Printed on July fifteenth, 2025 by Aristofanis Papadatos

InPlay Oil (IPOOF) has two interesting funding traits:

#1: It’s providing an above-average dividend yield of 11.1%, which is greater than 9 instances the typical dividend yield of the S&P 500.

#2: It pays dividends month-to-month as an alternative of quarterly.

Associated: Record of month-to-month dividend shares

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yields and payout ratios) by clicking on the hyperlink under:

The mix of an above-average dividend yield and a month-to-month dividend makes InPlay Oil a gorgeous choice for particular person buyers.

However there’s extra to the corporate than simply these components. Hold studying this text to be taught extra about InPlay Oil.

Enterprise Overview

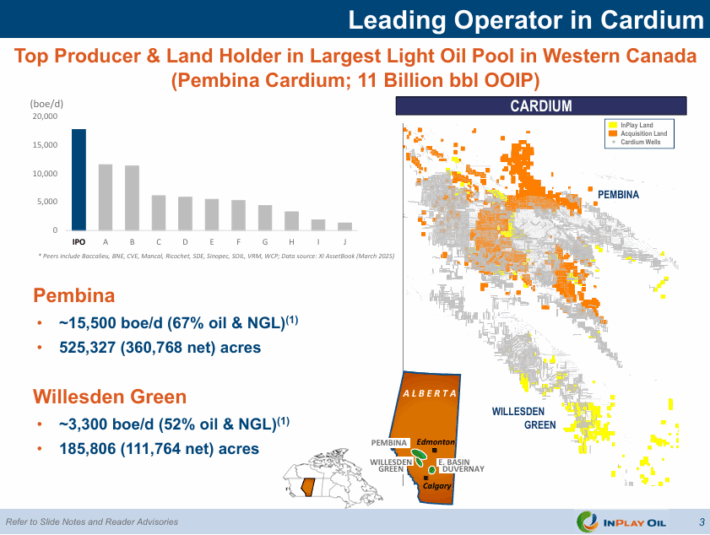

InPlay Oil is an oil and gasoline exploration and manufacturing firm centered on creating gentle oil and pure gasoline property in Alberta, primarily concentrating on the Cardium and Stomach River formations.

The corporate combines horizontal drilling, enhanced oil restoration, and infrastructure optimization to maximise effectivity and returns.

In 2024, InPlay Oil posted common manufacturing of 8,712 barrels of oil equal per day, with 58% of the output attributed to crude oil and pure gasoline liquids (NGLs). The corporate is the biggest Cardium oil producer and is headquartered in Calgary, Canada.

As an oil and gasoline producer, InPlay Oil is extraordinarily delicate to the boom-and-bust cycles of the oil and gasoline business. It has incurred losses in 5 of the final 10 years and has exhibited a markedly unstable efficiency report.

In 2015, it incurred extreme losses as a result of a steep lower within the costs of oil and gasoline. The corporate initiated a dividend solely in late 2022.

Then again, InPlay Oil has some benefits in comparison with well-known oil producers. Most oil and gasoline producers have been struggling to replenish their reserves as a result of pure decline of their producing wells.

Supply: Investor Presentation

InPlay Oil is the best oil and gasoline producer in Cardium, which is the biggest pool of sunshine oil in Western Canada. The big scale on this extremely prolific space creates economies of scale and bodes effectively for future manufacturing progress.

Within the first quarter of this 12 months, InPlay Oil posted an 8% lower in its manufacturing over the prior 12 months’s quarter. Given additionally the impact of a major lower within the common realized worth of oil, the adjusted funds stream per share of the corporate declined 31%, from $0.13 to $0.09.

In April, InPlay Oil accomplished the acquisition of Pembina Cardium, which is predicted to create greater than $15 million in annual synergies and enhance the annual free funds stream per share by 40%. Due to this extremely accretive acquisition, we count on InPlay Oil to develop its funds stream per share from $0.34 in 2024 to $0.75 this 12 months.

In reference to the worldwide enterprise panorama for oil and gasoline producers, OPEC offered robust help to the worth of oil by way of deep manufacturing cuts since 2021 however this technique approached its limits final 12 months.

The U.S., Canada and Brazil, which don’t belong to the cartel, have been rising their manufacturing and thus they’ve been gaining market share from OPEC.

This led many OPEC members, which depend on oil gross sales to fund their authorities budgets, to turn into dissatisfied with their lowered manufacturing quotas.

Angola exited OPEC firstly of final 12 months. In consequence, in April, OPEC started to unwind its manufacturing cuts, with a aim to lift its output by 2.2 million barrels per day till the tip of 2026. As this strategic shift of OPEC is prone to lead to a world surplus of oil, the worth of oil has declined this 12 months.

However, it has remained above common and thus InPlay Oil is prone to stay extremely worthwhile this 12 months, assisted additionally by the aforementioned acquisition.

Development Prospects

InPlay Oil has posted one of many highest reserve progress charges in its peer group over the past decade.

Supply: Investor Presentation

Due to a powerful report of worthwhile acquisitions, InPlay Oil has grown its manufacturing per share by 255% over the past decade and it has greater than doubled its proved plus possible reserves over the identical interval.

Administration has offered steering for 15% progress of manufacturing per share and 16% progress of reserves per share in 2025. Given additionally the confirmed skill of the corporate to amass worthwhile property and reap nice synergies from them, we count on 5% progress of funds stream per share over the following 5 years.

Then again, as an oil and gasoline producer, InPlay Oil is susceptible to the wild swings of the costs of oil and gasoline. The corporate posted report earnings per share in 2021 and 2022 due to the restoration of world oil consumption from the pandemic and the onset of the struggle in Ukraine, which led the costs of oil and gasoline to surge to a 13-year excessive in 2022.

Nonetheless, now that the worldwide oil market has absorbed the impression of the Ukrainian disaster and OPEC has begun to unwind its manufacturing cuts, the worth of oil has moderated.

In consequence, the funds stream per share of InPlay Oil have decreased from an all-time excessive of $3.00 in 2021 and $2.61 in 2022 to $0.34 in 2024. We count on funds stream per share of roughly $0.75 this 12 months.

InPlay Oil has an honest steadiness sheet. Its curiosity expense consumes 37% of its working revenue whereas its internet debt is $152 million, which is 77% of the market capitalization of the inventory. Beneath regular enterprise circumstances, the corporate will not be prone to have any downside servicing its debt.

Then again, within the occasion of a extreme and extended downturn, InPlay Oil might face some monetary stress as a result of its considerably leveraged steadiness sheet, which has resulted from the acquisitions of the corporate.

Dividend & Valuation Evaluation

InPlay Oil is at the moment providing an above-average dividend yield of 11.1%, which is greater than 9 instances the 1.2% yield of the S&P 500. The inventory is an fascinating candidate for revenue buyers, however they need to remember that the dividend is much from protected as a result of dramatic cycles of the costs of oil and gasoline.

InPlay Oil has a excessive payout ratio of 105%, which is unsustainable over the long term. However, due to its promising progress prospects, the corporate will not be prone to reduce its dividend sharply below the prevailing oil and gasoline costs.

In reference to the valuation, InPlay Oil is at the moment buying and selling for 9.5 instances its anticipated funds stream per share this 12 months. Given the excessive cyclicality of the corporate, we assume a good price-to-funds stream ratio of 9.0, which is a typical mid-cycle valuation stage for oil producers.

Subsequently, the present funds stream a number of is increased than our assumed honest price-to-funds stream ratio. If the inventory trades at its honest valuation stage in 5 years, it would incur a 1.0% annualized drag in its returns.

Making an allowance for the 5.0% annual progress of funds stream per share, the 11.1% present dividend yield but additionally a 1.0% annualized headwind of valuation stage, InPlay Oil may supply a 12.1% common annual whole return over the following 5 years.

The anticipated return alerts that the inventory is an efficient long-term funding, though now we have handed the height of the cycle of the oil and gasoline business.

Remaining Ideas

InPlay Oil has been thriving since 2021 due to a really perfect surroundings of above-average oil costs. The inventory is providing an above-average dividend yield of 11.1%, albeit with a excessive payout ratio of 105%. Given its promising progress prospects and its affordable valuation, the inventory seems enticing.

Then again, the corporate has confirmed extremely susceptible to the cycles of the costs of oil and gasoline. In consequence, it’s appropriate just for affected person buyers, who can endure excessive inventory worth volatility.

Furthermore, InPlay Oil is characterised by low buying and selling quantity. Which means that it’s laborious to ascertain or promote a big place on this inventory.

Further Studying

Don’t miss the sources under for extra month-to-month dividend inventory investing analysis.

And see the sources under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.