Ronald Reagan deserves a lot reward for his stalwart dedication to free commerce and reducing commerce obstacles.

Even his most contentious coverage—the Voluntary Export Restraint (VER) settlement with Japan—will be seen as a protection of free commerce, as soon as the context and Reagan’s restricted choices are understood.

However was the VER settlement a hit?

Do Commerce Restrictions Gas Development?

New Proper thinkers akin to Oren Cass actually appear to suppose so, claiming two successes from Reagan’s non-policy: the VERs brought on home job progress in manufacturing and elevated international funding within the US. This is a vital distinction and is essential to his argument. He’s asserting that each the manufacturing job progress and the international funding wouldn’t have occurred with out the VERs. He then alleges that these outcomes can and will probably be replicated below a smart tariff regime.

The impact of the VERs on job progress was, certainly, initially fairly optimistic. A 1985 Worldwide Commerce Fee report says that “it’s doubtless that the [VER] added about 5,400 jobs to US car employment in 1981, and by 1984, the [VER] was chargeable for a complete of 44,000 extra jobs within the home trade.” And to be fully truthful, the report goes on to say that “If the employment features within the metal trade and in different provider industries have been added to those numbers, the features in employment could be considerably greater.”

Frankly, that is unsurprising to anybody who has even a cursory understanding of economics. No economist denies that, within the brief run, employment results of protectionist insurance policies will be fairly optimistic. That is, partly, because of long-term contracts that companies throughout provide chains have with each other. With little time to regulate to cost modifications (an idea economists consult with as “elasticity”), producers have little selection however to just accept the upper costs. The Second Regulation of Demand teaches us that elasticity modifications over time, particularly that when the next worth persists for a very long time, purchasers could have extra time to search out changes to this new worth, which can exacerbate the diminishment in purchases brought on by the upper costs to start with.

For example of this, take into account aluminum. When confronted with greater costs as a result of tariffs positioned by the primary Trump administration, many aluminum canning operators lowered their purchases of aluminum and produced fewer cans. As a result of decreased manufacturing of cans, canning operations laid off employees. However over time, as the supply of options elevated, manufacturing processes for industries reliant on aluminum cans modified. Craft breweries, for instance, shifted away from promoting their beer in six packs of smaller cans and towards 4 packs of taller cans containing the identical quantity of beer. In doing so, they have been in a position to massively cut back the quantity of aluminum utilized by quantity of beer. Likewise, some are contemplating switching to glass bottles as an alternative, which might eradicate their purchases of aluminum completely. As gross sales of aluminum fall, so too does employment within the aluminum producing sector. The tariffs, which have been meant to guard the home aluminum trade, are literally having the alternative impact within the very trade they have been meant to guard. Surprisingly sufficient, it could seem that the pandemic (of all issues) is chargeable for the aluminum-producing sector’s resurgence, not tariffs.

Simply as with different types of commerce restrictions, because of the VERs, automobiles bought within the US — domestically produced or in any other case — all grew to become dearer. In 1980, Japanese automobiles have been promoting for $6,585 whereas home automobiles have been promoting for $7,758. In 1986, home automobile costs had elevated by 24 p.c to $8,229, and Japanese automobile costs grew by 18 p.c to $9,223. These value will increase fell disproportionately on extra price-sensitive shoppers (decrease revenue households). Whereas “shopping for a brand new automobile” may look like a luxurious, the rise in worth for brand new automobiles has knock-on results within the used automobile market, driving their costs up as effectively. Additional, we must always remember that yearly, a brand new group of individuals look to enter the workforce for the primary time, and shopping for a automobile could also be mandatory to take action. Dearer automobiles make life more durable for these individuals, too.

However have been the pains of the upper costs for automobiles merely a short-term ache that begot long-term features? Hardly.

The US auto trade, free of a lot of the pressures of international competitors squandered the chance to maneuver away from the midsize and huge automobile choices they’d been producing and towards the smaller, inexpensive, and extra fuel-efficient automobiles like these made by Japanese automakers. Oil shocks in 1973 and 1979 and a recession in 1980 and 1981 moved US shoppers away from wanting bigger, much less fuel-efficient automobiles, towards smaller, extra fuel-efficient automobiles, which was precisely what the Japanese automakers have been promoting within the US. Along with being cheaper and extra gasoline environment friendly than American automobiles, Japanese automobiles in 1980 additionally required far fewer repairs. By 1990, Japanese automobiles nonetheless required fewer repairs, and the hole in high quality had grown wider. Once more, this is smart to an economist: the sting of losses is a robust drive that drives innovation. By lowering this sting within the home auto trade, the VERs lowered the necessity for innovation within the home auto trade. Japanese automobile makers, in contrast, shifted their exports away from decrease high quality automobiles and towards greater high quality automobiles. Economist Robert Feenstra demonstrates that two-thirds of the elevated worth of Japanese automobiles after the VER took impact was due, in truth, to improved high quality of Japanese imported automobiles.

Because of this, within the Nineties, the Massive Three automakers — Ford, Basic Motors, and Chrysler (now Stellantis) — have been pressured to put off tens of 1000’s of employees. In reality, January of 1990, the LA Instances reported that “a staggering 42 of the 62 Massive Three Meeting vegetation are being shuttered not less than briefly throughout January.” If something, the brief time period pains of upper costs for shoppers led to the long run pains of lowered employment for employees.

In reality, the Massive Three didn’t even need the import restrictions to start with. Doug Irwin writes, “GM, Ford, and Chrysler didn’t need to prohibit imports as a result of they themselves had begun importing international produced automobiles below their very own nameplate. In 1975, the UAW charged twenty-eight international auto producers in eight nations with dumping, however home producers didn’t assist the petition as a result of 40 p.c of imported automobiles got here from their subsidiaries.”

However what in regards to the elevated international funding, notably within the American South? Absolutely, whereas Detroit struggled, carmakers like Honda and Toyota, who began to construct vegetation within the US and thus keep away from the export restraint restrictions, proper?

Mistaken.

First, it could be foolish to think about {that a} non permanent, voluntary restraint on exporting items into the US would impel Japanese auto companies to speculate tens of millions of {dollars} into constructing meeting vegetation and the mandatory infrastructure to make these vegetation operational.

Volkswagen started constructing manufacturing vegetation in Pennsylvania in 1978 and Honda constructed its first plant in Ohio in 1979, two years earlier than the VER, constructing bikes. Seeing their successes, Honda then introduced extra vegetation being in-built 1980, which started opening from 1982 to 1986. Why is that this?

In response to a 1990 report by the Philadelphia Federal Reserve, Japanese auto companies producing within the US made financial sense. This was not as a result of VER, it was as a result of “the manufacturing value differentials between [Japan and the US] have narrowed. One trade analyst has estimated that as of late 1989 an auto will be constructed at a transplant for $200 lower than one in-built Japan and delivered in america.” On the similar time, on account of alternate charges and wage charges in Japan, labor was changing into dearer in Japan relative to the US. In brief, rising prices of manufacturing in Japan meant that they sought to offshore manufacturing jobs… to the US.

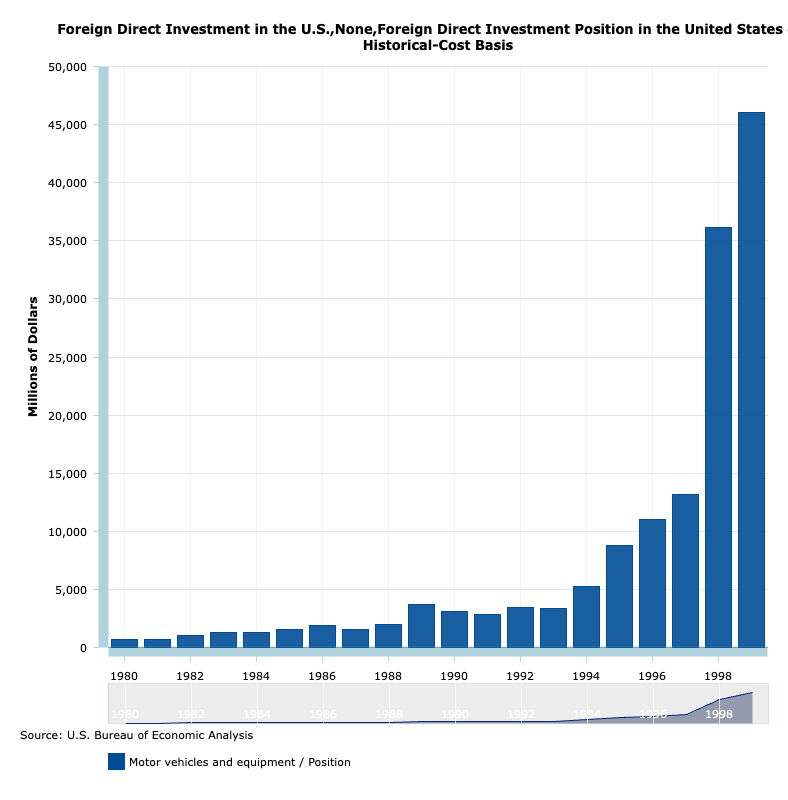

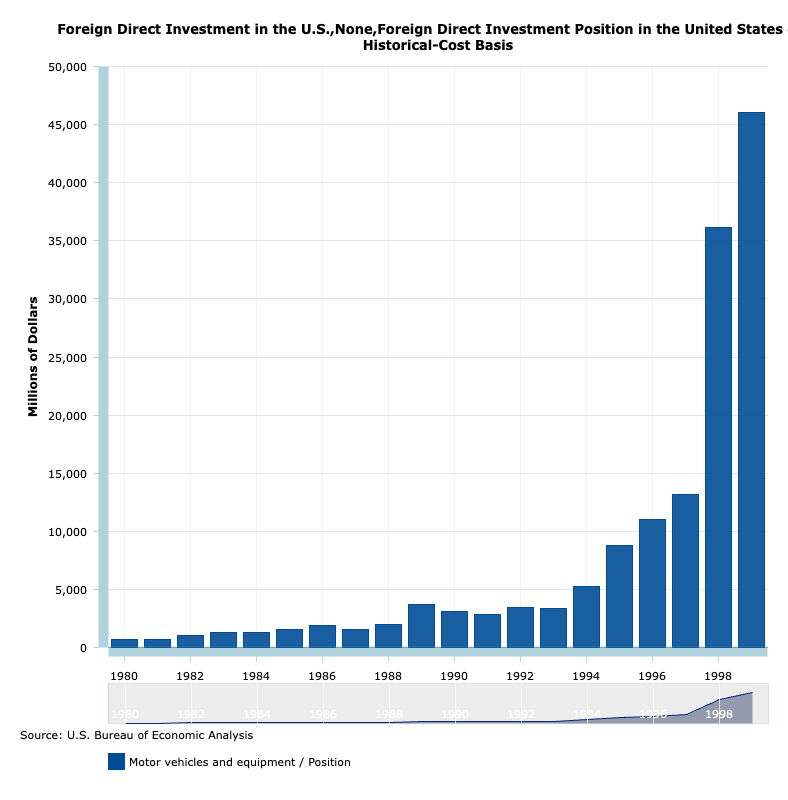

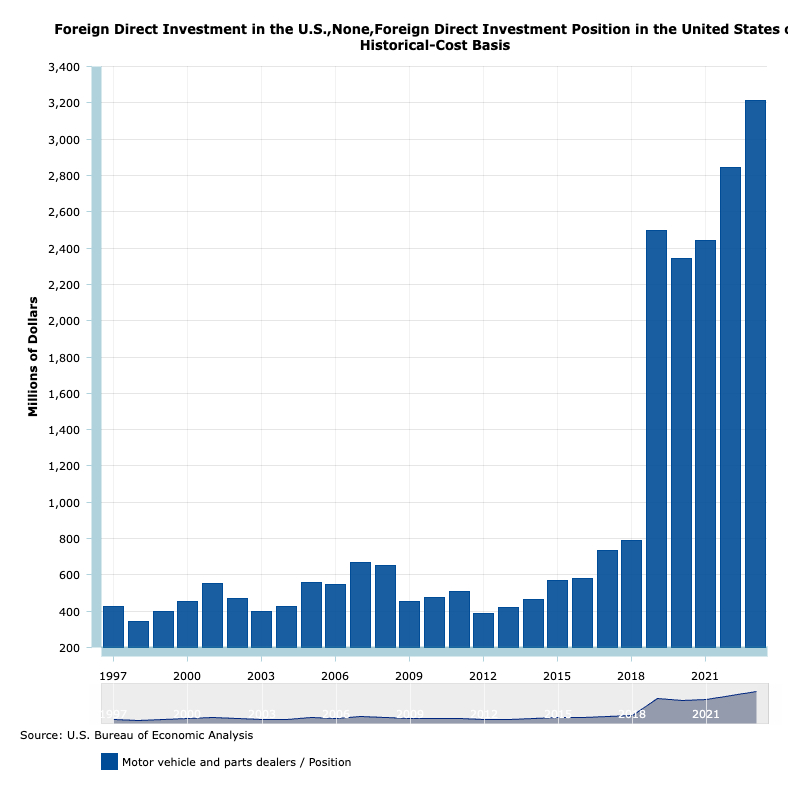

In reality, if we have a look at the info, we see about $652 million of international direct funding in 1981 versus $5.3 billion in 1994 when the VER ended. In different phrases, a 700 p.c improve in international funding. That appears like loads till we see that from the rise from 1994-1999: a 770 p.c improve in simply 5 years as in comparison with the fourteen years of the VER, rising international funding within the US auto sector from $5.3 billion to a staggering $46.1 billion.

If something, what this means is that it was commerce liberalization, not protectionism, that spurred international funding. However what about more moderen instances?

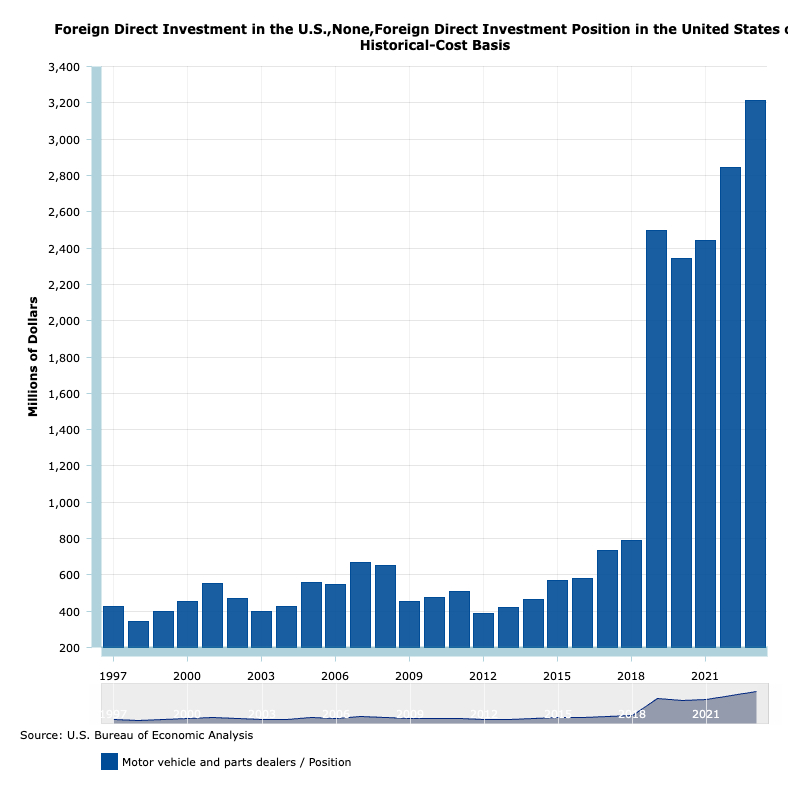

There was certainly a marked improve in international direct funding in 2019; in truth, it greater than tripled and remained considerably elevated by 2024. There’s a sure argument to be made that not less than the preliminary improve in international direct funding in 2019 was brought on by Trump’s tariffs.

However did all of this extra funding assist American employees? Hardly. Automotive employment, which had been rising steadily since collapsing in the course of the Nice Recession, instantly started to reverse starting in 2019 as 1000’s of jobs have been shed month-to-month. Right this moment, regardless of a rebound because the pandemic’s abatement, employment within the motor autos and elements sectors continues to be decrease than it was in January, 2019. Latest stories popping out of the Philadelphia and New York Federal Reserve Branches each proof declining manufacturing output in addition to falling basic exercise, new orders, and cargo. Michigan’s unemployment price elevated greater than some other state’s this previous month, pushed partly by declining employment in manufacturing. Volvo not too long ago introduced their want to put off lots of of employees in Pennsylvania and Maryland as a result of “orders are down amid market uncertainty.” Basic Motors will probably be shedding 700 employees within the US and Canada and US metal firm, Cleveland-Cliffs has already laid off 1,200 employees in an try and mitigate the consequences of the Trump administration’s tariffs on metal and auto imports.

Simply what this elevated international funding was used for is difficult to say, however one factor is obvious: in contrast to in the course of the 80s, when international traders noticed alternative within the US and invested accordingly, it didn’t assist the American employee.

Funding Follows Open Commerce

Like virtually all of Cass’s insights into historical past and economics, he finds a kernel of fact and builds an elaborate monstrosity of an argument on high of it counting on revisionist historical past and fallacious put up hoc reasoning. The easy fact is that the VER that Japan negotiated didn’t result in elevated international funding in america past what was introduced years previous to the VER even being thought of. In reality, international funding in america elevated dramatically when VER was rescinded, not whereas it was in impact.

Commerce liberalization confers upon the dual advantages of decrease costs for shoppers and decrease prices for producers. The decrease costs imply shoppers can higher afford their purchases, bettering their very own financial livelihoods. The decrease prices for producers (which get handed on to shoppers) imply cheaper manufacturing within the US relative to different nations. These decrease prices appeal to international funding, spurring home job progress and rising wages.

Ronald Reagan’s dedication to free commerce is actually difficult by the VER with Japan. Whereas protectionists like Oren Cass argue that the VER spurred manufacturing job progress and elevated international funding, the proof paints a special image. Quick-term features from the VER have been eroded by long-term inefficiencies within the US auto trade as lowered competitors stifled innovation. The Massive Three automakers didn’t adapt to shifting shopper calls for for fuel-efficient, dependable automobiles, which resulted in large layoffs and plant closures within the Nineties.

To the extent that international funding within the US occurred in the course of the VER, it was in truth pushed by broader financial elements like value differentials and alternate charges, not protectionism. Reagan’s dedication to free commerce is undamaged. Likewise, the VER’s legacy underscores a vital lesson: protectionist measures can ship short-term features on the expense of long-term prosperity. Precise financial energy lies in open markets, competitors and innovation — values that Reagan championed, even with the VER.