World shares have bounced again sharply for the reason that tariff-driven panic in April despatched markets to contemporary lows, rewarding dip patrons who stepped in and seized the second.

Now, because the market strikes sideways just under all-time highs, those that missed April’s rebound are asking the apparent query: When will the subsequent dip-buying alternative come up?

However right here’s the reality: hoping for one more panic isn’t a technique. A wiser transfer is to remain forward by concentrating on undervalued shares that the market might have mispriced. Oversold, essentially sound corporations typically conceal in plain sight—if you realize the place to look.

That’s the place Investing.com’s proprietary Honest Worth software can show a sport changer.

By making use of as much as 17 investment-grade basic and momentum fashions, it supplies a real-time worth calculation for each inventory available in the market—making it easy and fast to identify market mispricing.

Many traders have already used these indicators to uncover hidden gems throughout market downturns—shares the market had missed, however Honest Worth flagged early.

Take Banco Santander (BME:) and Gilead Sciences (NASDAQ:), for instance. Each have been recognized as undervalued by the Honest Worth software and didn’t simply hit their projected upside—they exceeded it.

Under is how their tales performed out:

1. Banco Santander: Deep Low cost Attracts Dip-Consumers, Inventory Soars 67%

Systematic valuation frameworks develop into particularly helpful when markets misprice essentially sound corporations. Banco Santander in April 2024 is an effective instance.

On the time, Santander was buying and selling at simply $4.79 per share regardless of reporting stable financials—$49.65 billion in income and earnings per share (EPS) of $0.73. This discrepancy positioned the inventory properly under its estimated intrinsic worth.

InvestingPro’s Honest Worth mannequin, which attracts on as much as 17 institutional-grade valuation strategies and accounts for components like market positioning, flagged a possible upside of 35%.

Over the next 11 months, the inventory rose steadily to $6.89, surpassing the preliminary projection with a acquire of 49%.

As fundamentals continued to enhance—income growing to $52.62 billion and EPS reaching $0.80—Santander prolonged its rally to $7.95. This marked a complete return of 67%, exceeding the unique upside estimate by over 30 proportion factors.

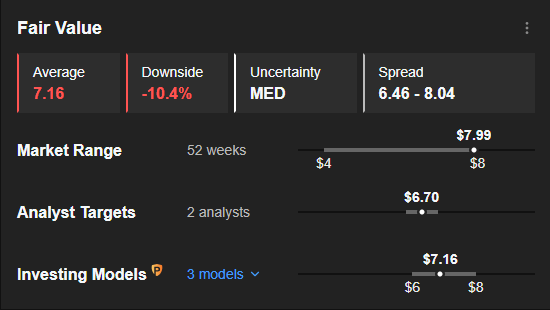

Because the inventory appreciated, Honest Worth estimates have been up to date in actual time and finally shifted into overvalued territory. The present mannequin signifies a possible draw back of 10.4%, suggesting a reassessment could also be warranted.

Supply: InvestingPro

This instance illustrates how systematic valuation instruments may also help traders establish pricing inefficiencies—and the way ongoing updates to these fashions can inform choices as situations evolve.

2. Gilead Sciences: Sturdy Observe-Via on Undervalued Sign Delivers 42.83% Surge

Again in November 2023, Gilead Sciences flashed on the Honest Worth radar as deeply undervalued, buying and selling 38% under its intrinsic price.

Buyers who acted on that sign have been rewarded. By Could 28, 2025, the inventory had delivered a return of +42.8%, fueled by scientific breakthroughs, bullish analyst sentiment, and a quickly increasing oncology pipeline.

In November 2023, the market largely missed it, however not for lengthy. By Could 2025, the inventory had rallied +42.8%, pushed by main scientific wins and renewed investor curiosity.

It’s most cancers drug Trodelvy, paired with Keytruda, slashed breast most cancers development by 35% in a key trial, prompting requires it to develop into the brand new normal of care.

In the meantime, pleasure constructed round lenacapavir, Gilead’s long-acting HIV prevention shot, fuelling the bullish case.

Analysts rapidly revised their views, with worth targets leaping as excessive as $135 firstly of 2024. Sturdy Q1 earnings and a booming oncology enterprise—now producing over $3B yearly—added gasoline to the rally.

Because the broader biotech sector traded at a steep low cost to the , worth hunters piled in.

Whereas dangers stay, together with a looming patent expiration for Biktarvy and muted 2025 income development, Gilead’s efficiency exhibits how the Honest Worth software can highlight alternative earlier than the group catches on.

As of now, the inventory stays pretty valued, primarily based on the Honest Worth software’s present evaluation.

Backside Line

The market gained’t all the time hand you the proper dip. However because the circumstances of Banco Santander and Gilead Sciences present, you don’t want to attend for chaos to uncover alternative.

For slightly below $10 a month, Honest Worth offers traders an edge by slicing by way of the noise and highlighting the place mispricings might exist, earlier than the remainder of the market catches on.

As an alternative of chasing the subsequent panic, place your self to behave with confidence, as a result of when the market does misprice a person inventory, you’ll be prepared to identify the chance.