The regained some floor on Thursday as Treasury yields rose after a chaotic session pushed by hypothesis about Fed Chair Powell’s future.

The Greenback strengthened in opposition to all main currencies, persevering with its rally this month. The dropped to 148.51 per Greenback, with some consultants predicting it may fall beneath 150. dipped 0.2% after U.S. shares rallied when Trump downplayed firing Powell. Treasury yields rose, with up two foundation factors to 4.47%. Asian shares traded in a decent vary.

The fell sharply, and authorities bonds dropped, as expectations grew for an by the central financial institution in August.

On tariffs, Trump softened his stance with China, aiming to rearrange a summit with President Xi Jinping and safe a commerce deal. He additionally introduced plans to ship letters to over 150 international locations about new tariffs, anticipated to vary from 10% to fifteen%.

Chinese language shares rose on Thursday, supported by authorities backing for the auto business and renewed curiosity in AI-related shares. Citi additionally upgraded China equities, pointing to higher earnings tendencies and long-term development alternatives.

The gained 0.4% to shut at 3,516.83, whereas the blue-chip Index rose 0.7%.

AI-related shares climbed 1.8%, and the data tech sector jumped 2.1%, boosted by information that Nvidia (NASDAQ:) will improve its provide of H20 chips to China. Auto shares had been up 1.7% after authorities promised to deal with extreme competitors and value wars within the EV market.

In Hong Kong, the stayed flat however remained close to a four-month excessive.

Biotech and healthcare shares surged over 5% every, as optimism grew a couple of potential commerce deal after U.S. President Trump softened his tone on China.

Citi upgraded China equities to “obese,” citing higher earnings prospects, truthful valuations, and development themes like AI and company reforms.

TSMC Posts 60% Soar in Second-Quarter Revenue

Taiwan Semiconductor Manufacturing (NYSE:), the main maker of superior AI chips, reported record-breaking quarterly earnings on Thursday, beating forecasts. The corporate highlighted rising demand for AI and raised its full-year income outlook, anticipating robust gross sales within the third quarter.

TSMC additionally famous that Nvidia, a key consumer, has been allowed by the U.S. to renew promoting its H20 AI chips to China, which is a significant market. CEO C.C. Wei referred to as this a optimistic growth for each Nvidia and TSMC.

Nonetheless, TSMC warned that U.S. tariffs may influence its earnings, presumably beginning within the fourth quarter.

UK Wage Progress Slows

Within the UK, common pay (excluding bonuses) elevated by 5% year-on-year to £677 per week within the three months to Might 2025. That is the slowest development in practically three years, down from a revised 5.3% within the earlier interval however barely above the 4.9% forecast based on ONS knowledge.

Wage development slowed in each the non-public sector (4.9% vs 5.2%) and public sector (5.5% vs 5.6%). Amongst industries, the very best wage development was in wholesale, retail, lodges, and eating places (7.1%), adopted by providers (6%), building (4.9%), manufacturing (4.8%), and finance/enterprise providers (3.1%).

After adjusting for inflation, actual wages grew by 1.1%.

European Open

European shares rose on Thursday after 4 days of losses, helped by robust earnings from Switzerland’s ABB (ST:) and hopes for a U.S.-EU commerce deal.

The gained 0.8% by early morning.

ABB shares jumped 8.2% after reporting document orders, pushed by robust U.S. demand and AI-related merchandise for knowledge facilities. Rivals Siemens (ETR:) and Schneider Electrical (EPA:) additionally rose 3.6% and 5.8%, boosting the European market.

Chipmakers recovered some losses from the day past, with ASML (NASDAQ:) up 1.7% after an 11% drop on Wednesday. This adopted TSMC’s document Q2 revenue.

On commerce, EU commerce chief Maros Sefcovic traveled to Washington for tariff talks with U.S. officers, based on an EU spokesperson.

On the FX Entrance, the greenback strengthened on Thursday, gaining 0.44% in opposition to the , virtually recovering from a spike late Wednesday.

The dipped 0.2% to 1.3395, whereas the Australian greenback dropped 1% to a three-week low of 0.646 after disappointing jobs knowledge and rising unemployment.

New Zealand’s additionally fell, shedding 0.54% to 0.5914.

Foreign money Energy Steadiness

Supply: OANDA Labs

struggled in a single day and that has continued following the European Open. The valuable metallic buying and selling across the 3327 deal with on the time of writing. Yesterday’s transient rally following the Powell/Trump fiasco proved to be short-lived.

proceed to carry and commerce in a decent vary regardless of President Trump’s assertion yesterday that he wish to see Oil costs round $64 a barrel. Oil costs have remained muted since Monday’s selloff with the final two days seeing uneven value motion.

Financial Knowledge Releases and Last Ideas

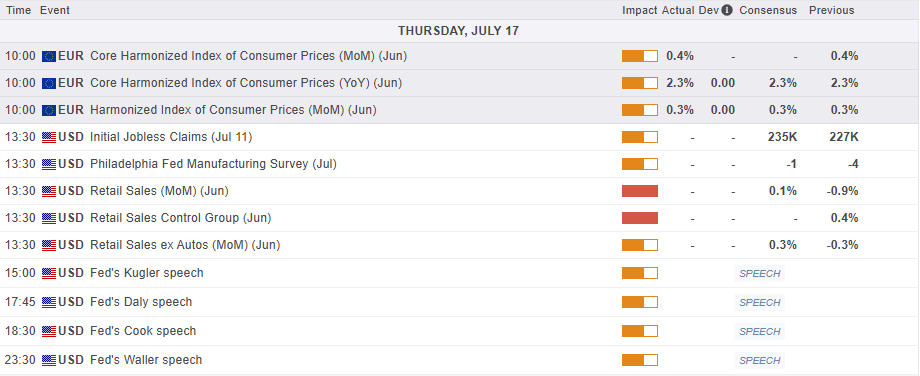

Trying on the financial calendar, there’s some medium and high-impact knowledge from the US later within the day.

US and knowledge shall be launched together with some earnings releases. We even have a couple of extra Federal Reserve policymakers talking forward of the Feds blackout interval.

MarketPulse Financial Calendar

Chart of the Day – DAX Index

From a technical standpoint, the has remained cautious and rangebound since Mondays retest of the important thing 24000 deal with.

The index is supported by each the 20 and 50-day MAs which relaxation across the 24000 deal with as effectively whereas the RSI can also be discovering assist on the impartial 50 deal with.

Commerce deal bulletins between the EU and the US could possibly be the catalyst wanted for the DAX to shake off this uneven value motion and discover some path.

DAX Each day Chart, July 17. 2025

Supply: TradingView.com

Help

Resistance

Unique Put up