Revealed on August fifth, 2025 by Bob Ciura

Excessive dividend shares are shares with a dividend yield properly in extra of the market common dividend yield of ~1.3%.

Excessive-yield shares could be very useful to shore up revenue after retirement. With that in thoughts, we have now created a free listing of over 200 excessive dividend shares with dividend yields above 5%.

You possibly can obtain your copy of the excessive dividend shares listing under:

Nonetheless, not all excessive dividend shares are equally secure.

There are lots of examples of excessive dividend shares decreasing or eliminating their dividends. Total, regardless of the constructive attributes connected to excessive dividend shares, their danger profile could be elevated.

Consequently, revenue buyers ought to attempt to discover dividend shares that not simply have excessive yields, but in addition have sustainable payouts backed by sturdy underlying fundamentals.

On this article, we have now analyzed the 6 excessive dividend shares from our Positive Evaluation Analysis Database with the most secure dividends primarily based on our Dividend Threat Rating score system.

The 6 excessive dividend shares under have present yields above 4% and Dividend Threat Scores of ‘A’, our highest rating.

The shares are listed under in response to their present yield, in ascending order.

Desk of Contents

Extremely-Protected Excessive Yielder #6: PepsiCo Inc. (PEP)

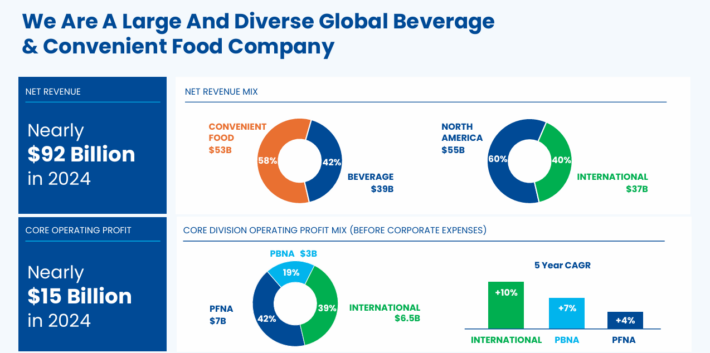

PepsiCo is a worldwide meals and beverage firm. Its merchandise embrace Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is cut up roughly 60-40 by way of meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July 18th, 2025, PepsiCo introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 in contrast unfavorably to $2.28 the prior 12 months, however this was $0.09 forward of expectations. Foreign money change decreased income by 1.5% and adjusted earnings-per-share by 5%.

Natural gross sales grew 2.1% for the second quarter. For the interval, quantity for drinks was as soon as once more unchanged whereas meals fell 1.5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEP (preview of web page 1 of three proven under):

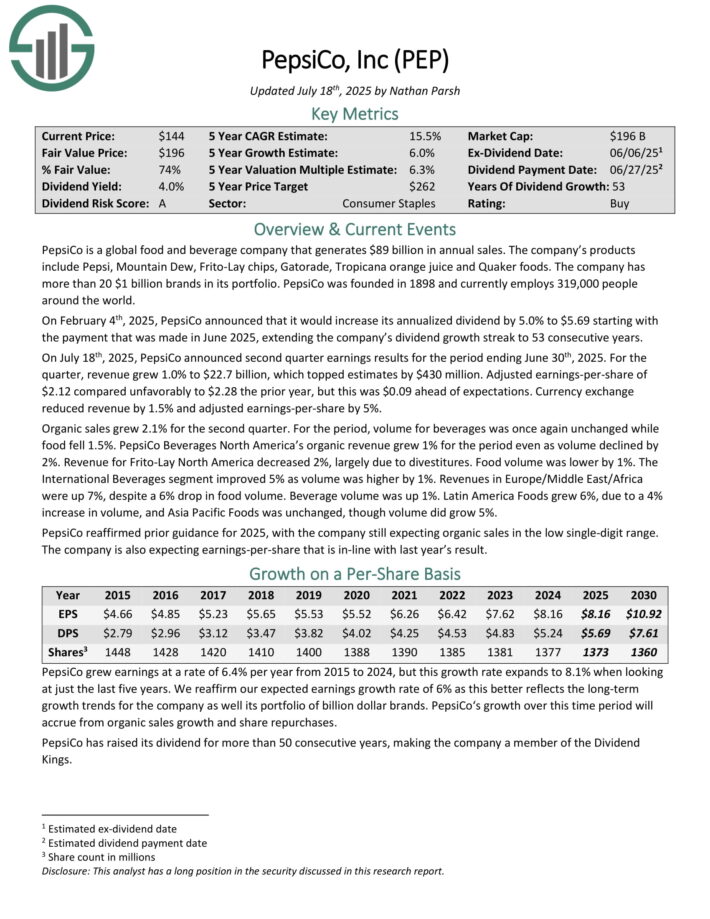

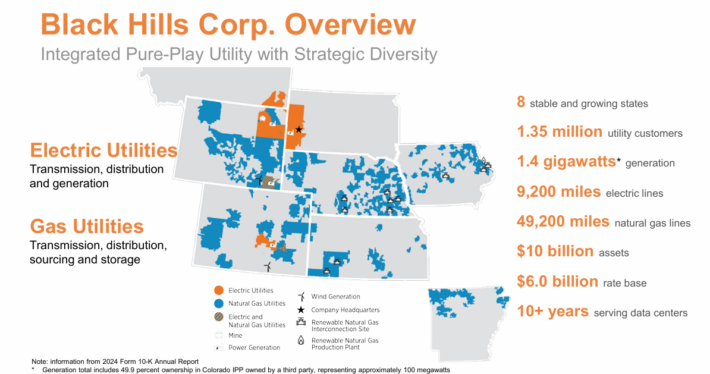

Extremely-Protected Excessive Yielder #5: Hormel Meals (HRL)

Hormel Meals was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise trade with almost $10 billion in annual income.

Hormel has stored with its core competency as a processor of meat merchandise for properly over 100 years, however has additionally grown into different enterprise strains by means of acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Just some of its high manufacturers embrace embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

The corporate has elevated its dividend for 59 consecutive years.

Supply: Investor Presentation

Hormel posted second quarter earnings on Might twenty ninth, 2025, and outcomes had been largely consistent with expectations. Adjusted earnings-per-share got here to 35 cents, which was a penny forward of estimates.

Income was up fractionally to $2.9 billion, assembly expectations. The corporate noticed a 7% decline in quantity and flat gross sales in each retail and foodservice. Pricing will increase helped to offset that.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRL (preview of web page 1 of three proven under):

Extremely-Protected Excessive Yielder #4: Goal Corp. (TGT)

Goal was based in 1902 and now operates about 1,850 large field shops, which supply common merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted first quarter earnings on Might twenty first, 2025, and outcomes had been weak. Earnings got here to $1.30 per share, which missed estimates by 35 cents. Income was additionally 3% decrease from the prior 12 months at $23.8 billion, lacking estimates by $550 million. Merchandise gross sales had been off 3.1% year-over-year, partially offset by a 13.5% enhance in different income.

Digital comparable gross sales had been up 4.7%, with same-day supply development of 35%. Power in Drive Up continues to drive these outcomes. Whole comparable gross sales fell 3.8%, and administration famous Goal held or gained market share in simply 15 of its 35 classes.

The corporate is investing closely in its enterprise to be able to navigate by means of the altering panorama within the retail sector. The payout is now 61% of earnings for this 12 months, which is elevated from historic ranges, however the dividend stays well-covered.

Goal’s aggressive benefit comes from its on a regular basis low costs on engaging merchandise in its guest-friendly shops.

Click on right here to obtain our most up-to-date Positive Evaluation report on TGT (preview of web page 1 of three proven under):

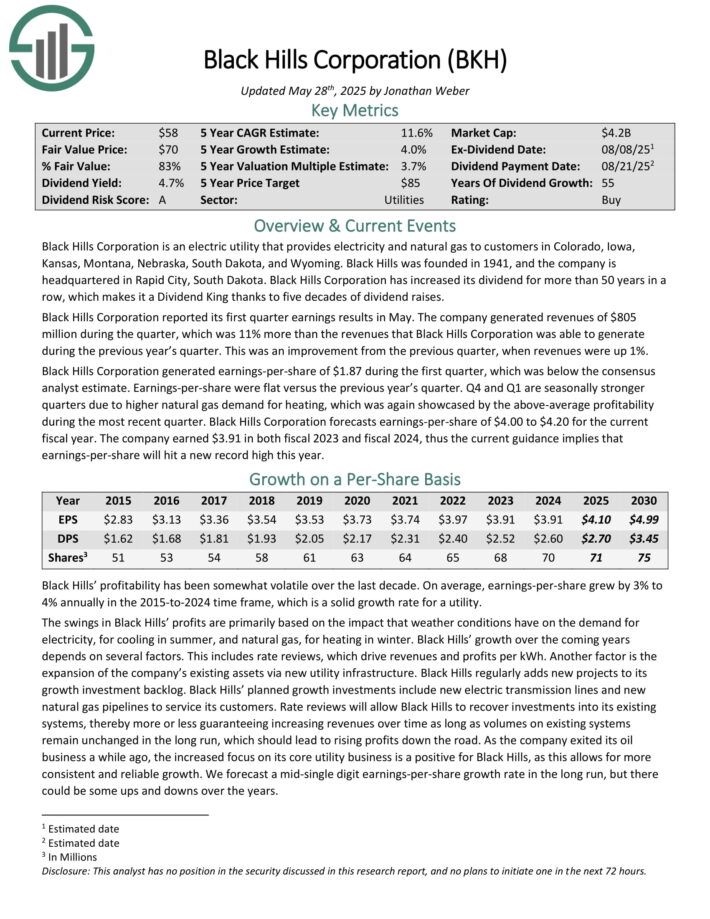

Extremely-Protected Excessive Yielder #3: Black Hills Company (BKH)

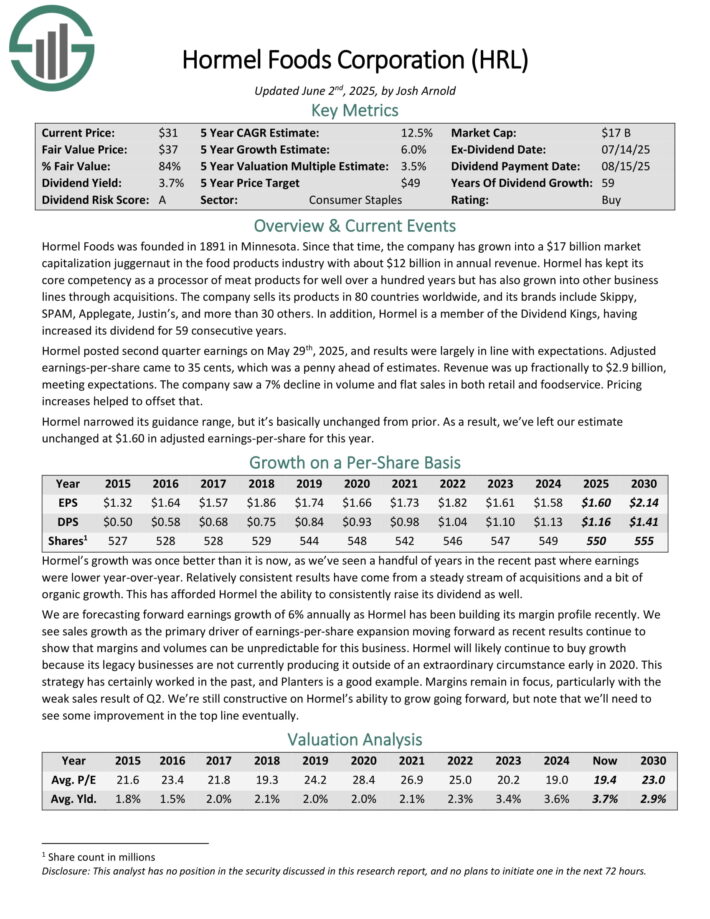

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to prospects in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility prospects in eight states. Its pure gasoline belongings embrace 49,200 miles of pure gasoline strains. Individually, it has ~9,200 miles of electrical strains and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Black Hills Company reported its first quarter earnings leads to Might. The corporate generated revenues of $805 million through the quarter, which was 11% year-over-year development.

Black Hills Company generated earnings-per-share of $1.87 through the first quarter, which was under the consensus analyst estimate. Earnings-per-share had been flat versus the earlier 12 months’s quarter.

This autumn and Q1 are seasonally stronger quarters as a consequence of increased pure gasoline demand for heating, which was once more showcased by the above-average profitability throughout the newest quarter.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on BKH (preview of web page 1 of three proven under):

Extremely-Protected Excessive Yielder #2: Sonoco Merchandise Co. (SON)

Sonoco Merchandise supplies packaging, industrial merchandise and provide chain providers to its prospects. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Client Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend development streak to 49 consecutive years.

On July twenty third, 2025, Sonoco Merchandise introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 in comparison with $1.28 within the prior 12 months, however was $0.08 lower than anticipated.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Client Packaging revenues surged 110% to $1.23 billion, principally as a consequence of contributions from Eviosys.

Quantity development was sturdy and favorable forex change charges additionally aided outcomes. Industrial Paper Packing gross sales fell 2% to $588 million as a result of influence of international forex change charges and decrease quantity following two plant divestitures in China final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco (SON) (preview of web page 1 of three proven under):

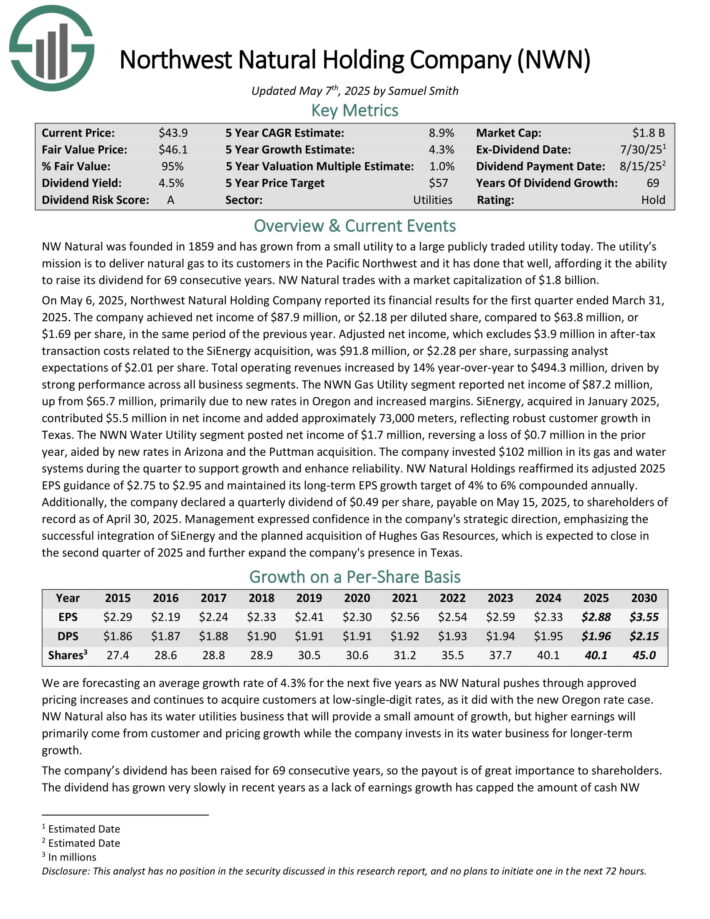

Extremely-Protected Excessive Yielder #1: Northwest Pure Holding (NWN)

Northwest was based over 160 years in the past as a pure gasoline utility in Portland, Oregon.

It has grown from a really small, native utility that offered gasoline service to a handful of shoppers to a really profitable regional utility with pursuits that now embrace water and wastewater, which had been bought in latest acquisitions.

The corporate’s operations are proven within the picture under.

Supply: Investor Presentation

Northwest supplies gasoline service to 2.5 million prospects in ~140 communities in Oregon and Washington, serving greater than 795,000 connections. It additionally owns and operates ~35 billion cubic toes of underground gasoline storage capability.

On Might 6, 2025, Northwest Pure Holding Firm reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved web revenue of $87.9 million, or $2.18 per diluted share, in comparison with $63.8 million, or $1.69 per share, in the identical interval of the earlier 12 months.

Adjusted web revenue, which excludes $3.9 million in after-tax transaction prices associated to the SiEnergy acquisition, was $91.8 million, or $2.28 per share, surpassing analyst expectations of $2.01 per share.

Whole working revenues elevated by 14% year-over-year to $494.3 million, pushed by sturdy efficiency throughout all enterprise segments.

NW Pure Holdings reaffirmed its adjusted 2025 EPS steering of $2.75 to $2.95.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven under):

Closing Ideas

Excessive dividend shares could be a pretty choice for buyers looking for a better stage of revenue from their funding portfolios.

Whereas no funding comes with out danger, some excessive dividend shares have demonstrated a historical past of monetary stability, constant earnings, and dependable dividend funds.

These 6 high-yielding dividend shares have engaging payouts above 4%, and carry our highest Dividend Threat rating.

Further Studying

In case you are considering discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources will likely be helpful:

Excessive-Yield Particular person Safety Analysis

And see the sources under for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.