of web page 1 of three proven beneath):

Extra Studying

The next Certain Dividend databases include essentially the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.