Revealed on July twenty eighth, 2025 by Bob Ciura

One of the best retirement shares have a mixture of a excessive dividend yield, and a safe payout that may face up to market downturns.

Excessive dividend shares are naturally interesting for earnings traders similar to retirees. Excessive-yield shares pay out dividends which are considerably larger than the market common.

For instance, the S&P 500’s common dividend yield is just ~1.2% proper now.

Because of this, high-yield shares might be very useful to shore up earnings after retirement.

With this in thoughts, we now have created a spreadsheet of over 200 shares (and intently associated REITs and MLPs, and so on.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with vital monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under:

In fact, traders at all times must do their analysis, to verify the underlying inventory can maintain its dividend payout.

To do that, we screened for shares within the Positive Evaluation Analysis Database with present yields above 5%, which have not less than 10 consecutive years of dividend development.

This text will present an inventory of the most effective retirement shares with excessive yields and safe dividend payouts. The shares are listed by dividend yield, in ascending order.

Desk Of Contents

The desk of contents under supplies for straightforward navigation of the article:

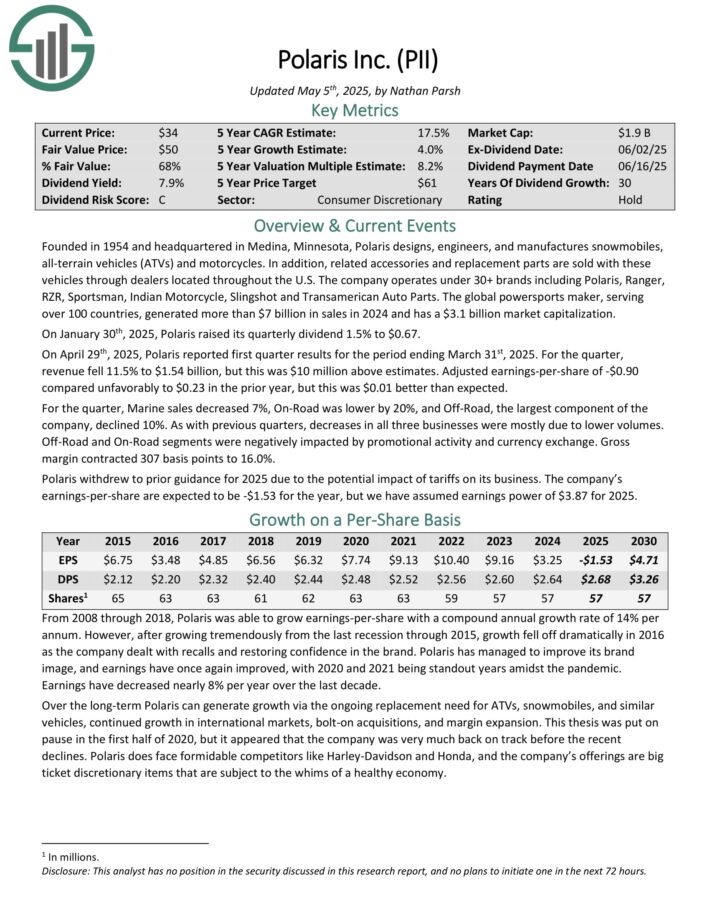

Greatest Retirement Inventory #10: Polaris Inc. (PII)

Polaris designs, engineers, and manufactures snowmobiles, all-terrain automobiles (ATVs) and bikes. As well as, associated equipment and alternative elements are offered with these automobiles by sellers positioned all through the U.S.

The corporate operates underneath 30+ manufacturers together with Polaris, Ranger, RZR, Sportsman, Indian Bike, Slingshot and Transamerican Auto Elements. The worldwide powersports maker, serving over 100 nations, generated greater than $7 billion in gross sales in 2024.

On April twenty ninth, 2025, Polaris reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income fell 11.5% to $1.54 billion, however this was $10 million above estimates.

Adjusted earnings-per-share of -$0.90 in contrast unfavorably to $0.23 within the prior yr, however this was $0.01 higher than anticipated.

For the quarter, Marine gross sales decreased 7%, On-Highway was decrease by 20%, and Off-Highway, the most important part of the corporate, declined 10%. As with earlier quarters, decreases in all three companies had been largely because of decrease volumes.

Click on right here to obtain our most up-to-date Positive Evaluation report on PII (preview of web page 1 of three proven under):

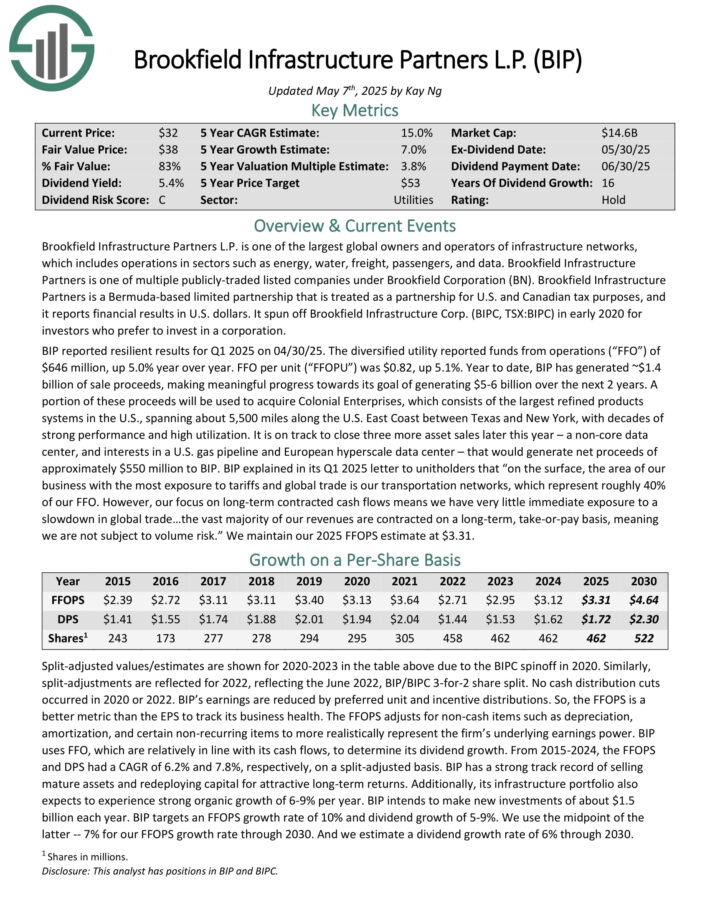

Greatest Retirement Inventory #9: Brookfield Infrastructure Companions LP (BIP)

Brookfield Infrastructure Companions L.P. is without doubt one of the largest international homeowners and operators of infrastructure networks, which incorporates operations in sectors similar to power, water, freight, passengers, and knowledge.

Brookfield Infrastructure Companions is certainly one of 4 publicly-traded listed partnerships that’s operated by Brookfield Asset Administration (BAM).

BIP has delivered 8% compound annual distribution development over the previous 10 years.

Supply: Investor Presentation

BIP reported resilient outcomes for Q1 2025 on 04/30/25. The diversified utility reported funds from operations of $646 million, up 5.0% yr over yr. FFO per unit (“FFOPU”) was $0.82, up 5.1%.

Yr up to now, BIP has generated ~$1.4 billion of sale proceeds, making significant progress in the direction of its aim of producing $5-6 billion over the following 2 years.

A portion of those proceeds might be used to accumulate Colonial Enterprises, which consists of the most important refined merchandise programs within the U.S., spanning about 5,500 miles alongside the U.S. East Coast between Texas and New York.

Click on right here to obtain our most up-to-date Positive Evaluation report on Brookfield Infrastructure Companions (preview of web page 1 of three proven under):

Greatest Retirement Inventory #8: Canandaigua Nationwide Company (CNND)

Canandaigua Nationwide Company (CNC) is the dad or mum firm of The Canandaigua Nationwide Financial institution & Belief Firm (CNB) and Canandaigua Nationwide Belief Firm of Florida (CNTF).

It gives a variety of monetary providers, together with banking, lending, mortgage providers, belief, funding administration, and insurance coverage.

With 23 branches throughout its service areas, CNC is deal with serving native communities by offering customized monetary options to people, companies, and municipalities.

CNC emphasizes neighborhood banking, specializing in reinvesting within the native economic system by a various lending portfolio. As of December thirty first, 2024, CNC reported whole deposits of $4.0 billion.

In early March, Canandaigua Nationwide launched its full-year outcomes for the interval ending December thirty first, 2024. For the yr, whole curiosity earnings grew 13% to $248 million.

Whole curiosity bills grew 29% to $111 million. Internet curiosity earnings grew by 3% to $137 million. Whole different earnings (service expenses on deposit accounts and belief and funding providers) elevated 6% to $54 million.

Whole different bills (Inc. salaries, occupancy, and advertising) grew 6% to $125 million. Internet earnings was $45 million, comparatively flat year-over-year. EPS was $24.15.

Click on right here to obtain our most up-to-date Positive Evaluation report on CNND (preview of web page 1 of three proven under):

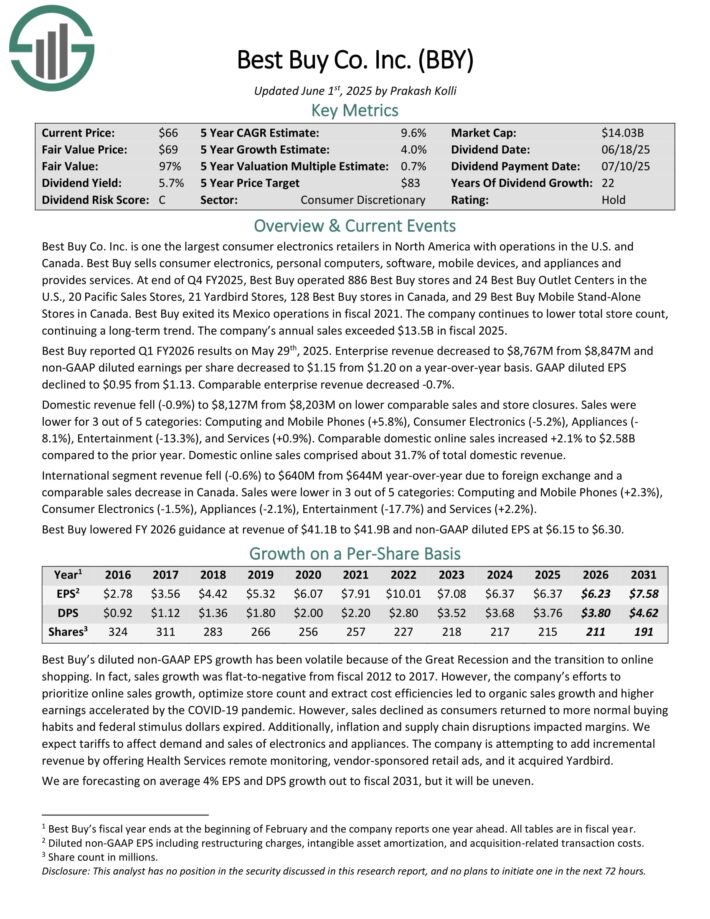

Greatest Retirement Inventory #7: Greatest Purchase Co. (BBY)

Greatest Purchase Co. Inc. is one the most important shopper electronics retailers in North America with operations within the U.S. and Canada. Greatest Purchase sells shopper electronics, private computer systems, software program, cellular gadgets, and home equipment and supplies providers.

At finish of This fall FY2025, Greatest Purchase operated 886 Greatest Purchase shops and 24 Greatest Purchase Outlet Facilities within the U.S., 20 Pacific Gross sales Shops, 21 Yardbird Shops, 128 Greatest Purchase shops in Canada, and 29 Greatest Purchase Cell Stand-Alone Shops in Canada. The corporate’s annual gross sales exceeded $13.5B in fiscal 2025.

Greatest Purchase reported Q1 FY2026 outcomes on Could twenty ninth, 2025. Enterprise income decreased to $8,767M from $8,847M and non-GAAP diluted earnings per share decreased to $1.15 from $1.20 on a year-over-year foundation. GAAP diluted EPS declined to $0.95 from $1.13.

Comparable enterprise income decreased -0.7%. Home income fell -0.9% on decrease comparable gross sales and retailer closures. Gross sales had been decrease for 3 out of 5 classes. Comparable home on-line gross sales elevated 2.1% in comparison with the prior yr. Home on-line gross sales comprised about 31.7% of whole home income.

Click on right here to obtain our most up-to-date Positive Evaluation report on BBY (preview of web page 1 of three proven under):

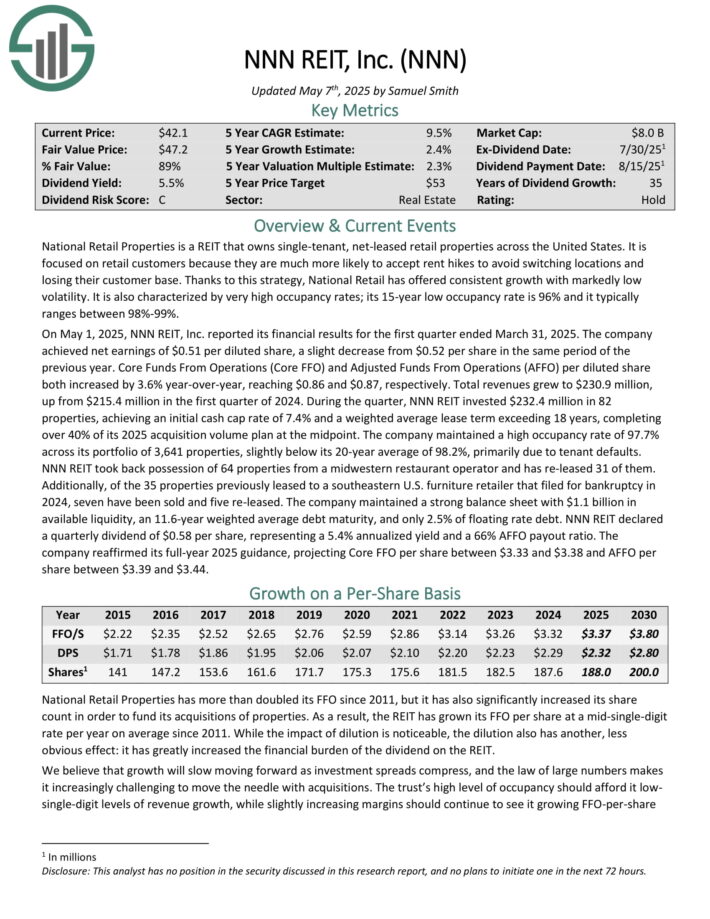

Greatest Retirement Inventory #6: NNN REIT Inc. (NNN)

Nationwide Retail Properties is a REIT that owns single-tenant, net-leased retail properties throughout america. It’s centered on retail prospects as a result of they’re much extra prone to settle for hire hikes to keep away from switching places and dropping their buyer base.

On Could 1, 2025, NNN REIT, Inc. reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved internet earnings of $0.51 per diluted share, a slight lower from $0.52 per share in the identical interval of the earlier yr.

Core Funds From Operations (Core FFO) and Adjusted Funds From Operations (AFFO) per diluted share each elevated by 3.6% year-over-year, reaching $0.86 and $0.87, respectively. Whole revenues grew to $230.9 million, up from $215.4 million within the first quarter of 2024.

In the course of the quarter, NNN REIT invested $232.4 million in 82 properties, attaining an preliminary money cap price of seven.4% and a weighted common lease time period exceeding 18 years, finishing over 40% of its 2025 acquisition quantity plan on the midpoint.

The corporate maintained a excessive occupancy price of 97.7% throughout its portfolio of three,641 properties, barely under its 20-year common of 98.2%, primarily because of tenant defaults.

Click on right here to obtain our most up-to-date Positive Evaluation report on NNN (preview of web page 1 of three proven under):

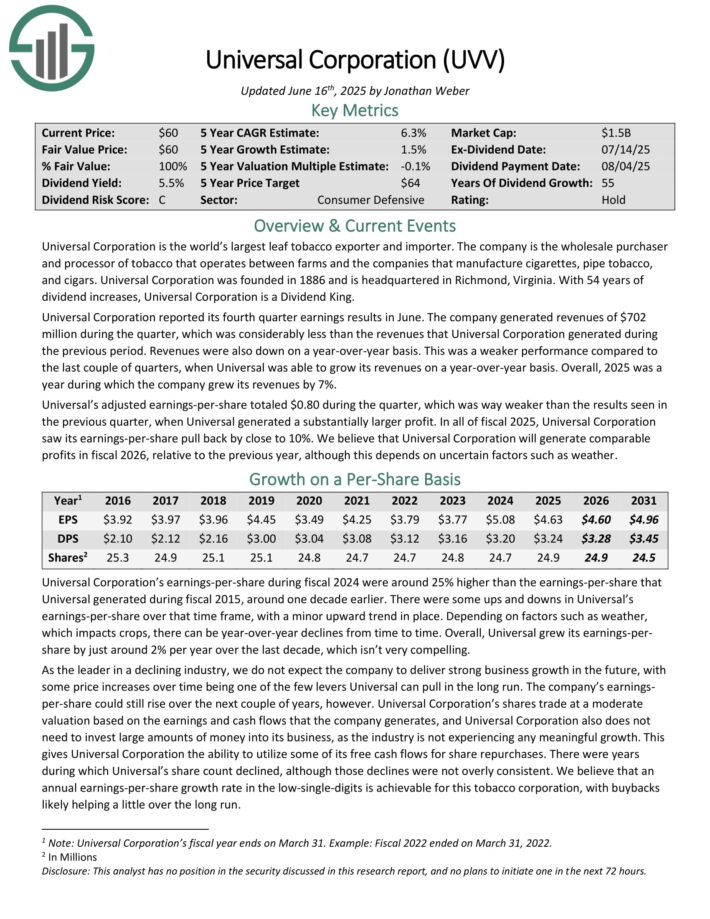

Greatest Retirement Inventory #5: Common Corp. (UVV)

Common Company is the world’s largest leaf tobacco exporter and importer. The corporate is the wholesale purchaser and processor of tobacco that operates between farms and the businesses that manufacture cigarettes, pipe tobacco, and cigars.

With 55 years of dividend will increase, Common Company is a Dividend King.

Common Company reported its fourth quarter earnings ends in June. The corporate generated revenues of $702 million throughout the quarter, which was significantly lower than the revenues that Common Company generated throughout the earlier interval. Revenues had been additionally down on a year-over-year foundation.

This was a weaker efficiency in comparison with the final couple of quarters, when Common was in a position to develop its revenues on a year-over-year foundation. General, 2025 was a yr throughout which the corporate grew its revenues by 7%.

Common’s adjusted earnings-per-share totaled $0.80 throughout the quarter, which was means weaker than the outcomes seen within the earlier quarter, when Common generated a considerably bigger revenue. In all of fiscal 2025, Common Company noticed its earnings-per-share pull again by near 10%.

Click on right here to obtain our most up-to-date Positive Evaluation report on UVV (preview of web page 1 of three proven under):

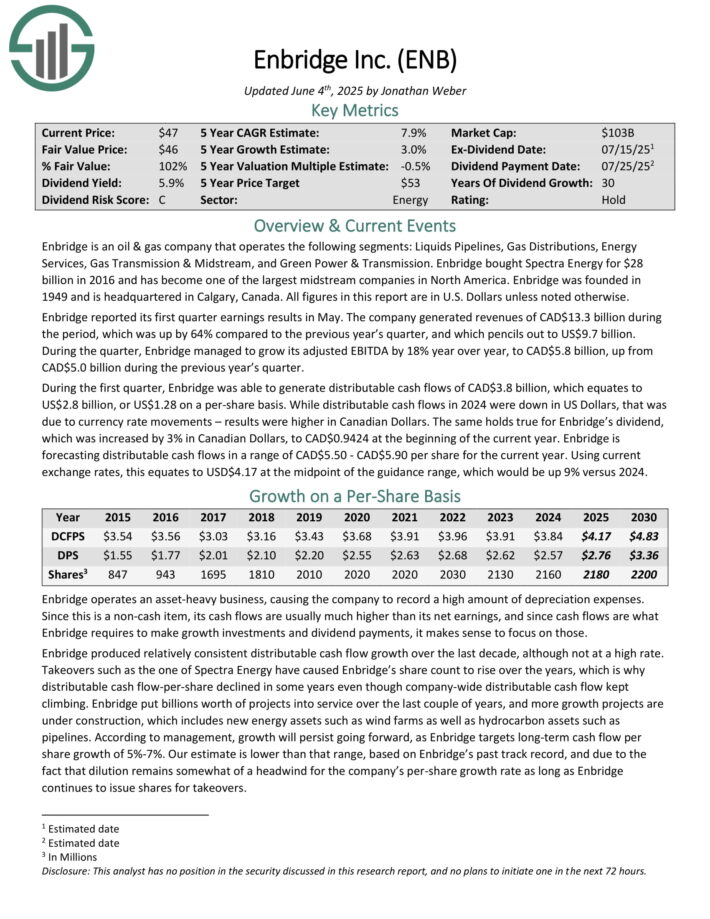

Greatest Retirement Inventory #4: Enbridge Inc. (ENB)

Enbridge is a Canadian oil inventory that operates the next segments: Liquids Pipelines, Gasoline Distributions, Vitality Providers, Gasoline Transmission & Midstream, and Inexperienced Energy & Transmission.

Enbridge purchased Spectra Vitality for $28 billion in 2016 and has change into one of many largest midstream firms in North America.

Enbridge was based in 1949 and is headquartered in Calgary, Canada.

Enbridge reported its first quarter earnings ends in Could. The corporate generated revenues of CAD$13.3 billion throughout the interval, which was up by 64% in comparison with the earlier yr’s quarter, and which pencils out to US$9.7 billion.

In the course of the quarter, Enbridge grew its adjusted EBITDA by 18% yr over yr. Distributable money flows got here to US$2.8 billion, or US$1.28 on a per-share foundation.

Enbridge is forecasting distributable money flows in a spread of CAD$5.50 – CAD$5.90 per share for the present yr. Utilizing present trade charges, this equates to USD$4.17 on the midpoint of the steering vary, which might be up 9% versus 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on ENB (preview of web page 1 of three proven under):

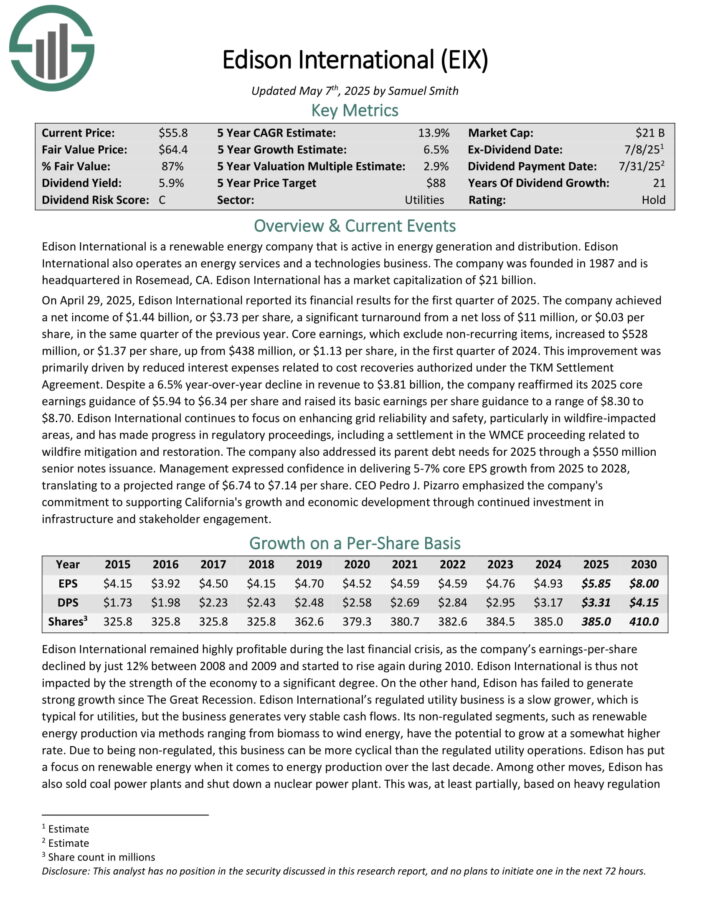

Greatest Retirement Inventory #3: Edison Worldwide (EIX)

Edison Worldwide is a renewable power firm that’s lively in power era and distribution. Edison Worldwide additionally operates an power providers and a applied sciences enterprise. The corporate was based in 1987 and is headquartered in Rosemead, CA.

On April 29, 2025, Edison Worldwide reported its monetary outcomes for the primary quarter of 2025. The corporate achieved a internet earnings of $1.44 billion, or $3.73 per share, a major turnaround from a internet lack of $11 million, or $0.03 per share, in the identical quarter of the earlier yr.

Core earnings, which exclude non-recurring gadgets, elevated to $528 million, or $1.37 per share, up from $438 million, or $1.13 per share, within the first quarter of 2024.

This enchancment was primarily pushed by lowered curiosity bills associated to price recoveries approved underneath the TKM Settlement Settlement. Regardless of a 6.5% year-over-year decline in income to $3.81 billion, the corporate reaffirmed its 2025 core earnings steering of $5.94 to $6.34 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on EIX (preview of web page 1 of three proven under):

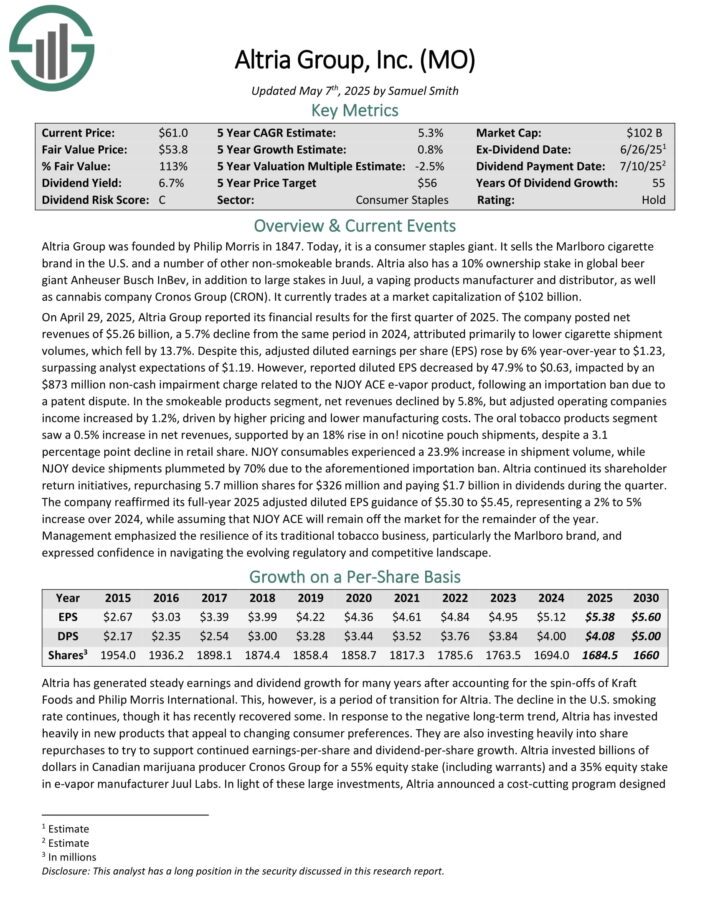

Greatest Retirement Inventory #2: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra underneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On April 29, 2025, Altria Group reported its monetary outcomes for the primary quarter of 2025. The corporate posted internet revenues of $5.26 billion, a 5.7% decline from the identical interval in 2024, attributed primarily to decrease cigarette cargo volumes, which fell by 13.7%.

Regardless of this, adjusted diluted earnings per share (EPS) rose by 6% year-over-year to $1.23, surpassing analyst expectations of $1.19.

Within the smokeable merchandise section, internet revenues declined by 5.8%, however adjusted working firms earnings elevated by 1.2%, pushed by larger pricing and decrease manufacturing prices.

The oral tobacco merchandise section noticed a 0.5% enhance in internet revenues, supported by an 18% rise in on! nicotine pouch shipments.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven under):

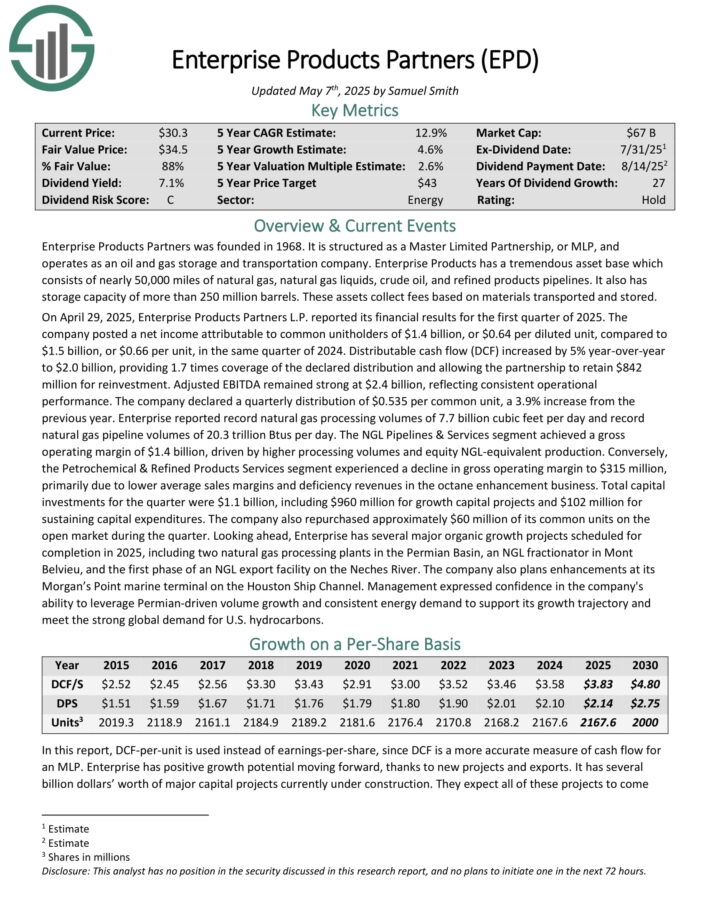

Greatest Retirement Inventory #1: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and fuel storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure fuel, pure fuel liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These property acquire charges primarily based on volumes of supplies transported and saved.

Supply: Investor Presentation

On April 29, 2025, Enterprise Merchandise Companions L.P. reported its monetary outcomes for the primary quarter of 2025. The corporate posted a internet earnings attributable to widespread unitholders of $1.4 billion, or $0.64 per diluted unit, in comparison with $1.5 billion, or $0.66 per unit, in the identical quarter of 2024.

Distributable money movement (DCF) elevated by 5% year-over-year to $2.0 billion, offering 1.7 instances protection of the declared distribution and permitting the partnership to retain $842 million for reinvestment.

Adjusted EBITDA remained robust at $2.4 billion, reflecting constant operational efficiency. The corporate declared a quarterly distribution of $0.535 per widespread unit, a 3.9% enhance from the earlier yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPD (preview of web page 1 of three proven under):

Remaining Ideas

One of the best retirement shares have robust enterprise fashions that generate excessive ranges of money movement. In flip, they will present excessive dividend payouts to traders, and lift their dividends every year.

The ten finest retirement shares on this article may very well be engaging investments for earnings traders searching for dependable dividends that may face up to recessions, and proceed to develop over time.

If you’re inquisitive about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.