Each are fully unsurprising, because the technical evaluation (and customary sense) supplied insights beforehand.

Sure, the US–China dramatic tariff lower announcement was the direct set off – the technical writing was on the wall for a very long time.

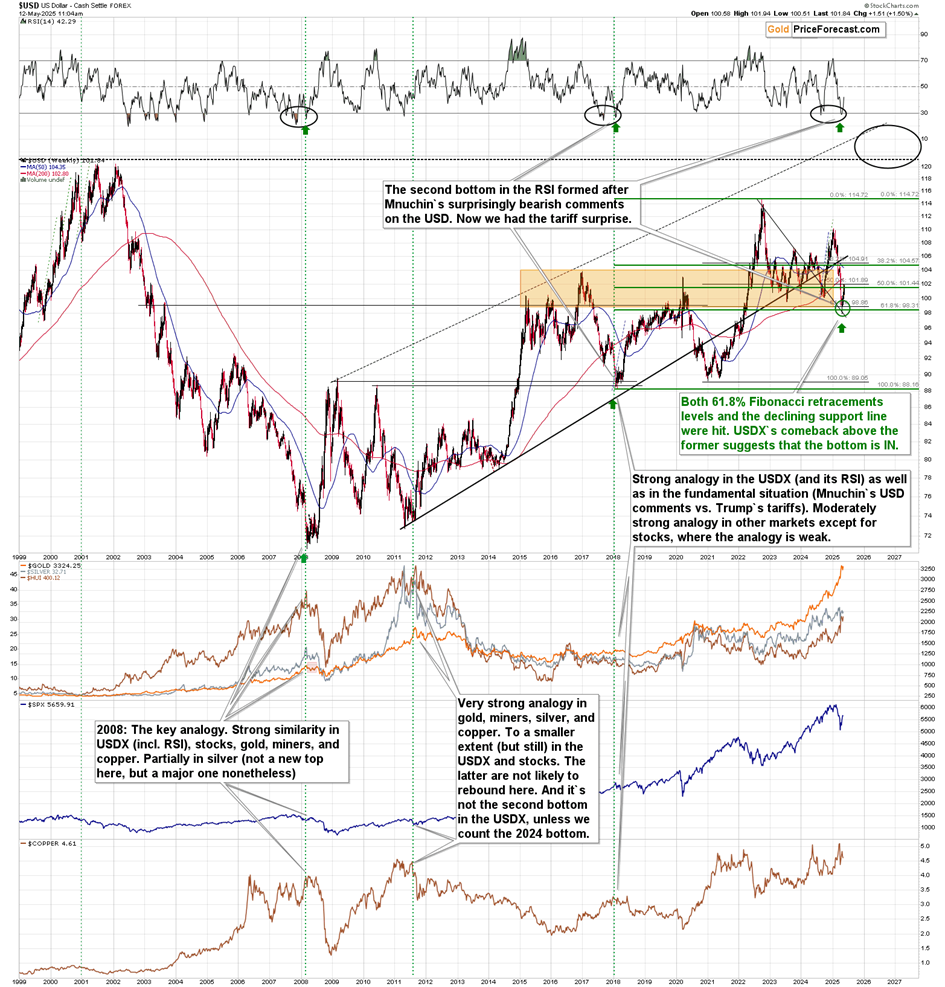

This goes particularly for the state of affairs within the , the place the sentiment was significantly damaging whereas it reversed by forming a traditional inverse head-and-shoulders sample, and it did so at extraordinarily robust help ranges primarily based on long-term 61.8% Fibonacci retracements.

Nonetheless, earlier than shifting to charts, let’s focus on what’s happening from the elemental viewpoint.

The Greenback-Tariff Dance: How Commerce Tensions Reshape Markets

The connection between the US Greenback Index, inventory markets, and commodity costs during times of commerce stress follows distinct patterns that skilled buyers can leverage for strategic positioning. When the US imposes tariffs, the greenback sometimes strengthens by means of decreased import demand and safe-haven capital flows, creating predictable ripple results throughout markets. This energy then exerts downward strain on commodity costs—significantly industrial metals like —by means of decreased international buying energy and monetary market dynamics.

How Tariffs Strengthen the Dollar

Commerce disputes constantly drive greenback appreciation by means of a number of reinforcing channels. Throughout the 2018-2020 US-China commerce struggle, the Greenback Index strengthened from roughly 90 to 98—an 8-9% appreciation—as tariffs escalated from 3.8% to 19.3% on Chinese language imports.

The connection operates by means of three major mechanisms:

1. Demand channel: Tariffs cut back US demand for imports, reducing the necessity for foreign exchange to buy these items. This creates direct upward strain on the greenback as fewer {dollars} are exchanged for foreign exchange.

2. Capital circulate channel: Commerce tensions set off international uncertainty that drives safe-haven capital flows into dollar-denominated property. Throughout the 2018-2019 escalation part, the DXY index elevated roughly 2% when tariffs rose from 10% to 25% on $200 billion of Chinese language items.

3. Rate of interest differential channel: If tariffs generate inflationary pressures domestically, central banks might reply with tighter financial coverage. Analysis from economist Stephen Miran suggests a ten% change in tariffs theoretically results in roughly 4%-dollar appreciation, although retaliatory tariffs can diminish this impact.

When the Greenback Rises, Copper Falls

Statistical proof confirms a constant damaging correlation between greenback energy and commodity costs, significantly for industrial metals like copper:

Please check out the important thing tops in copper that I marked with orange vertical traces. In every case, this was a serious, medium-term backside within the USD Index it was nonetheless comparatively near it (forward of a strong rally). This was additionally true for the 2018 prime in copper (backside within the USDX) that I didn’t mark on the chart.

This inverse relationship operates by means of a number of mechanisms:

– Buying energy impact: When the greenback strengthens, commodities change into dearer in non-dollar currencies, lowering international demand and pressuring dollar-denominated costs downward.

– Manufacturing price impact: For commodities produced outdoors the US however priced in {dollars}, a stronger greenback means producers obtain extra of their native foreign money per unit offered, doubtlessly incentivizing elevated manufacturing and decreasing costs.

– China issue: Because the world’s largest copper client, China’s buying habits considerably impacts costs. Greenback energy in opposition to the Chinese language immediately impacts Chinese language copper demand, as imports change into dearer.

Throughout the early 2018 tariff bulletins, copper costs declined by roughly 15-20% because the greenback strengthened, demonstrating this relationship in apply.

Why Inventory Rallies After Commerce Offers Fizzle

Market information reveals that inventory rallies following commerce deal bulletins typically show short-lived regardless of preliminary optimism. This sample was evident within the 2018-2020 US-China negotiations and is probably going about to repeat itself primarily based on the present settlement to cut back tariffs.

Financial idea explains this phenomenon by means of three distinct mechanisms:

1. Data asymmetry decision: Commerce offers initially resolve uncertainty, triggering market rallies. Nonetheless, as buyers course of the detailed implications and implementation challenges, preliminary enthusiasm provides approach to a extra nuanced evaluation.

2. Low cost charge vs. money circulate results: Bulletins briefly cut back the danger premium (low cost charge), inflicting quick worth will increase. Nonetheless, if precise money circulate advantages show extra modest than anticipated, costs subsequently regulate downward.

3. Tariff persistence results: Even decreased tariffs proceed to disrupt provide chains and international commerce. Quickly after the Could 2025 US-China settlement, Flexport CEO Ryan Petersen famous that even with tariffs decreased to 30%, important commerce disruption would persist after the earlier 145% charge had precipitated shipments from China to plunge 60%.

Why Tariffs Stay Headwinds Even at Decreased Ranges

Financial idea explains why tariffs create persistent headwinds for international commerce and inventory markets even when decreased:

Worth distortions: Tariffs create wedges between home and international costs, resulting in inefficient useful resource allocation. Analysis exhibits that even modest tariffs of 5-10% can considerably alter commerce flows.

Provide chain disruption: Fashionable manufacturing depends on advanced international provide chains. Tariffs power pricey changes to those preparations with results that persist lengthy after tariff reductions.

Uncertainty results: The coverage uncertainty created by tariff regimes deters enterprise funding and expands commerce prices. A examine from Yale’s Price range Lab estimated that the 2025 tariff escalation decreased development by 0.9 proportion factors, an impact that may solely partially reverse with the latest discount.

International transmission channels: Greenback energy impacts international commerce by means of monetary channels (tightening situations as a result of dollar-denominated debt worldwide), commerce financing results (growing native foreign money prices), and liquidity results (constraining financial exercise, significantly in rising markets).

Analysis from the Financial institution for Worldwide Settlements concludes that international commerce exercise is powerful when the greenback is weak however suffers when the greenback is powerful. This sample has remained remarkably constant even throughout main financial disruptions.

Elementary Conclusion

The interrelationships between tariffs, greenback energy, commodity costs, and inventory markets kind a predictable sample that buyers can leverage for strategic positioning. Whereas tariff reductions just like the latest US-China settlement present quick market reduction (an emotional one particularly), historic proof and financial idea counsel warning about sustained market optimism. The 30% residual tariffs will proceed to distort commerce flows, preserve upward strain on the greenback, and exert downward strain on commodity costs. The rally in shares can be prone to be non permanent.

Technically Talking

The USD Index soared.

The breakout above the declining resistance line is crystal-clear, and so is the invalidation of the transfer under the 2023 and 2024 lows. That is as bullish because it will get, particularly since this completely suits the bullish set-up from USD Index’s long-term chart.

Quoting my earlier feedback on the above charts:

“On a short-term foundation, we see that the USDX is on the verge of breaking above its steep, declining resistance line. On the identical time, a rally above this line may also take the USD again above its final yr’s lows, thus invalidating the breakdown.

That is the almost certainly approach ahead, and when it occurs, it should change into clear to many market individuals that the development has reversed.

That’s when the declines within the valuable metals market will change into a lot greater.”

At the moment’s breakout within the USD Index has certainly made it clear, and the decline in gold can be fairly sizable, as gold worth is down by over $100 {dollars} this week, though the markets have but to open within the U.S. Some individuals could be utilizing this second to purchase extra for his or her retirement accounts, whereas different will possible watch for even decrease costs.

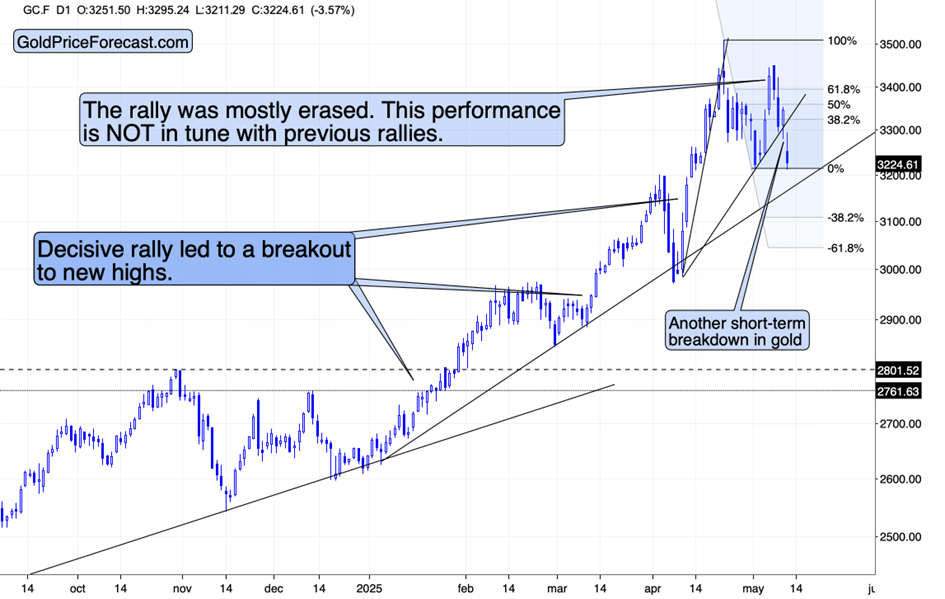

’s slide took it again to its early-Possibly lows and properly under the rising help line primarily based on it and the April low.

I advised my readers that the pre-FOMC rally was possible very non permanent and one thing that’s about to be reversed, and that’s precisely what occurred.

What’s subsequent? Simply because the rally within the USD Index is simply getting began (it’s apparent primarily based on the USD Index’s long-term chart), the alternative is the case for gold, , and mining shares. Declines in them are simply getting began.

It appears that evidently there’s only one factor stopping the decline from accelerating – the energy within the inventory market.

The soared primarily based on the information. It turned out that my lately bearish feedback on shares have been mistaken, whereas Paul Rejczak’s bullish ones (his Volatility Breakout System flashed a purchase sign for shares a while in the past) have been appropriate.

Properly, we did revenue on the simple a part of the rebound, although, which was my deliberate choice. I’m stepping out (with regard to describing trades) of the important thing space of my experience solely once I see one thing very good – similar to (it does certainly often yield nice outcomes) I now see it in copper (and copper shares).

So, anyway, what does the above inform us? Two issues.

One is that – equally to what we noticed in copper – the rally in shares isn’t as large because the slide that we noticed in April when the tariffs have been introduced, which means that the market could be waking as much as the fact that tariffs might be finally damaging for the world economies, together with the U.S. economic system.

The opposite is that because the present transfer is unlikely to final primarily based on the elemental state of affairs, we must be looking out for elements confirming or invalidating this. What we see above is that shares moved barely above their late-March excessive in addition to the (not that standard, however nonetheless necessary) 78.6% Fibonacci retracement stage. Which means that a transfer again under these ranges and an in depth under them can be an invalidation and a promote sign.

Will we see one thing like that? That is fairly possible given copper’s triangle-vertex-based reversal (lined in in the present day’s Gold Buying and selling Alert) that’s due in the present day. Copper and shares have been shifting in sync lately, so a prime in copper would possible correspond to a prime in shares.

Now, because the inventory market is probably going the factor that’s protecting many different markets up regardless of greenback’s energy (like silver, and mining shares), the above-mentioned declines in shares, would possible pull the set off on the declines additionally within the different markets.