I view diversification not solely as a survival technique however as an aggressive technique as a result of the subsequent windfall may come from a stunning place.” – Peter Bernstein

What’s the single most universally held perception in all of investing?

Give it some thought for a minute.

Our vote could be “Buyers MUST personal US shares.”

It has been effectively established that US shares have traditionally outperformed bonds over time, and likewise, US shares have outperformed most overseas inventory markets in addition to different asset courses.

What number of occasions have you ever seen a model of this chart?

Determine 1 – Asset Class Returns

It looks like US shares have compounded at round 10% for nearly endlessly, and the loopy math end result is that when you compound an funding at 10% for 25 years, you 10x your cash, and after 50 years you 100x your cash.

$10,000 plunked down at age 20 would develop to $1,000,000 in retirement. Superb!

For the previous 15 years, it’s been even higher than that. US shares have compounded at round 15% per 12 months because the backside of the World Monetary Disaster, outperforming virtually each asset over this era. This excellent efficiency has led to a close to common perception that US shares are “the one recreation on the town.” Beliefs result in actual world conduct.

Now don’t get us fallacious, Shares for the Lengthy Run is one in every of our all-time favourite books. Certainly, US shares most likely ought to be the bedrock place to begin for many portfolios.

But it surely looks like everyone seems to be “all in” on US shares. A current ballot of Meb’s Twitter followers discovered that 94% of individuals mentioned they maintain US shares. That’s no shock. However when everyone seems to be on the identical aspect of the identical commerce, effectively, that’s often not a recipe for long-term outperformance.

Regardless of US shares accounting for roughly 64% of the worldwide market cap, most US traders make investments almost all of their fairness portfolio in US shares. That could be a massive chubby wager on US shares vs. the index allocation. (If that is you, pat your self on the again, as US shares have outperformed nearly every thing over the previous 15 years, which looks like a complete profession for a lot of traders.)

We’re at present on the highest level in historical past for shares as a share of family property. Even larger than in 2000.

Given the current proof, it looks like traders could also be effectively served by placing all their cash in US shares…

So why are we about to query this sacred cow of investing?

We consider there are numerous paths to constructing wealth. Counting on a concentrated wager in only one asset class in only one nation may be extraordinarily dangerous. Whereas we frequently hear traders describe their funding in US market cap indexes as “boring,” traditionally, that have has been something however.

Contemplate, US shares declined by over 80% through the Nice Despair. Many traders can recall the more moderen Web bust and World Monetary Disaster the place shares declined by round half throughout every bear market.

That doesn’t sound boring to us.

US shares also can go very lengthy durations with out producing a constructive return after inflation and even underperforming one thing as boring as money and bonds. Does 68 years of shares underperforming bonds sound like rather a lot? Most individuals battle with just a few years of underperformance, strive a complete lifetime!

So, let’s do one thing that no sane investor in the complete world would do.

Let’s do away with your US shares.

Say what?!

This transfer will seemingly doom any portfolio to failure. Buyers will probably be consuming cat meals in retirement. Proper?

Let’s examine our biases on the door and take a look at a couple of thought experiments.

We’ll study one in every of our favourite portfolios, the worldwide market portfolio (GAA). This portfolio tries to copy a broad allocation the place you personal each public asset in the complete world. This complete is over $200 trillion final we checked.

At present, when you around the portfolio allocation, it’s roughly half bonds and half shares, and roughly have US and half overseas. There’s somewhat little bit of actual property and commodities thrown in too, however a lot of actual property is privately held, as is farmland. (We study varied asset allocation fashions in my free e book World Asset Allocation.)

This portfolio could possibly be referred to as the true market portfolio or possibly “Asset Allocation for Dummies” because you don’t really “do something”; you simply purchase the market portfolio and go about your online business. Shockingly, this asset allocation has traditionally been a implausible portfolio. Within the current article, “Ought to CalPERS Fireplace Everybody and Simply Purchase Some ETFs?”, Meb even demonstrated that each the most important pension fund and the most important hedge fund within the US have a tough time beating this fundamental “do nothing” portfolio.

Now, what when you determined to get rid of US shares from that portfolio and substitute them with overseas shares? Absolutely this insane resolution would destroy the efficiency of the portfolio?!

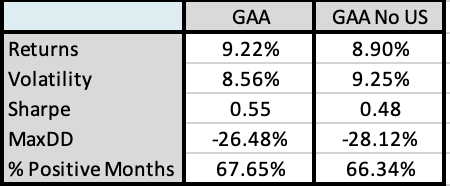

Right here is the GAA portfolio and GAA portfolio ex US shares with danger and return statistics again to 1972.

Determine 2 – Asset Allocation Portfolio Returns, With and With out US Shares, 1972-2022

Supply: GFD

Just about no distinction?! These outcomes can’t be true!

You lose out on lower than half of 1 p.c in annual compound returns. Not optimum, however nonetheless completely high quality. Anytime you cut back the universe of funding decisions, the chance and return figures typically lower as a consequence of diminishing breadth.

When now we have offered these findings to traders, the usual response is disbelief, adopted by an assumption that we should have made a math error someplace.

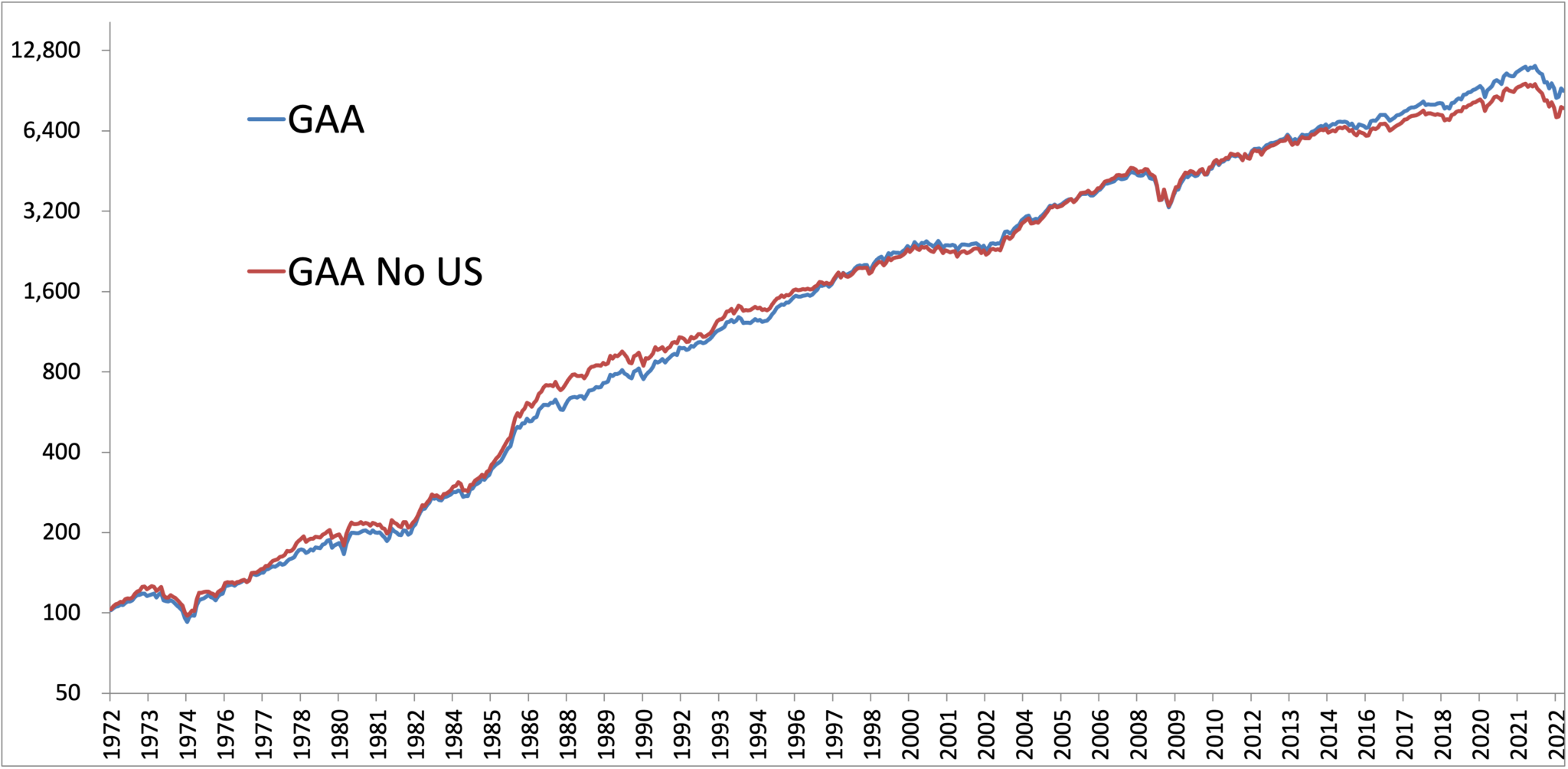

However there’s no error. You’ll be able to barely inform the distinction if you eyeball the fairness curves of the 2 collection.

Determine 3 – Asset Allocation Portfolio Returns, With and With out US Shares, 1972-2022

Supply: GFD

When you zoom out and run the simulation over the previous 100 years, the outcomes are constant – a few 0.50% distinction.

You seemingly don’t consider us, so let’s run one other check.

Do you keep in mind the outdated Coke vs. Pepsi style exams?

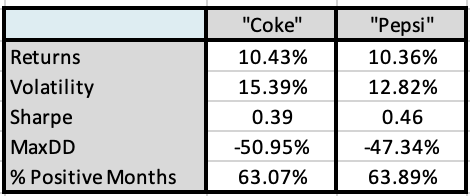

Let’s run the funding equal to see simply how biased you’re. Beneath are two portfolios. Which might you like?

Determine 4 – Asset Allocation Portfolio Style Take a look at, 1972-2022

Supply: GFD

It’s fairly onerous to inform the distinction, proper?

This may occasionally shock you, however column A is US shares. Column B is a portfolio made up of overseas shares, bonds, REITs, and gold, with somewhat leverage thrown in. (Our associates at Leuthold name the idea the Donut Portfolio.)

Each portfolios have close to similar danger and return metrics.

The stunning conclusion – you’ll be able to replicate the historic return stream of US shares with out proudly owning any US shares.

There’s no cause to cease right here…

It is vitally easy to assemble a historic backtest with a lot superior danger and return metrics than what you’d get investing in US shares alone. Shifting from market cap weighted US shares to one thing like a shareholder yield strategy traditionally has added a couple of share factors of returns in simulations. Additions akin to a pattern following strategy may be vastly additive over time within the areas of diversification and danger discount. We consider that traders can obtain larger returns with decrease volatility and drawdown with these additions. For extra particulars, we’d direct you to our outdated Trinity Portfolio white paper…)

Regardless of not essentially needing US shares, for many of us, they’re the place to begin. They’re good to have however you don’t HAVE to personal them, and positively not with the whole lot of your portfolio.

Because the US inventory market is displaying some cracks whereas buying and selling close to report valuation territory, possibly it’s time to rethink the close to universally held sacred perception…

“It’s a must to be all in on US shares.”