The Home of Representatives narrowly handed the One Massive Stunning Invoice Act (HR 119) in dramatic vogue (215-214) final month. A lot of the drama was on the Republican facet. The Home Freedom Caucus favored preserving the 2017 tax cuts however provided that there have been ample price range cuts to pay for it.

A central sticking level was Medicaid, each when it comes to guidelines and when it comes to funding. In the long run, the cuts have been bigger than nearly anybody anticipated, $880 billion over the following 10 years, and all however three Home Freedom Caucus members voted sure. Each Democrat voted no.

The Obamacare “enlargement” modified the unique mission of Medicaid, which was to make sure the working poor and disabled didn’t find yourself with out healthcare insurance coverage. Medicaid had been, up till the Inexpensive Care Act of 2010, the default type of insurance coverage for anybody who was poor or unable to work. Since then, even the younger and completely able-bodied can qualify for Medicaid. Including tens of millions of newly eligible enrollees burned by means of cash that might have been put towards parts of Medicaid’s unique mission, issues like investing in prenatal take care of poor ladies.

Medicaid’s price range woes worsened with the onset of COVID-19. Spending elevated much more quickly, partially from the absence of regular protection interruptions that have been eradicated throughout COVID’s steady enrollment provisions. On the identical time, an growing older inhabitants has led to quickly rising long-term care prices among the many poor aged. Lastly, a Byzantine system of below-market mandated reimbursement charges on the state stage has grow to be more and more onerous to save cash, particularly in states with ballooning rolls like California, the place Medicaid has been opened as much as unlawful aliens. Under-market mandated charges have brought on price-shifting distortions to build up, and make all the healthcare system much less environment friendly.

Medicaid is an impressive instance of how to not construction a authorities program. Its daunting complexity ends in individuals ceaselessly migrating into and out of this system (that is particularly problematic for packages that present some sort of insurance coverage due to antagonistic choice issues). As a result of it’s essentially a authorities forms, problem-solving is generally by means of top-down edicts or acts of Congress. In distinction, in lots of components of American society entrepreneurs constantly adapt, regulate, and innovate to take care of new issues and to reap the benefits of new alternatives to enhance service, cut back prices, or each.

The invoice now faces an unsure future within the Senate. Adjustments to Medicaid are going to supply a political backlash, even in some crimson states, since there might be political stress for state governments to choose up the slack. However most significantly, a really massive and dysfunctional system will stay intact and dysfunctional.

The issue with Medicaid goes far past Medicaid. In a wealthy society like ours, everybody goes to get a good quantity of healthcare a technique or one other. We’re empathetic, sympathetic, interconnected, and wealthy, so most of us really feel compelled to do one thing to assist the uninsured and people with out entry to care. If an individual is writhing in ache as a result of he can’t get healthcare, almost definitely neither you nor anybody personally would simply step over him with out concern.

That is the actual downside: healthcare in America has successfully grow to be a non-excludable good. A non-excludable good is one we can not preserve others from consuming (e.g., nationwide protection). Way back, economists labored out why such items are inevitably underprovided by the personal market due to free driving. Since just about everybody goes to get no less than some healthcare after they want it, some reap the benefits of that by not shopping for their very own medical insurance.

Among the many many financial challenges particular to healthcare markets, economists of all political stripes agree that that is the deepest downside. Recall that maybe the largest bone of rivalry with Obamacare was the person mandate, put into the invoice particularly to deal with the free rider downside. Many opposed the person mandate for a wide range of causes, however didn’t problem its premise, which was that there was a deep free rider downside to be handled in American healthcare.

The daring — however in all probability politically inconceivable — plan of action would have been for Home Republicans to get rid of the federal position in Medicaid. But when they don’t seem to be going to return this difficulty, and its financing, to the states, then relatively than additional tweaking Medicaid and creating new issues, a greater method could be to seek out another path to get authorities out of the enterprise of healthcare for the poor. Briefly: present fundamental healthcare insurance coverage by means of vouchers.

To place it merely, get rid of Obamacare, Medicare, and Medicaid and exchange them with a nationwide healthcare voucher system. This transformative change for American healthcare could possibly be restricted to the extent paid for with a nationwide gross sales tax, and our unfunded legal responsibility issues would merely disappear. Whereas, for sensible causes, this could seemingly have to start out on the nationwide stage, the objective could possibly be to then spin it off to the states.

Milton Friedman launched the concept of utilizing vouchers with respect to training 70 years in the past. His concepts have been summarily rejected as too naïve, too impractical, and at the same time as irresponsible. Now we’re within the midst of an explosion of college selection throughout the nation. How a lot better off would we be if we had listened to him way back?

Friedman didn’t advocate utilizing a voucher system for healthcare insurance coverage. Whereas his analysis of the issues confronting the American healthcare system was unimpeachable, he didn’t explicitly think about the issue of de facto non-excludability. Since this induces some residents to save cash by not shopping for healthcare insurance coverage, it ensures there’ll at all times be uninsured residents. That, in flip, in the end ensures some stage of presidency provision of both healthcare or healthcare insurance coverage.

I imagine that if he have been alive right now, Friedman would help vouchers for healthcare insurance coverage. Vouchers present the federal government with a method of funding an answer with out having the federal government be the mechanism that gives the answer. As such, it largely avoids the ever-growing creeping bureaucracies that suppress competitors and introduce innumerable distortions and endless political opportunism.

We are able to get rid of Medicaid, Medicare, and Obamacare by implementing a nationwide voucher program for healthcare insurance coverage for all residents. By structuring the price range course of to be self-balancing, we are able to guarantee future generations are now not saddled with a mix of accelerating debt they by no means agreed to and decrease high quality of service than those that have been accountable for that debt have been capable of take pleasure in.

Ever discover that when the subject is unfunded liabilities, Medicaid isn’t talked about? Is that as a result of Medicaid is on a wholesome price range path? Hardly. Medicaid will not be included in such conversations as a result of Medicaid will not be a self-funding program within the sense that it doesn’t have its personal devoted payroll tax funding. On the federal stage, it’s funded out of the final price range.

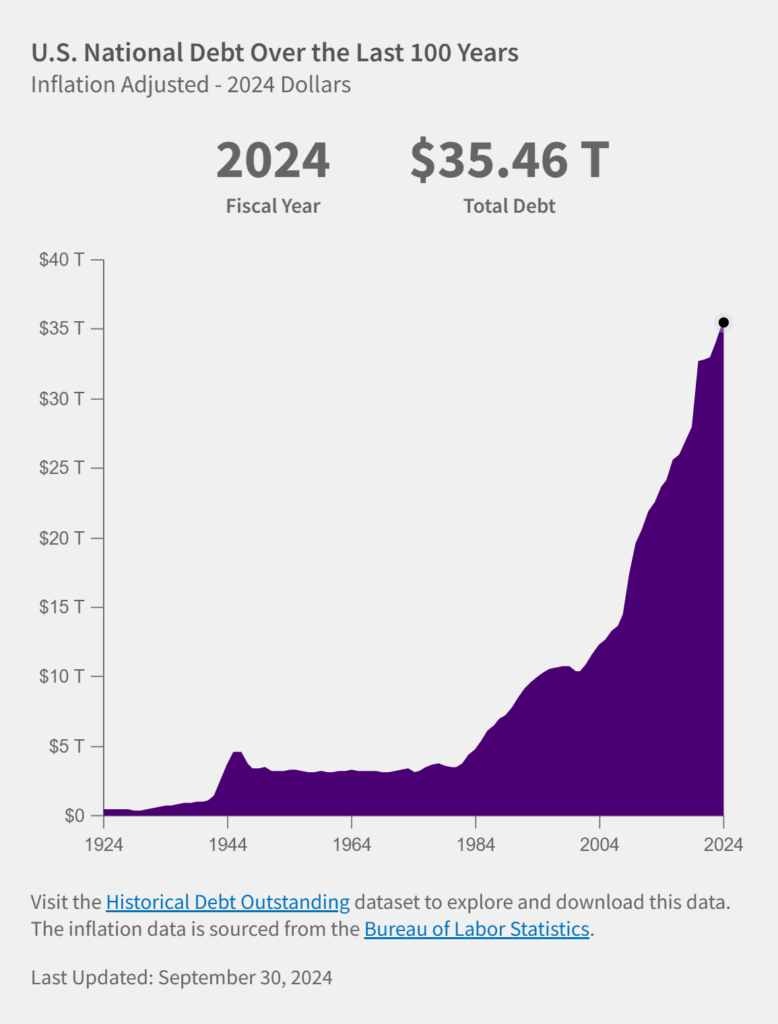

If the federal price range have been experiencing year-over-year surpluses, one might argue that it’s not burdening future People as a result of it’s being cross-subsidized. However we’re, actually, experiencing year-over-year deficits, so any greenback the federal authorities spends on Medicaid is successfully a greenback of extra federal debt on the margin. Rising federal spending on Medicaid equals rising federal debt.

Removed from a principled stand or a change in nationwide path, the newest Republican price range does little greater than kick the can down the highway — to keep away from the political price of truly doing what’s finest for the nation.

How far more dysfunction and irresponsibility are we going to tolerate so we are able to fake that our healthcare system is just for the deserving? We must be trustworthy about the truth that we do, and can proceed to, deal with everybody. That is nothing to apologize for but it surely’s one thing we have to come to grips with.

A voucher program would redirect authorities energy to unleash market competitors amongst healthcare insurers and amongst healthcare suppliers. They are going to hate it. The NEA’s response to high school vouchers ought to inform you all the pieces it’s worthwhile to know.