Are you uninterested in not earning profits within the foreign exchange market? Many merchants wrestle daily. The market’s ups and downs can confuse even essentially the most expert merchants.

However what should you may discover the market’s turning factors simply? This might change the whole lot.

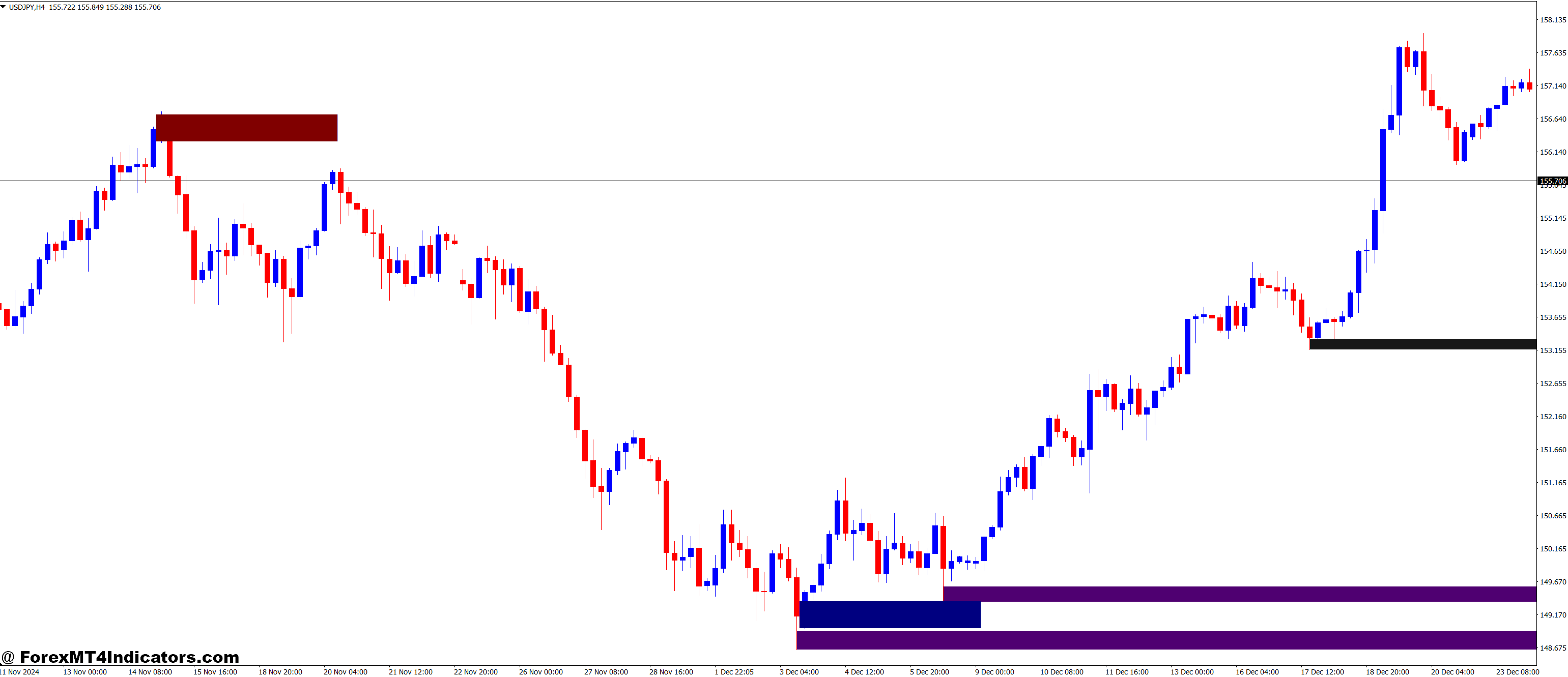

Meet the Shved Provide & Demand and Order Block Breaker foreign currency trading. It makes use of provide and demand and order block evaluation. This provides merchants a giant benefit out there.

By specializing in these key areas, you may make higher trades. This will tremendously improve your possibilities of profitable.

Key Takeaways

Combines provide and demand with order block evaluation

Identifies key market turning factors

Improves commerce entry precision

Appropriate for novice and skilled merchants

Helps lower by way of market noise

Boosts total buying and selling success charges

Understanding Provide and Demand in Foreign exchange Markets

Foreign exchange markets work on provide and demand. These forces form costs and open buying and selling probabilities. Let’s discover the details of provide and demand in foreign currency trading.

Fundamental Ideas of Market Forces

Provide and demand management forex costs. Excessive demand means costs go up. Low demand means costs drop. This steadiness creates areas the place costs typically transfer, serving to merchants.

Key Worth Motion Patterns

Worth patterns present the place provide and demand is perhaps. Inside bars are a key sample. They seem like small candles inside greater ones on charts.

Inside bars are extra dependable on every day charts

They will kind a number of instances inside a single-mother bar

Merchants use inside bars for breakout or reversal performs

Psychology Behind Provide and Demand Zones

Buying and selling psychology is essential in provide and demand zones. These spots typically have massive orders from market gamers. As costs hit these zones, merchants search for modifications based mostly on previous strikes.

Side

Influence on Buying and selling

Market Forces

Drive value actions and create buying and selling alternatives

Worth Motion Patterns

Assist determine the place provide and demand is perhaps

Buying and selling Psychology

Influences dealer habits at key value ranges

Introduction to Order Block Buying and selling

Order block buying and selling is essential in foreign exchange market evaluation. It helps discover vital spots the place massive orders change costs. This fashion, merchants can see the place costs would possibly cease or begin transferring.

What Are Order Blocks?

Order blocks are spots on charts the place a lot of shopping for or promoting occurs. These spots are crucial in market construction. They will change how costs transfer later. The Order Block Breaker Indicator reveals these vital areas.

Sorts of Order Blocks

There are completely different sorts of order blocks:

Bullish Order Blocks: Locations of robust shopping for

Bearish Order Blocks: Areas of robust promoting

Mitigation Blocks: Locations the place costs steadiness out

Figuring out Legitimate Order Blocks

Discovering actual order blocks wants an in depth take a look at value and quantity. Merchants use instruments like VWAP and OFV to verify these areas. The Shved Provide Demand Indicator additionally marks these busy buying and selling spots.

Indicator

Perform

Person Base

Order Block Breaker

Identifies zones of serious market affect

45,000+ customers

Shved Provide Demand

Charts of provide and demand areas

A part of 200+ out there indicators

FXSSI.OrderBook

Offers insights into provide and demand ranges

Included in lifetime software program license

The Energy of Shved Provide & Demand and Order Block Breaker Foreign exchange Buying and selling Technique

The Shved Provide & Demand and Order Block Breaker technique is a robust instrument for foreign currency trading. It mixes value motion evaluation with order circulate, giving merchants a giant benefit. By discovering key provide and demand zones and order blocks, merchants get a greater understanding of the market.

Worth Motion Superior Indicator indicators, like inside bars and pin bars, are key on this technique. They assist spot when the market would possibly change route. This makes it simpler to resolve when to enter or depart the market.

Order block detection reveals help and resistance zones by way of value motion. This, together with specializing in liquidity grabs and breakout areas, offers merchants a transparent view of the market. Including Honest Worth Gaps (FVG) makes predictions even higher.

This technique works effectively as a result of it makes use of completely different timeframes and chart strategies. Merchants can alter to completely different market varieties, from secure to transferring markets. By mixing technical indicators with value motion, it presents a full view of foreign currency trading.

Technical Elements of the Technique

The Shved Provide & Demand and Order Block Breaker Foreign currency trading technique makes use of many technical elements. These elements assist merchants see the market effectively and discover good buying and selling probabilities. Let’s take a look at the principle elements of this technique.

Indicator Settings and Configuration

The technique makes use of sure indicators to seek out provide and demand areas. The Non-Repainting Assist and Resistance indicator reveals vital ranges on the chart. It’s vital to set this indicator proper for the very best outcomes. Merchants typically use 14-21 candles and alter the sensitivity with market modifications.

Timeframe Choice

Selecting the best chart timeframes is essential for good technical evaluation. The Shved Provide & Demand technique works on many timeframes. However, many merchants like these:

H4 (4-hour) for pattern identification

H1 (1-hour) for entry affirmation

M15 (15-minute) for fine-tuning entries

Chart Evaluation Strategies

Merchants use completely different chart evaluation strategies to make higher choices. These embody:

Figuring out key help and resistance ranges

Recognizing value motion patterns like pin bars and engulfing candles

Analyzing order block formations and breaker zones

By utilizing these technical elements, merchants can perceive market dynamics higher. The aim is to maintain training and alter your strategy to suit your buying and selling fashion.

Element

Goal

Typical Settings

Non-Repainting Assist and Resistance

Establish key ranges

Lookback: 14-21 candles

Dynamic Provide and Demand Zones

Spotlight potential reversal areas

Sensitivity: 3-5

Order Block and Breaker Block

Spot important value motion zones

Block dimension: 10-20 pips

Entry and Exit Guidelines

The Shved Provide & Demand and Order Block Breaker technique has clear guidelines for coming into and exiting trades. For the very best outcomes, commerce on timeframes of quarter-hour or extra. This is applicable to all forex pairs, indices, and commodities.

Commerce entry occurs when value motion matches provide and demand zones. The Non-Repainting Assist and Resistance indicator helps discover these zones. The Dynamic Provide and Demand Zones indicator reveals inexperienced for bullish and pink for bearish areas.

For exiting trades, intention to take earnings on the center line of the regression channel. Or, goal the subsequent help/resistance ranges. Use a profit-to-stop loss ratio of 1:1.13 for managing threat. Set the preliminary cease loss beneath or above the final swing low or excessive.

Time Body

Regression Curve Durations

Deviation

15 min

185

2.0

30 min

170

2.0

60 min

165

2.0

4H

150

2.0

Day by day

140

2.0

Inside bars, a two-bar sample may be good for coming into trades with tight stops. Place purchase or promote stops on the excessive or low of the mom bar for breakout probabilities. Sticking to those guidelines is crucial for buying and selling success.

Danger Administration Tips

Efficient threat administration is essential for profitable foreign currency trading. The Shved Provide & Demand and Order Block Breaker technique has robust threat management. It protects your capital and goals to extend earnings.

Place Sizing

Good place sizing is important for managing threat. Begin with a small lot dimension of 0.01 for every forex pair. Once you hit 4 goal costs, double your lot dimension.

If you happen to hit a cease loss, lower your lot dimension in half. This balances threat and reward.

Cease Loss Placement

Place your cease loss beneath or above the earlier swing excessive or low. This respects market construction and limits losses. The technique additionally has a “Danger-Free” setting.

It strikes the cease loss to the entry value plus fee as soon as a revenue stage is reached.

Take Revenue Targets

Set your take revenue on the center line of the regression channel or use help and resistance ranges. The technique goals for a 1:3 risk-reward ratio. This implies for each unit of threat, you goal three models of revenue.

This ensures worthwhile trades outweigh losses over time.

Bear in mind, the “20 PIPs Problem” and “16S Program” are key elements of this technique’s cash administration. By following these pointers, you’ll be higher at navigating the foreign exchange market’s ups and downs.

Superior Order Block Patterns

Superior buying and selling patterns are key within the Shved Provide & Demand technique. They assist spot market strikes and information choices.

Bullish Order Blocks

Bullish indicators present up as bullish order blocks. These blocks occur when massive purchase orders push costs up. They kind at downtrend bottoms, hinting at a potential flip.

Merchants search for these on 15-minute charts or larger for higher indicators.

Bearish Order Blocks

Bearish order blocks present massive promoting strain. They kind at uptrend tops, hinting at a potential drop. Merchants use these with different indicators to identify bearish indicators.

Mitigation Patterns

Mitigation patterns present how the market handles massive orders. They assist discover the place costs would possibly pause or change route. Figuring out these patterns helps set higher stop-loss and take-profit ranges.

When utilizing these patterns, take into consideration the market’s greater image. Purpose for a revenue ratio of 1:1.13. Place cease losses beneath or above the final swing excessive or low. This methodology manages threat and takes benefit of market strikes.

Combining with Different Technical Indicators

Merchants can enhance their market evaluation by utilizing the Shved Provide & Demand and Order Block Breaker technique with different technical indicators. This combine makes buying and selling choices stronger within the foreign exchange market.

Shifting averages present a easy pattern line. They assist discover help and resistance ranges. When these ranges match provide and demand zones, it makes the buying and selling sign stronger.

The Relative Power Index (RSI) checks if costs are too excessive or too low. It provides extra to your evaluation.

The Shifting Common Convergence Divergence (MACD) indicator can also be helpful. It indicators when momentum modifications occur with order block formations. This might imply high-probability commerce entries. By utilizing these indicators collectively, merchants get a greater market evaluation framework.

Utilizing many indicators can provide extra insights. However, don’t make your technique too sophisticated. Begin with one or two indicators that work effectively collectively. Then, enhance your technique based mostly in your buying and selling outcomes and what you see out there.

Shifting averages for pattern identification

RSI for overbought/oversold situations

MACD for momentum modifications

By including these instruments, you’re not simply sticking to 1 technique. You’re constructing a robust system that appears at completely different elements of market habits. This might result in extra knowledgeable and worthwhile buying and selling decisions.

Frequent Buying and selling Errors to Keep away from

Buying and selling effectively is extra than simply understanding what to do. It’s additionally about managing dangers and understanding the market. Let’s take a look at some frequent errors that may spoil even the very best plans.

Over-leveraging

Utilizing an excessive amount of leverage is a giant mistake. Leverage could make your wins greater, however it might probably additionally make your losses greater. About 75% of merchants who use an excessive amount of leverage lose all their cash. At all times use a leverage that matches your threat stage and the way a lot cash you’ve got.

Ignoring Market Context

Not trying on the massive image is one other mistake. The MACD divergence can present when costs would possibly change route in 60% of instances. At all times take a look at completely different time frames and take into consideration the financial system.

Poor Commerce Administration

Not managing trades effectively can result in massive losses. The Common True Vary (ATR) might help set stop-loss orders, defending 75% of trades. Use the suitable sum of money for every commerce and set clear stop-loss and take-profit ranges.

Mistake

Influence

Resolution

Over-leveraging

75% account wipeout price

Use acceptable leverage

Ignoring Context

60% missed reversals

Multi-timeframe evaluation

Poor Administration

25% unprotected trades

Use ATR for stop-loss

By avoiding these frequent errors and specializing in good threat administration and market evaluation, merchants can do a lot better within the foreign exchange market.

Find out how to Commerce with Shved Provide and Demand and Order Block Breaker Foreign exchange Buying and selling Technique

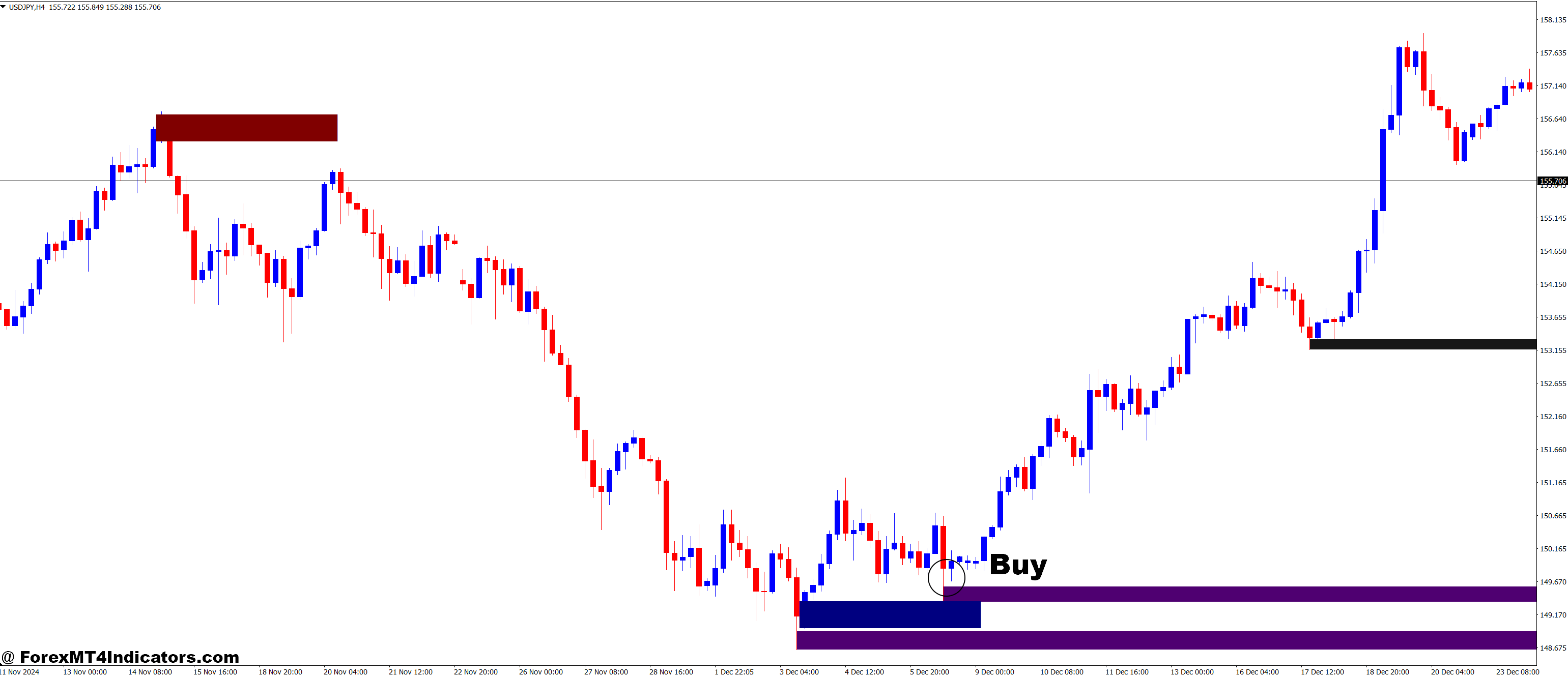

Purchase Entry

Search for a major bullish order block (a robust value move-up after consolidation or a drop).

This order block would be the space of curiosity to observe for value retracement.

Find a requirement zone the place the worth has beforehand bounced up sharply (the world the place the worth reveals indicators of shopping for curiosity).

Anticipate the worth to retrace again to the bullish order block or demand zone.

Search for value motion affirmation like:

A bullish candlestick sample (pin bar, engulfing, and so forth.).

Worth rejection on the demand zone or order block (wick rejections, consolidation).

Enter lengthy when the worth reveals clear rejection or consolidation on the bullish order block/demand zone.

Cease-loss slightly below the order block or demand zone.

Take-profit on the subsequent key resistance stage or based mostly in your risk-to-reward ratio (e.g., 2:1).

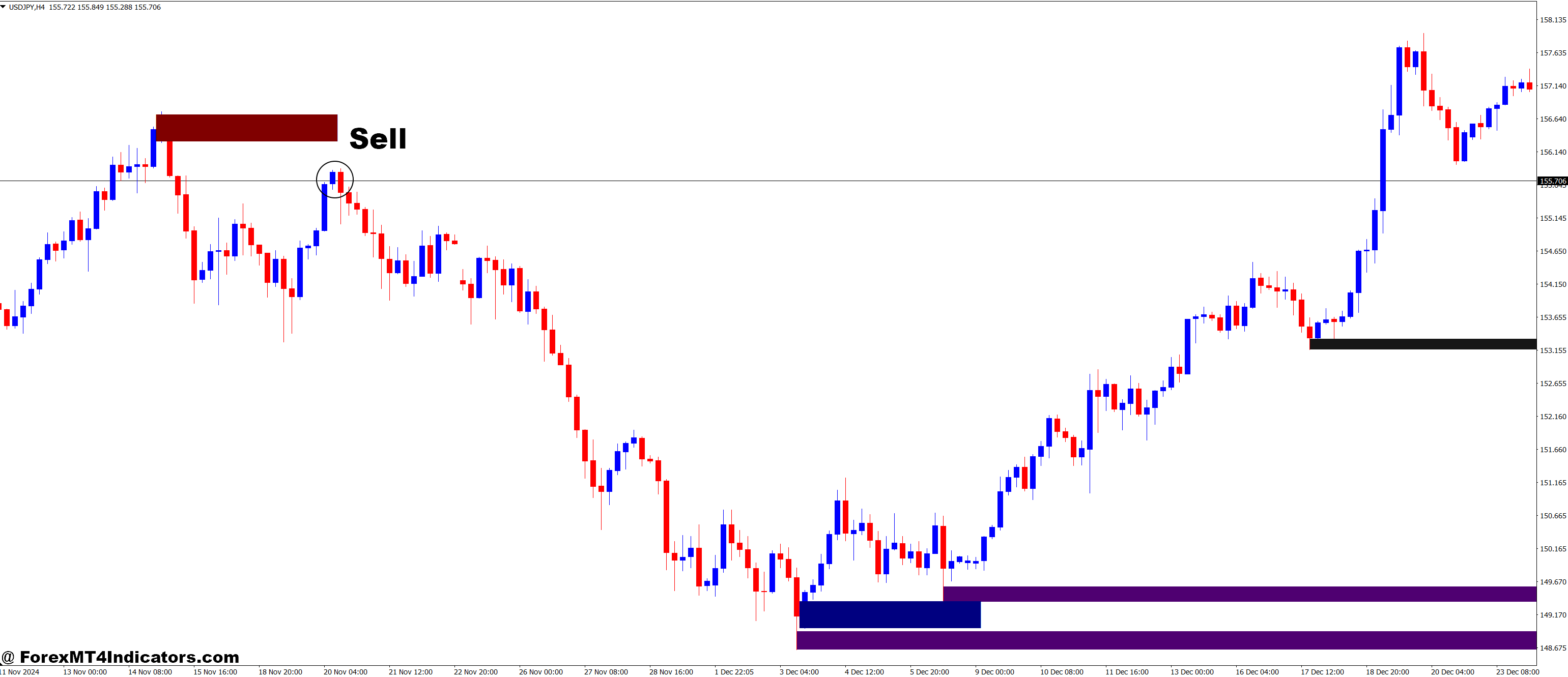

Promote Entry

Search for a major bearish order block (robust value transfer down after consolidation or an increase).

This order block is the world of curiosity to attend for a value retracement.

Find a provide zone the place the worth has beforehand dropped sharply (an space displaying indicators of promoting curiosity).

Anticipate the worth to retrace again to the bearish order block or provide zone.

Search for value motion affirmation like:

A bearish candlestick sample (bearish engulfing, taking pictures star, and so forth.).

Worth rejection on the provide zone or order block (wick rejections, consolidation).

Enter brief when the worth reveals clear rejection or consolidation on the bearish order block/provide zone.

Cease-loss simply above the order block or provide zone.

Take-profit on the subsequent key help stage or based mostly in your risk-to-reward ratio (e.g., 2:1).

Conclusion

The Shved Provide & Demand and Order Block Breaker Foreign exchange Buying and selling Technique is highly effective. It helps discover vital market modifications. This technique mixes provide and demand with order block evaluation for higher buying and selling decisions.

Studying by no means stops for merchants. The Order Block Breaker Indicator works with MetaTrader 4. It finds key value areas robotically. This protects time and lets merchants work on their methods.

As merchants get higher, they could wish to strive extra instruments. The Foreign exchange Entry Level Indicator and the Pattern Path Non-Repaint Indicator are good examples. They will make buying and selling much more correct. Buying and selling success takes effort and time, however this technique is a superb begin.

Beneficial MT4 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Profitable Foreign exchange Dealer

Extra Unique Bonuses All through The 12 months

Unique 50% Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here beneath to obtain:

Get Obtain Entry