In This Article

Builders constructed almost 600,000 house items final yr, setting a brand new report. That glut of recent provide, coupled with fears over commerce war-induced inflation and recession, has brought about rents to sluggish, stall, and even drop in 2025.

In actual fact, 73 cities throughout the nation have seen rents fall within the first 5 months of the yr. Right here’s the place they’re, a deeper dive into what’s inflicting rents to fall, and the outlook for rents shifting ahead.

Cities With Falling Rents

With a couple of exceptions, cities with falling rents have principally clustered within the Sunbelt, Northeast, and Midwest.

Whereas all actual property is native, the nationwide development has definitely moved in renters’ favor. On its Lease Supervisor overview, Zillow now exhibits the typical lease nationwide has dropped by $30 during the last yr.

Softening rental markets can ding buyers in different methods, too. Usually, property managers must provide incentives to lure new renters and hold occupancy robust. Whereas many of the multifamily investments we’ve gone in on by way of the co-investing membership have prevented it, now we have seen a few properties which have needed to enhance incentives.

For reference, listed here are the 20 cities the place rents have fallen essentially the most in 2025:

What’s Inflicting Rents to Drop?

Markets transfer in cycles, and rents surged after the pandemic, after remaining artificially locked as a result of eviction moratoriums. That post-pandemic surge has slowed to a trickle in 2025, and a drought in many markets.

Glut of recent provide

As touched upon, some markets acquired flooded with new rental stock. Housing begins for multifamily properties reached a month-to-month low of 233 in April 2020, at “peak pandemic panic.” Over the subsequent two years, they almost tripled to 615 by November 2022.

A lot of these initiatives accomplished in 2024 are coming onto the market now in 2025.

Softening labor market

As of this writing, the newest Labor Division knowledge noticed the four-week shifting common of jobless claims attain the highest degree since August 2023.

Fewer employers are hiring, and fewer staff are quitting. There’s a lot uncertainty within the financial system between commerce wars, tariffs, and wild public coverage swings in Washington, D.C. that employers and staff alike are treading rigorously.

Much less assured staff make extra conservative renters, who’re much less keen to splurge on greater rents.

Client spending pullback

It types a broader development of shoppers pulling again on the whole. Everybody seems to be holding their breath, ready to see what comes subsequent. And in doing so, they’re spending much less and hoarding additional cash.

Whereas it’s onerous to measure “vibes,” the Client Confidence Index fell 11.3% from June 2024 to June 2025.

You may additionally like

Implications for Revenue Traders

Kapil Singla, an investor with Shiny Future Residence Consumers in Birmingham, tells BiggerPockets that even slight lease drops imply tenants have extra negotiating energy and time to evaluation listings. “For buyers, it’s a clear market sign to evaluation pricing, enhance unit attraction, and place your self as the most suitable choice close by,” he provides.

I wrote earlier this month about cities the place residence costs are falling. Falling rents put much more downward strain on rental property costs, which creates room for negotiating deep reductions with determined sellers.

“When rents soften, sellers get extra versatile, and patrons can safe higher offers,” provides Austin Glanzer of 717HomeBuyer in a dialog with BiggerPockets. “It’s a good time to scour for underpriced properties and add worth by way of renovations.”

That proves doubly true when you imagine inflation will rear up once more as a result of incoming tariffs. Rental buyers can lock in month-to-month mortgage funds in immediately’s {dollars}, solely to have inflation drive rents up over the subsequent few years.

James Heller with The Atlas Portfolio in Cincinnati recommends buyers not simply search out nice offers however to additionally add income. “Search for properties with room for strategic upgrades,” he suggested when chatting with BiggerPockets.

That would imply value-add renovations, after all, nevertheless it may additionally imply including an ADU or splitting one property into two items. It may imply switching from a long-term rental to a short-term or medium-term rental or some different inventive manner to generate extra earnings from the identical property.

On the co-investing membership, we’ve vetted and invested in some group offers the place the operator added worth much more creatively. For instance, final month, we invested in two property tax abatement offers, the place operators partnered with native municipalities to put aside a share of the items for inexpensive housing. In alternate, they acquired a property tax abatement that immediately added six figures in web working earnings.

What’s the Outlook for Future Rents?

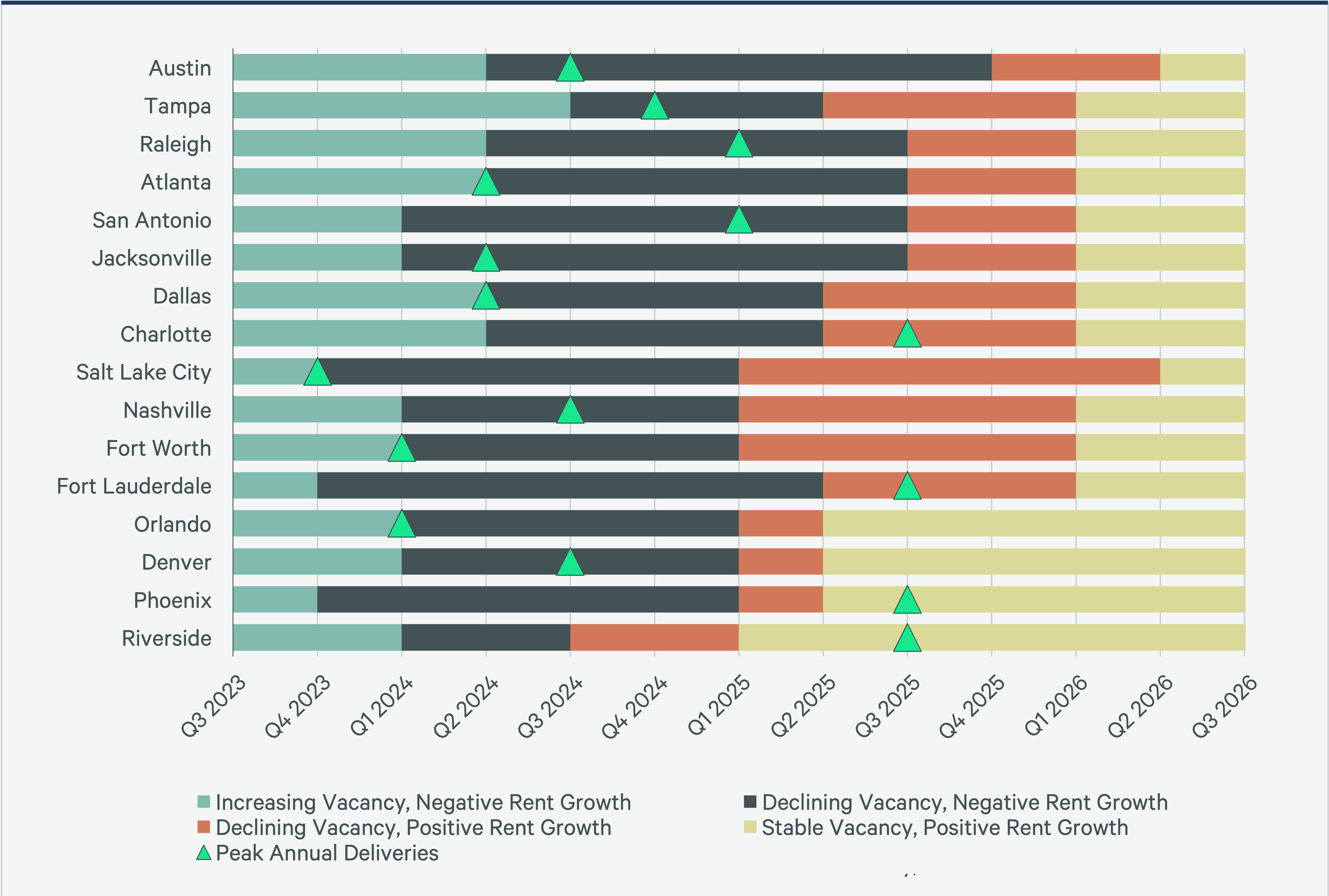

The flood of recent rental items hitting the market during the last two years is about to ease. Yardi initiatives far fewer new items hitting the market in 2026 and 2027 than in 2022-2025. Likewise, CBRE sees the identical slowing of recent provide and retightening of rental markets. Try their timelines for restoration for these main cities with detrimental lease development:

Circling again to multifamily housing begins, they dropped to 316 in Might.

Briefly, rents seem like bottoming out proper about now nationwide. Zillow initiatives whole lease development in 2025 at 2.8% for single-family properties and 1.6% for multifamily. In the meantime, CBRE forecasts whole lease development at a 2.6% annual price by the top of 2025.

Delicate rental markets create alternatives and bargains for buyers. Within the co-investing membership, we proceed assembly each month to vet new offers and go into them collectively. It’s a core a part of my investing philosophy of dollar-cost averaging: I make investments $5,000 in a brand new actual property deal each single month. That helps me earn excessive returns over time, even when different buyers hem and haw and fret over the headlines.

Don’t count on rents to skyrocket like they did in 2022 and 2023, however don’t count on them to fall in most markets both. Regularly, the glut of provide will get absorbed over the subsequent two years, and most rental markets ought to stabilize by the top of this yr.

By way of all of it, I plan to maintain investing small quantities each month as yet one more member of an funding membership.

Analyze Offers in Seconds

No extra spreadsheets. BiggerDeals exhibits you nationwide listings with built-in money circulate, cap price, and return metrics—so you may spot offers that pencil out in seconds.