Up to date on June thirteenth, 2025 by Bob Ciura

On the planet of investing, volatility issues. Buyers are reminded of this each time there’s a downturn within the broader market and particular person shares which can be extra risky than others expertise huge swings in worth.

Volatility is a proxy for danger; extra volatility typically means a riskier portfolio. The volatility of a safety or portfolio in opposition to a benchmark is known as Beta.

In brief, Beta is measured by way of a system that calculates the value danger of a safety or portfolio in opposition to a benchmark, which is often the broader market as measured by the S&P 500.

Right here’s how one can learn inventory betas:

A beta of 1.0 means the inventory strikes equally with the S&P 500

A beta of two.0 means the inventory strikes twice as a lot because the S&P 500

A beta of 0.0 means the shares strikes don’t correlate with the S&P 500

A beta of -1.0 means the inventory strikes exactly reverse the S&P 500

Curiously, low beta shares have traditionally outperformed the market… However extra on that later.

You possibly can obtain a spreadsheet of the 100 lowest beta S&P shares (together with essential monetary metrics like price-to-earnings ratios and dividend yields) under:

This text will focus on beta extra completely, why low-beta shares are inclined to outperform, and supply a dialogue of the 5 lowest-beta dividend shares within the Positive Evaluation Analysis Database.

The desk of contents under permits for straightforward navigation.

Desk of Contents

The Proof for Low Beta Shares Outperformance

Beta is useful in understanding the general worth danger stage for traders throughout market downturns particularly. The decrease the Beta worth, the much less volatility the inventory or portfolio ought to exhibit in opposition to the benchmark.

That is useful for traders for apparent causes, notably these which can be near or already in retirement, as drawdowns ought to be comparatively restricted in opposition to the benchmark.

Importantly, low or excessive Beta merely measures the scale of the strikes a safety makes; it doesn’t imply essentially that the value of the safety stays practically fixed.

Securities may be low Beta and nonetheless be caught in long-term downtrends, so that is merely yet one more software traders can use when constructing a portfolio.

The standard knowledge would counsel that decrease Beta shares ought to underperform the broader markets throughout uptrends and outperform throughout downtrends, providing traders decrease potential returns in trade for decrease danger.

Nevertheless, historical past would counsel that merely isn’t the case.

Certainly, this paper from Harvard Enterprise Faculty means that not solely do low Beta shares not underperform the broader market over time – together with all market situations – they really outperform.

An extended-term research whereby the shares with the bottom 30% of Beta scores within the US had been pitted in opposition to shares with the very best 30% of Beta scores advised that low Beta shares outperform by a number of share factors yearly.

Over time, this kind of outperformance can imply the distinction between a cushty retirement and having to proceed working.

Whereas low Beta shares aren’t a panacea, the case for his or her outperformance over time – and with decrease danger – is kind of compelling.

How To Calculate Beta

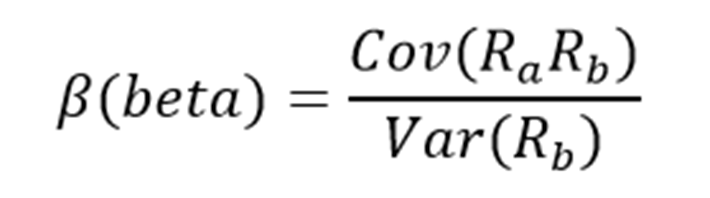

The system to calculate a safety’s Beta is pretty simple. The end result, expressed as a quantity, reveals the safety’s tendency to maneuver with the benchmark.

For instance, a Beta worth of 1.0 signifies that the safety in query ought to transfer in lockstep with the benchmark. A Beta of two.0 signifies that strikes within the safety ought to be twice as giant in magnitude because the benchmark and in the identical course, whereas a unfavorable Beta signifies that actions within the safety and benchmark have a tendency to maneuver in reverse instructions or are negatively correlated.

Associated: The S&P 500 Shares With Adverse Beta.

In different phrases, negatively correlated securities can be anticipated to rise when the general market falls, or vice versa. A small worth of Beta (one thing lower than 1.0) signifies a inventory that strikes in the identical course because the benchmark, however with smaller relative adjustments.

Right here’s a take a look at the system:

The numerator is the covariance of the asset in query with the market, whereas the denominator is the variance of the market. These complicated-sounding variables aren’t truly that tough to compute – particularly in Excel.

Moreover, Beta will also be calculated because the correlation coefficient of the safety in query and the market, multiplied by the safety’s commonplace deviation divided by the market’s commonplace deviation.

Lastly, there’s a vastly simplified technique to calculate Beta by manipulating the capital asset pricing mannequin system (extra on Beta and the capital asset pricing mannequin later on this article).

Right here’s an instance of the information you’ll must calculate Beta:

Threat-free charge (sometimes Treasuries at the least two years out)

Your asset’s charge of return over some interval (sometimes one yr to 5 years)

Your benchmark’s charge of return over the identical interval because the asset

To indicate how one can use these variables to do the calculation of Beta, we’ll assume a risk-free charge of two%, our inventory’s charge of return of seven% and the benchmark’s charge of return of 8%.

You begin by subtracting the risk-free charge of return from each the safety in query and the benchmark. On this case, our asset’s charge of return internet of the risk-free charge can be 5% (7% – 2%).

The identical calculation for the benchmark would yield 6% (8% – 2%).

These two numbers – 5% and 6%, respectively – are the numerator and denominator for the Beta system. 5 divided by six yields a worth of 0.83, and that’s the Beta for this hypothetical safety.

On common, we’d count on an asset with this Beta worth to be 83% as risky because the benchmark.

Interested by it one other approach, this asset ought to be about 17% much less risky than the benchmark whereas nonetheless having its anticipated returns correlated in the identical course.

Beta & The Capital Asset Pricing Mannequin (CAPM)

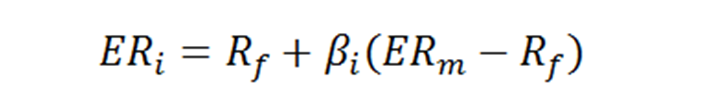

The Capital Asset Pricing Mannequin, or CAPM, is a typical investing system that makes use of the Beta calculation to account for the time worth of cash in addition to the risk-adjusted returns anticipated for a specific asset.

Beta is an integral part of the CAPM as a result of with out it, riskier securities would seem extra favorable to potential traders. Their danger wouldn’t be accounted for within the calculation.

The CAPM system is as follows:

The variables are outlined as:

ERi = Anticipated return of funding

Rf = Threat-free charge

βi = Beta of the funding

ERm = Anticipated return of market

The chance-free charge is similar as within the Beta system, whereas the Beta that you simply’ve already calculated is solely positioned into the CAPM system. The anticipated return of the market (or benchmark) is positioned into the parentheses with the market danger premium, which can be from the Beta system. That is the anticipated benchmark’s return minus the risk-free charge.

To proceed our instance, right here is how the CAPM truly works:

ER = 2% + 0.83(8% – 2%)

On this case, our safety has an anticipated return of 6.98% in opposition to an anticipated benchmark return of 8%. That could be okay relying upon the investor’s objectives because the safety in query ought to expertise much less volatility than the market due to its Beta of lower than 1.

Whereas the CAPM definitely isn’t excellent, it’s comparatively straightforward to calculate and provides traders a method of comparability between two funding alternate options.

Now, we’ll check out 5 shares that not solely provide traders low Beta scores, however engaging potential returns as nicely.

Evaluation On The Prime 5 Low Beta Shares

The next 5 low beta shares have the bottom (however optimistic) Beta values, in ascending order from lowest to highest. In addition they pay dividends to shareholders.

We centered on Betas above 0, as we’re nonetheless searching for shares which can be positively correlated with the broader market:

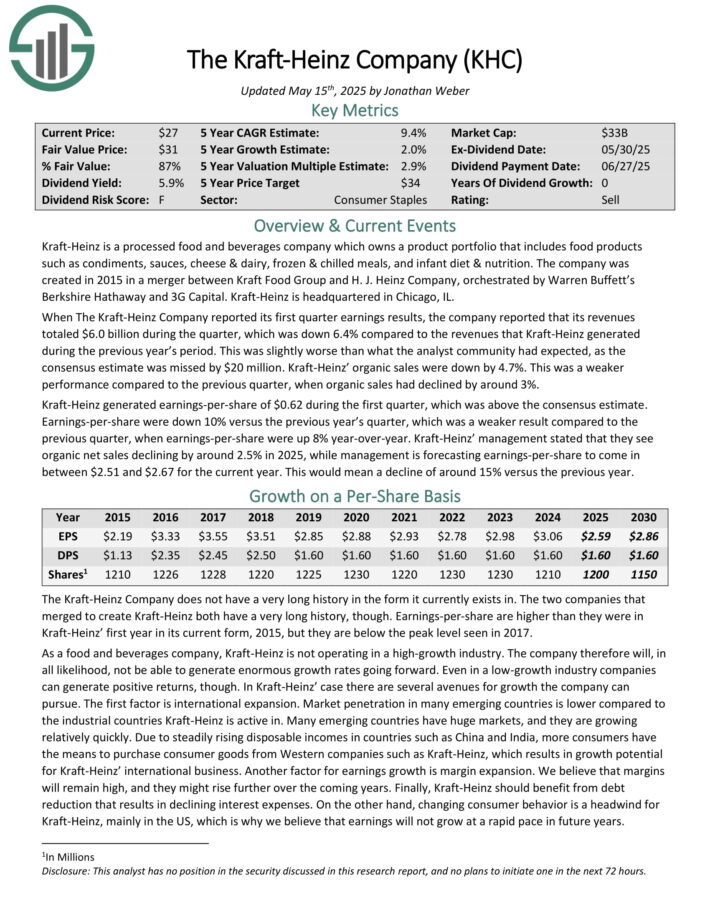

5. Kraft-Heinz Co. (KHC)

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise equivalent to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler eating regimen & vitamin.

When The Kraft-Heinz Firm reported its first quarter earnings outcomes, the corporate reported that its revenues totaled $6.0 billion in the course of the quarter, which was down 6.4% in comparison with the revenues that Kraft-Heinz generated in the course of the earlier yr’s interval.

This was barely worse than what the analyst group had anticipated, because the consensus estimate was missed by $20 million. Kraft-Heinz’ natural gross sales had been down by 4.7%.

Kraft-Heinz generated earnings-per-share of $0.62 in the course of the first quarter, which was above the consensus estimate. Earnings-per-share had been down 10% versus the earlier yr’s quarter, which was a weaker end result in comparison with the earlier quarter, when earnings-per-share had been up 8% year-over-year.

Kraft-Heinz’ administration said that they see natural internet gross sales declining by round 2.5% in 2025, whereas administration is forecasting earnings-per-share to return in between $2.51 and $2.67 for the present yr. This could imply a decline of round 15% versus the earlier yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on KHC (preview of web page 1 of three proven under):

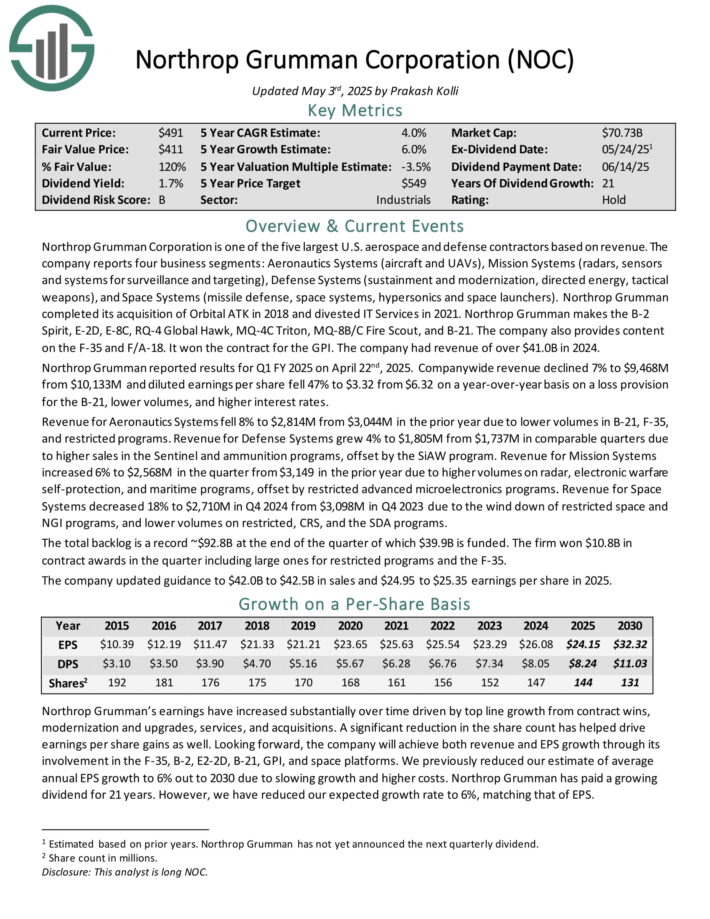

4. Northrup Grumman Company (NOC)

Northrop Grumman Company is without doubt one of the 5 largest U.S. aerospace and protection contractors based mostly on income.

The corporate stories 4 enterprise segments: Aeronautics Techniques (plane and UAVs), Mission Techniques (radars, sensors and methods for surveillance and concentrating on), Protection Techniques (sustainment and modernization, directed vitality, tactical weapons), and Area Techniques (missile protection, area methods, hypersonics and area launchers).

The corporate had income of over $41.0B in 2024.

Northrop Grumman reported outcomes for Q1 FY 2025 on April twenty second, 2025. Firm-wide income declined 7% to $9.468 billion and diluted earnings per share fell 47% to $3.32 on a year-over-year foundation on a loss provision for the B-21, decrease volumes, and better rates of interest.

Income for Aeronautics Techniques fell 8% to $2.814 billion as a result of decrease volumes in B-21, F-35, and restricted packages. Income for Protection Techniques grew 4% as a result of larger gross sales within the Sentinel and ammunition packages, offset by the SiAW program.

The entire backlog is a file ~$92.8B on the finish of the quarter of which $39.9B is funded. The agency gained $10.8B in contract awards within the quarter together with giant ones for restricted packages and the F-35.

The corporate up to date steering to $42.0B to $42.5B in gross sales and $24.95 to $25.35 earnings per share in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on NOC (preview of web page 1 of three proven under):

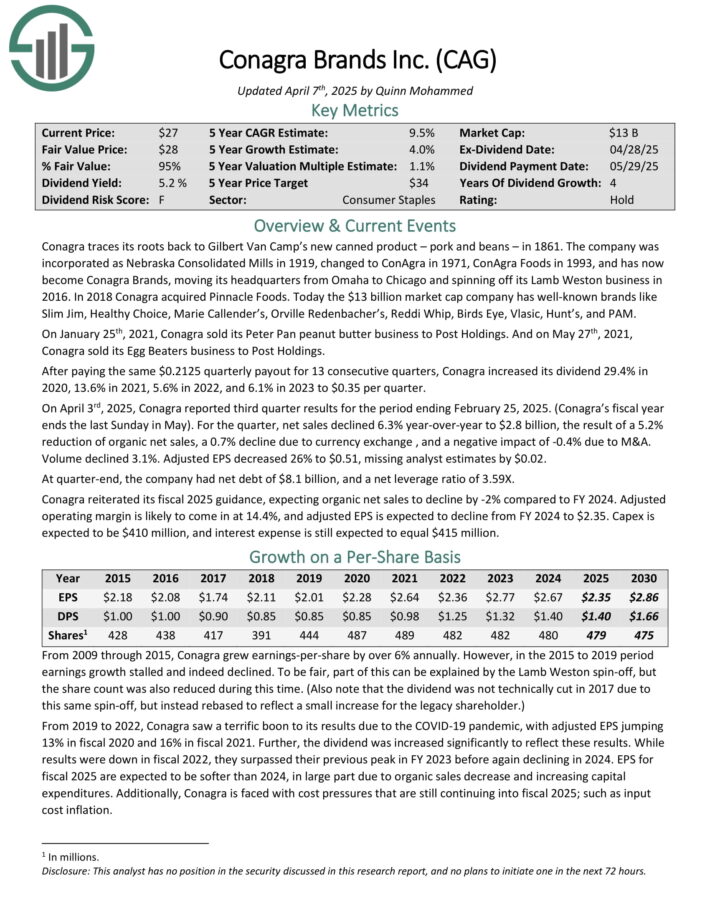

3. Conagra Manufacturers (CAG)

Conagra has well-known manufacturers like Slim Jim, Wholesome Selection, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

On April third, 2025, Conagra reported third quarter outcomes for the interval ending February 25, 2025. For the quarter, internet gross sales declined 6.3% year-over-year to $2.8 billion, the results of a 5.2% discount of natural internet gross sales, a 0.7% decline as a result of forex trade , and a unfavorable affect of -0.4% as a result of M&A.

Quantity declined 3.1%. Adjusted EPS decreased 26% to $0.51, lacking analyst estimates by $0.02. At quarter-end, the corporate had internet debt of $8.1 billion, and a internet leverage ratio of three.59X.

Conagra reiterated its fiscal 2025 steering, anticipating natural internet gross sales to say no by -2% in comparison with FY 2024. Adjusted working margin is more likely to are available in at 14.4%, and adjusted EPS is anticipated to say no from FY 2024 to $2.35.

Click on right here to obtain our most up-to-date Positive Evaluation report on CAG (preview of web page 1 of three proven under):

2. Campbell Soup Co. (CPB)

Campbell Soup Firm is a multinational meals firm headquartered in Camden, N.J. The corporate manufactures and markets branded comfort meals merchandise, equivalent to soups, easy meals, drinks, snacks, and packaged recent meals.

The corporate’s portfolio focuses on two particular companies: Campbell Snacks, and Campbell Meals and Drinks. Campbell generated annual gross sales of $9.6 billion in fiscal 2024.

On March 12, 2024, Campbell closed on its acquisition of Sovos Manufacturers (SOVO) for $23 per share in money, which represented a complete enterprise worth of $2.7 billion, and was funded by issuing new debt. Sovos is a pacesetter in excessive development premium Italian sauces, and owns the market-leading Rao’s model.

Campbell Soup reported second quarter FY 2025 outcomes on March fifth, 2025. Web gross sales for the quarter improved by 9% year-over-year to $2.7 billion. This enhance was largely a results of the Sovos Manufacturers acquisition. Adjusted EPS was 8% decrease year-over-year at $0.74 for the quarter, which beat expectations by two cents.

The corporate repurchased $56 million price of shares in H1. There stays $301 million remaining underneath the present $500 million share repurchase program, which is along with the present $205 million remaining on its anti-dilutive share repurchase program.

Management up to date its full-year fiscal 2025 steering. Administration now estimates that in fiscal 2025, Campbell’s adjusted earnings per share can be down 1% to 4%.

Click on right here to obtain our most up-to-date Positive Evaluation report on CPB (preview of web page 1 of three proven under):

1. Basic Mills (GIS)

Basic Mills is a packaged meals large, with greater than 100 manufacturers and operations in additional than 100 nations. Basic Mills has not reduce its dividend for 125 consecutive years.

In mid-March, Basic Mills reported (3/19/25) outcomes for Q3-2025. Web gross sales and natural gross sales fell -5% every over the prior yr’s quarter, primarily as a result of retailer stock reductions. It was the second-worst decline within the final 5 years.

Gross margin expanded from 33.5% to 33.9%, as price financial savings offset enter inflation. Adjusted earnings-per-share decreased -15%, from $1.18 to $1.00, however exceeded the analysts’ consensus by $0.04.

Basic Mills is going through robust comparisons, because the pandemic has subsided. It generates 85% of its gross sales from at-home meals demand. It is usually going through excessive price inflation, which is more likely to persist for some time. As well as, it’s at present investing in its pet enterprise to reinvigorate development, on the expense of short-term earnings.

Because of this, the corporate lowered its already cautious steering for fiscal 2025. It expects a 1.5%-2% decline in natural gross sales and a 7%-8% decline in earnings per-share (vs. a 2% decline in earlier steering).

Click on right here to obtain our most up-to-date Positive Evaluation report on GIS (preview of web page 1 of three proven under):

Closing Ideas

Buyers should take danger under consideration when choosing from potential investments. In spite of everything, if two securities are in any other case comparable when it comes to anticipated returns however one affords a a lot decrease Beta, the investor would do nicely to pick out the low Beta safety as they could provide higher risk-adjusted returns.

Utilizing Beta might help traders decide which securities will produce extra volatility than the broader market and which of them might assist diversify a portfolio, equivalent to those listed right here.

The 5 shares we’ve checked out not solely provide low Beta scores, however additionally they provide engaging dividend yields. Sifting by way of the immense variety of shares accessible for buy to traders utilizing standards like these might help traders discover the very best shares to swimsuit their wants.

At Positive Dividend, we regularly advocate for investing in corporations with a excessive chance of accelerating their dividends each yr.

If that technique appeals to you, it might be helpful to flick thru the next databases of dividend development shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.