Up to date on June twentieth, 2025 by Bob Ciura

The “Canines of the Dow” investing technique is a quite simple method for buyers to attain diversification and revenue of their portfolios whereas remaining within the sphere of extra conservative blue chip shares.

The technique consists of investing within the 10 highest-yielding shares within the Dow Jones Industrial Common, an index of 30 U.S. shares.

Excessive dividend shares are shares with a dividend yield properly in extra of the market common dividend yield of ~1.3%.

With that in thoughts, we’ve got created a free listing of over 200 excessive dividend shares with dividend yields above 5%.

You’ll be able to obtain your copy of the excessive dividend shares listing beneath:

The “Canines of the Dow” technique produces above-average revenue and concentrates on shares that usually commerce at decrease valuations relative to the remainder of the DJIA.

Provided that the DJIA represents a few of the largest corporations on the planet, its “canines” are usually corporations with robust monitor data which have hit momentary issues.

This can be a nice and easy technique for worth buyers trying to buy good companies which are at present out of favor.

To implement this technique, take the sum of money it’s important to make investments after which divide it equally among the many 10 highest-yielding shares within the DJIA.

Maintain these shares for an entire yr after which on the finish of 12 months, take a look at the 30 Dow shares once more and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the method. Along with the simplicity and deal with high quality, worth, and revenue that this technique generates, it additionally improves self-discipline by stopping extreme emotion-driven buying and selling.

It additionally encourages buyers to reap the tax advantages from holding positions for a minimum of one yr earlier than promoting, thereby being taxed on the long-term capital good points tax charge as an alternative of the short-term charge.

The 2025 Canines of the Dow

The listing of the 2025 Canines of the Dow is beneath, together with the present dividend yield of the top-ten yielding DJIA shares.

Click on on an organization’s identify to leap on to evaluation on that firm.

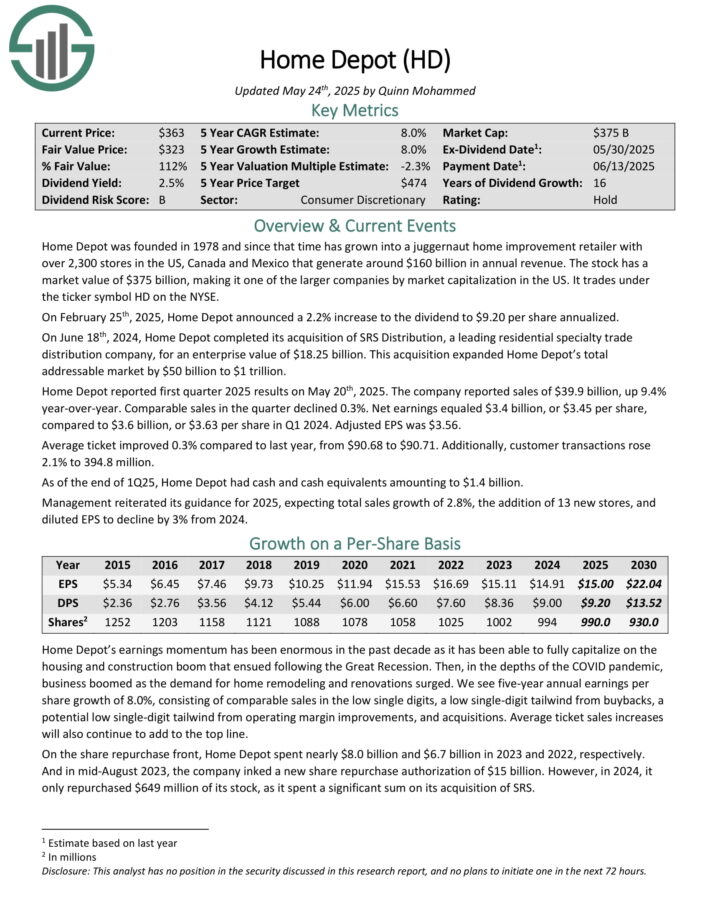

Canine of the Dow #10: Procter & Gamble (PG)

Procter & Gamble is a client merchandise big that sells its merchandise in over 180 international locations.

Notable manufacturers embody Pampers, Luvs, Tide, Acquire, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Outdated Spice, Daybreak, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and lots of extra.

Procter & Gamble has paid a dividend for 134 years and has grown its dividend for 69 consecutive years – one of many longest lively streaks of any firm.

On April eighth, 2025, Procter & Gamble raised its dividend by 5%, from $1.0065 per quarter to $1.0568.

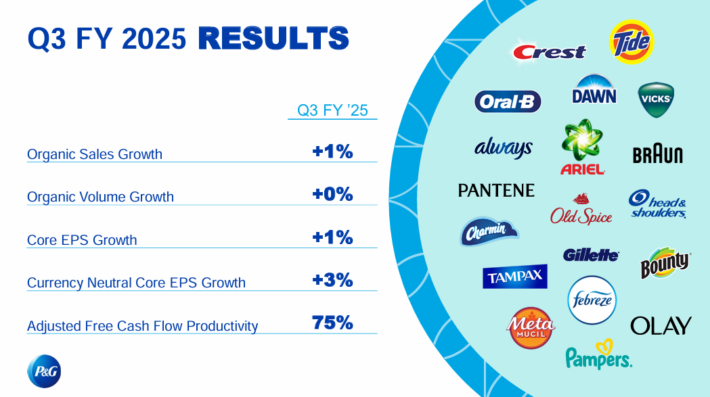

In late April, Procter & Gamble reported (4/24/25) monetary outcomes for the third quarter of fiscal 2025 (its fiscal yr ends June thirtieth).

Supply: Investor Presentation

Gross sales dipped -2% however its natural gross sales edged up 1% over final yr’s quarter, because of increased costs.

Core earnings-per-share grew 1%, from $1.52 to $1.54, beating the analysts’ consensus by $0.01. The agency gross sales amid sustained worth hikes are a testomony to the power of the manufacturers of Procter & Gamble.

Click on right here to obtain our most up-to-date Certain Evaluation report on PG (preview of web page 1 of three proven beneath):

Canine of the Dow #9: Nike Inc. (NKE)

Nike is the world’s largest athletic footwear, attire and tools maker. The namesake is among the most respected manufacturers on the planet. Nike’s choices deal with six classes: operating, basketball, the Jordan model, soccer (soccer), coaching, and sportswear. Nike additionally owns Converse.

In mid-March, Nike launched (3/20/25) outcomes for the third quarter of fiscal 2025 (Nike’s fiscal yr ends on Could thirty first). Gross sales and direct gross sales decreased -9% and -12%, respectively, vs. the prior yr’s quarter. Digital gross sales declined -15%.

Gross margin contracted from 44.8% to 41.5% as a result of increased reductions and better product prices and earnings-per-share declined -30%, from $0.77 to $0.54, because of the sharp lower in gross sales and thinner margins. Nike is severely harm by the impression of inflation on client spending and altered its CEO in September in an effort to show round.

The brand new CEO is attempting to drive the corporate again to a full-priced mannequin to reinforce revenue margins however he believes that nice endurance will likely be required all through this course of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Nike (NKE) (preview of web page 1 of three proven beneath):

Canine of the Dow #8: House Depot (HD)

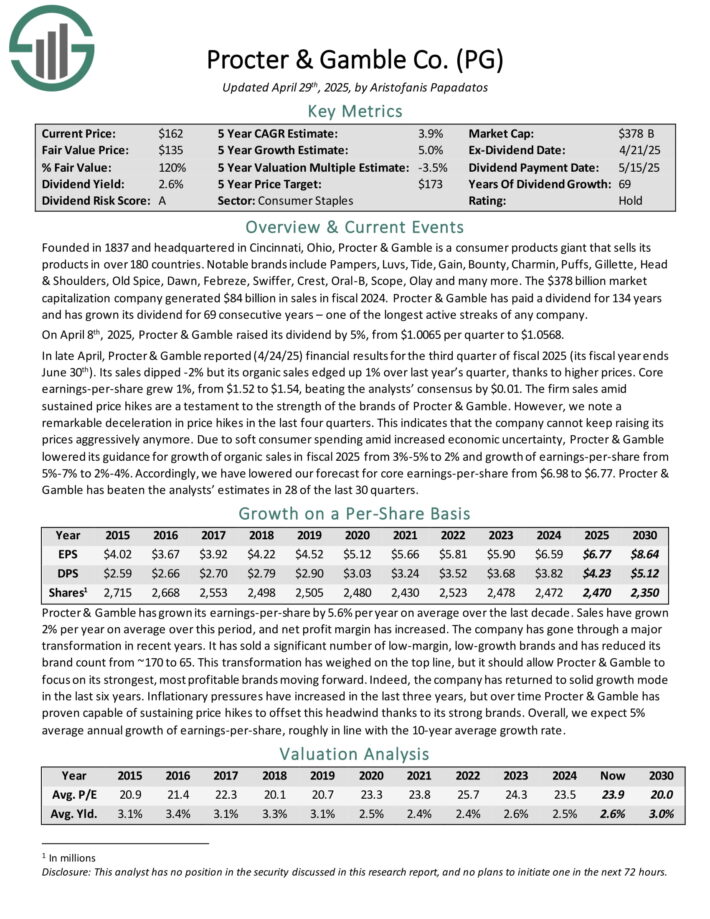

House Depot was based in 1978 and since that point has grown right into a juggernaut dwelling enchancment retailer with over 2,300 shops within the US, Canada and Mexico that generate round $153 billion in annual income.

House Depot reported first quarter 2025 outcomes on Could twentieth, 2025. The corporate reported gross sales of $39.9 billion, up 9.4% year-over-year. Comparable gross sales within the quarter declined 0.3%. Web earnings equaled $3.4 billion, or $3.45 per share, in comparison with $3.6 billion, or $3.63 per share in Q1 2024. Adjusted EPS was $3.56.

Common ticket improved 0.3% in comparison with final yr, from $90.68 to $90.71. Moreover, buyer transactions rose 2.1% to 394.8 million.

Administration reiterated its steerage for 2025, anticipating complete gross sales development of two.8%, the addition of 13 new shops, and diluted EPS to say no by 3% from 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on HD (preview of web page 1 of three proven beneath):

Canine of the Dow #7: UnitedHealth Group (UNH)

UnitedHealth dates again to 1974 when Constitution Med was based by a gaggle of well being care professionals on the lookout for methods to broaden healthcare choices for customers. It produces about $445 billion in income yearly.

The corporate has two main reporting segments: UnitedHealth and Optum. The previous gives world healthcare advantages to people, employers, and Medicare/Medicaid beneficiaries.

The Optum phase is a providers enterprise that seeks to decrease healthcare prices and optimize outcomes for its prospects.

UnitedHealth posted first-quarter earnings on April seventeenth, 2025, and outcomes missed estimates on each the highest and backside traces. As well as, a large steerage minimize was made, taking buyers unexpectedly and inflicting an enormous drop within the share worth on the information.

Adjusted earnings-per-share got here to $7.20, which was 9 cents worse than anticipated. Income was up virtually 10% year-over-year to $110 billion, however missed estimates by greater than $2 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on UNH (preview of web page 1 of three proven beneath):

Canine of the Dow #6: Coca-Cola (KO)

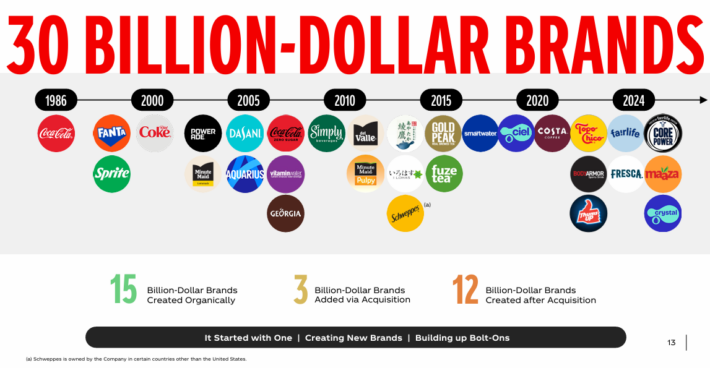

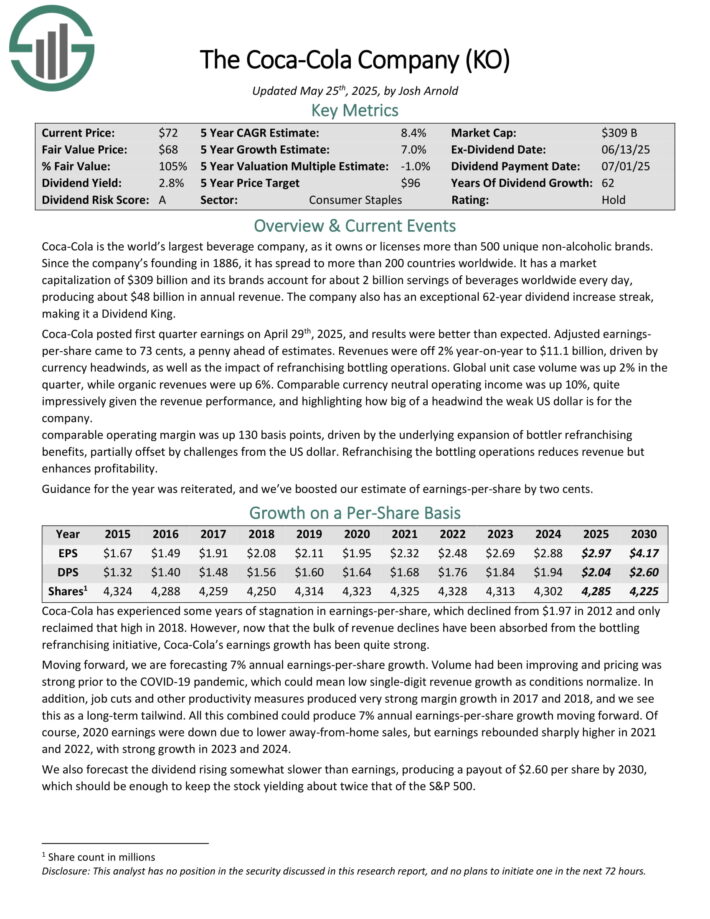

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 international locations worldwide.

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate a minimum of $1 billion in annual gross sales.

Supply: Investor Presentation

Coca-Cola posted first quarter earnings on April twenty ninth, 2025, and outcomes have been higher than anticipated. Adjusted earnings per-share got here to 73 cents, a penny forward of estimates.

Revenues have been off 2% year-on-year to $11.1 billion, pushed by foreign money headwinds, in addition to the impression of refranchising bottling operations. World unit case quantity was up 2% within the quarter, whereas natural revenues have been up 6%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

Canine of the Dow #5: Amgen Inc. (AMGN)

Amgen is the most important impartial biotech firm on the planet. Amgen discovers, develops, manufactures, and sells medicines that deal with critical diseases.

The corporate focuses on six therapeutic areas: heart problems, oncology, bone well being, neuroscience, nephrology, and irritation.

On Could 1st, 2025, Amgen reported first quarter earnings outcomes. Income grew 8.7% to $8.1 billion, which was $60 million forward of estimates.

Adjusted earnings-per-share of $4.90 in contrast favorably to $3.96 within the prior yr and was $0.64 greater than anticipated.

Supply: Investor Presentation

For the quarter, development was primarily as a result of a 14% enchancment in volumes, offset by a 6% decline in pricing. Gross sales for Enbrel, which treats rheumatoid arthritis, have been down 10% to $510 million as internet promoting costs have been down 47% year-over-year.

Prolia, which treats osteoporosis, grew 10% to a $1.1 billion, pushed as soon as once more by quantity development.

The corporate did reiterate that biosimilar competitors will possible impression gross sales in 2025. Repatha, which is used to manage ldl cholesterol, improved 27% to $656 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on Amgen Inc. (AMGN) (preview of web page 1 of three proven beneath):

Canine of the Dow #4: Johnson & Johnson (JNJ)

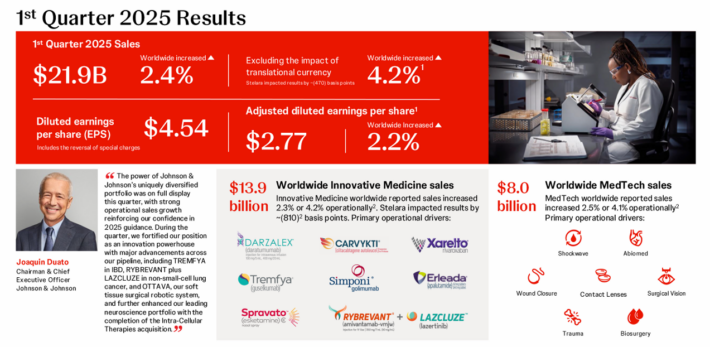

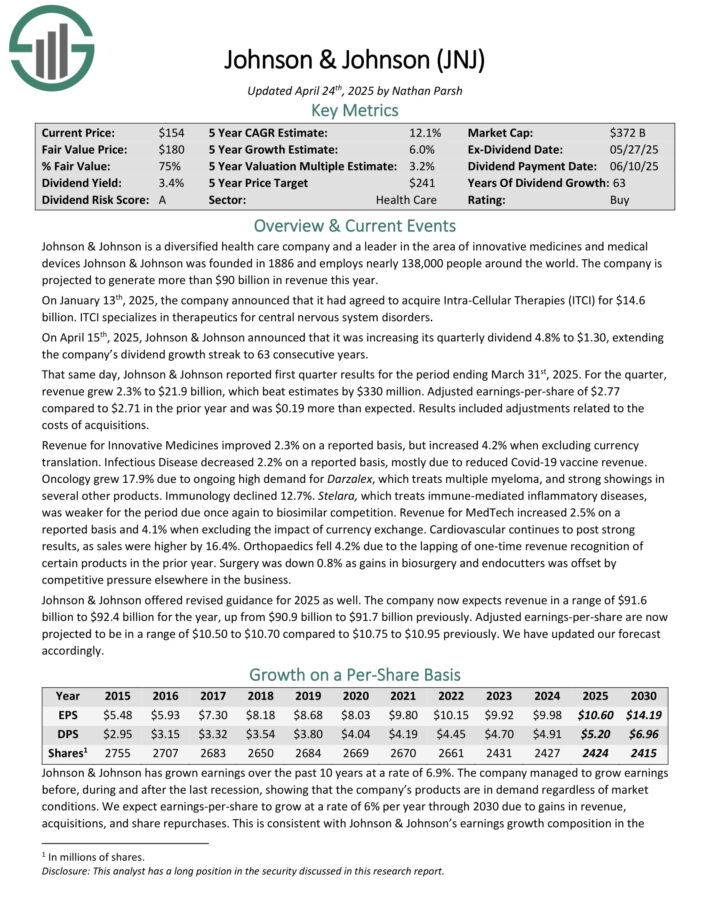

Johnson & Johnson is a diversified well being care firm and a pacesetter within the space of revolutionary medicines and medical units Johnson & Johnson was based in 1886.

On April fifteenth, 2025, Johnson & Johnson introduced that it was growing its quarterly dividend 4.8% to $1.30, extending the corporate’s dividend development streak to 63 consecutive years.

Supply: Investor Presentation

That very same day, Johnson & Johnson reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 2.3% to $21.9 billion, which beat estimates by $330 million.

Adjusted earnings-per-share of $2.77 in comparison with $2.71 within the prior yr and was $0.19 greater than anticipated. Outcomes included changes associated to the prices of acquisitions.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

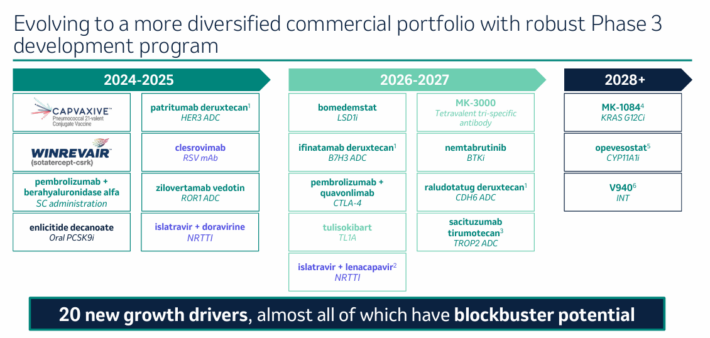

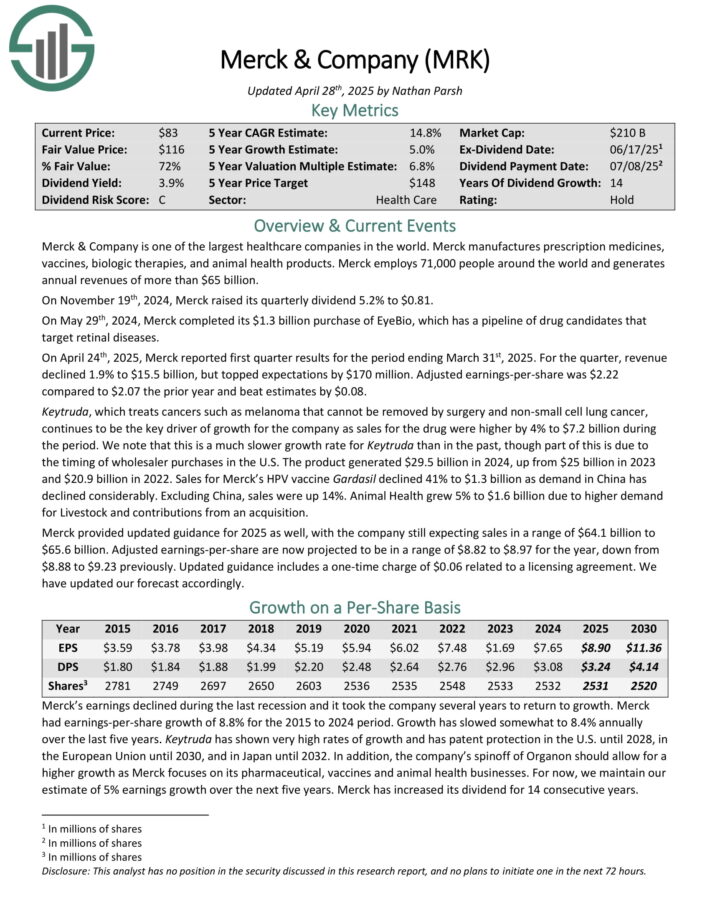

Canine of the Dow #3: Merck & Firm (MRK)

Merck & Firm is among the largest healthcare corporations on the planet. Merck manufactures prescription medicines, vaccines, biologic therapies, and animal well being merchandise.

Merck employs 68,000 individuals around the globe and generates annual revenues of greater than $63 billion.

Supply: Investor Presentation

On April twenty fourth, 2025, Merck reported first quarter outcomes. For the quarter, income declined 1.9% to $15.5 billion, however topped expectations by $170 million. Adjusted earnings-per-share was $2.22 in comparison with $2.07 the prior yr and beat estimates by $0.08.

Keytruda, which treats cancers equivalent to melanoma that can not be eliminated by surgical procedure and non-small cell lung most cancers, continues to be the important thing driver of development for the corporate as gross sales for the drug have been increased by 4% to $7.2 billion through the interval. The product generated $29.5 billion in 2024, up from $25 billion in 2023 and $20.9 billion in 2022.

Click on right here to obtain our most up-to-date Certain Evaluation report on MRK (preview of web page 1 of three proven beneath):

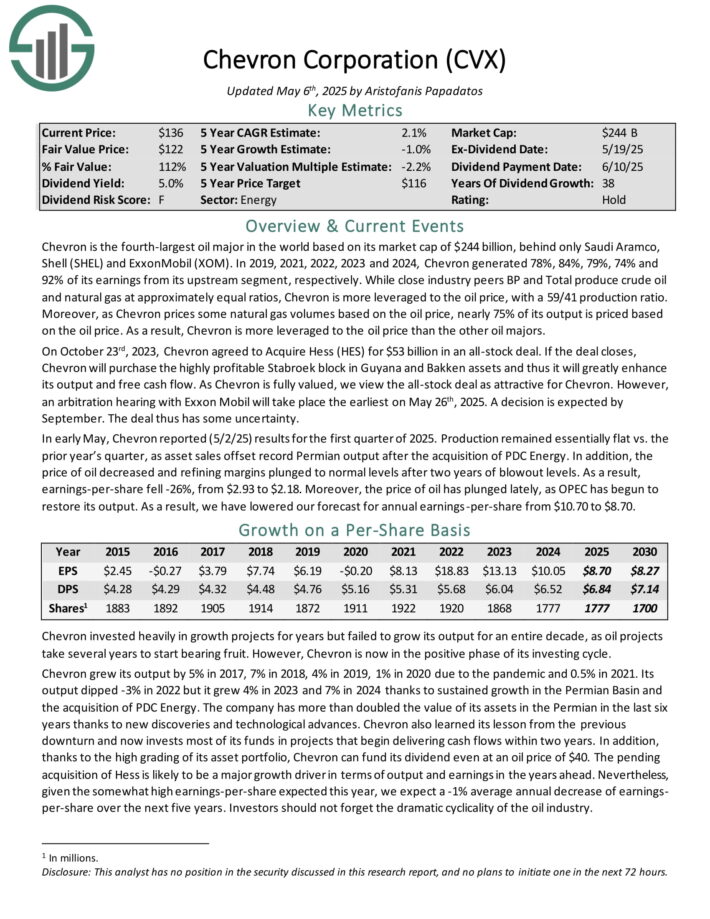

Canine of the Dow #2: Chevron Company (CVX)

Chevron is among the largest oil majors on the planet. The corporate sees the majority of its earnings from its upstream phase and has a better crude oil and pure gasoline manufacturing ratio than most of its friends.

Chevron has elevated its dividend for 38 consecutive years, inserting it on the Dividend Aristocrats listing.

Supply: Investor Presentation

In early Could, Chevron reported (5/2/25) outcomes for the primary quarter of 2025. Manufacturing remained primarily flat from the prior yr’s first quarter, as asset gross sales offset report Permian output after the acquisition of PDC Vitality.

As well as, the value of oil decreased and refining margins plunged to regular ranges after two years of elevated ranges.

In consequence, earnings-per-share fell -26%, from $2.93 to $2.18. Furthermore, the value of oil has plunged these days, as OPEC has begun to revive its output.

Chevron grew its output by 7% in 2024 because of sustained development within the Permian Basin and acquisitions. The corporate has greater than doubled the worth of its belongings within the Permian within the final six years because of new discoveries and technological advances.

Click on right here to obtain our most up-to-date Certain Evaluation report on Chevron Company (CVX) (preview of web page 1 of three proven beneath):

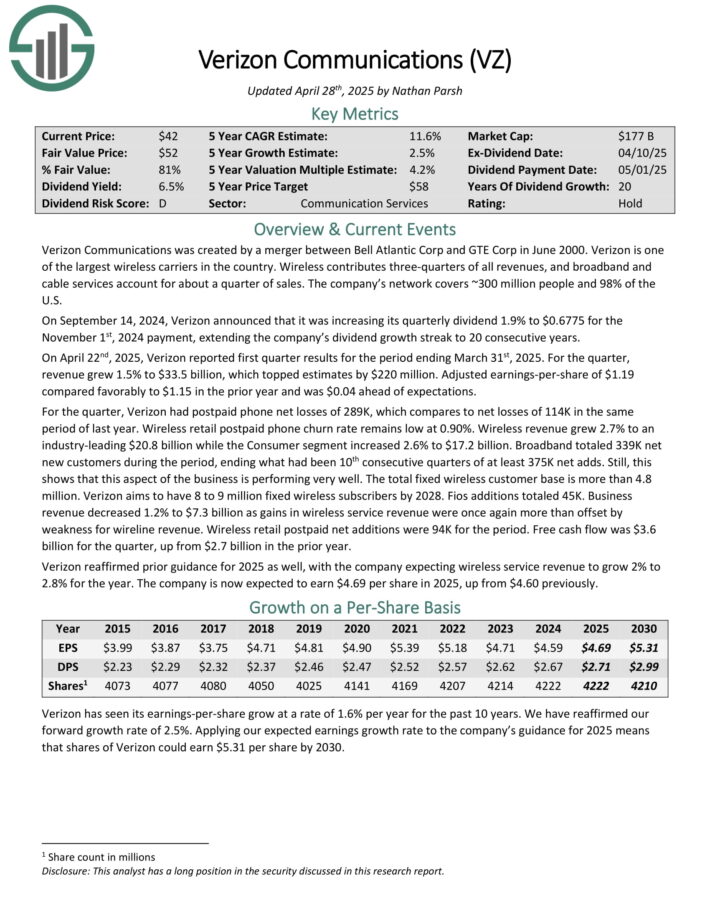

Canine of the Dow #1: Verizon Communications (VZ)

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is among the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a few quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S.

On April twenty second, 2025, Verizon reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 1.5% to $33.5 billion, which topped estimates by $220 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $1.19 in contrast favorably to $1.15 within the prior yr and was $0.04 forward of expectations.

For the quarter, Verizon had postpaid telephone internet losses of 289K, which compares to internet losses of 114K in the identical interval of final yr. Wi-fi retail postpaid telephone churn charge stays low at 0.90%.

Wi-fi income grew 2.7% to an industry-leading $20.8 billion whereas the Client phase elevated 2.6% to $17.2 billion.

Broadband totaled 339K internet new prospects through the interval, ending what had been tenth consecutive quarters of a minimum of 375K internet provides.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven beneath):

Remaining Ideas

Given the descriptions above, the Canines of the Dow are clearly a really various group of blue-chip shares that every take pleasure in important aggressive benefits and prolonged histories of paying rising dividends.

In consequence, this investing technique is a good, low-risk method for unsophisticated buyers to method dividend development investing.

Whereas it could not outperform the broader market yearly, it’s just about assured to supply buyers with a mix of enticing present yield with steadily rising revenue over time.

If you’re all for discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend assets will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.