Key Takeaways

Bitcoin bull Saylor simply hinted at Technique’s new Bitcoin acquisition.

The corporate plans a $2 billion convertible observe providing for Bitcoin acquisitions.

Share this text

Following a short pause, Technique could have resumed its Bitcoin buy. Michael Saylor on Sunday posted the Bitcoin tracker on X, which is usually adopted by a Bitcoin acquisition announcement.

I do not suppose this displays what I bought accomplished final week. pic.twitter.com/57Qe7QfwKm

— Michael Saylor⚡️ (@saylor) February 23, 2025

Saylor’s tweet comes after Technique introduced a $2 billion convertible senior observe providing on Wednesday, carrying 0% curiosity and maturing in 2030, with proceeds supposed for common company functions, together with Bitcoin acquisitions.

The Tysons, Virginia-based firm, which not too long ago rebranded from MicroStrategy, at the moment holds 478,740 Bitcoin valued at roughly $46 billion at present costs. Its newest Bitcoin acquisition of seven,633 BTC occurred within the week ending Feb. 9, at a mean worth of $97,255 per coin.

Following its current sale of Class A typical inventory, Technique maintains round $4 billion of shares obtainable on the market. The agency typically makes use of proceeds from these gross sales to finance its subsequent BTC buy.

Technique has invested roughly $31 billion in Bitcoin at a mean worth of $65,000 per coin, producing almost $15 billion in unrealized features.

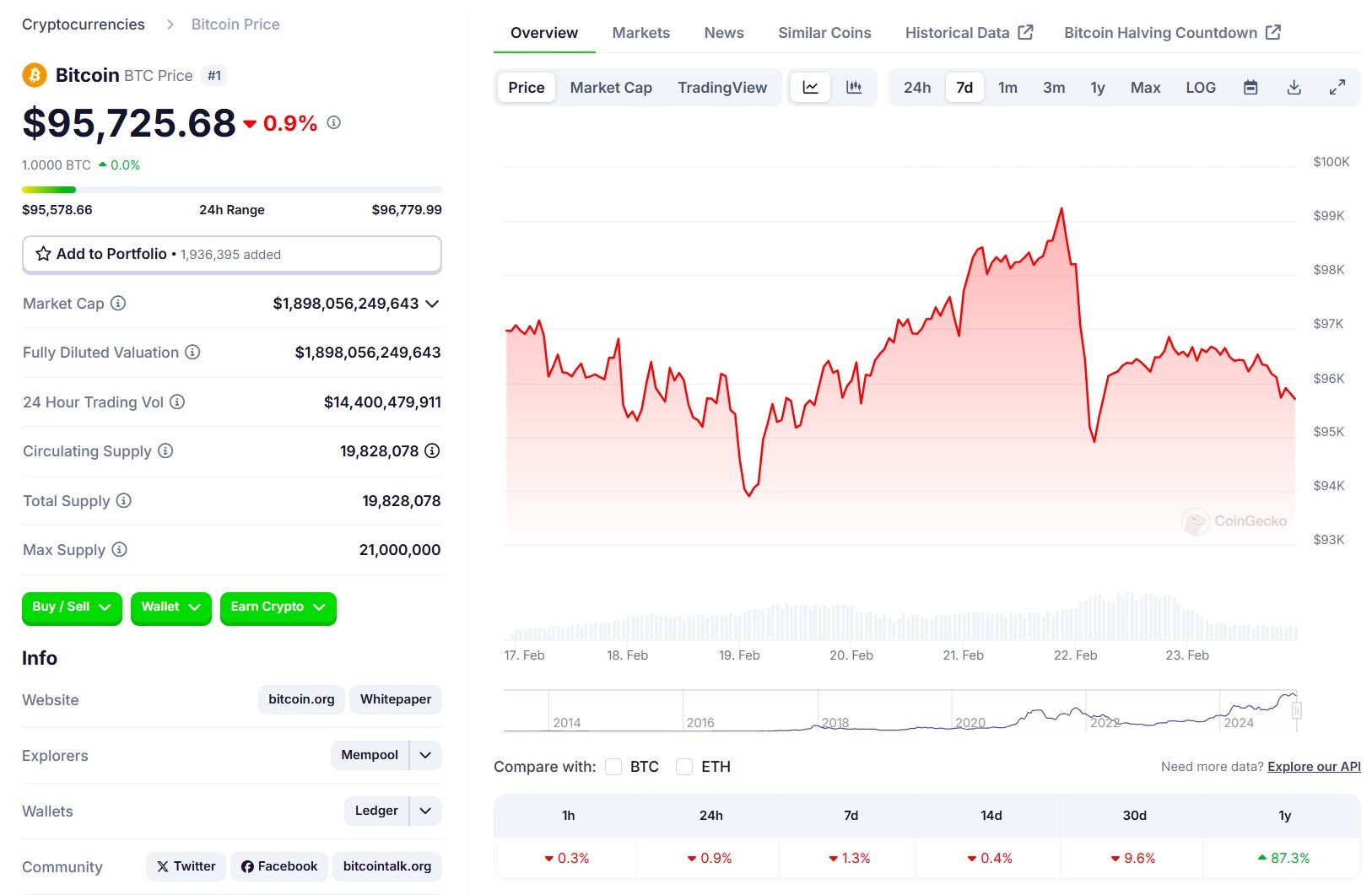

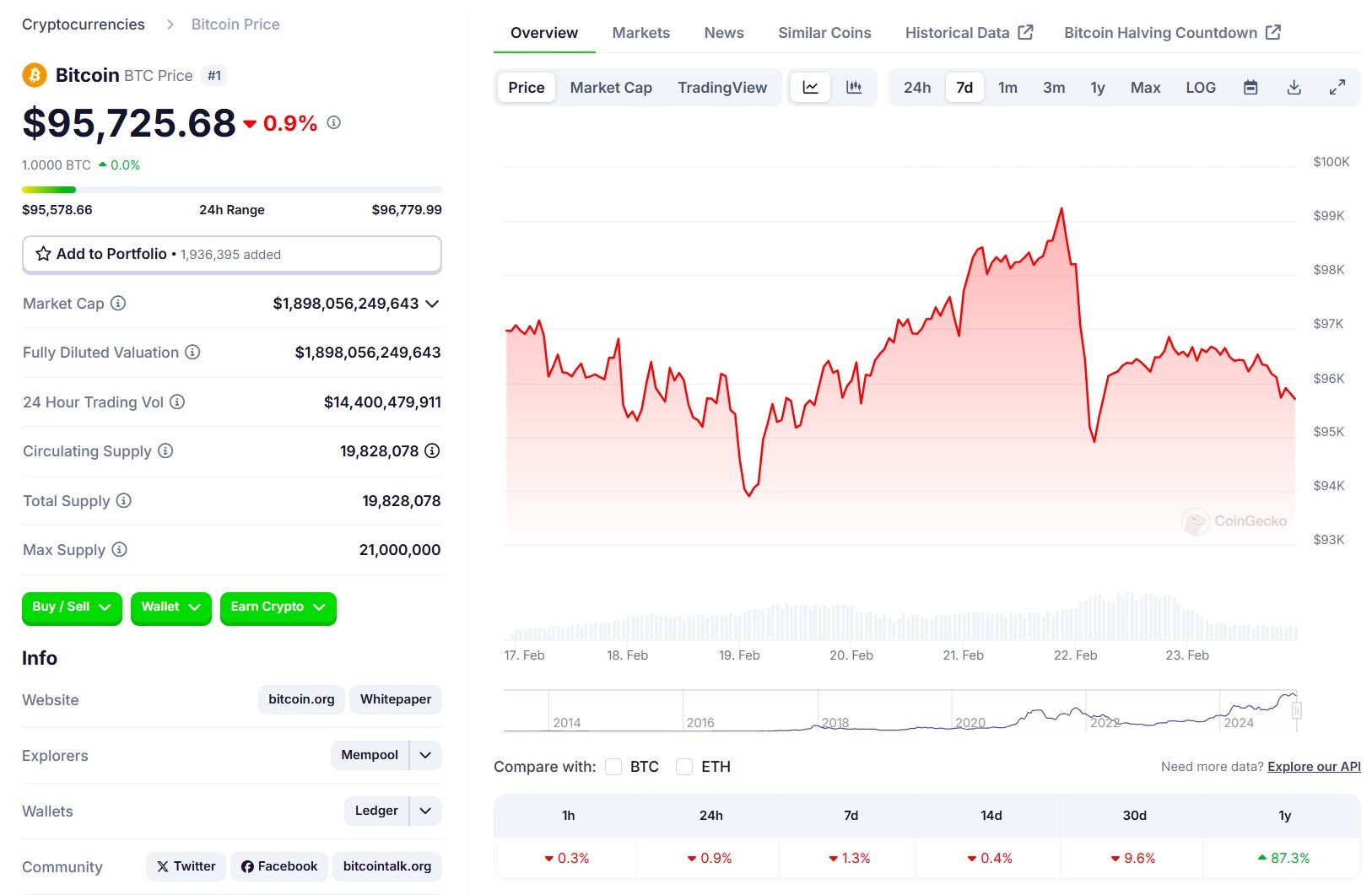

Bitcoin skilled volatility this week, reaching $99,000 on Friday earlier than pulling again beneath $95,000 following a $1.4 billion hack focusing on Bybit, in response to CoinGecko information.

The digital asset at the moment trades at round $95,700, exhibiting a slight decline over the previous 24 hours.

Share this text