Electrical autos have been surging, till Washington abruptly hit the brakes. Now the US faces a precipice in its adoption curve. Will it recuperate or fall behind?

1. A Turning Level in US EV Coverage

On 4 July 2025, the US crossed a coverage Rubicon. Congress handed the One Large Stunning Invoice and President Trump signed it the identical day, formally terminating the federal EV tax credit by 30 September 2025—a full seven years forward of schedule.

Initiated beneath the Inflation Discount Act (IRA) in 2022, these credit, as much as $7,500 for brand new EVs, $4,000 for used, and as a lot as $40,000 for industrial autos, have been as soon as hailed as a cornerstone of the clear transportation transition. Their elimination marks a radical shift at a second when electrical mobility was simply starting to achieve mass-market traction.

The administration claims the transfer will save the federal authorities $170 billion over the subsequent decade. Whereas fiscal prudence is comprehensible, the timing raises pressing questions on the way forward for emissions reductions, home EV manufacturing, and America’s aggressive stance within the world clear expertise race. These incentives have been designed not solely to decrease upfront car prices but in addition to catalyze business funding, shopper adoption, and provide chain development.

By pulling the plug so abruptly, the federal government dangers destabilizing an business nonetheless depending on constant coverage alerts to plan manufacturing and investments. This sudden withdrawal might discourage automakers and suppliers from increasing EV manufacturing capability, doubtlessly ceding technological management to worldwide rivals.

Because the nation halts its electrical car technique, the broader implications stay as unsure as they’re consequential, making a coverage vacuum at a essential juncture for local weather and industrial coverage.

Supply: The Salata Institute, Harvard College

The rollback of the EV tax credit goes far past merely ending rebate checks, it represents a sweeping and systematic reversal of the federal technique fastidiously constructed since 2022 to speed up electrical car adoption. By 30 September, assist for EV patrons will vanish solely, slicing off incentives for each new and used electrical autos that had beforehand certified for credit as much as $7,500 and $4,000, respectively.

Equally vital, industrial and leasing subsidies, some price tens of hundreds of {dollars}, have additionally been eradicated, sharply lowering the financial motivation for fleet electrification, a essential section for scaling clear transport.

Infrastructure funding—a key pillar of the transition—is subsequent to fall sufferer. The Nationwide Electrical Automobile Infrastructure (NEVI) program, initially funded with $5 billion beneath the 2021 Bipartisan Infrastructure Regulation to construct fast-charging stations alongside highways at fifty-mile intervals, was abruptly halted by the administration in February.

This suspension, regardless of ongoing authorized challenges from a number of states and a partial injunction restoring some funding, has created substantial uncertainty inside the EV charging sector, delaying deliberate deployments and shaking the arrogance of personal traders and utility companions very important to increasing the nationwide charging community.

Regulatory protections that underpin long-term emission reductions are additionally unravelling. Shortly after reinstating federal oversight, President Trump revoked California’s Clear Air Act waivers, utilizing the Congressional Evaluate Act to strip the state and its companions of the authority to implement stricter emissions limits and zero-emission car mandates.

In the meantime, the administration has signaled intentions to revisit and doubtlessly weaken nationwide greenhouse gasoline and gas economic system requirements for autos manufactured after 2027, although formal rulemaking has but to be finalized.

Moreover, the Inflation Discount Act’s manufacturing tax credit for home battery and demanding supplies manufacturing at the moment are beneath risk. These incentives had fueled new giga-factory development and provide chain investments essential for scaling US-based EV manufacturing. Their rollback jeopardizes these investments and dangers stalling the expansion of a home manufacturing base important for long-term competitiveness.

Taken collectively, these modifications signify essentially the most drastic reversal of US EV coverage in over a decade, systematically dismantling what was as soon as a multifaceted system of incentives, infrastructure funding, and regulatory guardrails designed to speed up electrification, elevating profound questions in regards to the future trajectory of American clear transportation.

2. Brief-Time period Surge and Market Reactions

As federal EV subsidies close to expiration on 30 September, sellers report giant inventories and are aggressively slicing costs to spur last-minute gross sales. {Tesla (NASDAQ:)} maintained robust Q2 volumes regardless of a 9% drop year-over-year, and GM hit a report 46,000 EV gross sales within the quarter. This short-term surge, pushed by customers dashing to say rebates, masks a looming threat: with out subsidies, price-sensitive patrons could maintain again, inflicting a possible hunch in mainstream EV adoption.

Investor reactions have been blended. Pure-play EV firms like {Rivian (NASDAQ:)} and {Lucid (NASDAQ:)} noticed inventory positive aspects: 4.6% and eight.8% respectively, due to continued eligibility for credit by means of leasing or battery sourcing guidelines. Tesla’s shares lagged, as its earnings rely closely on emissions-credit income and shopper incentives now in jeopardy. Total, whereas smaller EV makers could profit initially, mass-market demand faces uncertainty as worth premiums rise and promotional pushes fade.

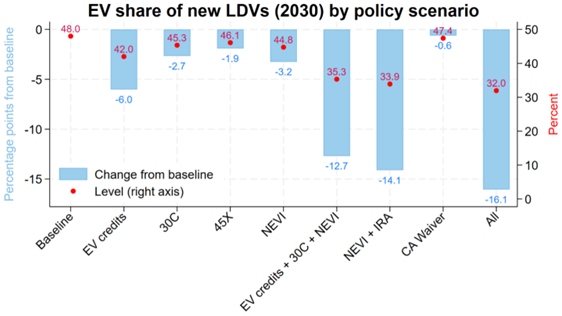

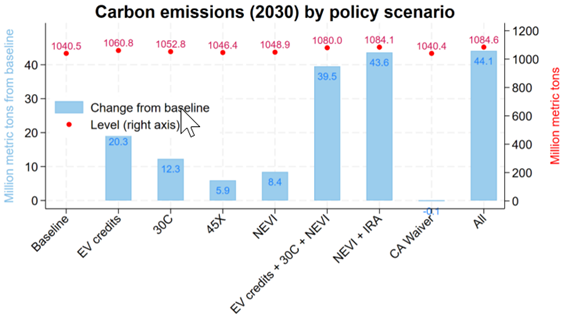

Harvard’s Salata Institute modelled the influence of rolling again EV insurance policies. Beneath the Inflation Discount Act (IRA), EVs have been anticipated to seize 48% of recent car gross sales by 2030. Eradicating simply the buyer tax credit cuts this to 42%. When mixed with halted infrastructure funding, weakened state mandates, and revoked emissions guidelines, adoption might drop additional to roughly one-third of recent gross sales.

This decline has direct environmental penalties. The rollback could add 20 to 44 million metric tons of CO₂ emissions in 2030, roughly equal to placing practically ten million gasoline automobiles again on the street. The US Power Division equally forecasts a 2–3-year delay in reaching EV adoption milestones. These setbacks threaten home manufacturing unit ramp-ups and broader business momentum simply as EVs strategy mass-market viability.

Supply: The Salata Institute, Harvard College

Sure, eradicating credit yields arduous federal financial savings: round $168.5 billion over a decade. However that acquire comes at a steep worth: misplaced local weather advantages, weakened provide chains, a painful geopolitical retreat, and crucially, vital fairness issues, as essentially the most weak customers lose entry to important monetary assist.

The rollback additionally freezes $12 billion in NEVI spending, whereas shelving IRA battery manufacturing credit (45X) saves one other $7 billion. Sarcastically, the California emissions waiver scrapping provides nearly nothing to financial savings, however hurts EV targets. In sum, most monetary financial savings come from a single transfer, the credit score elimination, however practically each different facet contributes closely to local weather and industrial fallout, elevating the query: which customers will slip by means of the cracks?

Not all patrons will likely be affected equally by the tip of federal EV incentives. Decrease‑ and center‑revenue purchasers, key to attaining mass-market adoption, stand to lose essentially the most, as they typically relied on credit to bridge the value hole between electrical and standard autos. With common EV transaction costs nonetheless considerably above these of comparable gas-powered automobiles, subsidies have been ceaselessly the deciding consider affordability.

On the different finish of the spectrum, luxurious EV patrons, similar to these buying from manufacturers like Rivian and Lucid, have extra monetary flexibility and proceed to learn from leasing constructions and personal reductions that may soften the influence of subsidy elimination.

Automakers are responding with focused seller incentives, producer rebates, and extra aggressive lease packages. Whereas these measures could assist cushion the transition, they lack the size and consistency of federal coverage and are unlikely to completely offset the lack of broad-based subsidies.

State governments could try to fill the void, similar to California and Massachusetts, whose robust political and financial assist might preserve some EV incentives. Nonetheless, with no coordinated federal effort, the effectiveness of such measures will fluctuate extensively and sure go away lower-income communities at an obstacle in lots of elements of the nation.

On the identical time, the IRA’s EV push had pushed substantial manufacturing unit funding together with giga-factories, battery crops, and provide chain hubs in Republican districts. Now many stand on unstable footing.

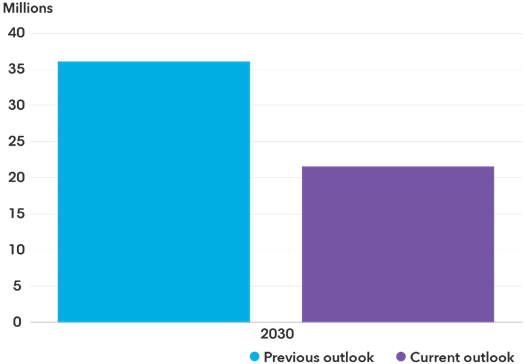

Transport analyst forecasts recommend 40 to 60% of deliberate EV factories will likely be in danger if coverage assist evaporates. {Basic Motors (NYSE:)} and have already delayed or cancelled giga-factory plans, Tesla postponed its finances mannequin plans, and even European and Asian rivals are recalibrating their US methods amidst elevated uncertainty. In impact, the US dangers shrinking its EV manufacturing base simply as world rivals speed up.

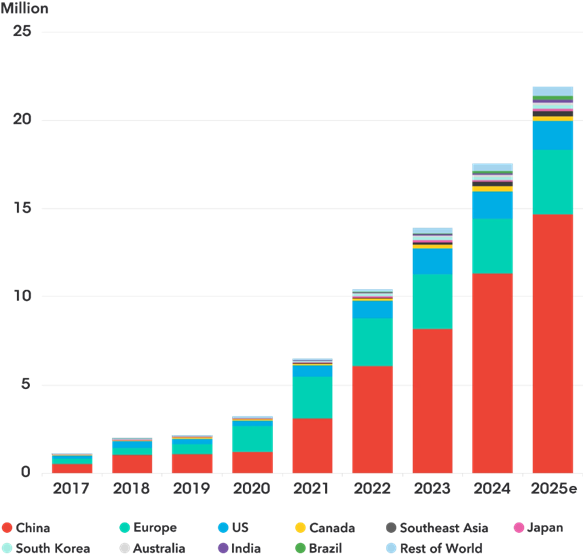

Globally, EV adoption has soared: approaching 25% of recent automobile gross sales in 2025. With China main the cost, Europe aggressively implementing quotas and subsidies, the US is veering off the principle observe.

China’s EV-led financial technique, which incorporates concentrated provide chains, export ambitions, battery dominance, will profit from weakened US competitors. This might undo years of funding and mission-driven innovation throughout a number of sectors. If home coverage bakes in subpar uptake, the US forfeits management, and all the roles, IP, and affect that include it.

Supply: Bloomberg NEF, Eco-Motion, China Electrical Automobile Infrastructure Promotion Alliance, numerous private and non-private sources

The rollback hits infrastructure arduous. NEVI, which aimed to ship quick chargers each 50 miles alongside interstates, is now paused. The consequence: rural America and renters in city corridors stay with out charging entry. With vary anxiousness nonetheless a barrier, the shortage of nationwide charging infrastructure will reinforce urban-rural divides and restrict the place EVs can truly be used. This additionally threatens networks like Electrify America, which depend on coverage assist and utilization scale.

The local weather influence is equally stark. This transfer provides tens of millions extra tones of CO₂ to America’s 2030 emissions than projected. Electrical autos, key to decarbonizing transport—at the moment the nation’s single largest supply of emissions—will backslide. Local weather targets develop into much less attainable, local weather adaptation tougher, and emergency eventualities extra possible.

Supply: The Salata Institute, Harvard College

What Occurs Subsequent: Trying Forward

Within the brief time period, a wave of EV purchases is anticipated as customers rush to safe rebates earlier than the deadline, supported by seller reductions and promotions. Nonetheless, as soon as federal credit expire, demand are prone to fall sharply, settling at a decrease baseline.

Automakers and dealerships plan to counter this hole with elevated incentives and leasing offers, whereas some states could proceed providing restricted subsidies. But, these fragmented efforts can’t change the nationwide attain or consistency of federal assist, particularly for price-sensitive patrons.

Globally, the US dangers shedding floor. China’s EV market continues to surge with robust authorities backing, whereas Europe tightens emissions requirements and accelerates zero-emission car mandates. Until insurance policies alter, US could fall behind key rivals in EV adoption, manufacturing, and innovation.

Long run, enhancements in battery expertise and extra mannequin availability might reignite development by the mid-2030s. Nonetheless, the five-year hole created by this coverage reversal represents not only a delay however misplaced alternatives in emissions reductions, provide chain growth, and industrial management.

Supply: Bloomberg NEF

Conclusion: A True Fork within the Highway

The “EV cliff” is now regulation. On 4 July 2025, President Trump signed the “One Large Stunning Invoice,” formally ending federal EV tax credit and gutting the spine of US electrical mobility coverage. This isn’t only a rollback: it’s a rupture. Progress forecasts are being minimize, emissions targets thrown off beam, and factories now face dwindling demand.

The US will stay within the EV race, however not as a frontrunner. International rivals will form the subsequent period of transport innovation whereas America dangers falling behind. Some coverage rebound could come, however not with out price. 4 July should mark independence, however in 2025, it additionally marked the day America selected to stall its electrical future. Whether or not it regains momentum is determined by what occurs subsequent.

Unique Publish