The most recent knowledge from the Bureau of Labor Statistics verify that the Federal Reserve has made a number of progress on inflation. The Shopper Value Index (CPI) grew 2.3 % over the previous 12 months. It has grown at an annualized charge of simply 1.6 % over the previous three months. Regardless of this progress, nevertheless, Fed officers voted to carry the federal funds charge goal vary at 4.25 to 4.5 % final week.

When will the Fed start chopping rates of interest — and the way far will charges fall this 12 months? The brief solutions are “not quickly” and “not a lot.”

The Fed is at the moment in a holding sample, awaiting additional readability on the fallout from President Trump’s commerce conflict. On the one hand, decrease inflation readings would appear to warrant a decrease rate of interest goal. Recall that the actual (inflation-adjusted) federal funds charge goal is the same as the nominal goal set by the Fed minus anticipated inflation.

To the extent that they coincide with decrease inflation expectations, decrease inflation readings lead to a passive tightening of financial coverage as they push the actual federal funds charge goal up. To forestall coverage from tightening additional within the face of falling inflation, the Fed should decrease its federal funds charge goal.

However, Fed officers are nervous that increased tariff charges launched by the Trump administration would possibly unanchor inflation expectations. Fed Chair Jerome Powell summarized the anticipated results of upper tariff charges on the post-meeting press convention final week:

If the big will increase in tariffs which were introduced are sustained, they’re prone to generate an increase in inflation, a slowdown in financial development, and a rise in unemployment. The results on inflation may very well be short-lived, reflecting a one-time shift within the value stage. It’s also attainable that the inflationary results might as a substitute be extra persistent. Avoiding that end result will rely on the scale of the tariff results, on how lengthy it takes for them to cross by means of absolutely into costs, and finally on retaining long term inflation expectations well-anchored.

Powell made it clear that the Fed’s “obligation is to maintain long term inflation expectations nicely anchored and to stop a one-time improve within the value stage from changing into an ongoing inflation downside.”

The tariffs are, in impact, an opposed provide shock, just like the opposed provide shock brought on by COVID-19 in 2020. The Fed couldn’t forestall the illness from spreading or rescind stay-at-home orders in 2020. It can’t restore provide chains disrupted by increased tariff charges at the moment. The perfect it will probably do is look by means of the opposed provide shock and maintain nominal spending on a secure trajectory. Its failure to do that starting in 2021 resulted in above-target inflation. The Fed doesn’t wish to repeat that mistake.

Right here’s the issue: though disinflation warrants decreasing the federal funds charge goal, that transfer may very well be misconstrued as an try and offset the decline in financial development related to the upper tariff charges. If the general public expects the Fed to ship an expansionary financial coverage in response to the opposed provide shock, inflation expectations will rise and probably turn into unanchored. To keep away from that, the Fed is holding its federal funds charge goal regular for now and assuring the general public that it’ll not try and offset a tariff-induced contraction.

How lengthy will the Fed keep its holding sample? Previous to final week’s assembly (and Powell’s commentary), markets anticipated the Fed would possible reduce its federal funds charge goal in July. On Could 6, 2025, the CME Group reported futures markets have been pricing in a 77.7 % likelihood that the federal funds charge goal can be at or under 4.25 % following the July assembly.

Now, it experiences the chances at simply 36.8 %.

Extra possible, the Fed will start chopping rates of interest in September. The CME Group now experiences 74.5 % odds that the federal funds charge goal can be decrease following the September assembly.

Again in March, the median Federal Open Market Committee member projected that the federal funds charge would fall 50 foundation factors by the tip of this 12 months. That also seems to be possible.

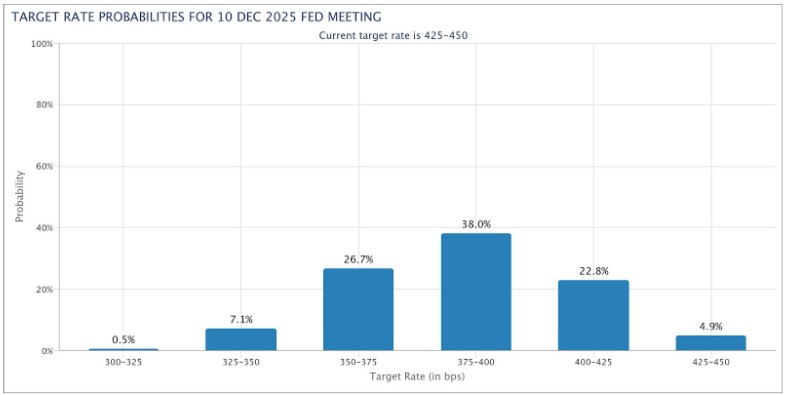

In line with the CME Group, there’s at the moment a 22.8 % likelihood that the federal funds charge goal is 25 foundation factors decrease following the December assembly; a 38.0 % likelihood it’s 50 foundation factors decrease; and a 26.7 % likelihood it’s 75 foundation factors decrease. All instructed, the futures market is pricing in a 72.3 % likelihood the Fed’s goal charge is decrease by at the least 50 foundation factors by the tip of the 12 months. FOMC members will submit revised projections in June.

In the end, the Fed’s rate of interest selections will rely on the incoming knowledge — and the readability these knowledge convey.

“In the interim,” Powell mentioned final week, the Fed is “nicely positioned to attend for larger readability earlier than contemplating any changes to our coverage stance.”