Think about a pal of yours who’s $456,000 in bank card debt stated to you, “I’ve received a plan to make an additional $3,010 per 12 months and get myself again on observe.” You realize this individual nicely sufficient to know that their wage can’t be far more than $62,000. Would you roll your eyes at this individual’s claims or would you hear intently and suppose, “By golly, this individual is heading in the right direction!”

Sadly, this case is strictly what the White Home is peddling to the American individuals proper now.

Simply final week, the Congressional Finances Workplace despatched a letter to Democrats who had requested an estimate of the income technology of the tariffs. Put merely, the CBO initiatives that the Trump tariffs enacted between these dates would result in an total discount within the federal deficit of $2.8 trillion over the subsequent decade.

The Administration and a lot of the media are touting this as an enormous victory for fiscal well being. Some are even pointing to it as proof that “Trump was proper” and social media is replete with digital high-fives and congratulations. Nonetheless, in doing so, these pundits are committing a elementary mistake: conflating deficit discount with debt discount.

Deficits vs Debt: A Clear Distinction

The excellence between deficits and debt could seem trivial, as many use the 2 interchangeably. This conflation won’t imply a lot in our on a regular basis, private lives, however the distinction makes all of the distinction in relation to federal budgets. To place it merely, a deficit happens when there may be annual overspending. For instance, suppose your pal earns $62,000 per 12 months, which simply so occurs to be the annualized earnings of the median full-time wage and wage employee in america, in keeping with the BLS. In the event that they spent $85,000 per 12 months (37 % greater than their earnings), they’d be engaged in $23,000 per 12 months in deficit spending. This must be financed by borrowing cash from pals, members of the family, banks, or by opening a brand new bank card.

Debt, by comparability, is the overall accumulation of all of the deficits (and surpluses) incurred over a number of years. In case your pal’s monetary scenario remained unchanged for a whole decade, then we might say that they ran deficits of $23,000 every year and that this resulted in a complete debt of $230,000.

So what does this need to do with the White Home and what they’re telling the American individuals? In a phrase: every thing.

If we take a look at final 12 months’s figures, the federal authorities had complete revenues of $4.92 trillion towards $6.75 trillion in spending. This distinction is the supply of the $1.83 trillion in deficit spending for simply 2024 alone. By the way, that is 37 % greater than they took in in revenues for 2024. By comparability, it took till 1981 for the overall federal debt to hit $1 trillion. In reality, President Reagan warned in regards to the coming “incomprehensible” trillion-dollar nationwide debt throughout his first tackle to a joint session of Congress in February of 1981. The federal authorities elevated the nationwide debt by just below $2 trillion in simply 2024 alone. Identical to a family, this deficit spending have to be financed one way or the other. The federal government can borrow the cash by issuing debt, akin to borrowing cash from pals, members of the family, or a financial institution. In contrast to a family, although, they’ve one other route: inflating the debt away by printing more cash.

If we add all of the earlier years’ deficits (and surpluses) for the federal authorities, we arrive at their present stage of nationwide debt: a staggering $36.2 trillion. This provides the federal authorities a debt-to-income ratio of seven.4. In different phrases, to repay the nationwide debt, the federal authorities must allocate each single penny of the finances for the subsequent 7 years and 5 months, assuming zero curiosity on the debt. In case your pal ran his finances the best way Congress runs theirs, he would have $456,000 in bank card debt.

The CBO’s Letter

So what about that letter the CBO despatched? It introduced that the tariffs, assuming that they’re reinstated, final all ten years (i.e. should not rescinded by a future administration), and should not evaded in any respect (these are Herculean assumptions), then the overall deficit over the subsequent ten years will probably be lowered by $2.8 trillion. That works out to a median of $280 billion per 12 months. However what impact will this have on the overall deficit every year? The CBO initiatives that the deficit for 2025 will probably be $1.9 trillion.

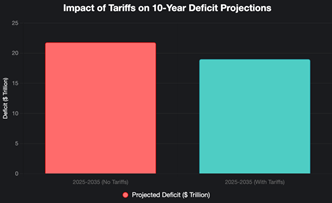

Reducing $280 billion from this would scale back the deficit to $1.62 trillion. Going additional, the CBO initiatives deficits for every of the subsequent ten years as nicely. And whereas there are causes to consider that these numbers is not going to show to be correct sooner or later, they had been decided the identical method as these financial savings. Over the subsequent ten years, the CBO initiatives that we are going to run deficits totaling $21.8 trillion. The extra tariff income will scale back this to $19 trillion.

Extending this to the nationwide debt image, the CBO’s letter says that the nationwide debt is not going to develop to $58 trillion in 2036 as that they had initially predicted, however as a substitute a “mere” $55.2 trillion.

Returning to the analogy of our pal, this is able to be akin to him solely going one other $201,000 in debt over the subsequent ten years as a substitute of an extra $231,000, rising his total debt to $657,000 as a substitute of $687,000.

This particular person part of the President’s fiscal plan is a step in the suitable path, positive, however there may be completely no motive to throw a parade over this. Even in isolation, this can nonetheless lead to a rising stage of federal debt. We will see this plainly once we contemplate the CBO’s rating of, for instance, the Massive Stunning Invoice, which finds important total addition to the nationwide debt, over and above the financial savings from the purported tariff revenues.

Consuming The Elephant

Decreasing the federal deficit by $2.8 trillion over the subsequent decade sounds spectacular to us mere fiscal mortals. However it’s at greatest a drop within the bucket when the nationwide debt is, even below charitable assumptions, projected to develop to $55.2 trillion over the subsequent ten years. Retired Admiral Michael Mullen, then the Chairman of the Joint Chiefs of Employees, warned of our nationwide debt’s impact of crippling our nation’s capabilities, making us much less protected. His warning got here in 2010, when the federal debt was a mere $13.5 trillion and the federal deficit was a mere $1.29 trillion.

Whereas it’s true that one of the simplest ways to eat an elephant is “one chew at a time” and we actually ought to have fun taking this chew out of the issue of nationwide deficits, the necessity to have a frank and critical dialog about our nation’s present fiscal actuality has by no means been extra pressing. Certainly, there may be nonetheless far more of the elephant to eat and sadly, the duty earlier than us is just getting bigger, not smaller.

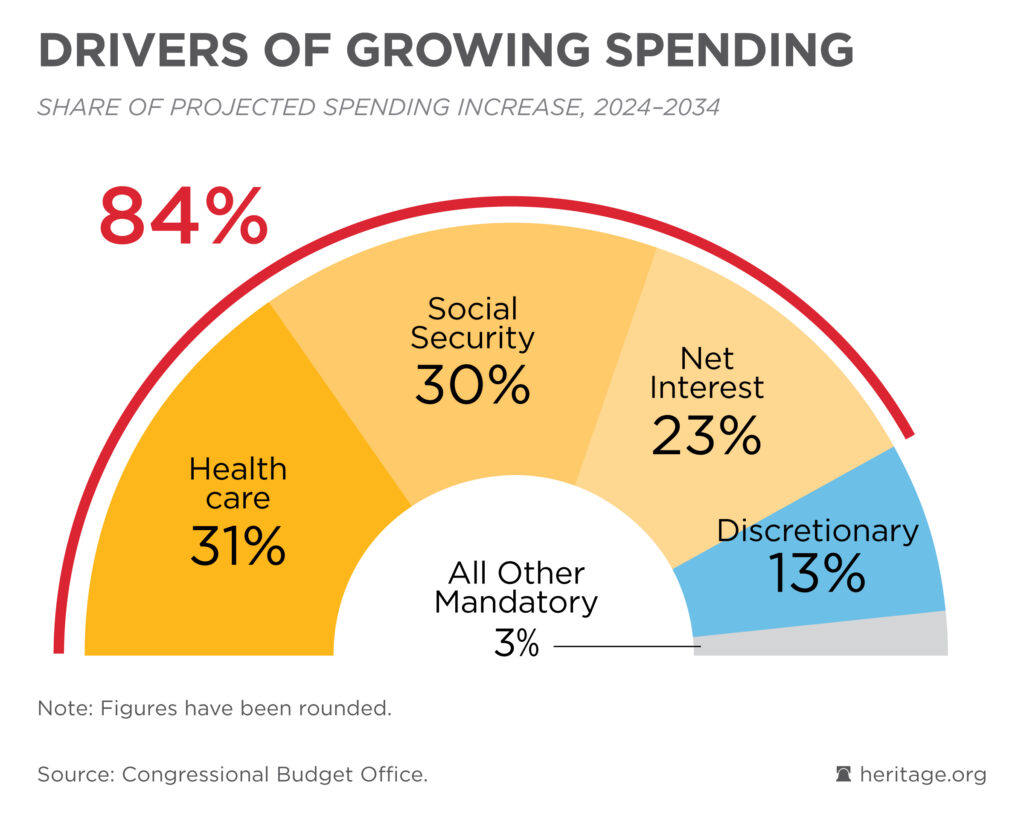

Fixing the nationwide debt by means of elevated revenues is, fairly merely, not going to occur. We’ve let it develop so massive already that the extent of taxation crucial to take action would completely devastate our economic system and outcome within the impoverishment of just about each American. This must be tackled by means of spending cuts.

However “extra spending” is a symptom of the true drawback, not the trigger. The true drawback is that we’ve assigned far too many tasks to the federal authorities, a number of of which they don’t have any enterprise having within the first place. The elevated delegation of tasks has led inexorably to the expansion within the federal finances over time.

We can’t afford to have fun half-measures like tariff revenues. With out deep, structural spending cuts and a elementary rethinking of what authorities ought to do, we’ll solely kick the can additional down the highway and burden future generations with much more crippling debt that may crush the American dream. Time is working out for the intense conversations that must occur.