July 2025 was an thrilling month for Burning Grid, delivering robust outcomes throughout all three danger ranges, main technical updates, and a major milestone with Darwinex Zero.

This report summarizes efficiency, technique conduct, technical developments, and a particular spotlight of the month.

1️⃣ Technique Efficiency

Burning Grid at present runs in three danger profiles:

Low Danger – Stability & conservative progress

Medium Danger – Balanced risk-to-reward profile

Excessive Danger – Most efficiency below managed danger

All accounts had been traded actively in July and present the anticipated variations in drawdown and progress.

Nonetheless, one notable occasion was the lack of a CHFJPY technique on July 15, which resulted in a short lived fairness drop. 💡 Remarkably, the losses had been absolutely recovered in lower than 48 hours, demonstrating the resilience and restoration logic of Burning Grid.

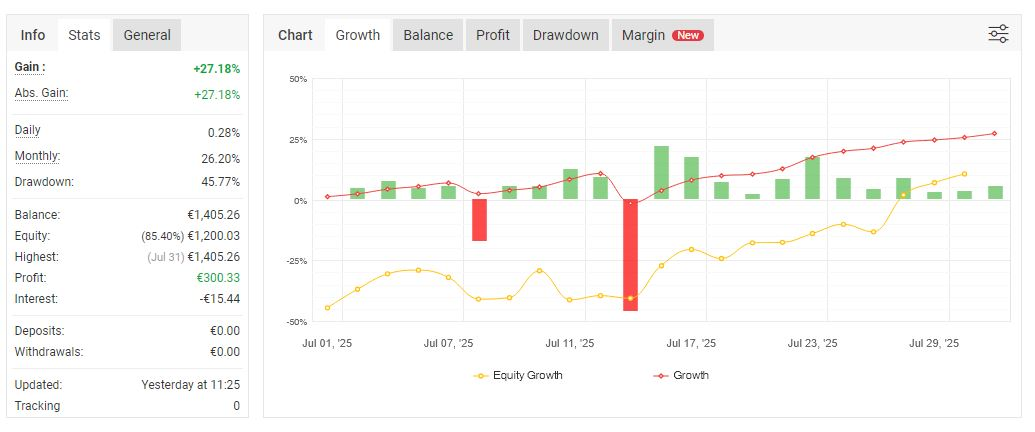

🔹 Excessive Danger – Aggressive Development with Self-discipline

The Excessive-Danger account stays the efficiency flagship, though it naturally carries the very best volatility.Fairness charts present drawdowns throughout energetic grid clusters, however these are contained by rule-based exits.

Regardless of heavier capital publicity, the technique ended the month with over +30 % progress — a testomony to logic-driven loss management.

🔸 Medium Danger – The Strategic Stability

Medium Danger as soon as once more proves to be one of the best steadiness of efficiency and stability.Whereas short-term drawdowns occurred, the restoration logic ensured easy recoveries and constant progress.

With its excessive win fee and reasonable capital stress, this profile is the beneficial customary selection for many merchants.

🔹 Low Danger – Regular, Conservative Development

The conservative variant continues to ship excessive stability and low fluctuations.With 95 % profitable trades and minimal drawdowns, Low Danger is right for merchants preferring long-term, low-stress grid buying and selling.

📊 Technique Comparability (July 2025)

2️⃣ ⭐ Particular Spotlight: Darwinex Zero – First Allocation Achieved

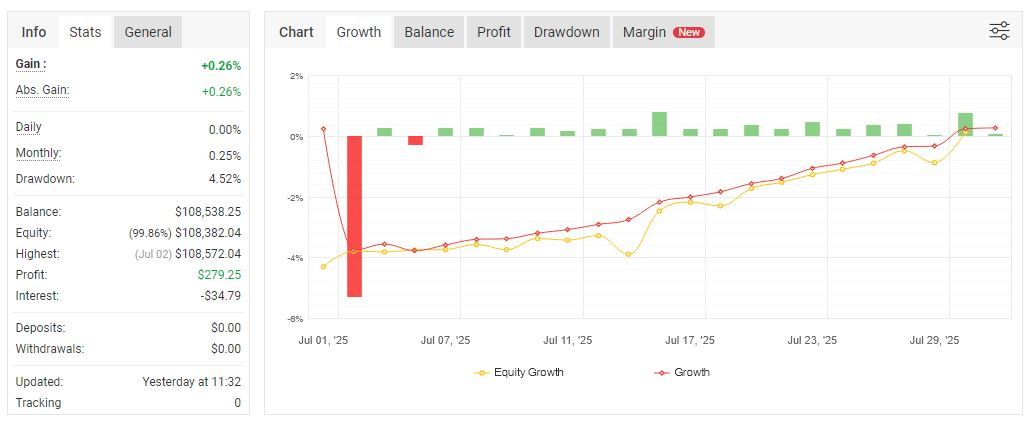

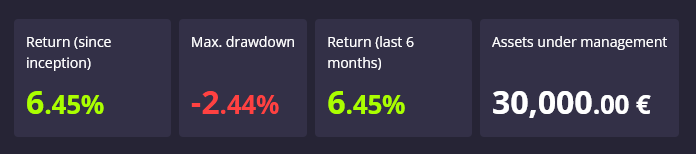

A key milestone in July: Burning Grid, mixed with Burning London and a preview model of Burning Aurum, achieved its first capital allocation by way of Darwinex Zero.

📅 Timeline

July 2, 2025:All open positions had been deliberately closed to start out with a clear slate for the Darwinex account.⚠ This resulted in a realized lack of almost 4 %.

Instantly after:The account was relaunched with a Darwinex-optimized setup that includes the Excessive-Danger Stage setup plus blocking operating symbols.

Regardless of the preliminary -4 % realized loss, the account immediately certified for the primary allocation, highlighting the robustness of the mixed system.

💡 Takeaway:Reaching the allocation regardless of a realized 4 % loss demonstrates that Burning Grid and its companion methods can meet strict, capital-market-like necessities whereas sustaining investor-friendly drawdowns.

Sadly Darwinex Zero is utilizing demo accounts, so its not attainable to run a sign on Metatrader.

3️⃣ 🔧 Technical Updates – July 2025

Burning Grid obtained three main updates in July, enhancing usability {and professional} deployment:

1️⃣ Image & Forex Blocker

Non-obligatory blocker at image or forex degree

Prevents a number of methods from buying and selling the identical image or correlated currencies concurrently

Use case: Enabled for Darwinex Zero to keep away from overlapping danger

2️⃣ Prop Agency & Small Account Modes

New selectable modes within the EA interface

Optimized for prop-firm accounts and small-cap buying and selling

Simplified setup — no guide setfile changes required

3️⃣ Auto-Mode for Small Accounts

Absolutely automates small account administration

Mechanically switches to Common Mode as soon as account fairness exceeds $10,000

Fully removes the necessity for separate small-account setfiles

💡 Benefit: These updates make Burning Grid extra versatile, safer, and future-proof, particularly for prop agency evaluations and account scaling.

4️⃣ 🙌 Neighborhood & Outlook

Burning Grid’s evolution is pushed by its neighborhood.Key options just like the Image Blocker and Auto-Mode had been applied immediately from consumer suggestions.

💬 Be part of the dialogue and affect future growth right here:Neighborhood Thread

The principle focus for August 2025 can be on the finalization of Burning Aurum – our first devoted gold buying and selling bot.

Burning Aurum is designed to enrich the prevailing Burning Grid and Burning London methods by focusing completely on XAUUSD (Gold), leveraging:

Exact volatility-based entry logic

Adaptive grid management tailor-made to gold’s distinctive conduct

Built-in danger & information administration for high-impact financial occasions

💡 Our purpose is to make Burning Aurum a shining centerpiece in our lineup, delivering strong efficiency on one of many world’s most dynamic buying and selling devices.

If growth and last testing proceed as deliberate, we anticipate to current this golden gem to our neighborhood by the top of August.

📌 Conclusion

July 2025 proves that Burning Grid is worthwhile, strong, and prepared for skilled use.

Three danger profiles – one thing for each dealer

Technical enhancements for prop agency & small account deployment

Profitable Darwinex Zero allocation regardless of a start-loss

For real-world buying and selling, we advocate beginning capital of not less than €10,000 per setup to totally make the most of the EA’s built-in security and scaling potential.

Small Accounts can begin with beginning capital of $500. Take care to decide on both Auto Mode or Small Account Mode + right Setup Information!

🔗 Assets & References

🛒 Burning Grid on MQL5 Market – https://www.mql5.com/en/market/product/135273 📖 Learn the Full Weblog Article – https://www.mql5.com/en/blogs/publish/762740 💬 Be part of the Neighborhood & Assist Group – https://www.mql5.com/en/messages/0151274c579fdb01

🛒 Burning London on MQL5 Market – https://www.mql5.com/en/market/product/138938