Revealed on August twenty fifth, 2025 by Bob Ciura

Dividend investing is finally about changing your working earnings with a passive earnings stream for a financially free retirement (or early retirement).

The fact of inflation signifies that your passive earnings stream can’t simply be static. It should be perpetually rising.

To construct perpetually rising – lasting – retirement earnings, spend money on a fairly diversified basket of earnings securities which have the next traits:

Pay dividends (the upper the yield the higher)

Are more likely to develop their funds (the quicker the higher)

Have protected dividends so you might be more likely to see secure or higher earnings throughout a recession (the safer the dividend, the higher)

Dividend investments must be protected, rising earnings securities.

In terms of protected and rising earnings, there are not any higher shares than the Dividend Kings. The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

You’ll be able to see the complete downloadable spreadsheet of all 56 Dividend Kings (together with essential monetary metrics akin to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

The ten prime retirement earnings shares beneath are Dividend Kings primarily based within the U.S., with present yields above 2.5%, equal to double the present dividend yield of the S&P 500 Index.

As well as, all of them have Dividend Threat Rating of ‘A’, indicating sturdy dividend security.

The ten shares are ranked by dividend yield beneath.

Desk of Contents

Prime Retirement Revenue Inventory: Coca-Cola Co. (KO)

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

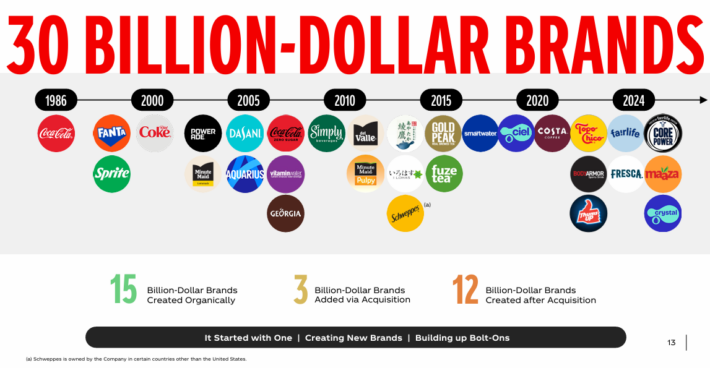

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate no less than $1 billion in annual gross sales.

Supply: Investor Presentation

Coca-Cola posted second quarter earnings on July twenty second, 2025, and outcomes had been considerably blended. Adjusted earnings-per-share got here to 87 cents, which was three cents forward of estimates. Income was up 0.8% year-over-year to $12.5 billion, lacking estimates by $80 million.

Natural income was up 5%, together with 6% development in pricing and blend, partially offset by a 1% decline in volumes. The corporate nonetheless expects to ship 5% to six% development in natural income this 12 months, unchanged from prior. Web income is predicted to face a 1% to 2% headwind from forex impacts primarily based on present positioning.

Glowing smooth drinks quantity was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% because it grew in all geographic segments. Comparable working margin growth in the course of the quarter was as much as 37.1% of income, pushed by natural development, the timing of selling investments, and efficient price administration. Foreign money headwinds partially offset a few of that..

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

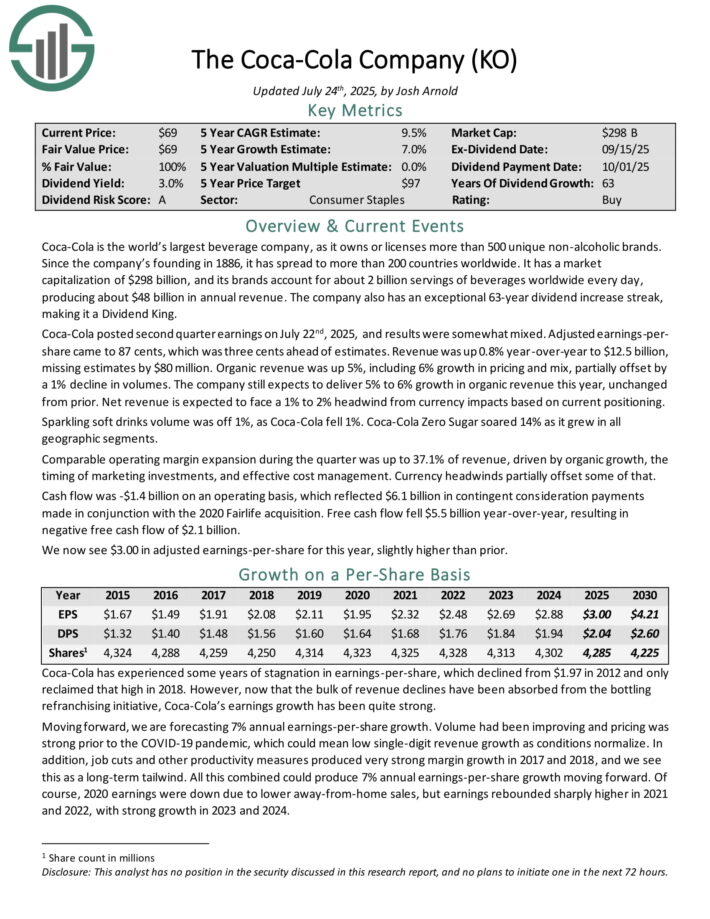

Prime Retirement Revenue Inventory: Real Components Co. (GPC)

Real Components has the world’s largest international auto elements community, with greater than 10,800 areas worldwide. As a serious distributor of automotive and industrial elements, Real Components generates annual income of almost $24 billion.

It operates two segments, that are automotive (contains the NAPA model) and the commercial elements group which sells industrial substitute elements to MRO (upkeep, restore, and operations) and OEM (authentic tools producer) prospects.

Real Components posted second quarter earnings on July twenty second, 2025, and outcomes had been significantly better than anticipated. Adjusted earnings-per-share got here to $2.10, which was 4 cents forward of estimates. Income was $6.2 billion, up 3.3% year-over-year, and beating estimates by $90 million.

The corporate’s Automotive Components Group noticed gross sales up 5%, whereas Industrial Components rose by 0.7%. Comparable gross sales in Automotive rose 0.4%, whereas comparable gross sales for Industrials was down 0.1%.

Real Components now expects gross sales development of 1% to three% for this 12 months, down from 2% to 4%. As well as, earnings had been lowered by 25 cents per share on each ends of the vary, which is now $7.50 to $8.00.

Click on right here to obtain our most up-to-date Certain Evaluation report on GPC (preview of web page 1 of three proven beneath):

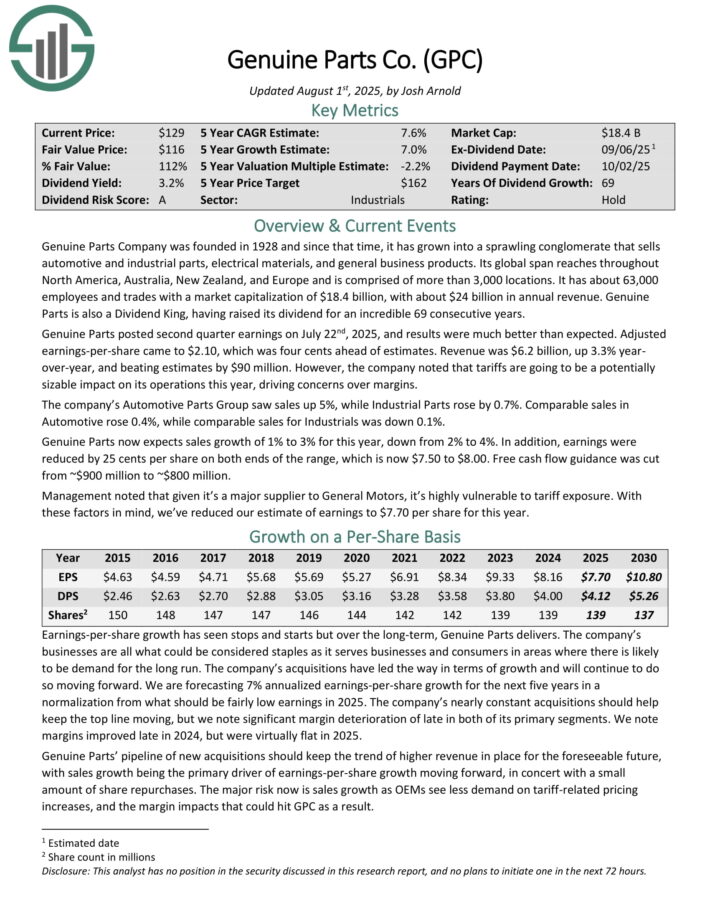

Prime Retirement Revenue Inventory: Stepan Co. (SCL)

Stepan manufactures primary and intermediate chemical substances, together with surfactants, specialty merchandise, germicidal and material softening quaternaries, phthalic anhydride, polyurethane polyols and particular elements for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise traces: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets.

The surfactants enterprise is Stepan’s largest by income. A surfactant is an natural compound that incorporates each water-soluble and water-insoluble parts.

Stepan posted second quarter earnings on July thirtieth, 2025, and outcomes had been a lot worse than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 52 cents, which was nowhere near estimates for 90 cents. Income was up 7% year-over-year to $595 million, lacking estimates by $3.6 million.

Surfactant gross sales had been $412 million, with promoting costs hovering 11% on pass-through of uncooked materials prices, primarily. Gross sales volumes had been down 1%. Polymers web gross sales had been up 2% to $163 million. Volumes had been up 7% however promoting costs declined 7%. Specialty Product gross sales had been $20.5 million, up 22%, however margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted web earnings was $12 million. Money from operations got here to $11.2 million, and free money circulate was detrimental $14.4 million on larger working capital necessities, in addition to uncooked materials builds.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCL (preview of web page 1 of three proven beneath):

Prime Retirement Revenue Inventory: AbbVie Inc. (ABBV)

AbbVie is a biotechnology firm centered on growing and commercializing medicine for immunology, oncology and virology. AbbVie was spun off by Abbott Laboratories in 2013.

AbbVie has turn out to be one of many largest gamers within the biotechnology trade, particularly following the closing of its acquisition of previously unbiased pharma firm Allergan.

AbbVie reported its second quarter earnings outcomes on July 31. The corporate was in a position to generate revenues of $15.4 billion in the course of the quarter, which was 7% greater than AbbVie’s revenues in the course of the earlier 12 months’s quarter.

Revenues had been positively impacted by compelling development from a few of its main medicine, together with Skyrizi and Rinvoq, whereas Humira gross sales declined by 58% attributable to rising competitors from biosimilars and market share losses.

AbbVie earned $2.97 per share in the course of the second quarter, up 12% year-over-year. Earnings-per-share beat the consensus analyst estimate by $0.06.

Steerage for 2025’s adjusted earnings-per-share was raised in the course of the earnings name; the corporate expects to earn $11.88 – $12.08 on a per-share foundation this 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on ABBV (preview of web page 1 of three proven beneath):

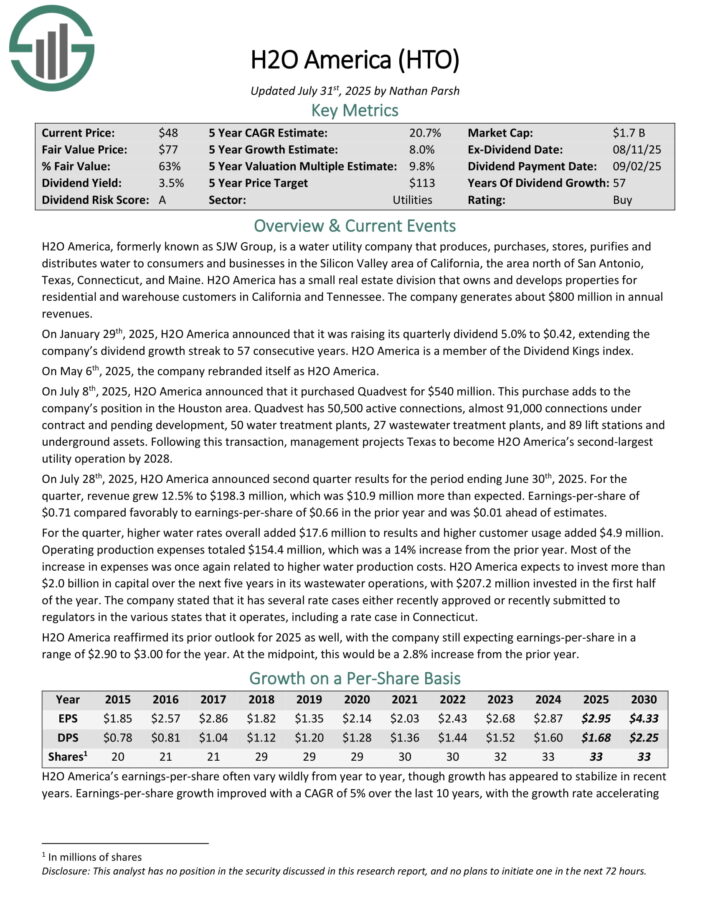

Prime Retirement Revenue Inventory: H2O America (HTO)

H2O America, previously generally known as SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

It additionally has a small actual property division that owns and develops properties for residential and warehouse prospects in California and Tennessee. The corporate generates about $670 million in annual revenues.

On July eighth, 2025, H2O America introduced that it bought Quadvest for $540 million. This buy provides to the corporate’s place within the Houston space.

Quadvest has 50,500 lively connections, virtually 91,000 connections below contract and pending improvement, 50 water therapy crops, 27 wastewater therapy crops, and 89 elevate stations and underground belongings.

On July twenty eighth, 2025, H2O America introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 12.5% to $198.3 million, which was $10.9 million greater than anticipated.

Earnings-per-share of $0.71 in contrast favorably to earnings-per-share of $0.66 within the prior 12 months and was $0.01 forward of estimates.

For the quarter, larger water charges total added $17.6 million to outcomes and better buyer utilization added $4.9 million. Working manufacturing bills totaled $154.4 million, which was a 14% improve from the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on HTO (preview of web page 1 of three proven beneath):

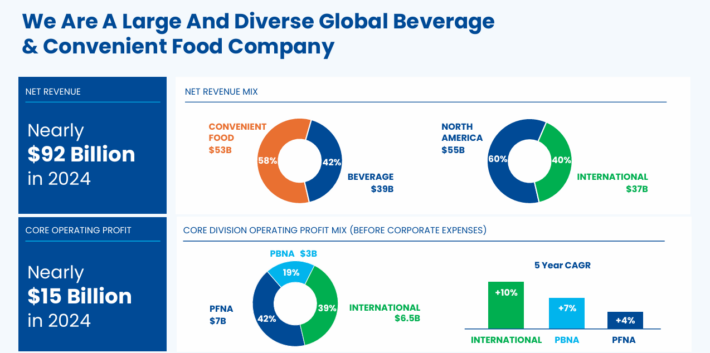

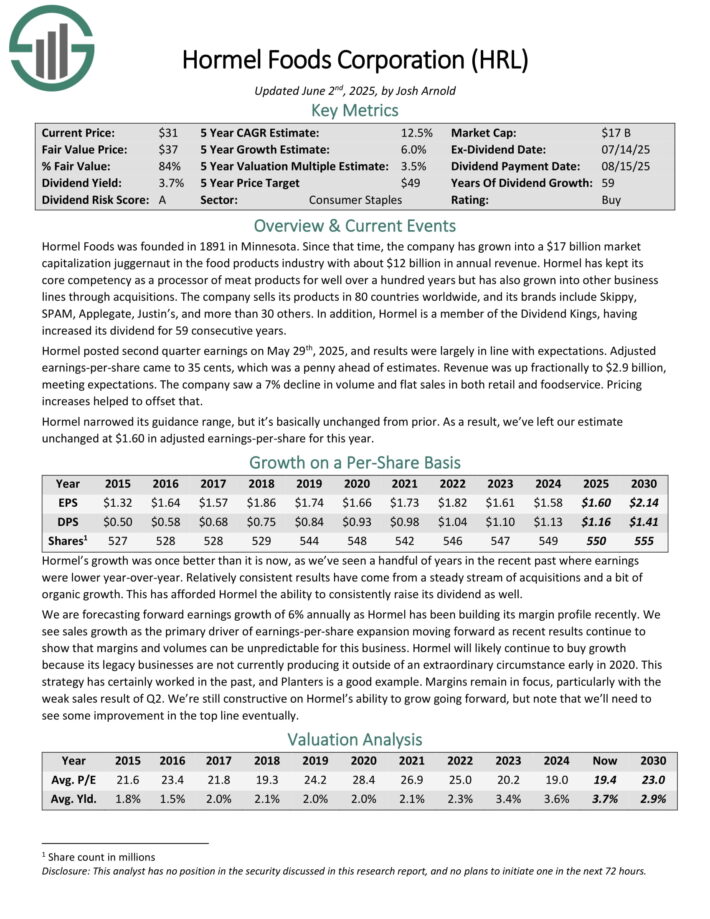

Prime Retirement Revenue Inventory: PepsiCo Inc. (PEP)

PepsiCo is a worldwide meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 by way of meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July 18th, 2025, PepsiCo introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 in contrast unfavorably to $2.28 the prior 12 months, however this was $0.09 forward of expectations. Foreign money trade lowered income by 1.5% and adjusted earnings-per-share by 5%.

Natural gross sales grew 2.1% for the second quarter. For the interval, quantity for drinks was as soon as once more unchanged whereas meals fell 1.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven beneath):

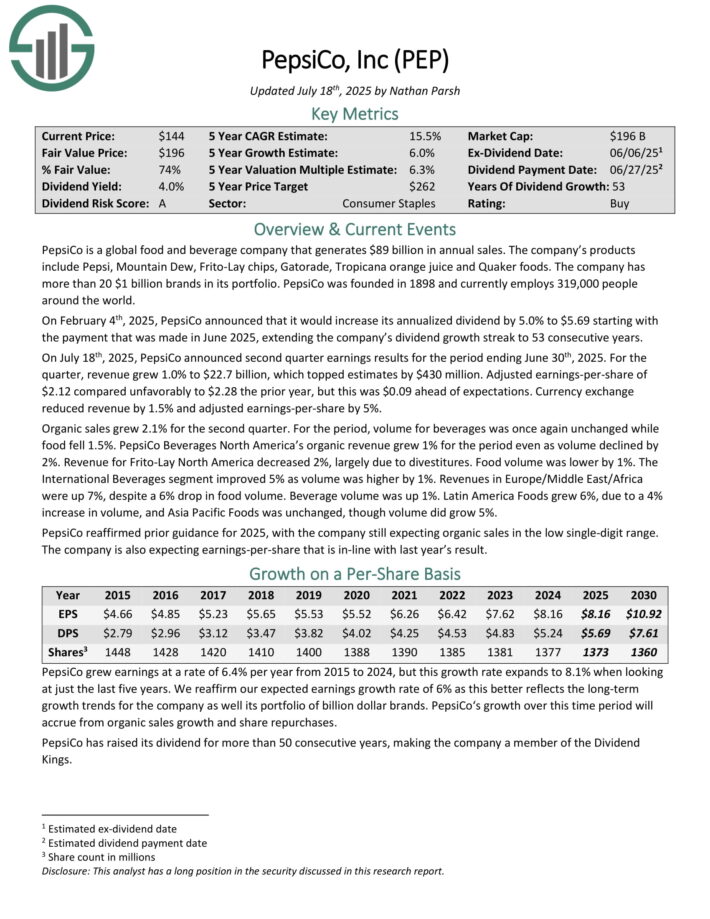

Prime Retirement Revenue Inventory: Hormel Meals (HRL)

Hormel Meals is a juggernaut within the meals merchandise trade with almost $10 billion in annual income. It has a big portfolio of category-leading manufacturers. Just some of its prime manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive development. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s development.

Hormel posted second quarter earnings on Could twenty ninth, 2025, and outcomes had been largely consistent with expectations. Adjusted earnings-per-share got here to 35 cents, which was a penny forward of estimates.

Income was up fractionally to $2.9 billion, assembly expectations. The corporate noticed a 7% decline in quantity and flat gross sales in each retail and foodservice. Pricing will increase helped to offset that.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven beneath):

Prime Retirement Revenue Inventory: Black Hills Corp. (BKH)

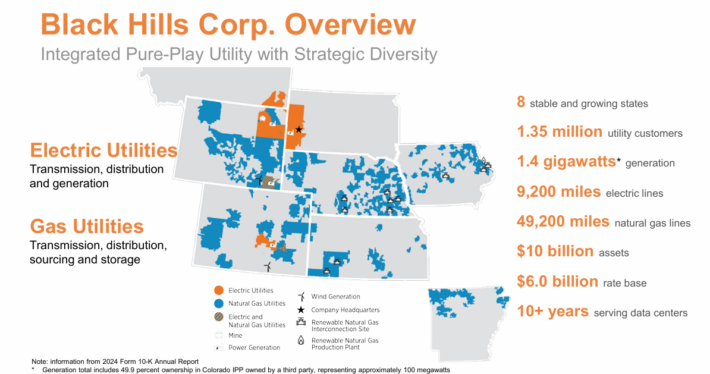

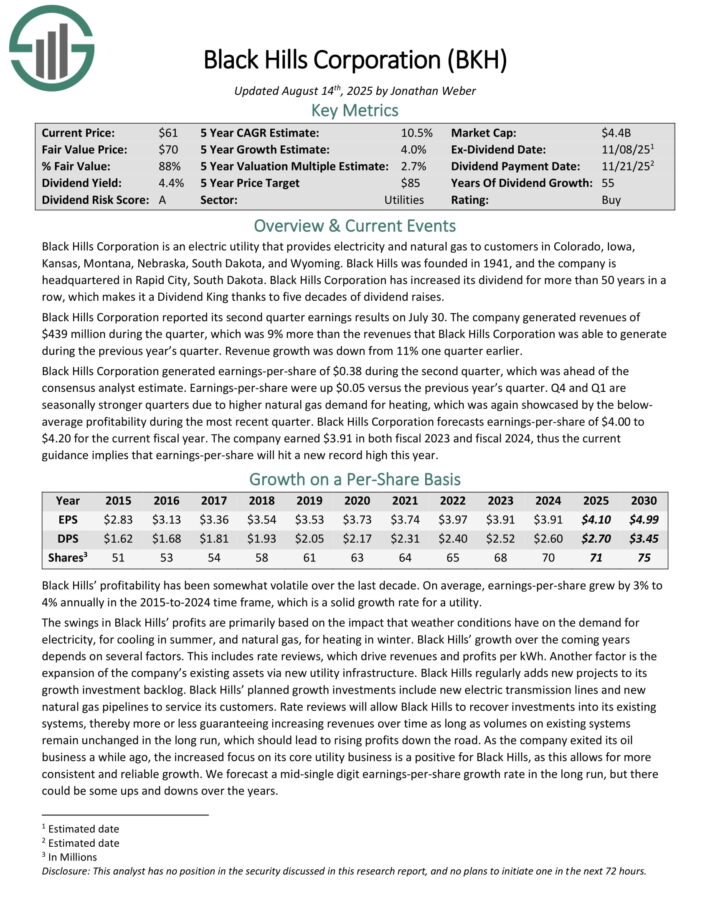

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to prospects in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility prospects in eight states. Its pure gasoline belongings embody 49,200 miles of pure gasoline traces. Individually, it has ~9,200 miles of electrical traces and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Black Hills Company reported its second quarter earnings outcomes on July 30. The corporate generated revenues of $439 million in the course of the quarter, up 9% year-over-year.

Black Hills Company generated earnings-per-share of $0.38 in the course of the second quarter, which was forward of the consensus analyst estimate.

Earnings-per-share had been up $0.05 versus the earlier 12 months’s quarter. This fall and Q1 are seasonally stronger quarters attributable to larger pure gasoline demand for heating.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven beneath):

Prime Retirement Revenue Inventory: Goal Company (TGT)

Goal was based in 1902 and now operates about 1,850 massive field shops, which provide basic merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted first quarter earnings on Could twenty first, 2025, and outcomes had been weak. Earnings got here to $1.30 per share, which missed estimates by 35 cents. Income was additionally 3% decrease from the prior 12 months at $23.8 billion, lacking estimates by $550 million. Merchandise gross sales had been off 3.1% year-over-year, partially offset by a 13.5% improve in different income.

Digital comparable gross sales had been up 4.7%, with same-day supply development of 35%. Power in Drive Up continues to drive these outcomes. Whole comparable gross sales fell 3.8%, and administration famous Goal held or gained market share in simply 15 of its 35 classes.

The corporate is investing closely in its enterprise in an effort to navigate by the altering panorama within the retail sector. The payout is now 61% of earnings for this 12 months, which is elevated from historic ranges, however the dividend stays well-covered.

Goal’s aggressive benefit comes from its on a regular basis low costs on enticing merchandise in its guest-friendly shops.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

Prime Retirement Revenue Inventory: Northwest Pure Holding (NWN)

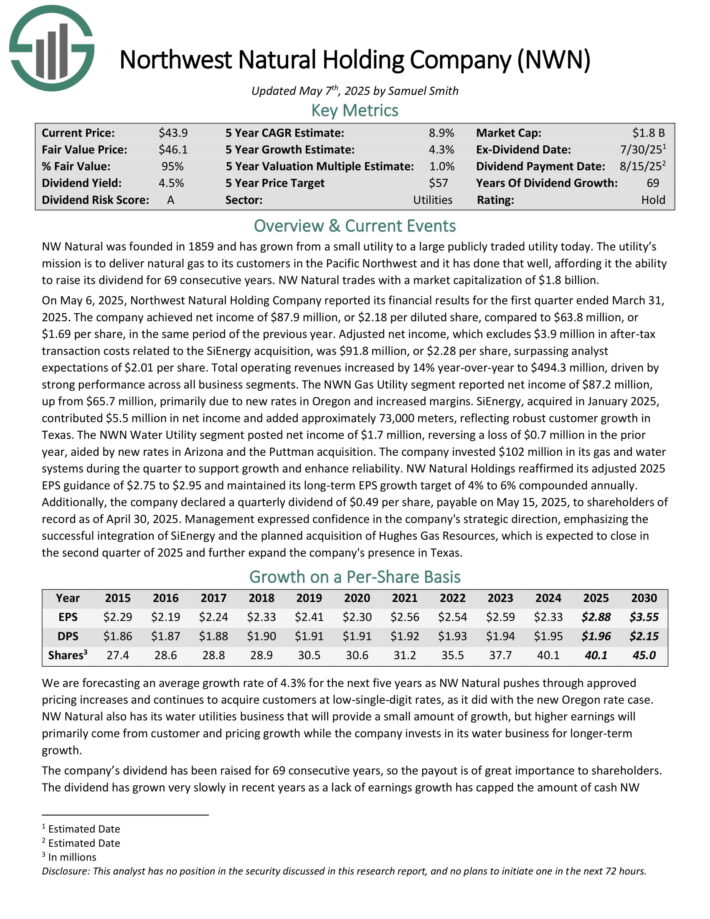

NW Pure was based in 1859 and has grown from only a handful of consumers to serving greater than 760,000 in the present day. The utility’s mission is to ship pure gasoline to its prospects within the Pacific Northwest.

Supply: Investor Presentation

On Could 6, 2025, Northwest Pure Holding Firm reported its monetary outcomes for the primary quarter ended March 31, 2025. The corporate achieved web earnings of $87.9 million, or $2.18 per diluted share, in comparison with $63.8 million, or $1.69 per share, in the identical interval of the earlier 12 months.

Adjusted web earnings, which excludes $3.9 million in after-tax transaction prices associated to the SiEnergy acquisition, was $91.8 million, or $2.28 per share, surpassing analyst expectations of $2.01 per share. Whole working revenues elevated by 14% year-over-year to $494.3 million, pushed by sturdy efficiency throughout all enterprise segments.

The NWN Fuel Utility phase reported web earnings of $87.2 million, up from $65.7 million, primarily attributable to new charges in Oregon and elevated margins. SiEnergy, acquired in January 2025, contributed $5.5 million in web earnings and added roughly 73,000 meters, reflecting sturdy buyer development in Texas.

The NWN Water Utility phase posted web earnings of $1.7 million, reversing a lack of $0.7 million within the prior 12 months, aided by new charges in Arizona and the Puttman acquisition.

NW Pure Holdings reaffirmed its adjusted 2025 EPS steering of $2.75 to $2.95.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWN (preview of web page 1 of three proven beneath):

Last Ideas

Screening to seek out the very best Dividend Kings shouldn’t be the one strategy to discover high-quality dividend development inventory concepts.

Certain Dividend maintains comparable databases on the next helpful universes of shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.