Printed on June thirtieth, 2025 by Bob Ciura

Palantir Applied sciences (PLTR) is without doubt one of the market’s premier progress shares. In simply the previous three years, Palantir inventory has produced returns of greater than 1,200%.

As the corporate’s income progress has exploded and it has turn into worthwhile, it’s pure for buyers to surprise if a dividend fee is perhaps on the horizon.

Whether or not an organization pays a dividend relies on many components. 1000’s of publicly-traded corporations pay dividends to shareholders, and a few have maintained lengthy histories of elevating their dividends yearly.

For instance, the Dividend Aristocrats are a choose group of 69 shares within the S&P 500 which have raised their dividends for 25+ years in a row.

You may obtain an Excel spreadsheet of all Dividend Aristocrats (with metrics that matter, reminiscent of price-to-earnings ratios and dividend yields) by clicking the hyperlink beneath:

Disclaimer: Certain Dividend shouldn’t be affiliated with S&P World in any manner. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official knowledge from S&P World. Seek the advice of S&P World for official info.

Then again, different corporations don’t pay a dividend proper now and won’t for a really very long time (or ever).

Buyers within the firm might need to know if Palantir will ever pay a dividend to shareholders. This text will try and reply that query.

Enterprise Overview

Palantir had its preliminary public providing on September 30, 2020. The inventory opened up at $10 earlier than ending the day at $9.50. Nonetheless, the inventory has carried out fairly properly previously 5 years, and now trades above $130 per share.

At the moment, Palantir has a market capitalization above $300 billion, making it a mega-cap inventory.

Palantir was based in 2003, partially by well-known enterprise capitalist Peter Thiel. Thiel has been the brains, cash or each behind among the know-how sectors most profitable endeavors, together with Meta Manufacturers (META) and PayPal (PYPL).

Palantir is without doubt one of the main suppliers of software program platforms for the intelligence neighborhood. The corporate has 4 most important platforms.

The Palantir Gotham platform can establish patterns hidden in datasets, which vary from indicators intelligence sources to studies with confidential informants. Gotham is utilized by counter-terrorism analysts throughout the U.S. Intelligence Neighborhood and U.S. Division of Protection.

Palantir Foundry creates a central working system for an organization’s knowledge which permits customers to combine and analyze knowledge wanted in a single centrally situated place.

AIP permits clients to automate just about all areas of their companies. Its Workflow Builder can assemble AI apps, actions, and brokers.

Lastly, Apollo homes software program deployment instruments. Options embrace SaaS, safety, compliance, and extra.

Development Prospects

The corporate’s platforms can be utilized to deal with all kinds of industries, starting from protection to well being care to meals to vitality. This doesn’t restrict Palantir skill to draw clients to only a few areas of the economic system.

With a deep pool of potential clients, Palantir isn’t any area of interest enterprise.

The necessity for companies and organizations to have the ability to safely safe its knowledge in a central location can also be a necessity and Palantir is ready to scale their platform to satisfy their wants.

Palantir has translated these progress prospects into outcomes.

On Could fifth, the corporate reported first-quarter monetary outcomes. For the quarter, income of $883.85 million beat analyst expectations by $21.72 million. Adjusted earnings-per-share of $0.13 was in-line with estimates.

U.S. income elevated 55% year-over-year, together with 71% year-over-year progress in U.S. business income.

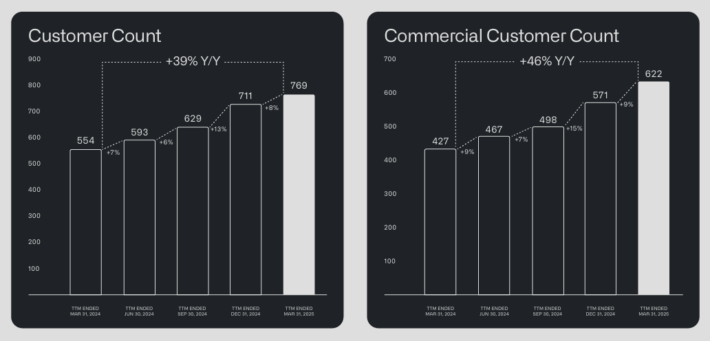

Supply: Investor Presentation

The corporate has additionally been busy profitable new enterprise since going public. Palantir closed on 139 offers within the first quarter price a minimum of $1 million, 51 of which have been price a minimum of $5 million.

Palantir can also be starting to seek out extra of a global presence. The corporate can proceed to develop its enterprise by increasing its space of operations.

Aggressive Benefits

Palantir has a number of benefits that units it aside from the competitors. First, Palantir’s refined platform may help corporations optimize their enterprise and discover methods to take away prices from the system. This may help enhance working efficiency whereas decreasing bills.

The corporate’s merchandise are additionally in excessive demand amongst army clients. Whereas considerably controversial amongst sure buyers, the corporate’s platforms have been confirmed to work in these areas which makes them a preferred selection amongst the intelligence and protection communities.

As soon as belief has been gained, there might be switching prices related to these businesses selecting one other vendor.

Palantir additionally has the advantage of rising clients whereas additionally decreasing in reliance on only a few clients.

Supply: Investor Presentation

Palantir generated GAAP web revenue of $214 million together with GAAP earnings-per-share of $0.08, that means the corporate has reached profitability.

The corporate additionally raised steerage, now anticipating 2025 income of $3.89 billion to $3.902 billion. Palantir additionally expects free money movement of $1.6 billion to $1.8 billion.

In the meantime, the corporate has the benefit of great money reserves. As of the top of its most up-to-date quarter, Palantir had a complete of $5.43 billion of money and money equivalents, and marketable securities on its stability sheet.

Present property whole $6.28 billion, in contrast with present liabilities of $976.4 million, indicating very sturdy liquidity. Only a few younger public corporations have such an enormous sum of liquid property out there, with out important long-term debt.

Such a powerful stability sheet will increase the prospect that the corporate may pay a dividend sooner or later.

Lastly, Palantir remains to be run by the identical management as when the corporate was based. Thiel stays chairman and his handpicked CEO Alex Karp has been in place since 2004.

Will Palantir Ever Pay A Dividend?

Palantir is a uncommon firm that has proven sturdy income and earnings progress since its IPO, together with an abundance of money on its stability sheet.

Corporations trying to pay a dividend must be worthwhile with sturdy stability sheets as a way to distribute a dividend.

On the floor, Palantir meets these necessities, that means it may theoretically pay a dividend. Nonetheless, there are different concerns for corporations nonetheless of their progress stage, reminiscent of Palantir.

Primarily, progress corporations must reinvest money movement again into their companies, to remain on the expansion observe. Certainly, Palantir continues to take a position the overwhelming majority of its proceeds again into the enterprise.

Working bills rose 22% within the first quarter, year-over-year. This was as a result of firm growing its gross sales and market, analysis and improvement and normal and administrative budgets to a extra affordable degree for a rising and increasing firm.

With excessive bills comes a low degree of earnings, which impacts any potential dividend need Palantir might have. Regardless that the corporate was worthwhile in its first quarter, Palantir is simply anticipated to earn $0.37 per share this yr.

Earnings-per-share are anticipated to develop by 16% subsequent yr to $0.43. This leaves comparatively little room to pay a dividend.

For instance, ff the corporate needed to allocate half of subsequent yr’s earnings-per-share to a dividend, then shareholders may obtain a quarterly dividend of roughly $0.05. This equates to a yield of simply 0.1% on the present worth, which possible wouldn’t have a lot enchantment for revenue buyers.

On the identical time, buyers aren’t flocking to Palantir due to its skill to throw off revenue. The younger firm is already worthwhile and seeing an unimaginable progress fee. Any use of capital to pay a paltry dividend could be capital that couldn’t be spent elsewhere.

Palantir is significantly better off preserving capital to reinvest in its enterprise. The money on the stability sheet can all the time be used to make an acquisition or assist develop the enterprise in another manner.

Due to this fact, we consider it might be a minimum of 5 to 10 years earlier than Palantir is able the place initiating a dividend is sensible.

Closing Ideas

After a gradual begin, there is no such thing as a doubting Palantir has been a superb funding following its IPO. The inventory has rocketed increased in simply the previous few years, producing a lifetime of returns in a comparatively quick time.

The corporate produced GAAP earnings in its first quarter and confirmed that income progress stays very excessive. Palantir additionally has a variety of progress in entrance of it and has a number of aggressive benefits that ought to propel it increased.

Buyers in search of a progress inventory, and don’t thoughts the controversies relating to the corporate’s platforms, may do properly proudly owning shares of Palantir. What they possible received’t see is a dividend anytime quickly.

For shareholders of Palantir, they’re in all probability extra excited in regards to the whole return prospects than a small dividend.

Extra Studying

See the articles beneath for an evaluation of whether or not different shares that at the moment don’t pay dividends will in the future pay a dividend:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.