Earlier this week I broke down how the report masked underlying financial weak point. This morning we obtained extra affirmation of a slowing financial system. The missed expectations, with solely 73K jobs gained in July, whereas Might and June outcomes had been revised decrease by an astounding 258K.

This pushed the 12 month common (orange line) to its lowest ranges because the pandemic. The entire job positive aspects got here primarily from the well being care sector.

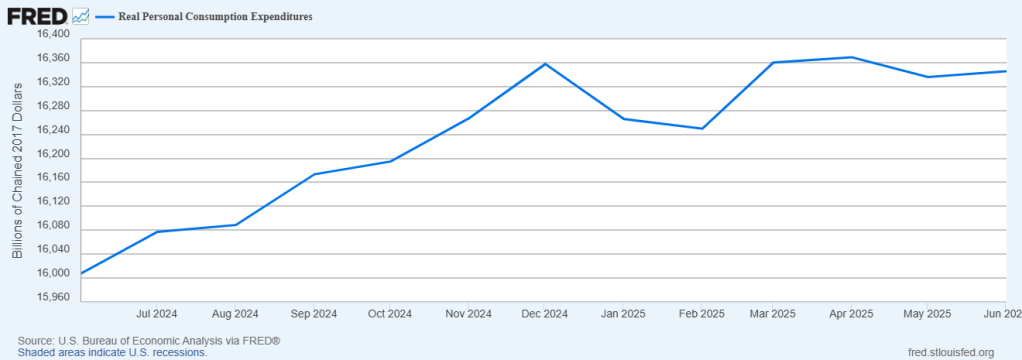

And (about 70% of the US financial system) on a month-to-month foundation is unfavorable for 2025.

And (about 70% of the US financial system) on a month-to-month foundation is unfavorable for 2025.

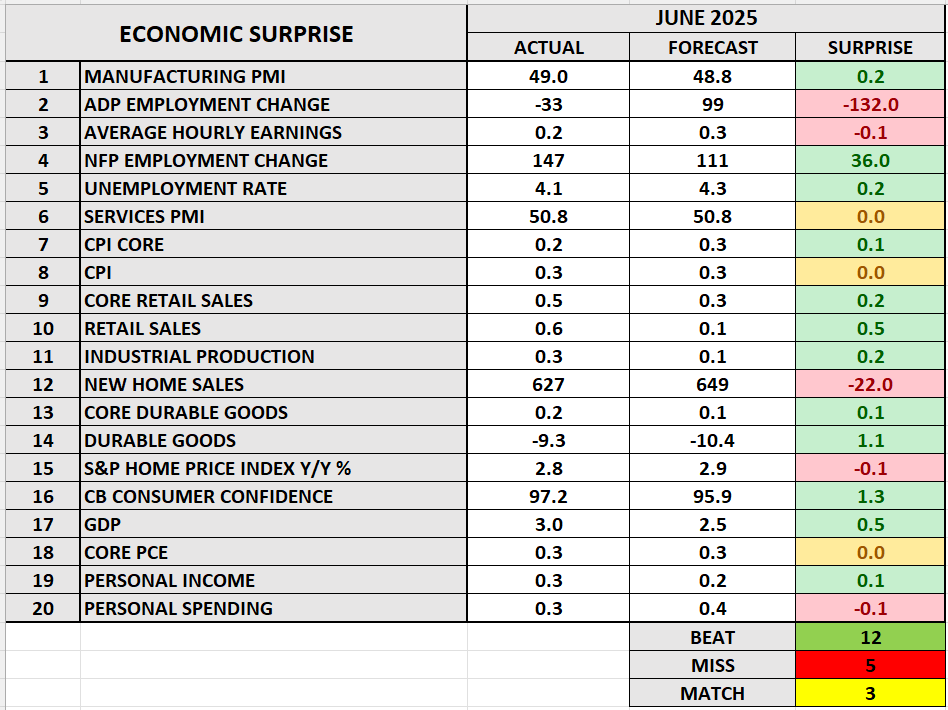

It’s a foul begin for the July financial knowledge to date, however its nonetheless early. June financial knowledge was largely constructive. With 12 of 20 key knowledge factors coming in higher than anticipated. Tied for one of the best month of 2025 to date.

It’s a foul begin for the July financial knowledge to date, however its nonetheless early. June financial knowledge was largely constructive. With 12 of 20 key knowledge factors coming in higher than anticipated. Tied for one of the best month of 2025 to date.

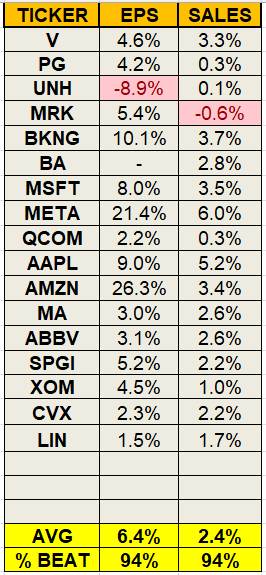

Earnings, nevertheless, have been stellar. 17 mega cap ($200B+ market cap) firms reported Q2 outcomes this week. 15 of 17 beat their earnings expectations (94% beat price), whereas Boeing (NYSE:) got here in higher than anticipated however the outcomes had been nonetheless unfavorable, due to this fact I excluded them. 16 of 17 firms beat their gross sales expectations by a mean of two.4%.

This has pushed up Q2 earnings progress for the S&P 500 from 7.7% to 11.2% this week. And gross sales progress is up from 4.5% to five.6%.

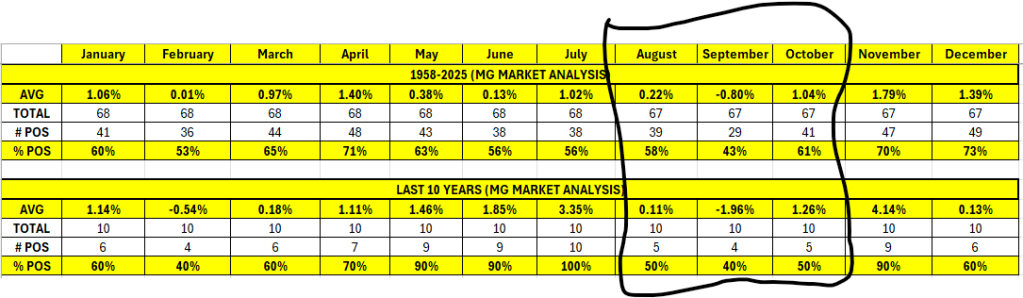

We identified final month how July has been seasonally robust. And it didn’t disappoint, closing constructive for the eleventh straight 12 months. Trying forward, we’re getting into right into a seasonally weak interval. With August – October returning constructive roughly 50% of the time, and with weak common returns. That doesn’t imply we are able to’t get strong returns, however it’s one thing to think about.

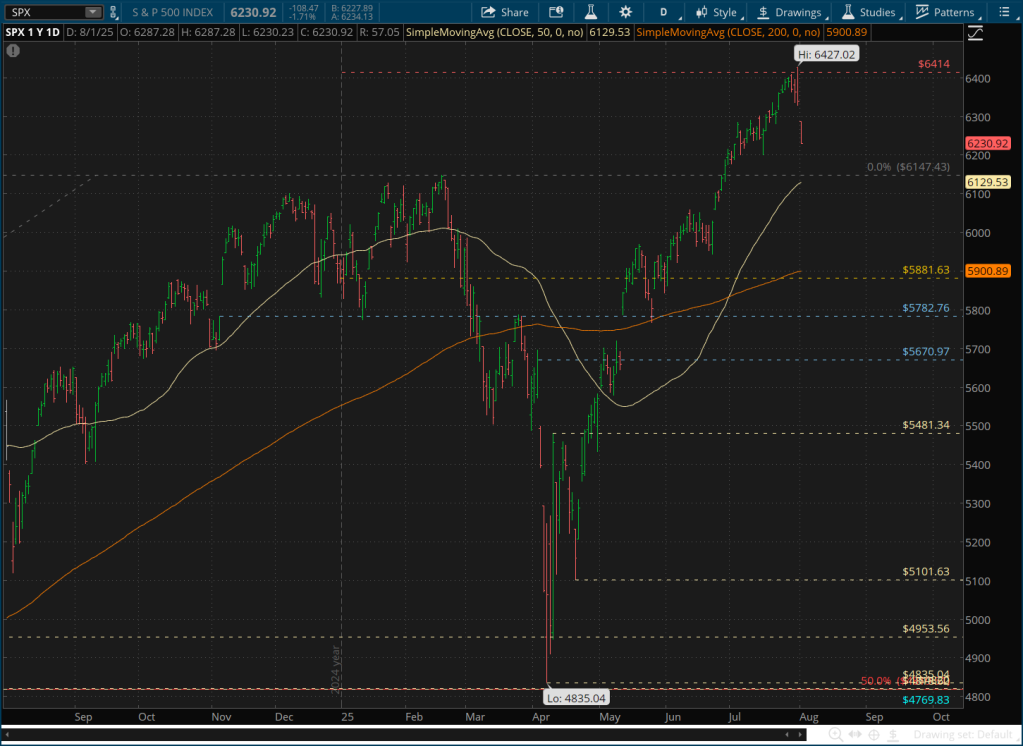

We identified final month how July has been seasonally robust. And it didn’t disappoint, closing constructive for the eleventh straight 12 months. Trying forward, we’re getting into right into a seasonally weak interval. With August – October returning constructive roughly 50% of the time, and with weak common returns. That doesn’t imply we are able to’t get strong returns, however it’s one thing to think about. Particularly towards the backdrop of the technicals. The common annual value return for the is 9.1%. And we hit that stage on yesterday’s hole up (pink dotted line at 6414) and has to date hit a unfavorable response.

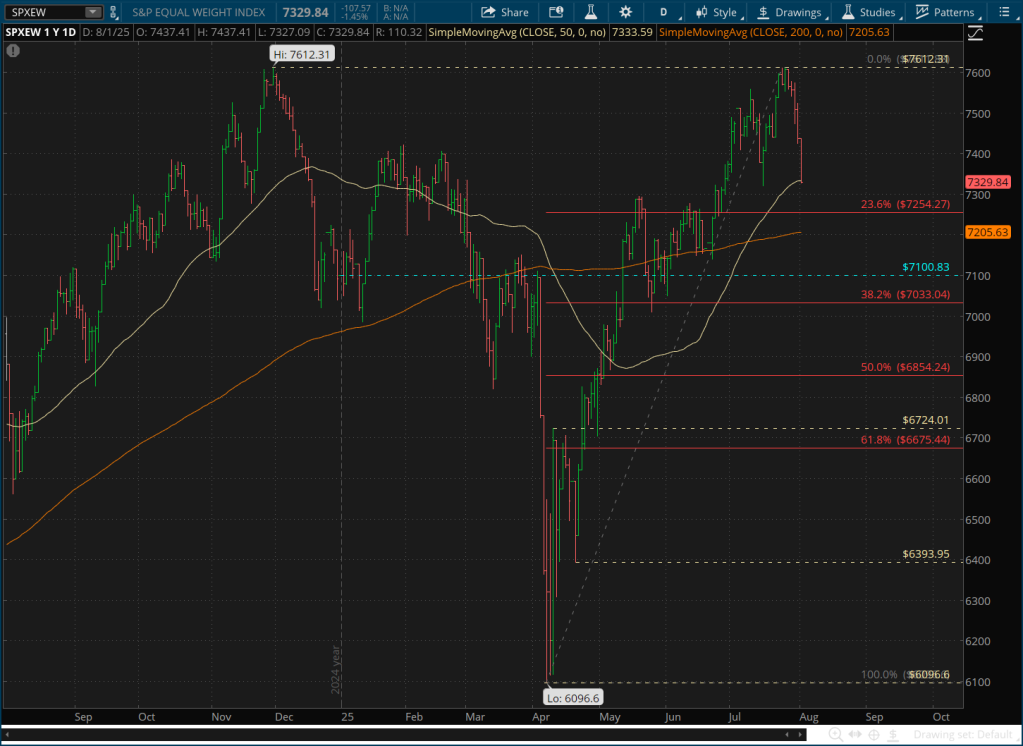

Particularly towards the backdrop of the technicals. The common annual value return for the is 9.1%. And we hit that stage on yesterday’s hole up (pink dotted line at 6414) and has to date hit a unfavorable response. On the identical time, the equal weighted S&P 500 retested its prior file excessive resistance pivot. This might show to be a troublesome hurdle, if the financial system continues to indicate weak point.

On the identical time, the equal weighted S&P 500 retested its prior file excessive resistance pivot. This might show to be a troublesome hurdle, if the financial system continues to indicate weak point.

The US greenback rallied again as much as the 2024 lows (blue dotted line) however obtained rejected after the announcement of but extra tariffs and the weak financial knowledge this morning.

The US greenback rallied again as much as the 2024 lows (blue dotted line) however obtained rejected after the announcement of but extra tariffs and the weak financial knowledge this morning.

Whereas the ten 12 months price stays rangebound and set to retest the decrease finish of the vary.

Whereas the ten 12 months price stays rangebound and set to retest the decrease finish of the vary.

Backside line is AI has been carrying the market this 12 months. Earnings progress has been surprisingly robust. Analysts had anticipated about 5% EPS progress in Q2 when earnings season started, and now with about 66% of firms reported outcomes to date, that progress price has shot as much as 11.2%.

However there’s a restrict to how a lot the market can proceed to look previous and ignore. Particularly at 22x to 25x PE’s and a unfavorable fairness threat premium. The financial slowdown is actual, however that doesn’t imply it is going to flip right into a recession.

Search for market weak point within the subsequent few months that would maybe create a great setup into years finish. The common annual return for all years mixed (since 1958) is 9.1%, however the common return for up years is 17%.

Some issues to consider.