Up to date on August twenty eighth, 2025 by Bob Ciura

To spend money on nice companies, you need to discover them first. That’s the place Warren Buffett is available in…

Berkshire Hathaway (BRK.B) has an fairness funding portfolio price roughly $258 billion.

Berkshire Hathaway’s portfolio is crammed with high quality shares. You’ll be able to ‘cheat’ from Warren Buffett shares to seek out picks to your portfolio. That’s as a result of Buffett (and different institutional traders) are required to periodically present their holdings in a 13F Submitting.

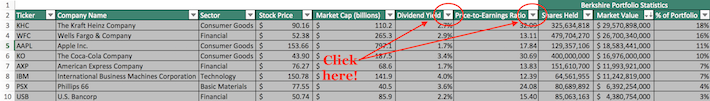

You’ll be able to see all of Warren Buffett’s inventory holdings (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

This text analyzes Warren Buffett’s high 20 shares primarily based on data disclosed within the Q2 2025 13F submitting.

Desk of Contents

You’ll be able to skip to a selected part with the desk of contents beneath. Shares are listed by proportion of the full portfolio, from highest to lowest.

How To Use Warren Buffett Shares To Discover Funding Concepts

Having a database of Warren Buffett shares is extra highly effective when you may have the power to filter it primarily based on vital investing metrics.

That’s why this text’s Excel obtain is so helpful…

It means that you can search Warren Buffett shares to seek out dividend funding concepts that match your particular portfolio.

For these of you unfamiliar with Excel, this part will present you how you can filter Warren Buffett shares for 2 vital investing metrics – price-to-earnings ratio and dividend yield.

Step 1: Click on on the filter icon within the column for dividend yield or price-to-earnings ratio.

Step 2: Filter every metric to seek out high-quality shares. Two examples are supplied beneath.

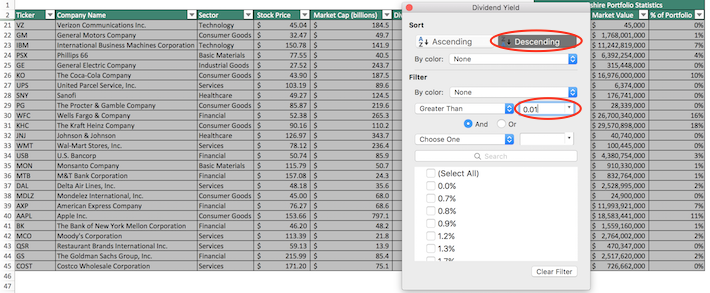

Instance 1: To seek out shares with dividend yields above 1% and listing them in descending order, click on the ‘Dividend Yield’ filter and do the next:

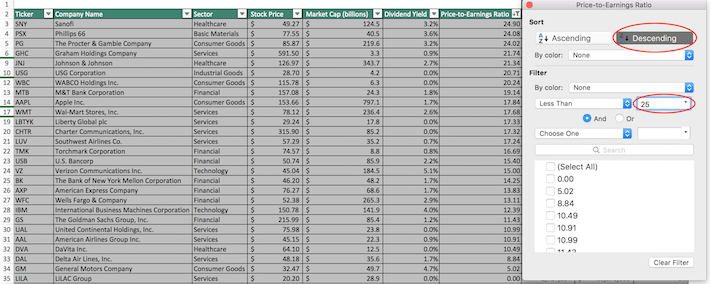

Instance 2: To seek out shares with price-to-earnings ratios beneath 25 and listing them in descending order, click on the ‘Worth-to-Earnings Ratio’ filter and do the next:

Warren Buffett & Dividend Shares

Buffett has grown his wealth by investing in and buying companies with sturdy aggressive benefits buying and selling at truthful or higher costs.

Most traders know Warren Buffett seems to be for high quality, however few know the diploma to which he invests in dividend shares:

All of Warren Buffett’s high 10 shares pay dividends

His high 5 holdings have a mean dividend yield of ~2.2% (and make up 70% of his portfolio)

Lots of his dividend shares have paid rising dividends over many years

Warren Buffett prefers to spend money on shareholder-friendly companies with lengthy observe information of success.

Maintain studying this text to see Warren Buffett’s 20 highest conviction inventory alternatives analyzed. These are the 20 shares with the best worth (most weight) in Berkshire Hathaway’s portfolio.

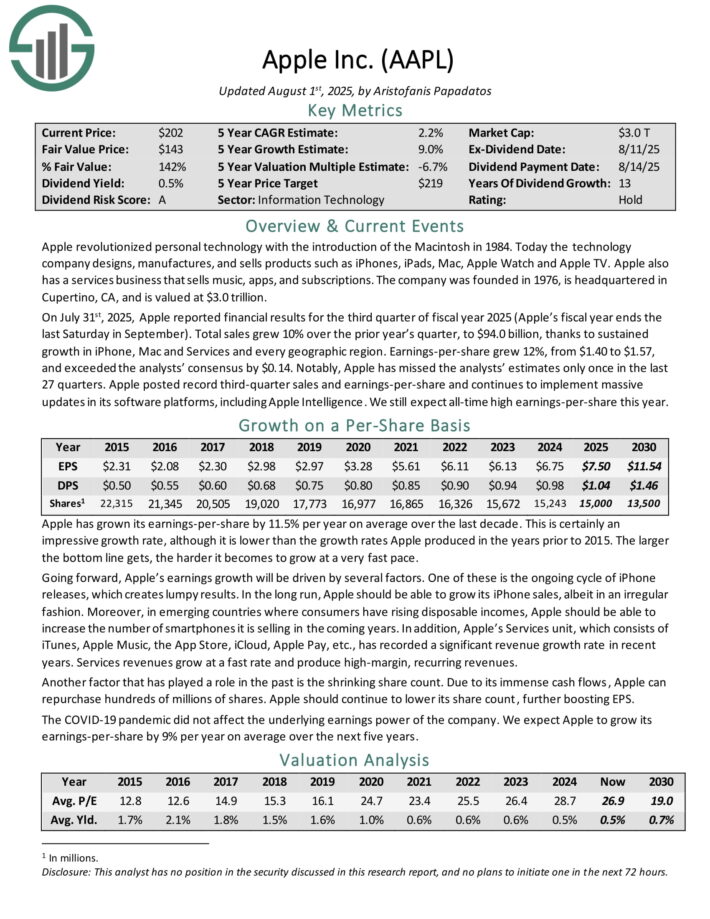

#1: Apple, Inc. (AAPL)

Dividend Yield: 0.4percent% of Warren Buffett’s Portfolio: 22.31%

Apple is Berkshire’s largest place by far, due largely to Apple’s superb rally over the previous few years.

The know-how firm designs, manufactures and sells merchandise comparable to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a providers enterprise that sells music, apps, and subscriptions.

Apple can also be a high holding of different influential traders, comparable to Kevin O’Leary.

On July thirty first, 2025, Apple reported monetary outcomes for the third quarter of fiscal 12 months 2025. Whole gross sales grew 10% over the prior 12 months’s quarter, to $94.0 billion, because of sustained progress in iPhone, Mac and Companies and each geographic area. Earnings-per-share grew 12%, from $1.40 to $1.57, and exceeded the analysts’ consensus by $0.14.

Notably, Apple has missed the analysts’ estimates solely as soon as within the final 27 quarters. Apple posted document third-quarter gross sales and earnings-per-share.

Going ahead, Apple’s earnings progress can be pushed by a number of components. Considered one of these is the continued cycle of iPhone releases, which creates lumpy outcomes. In the long term, Apple ought to have the ability to develop its iPhone gross sales, albeit in an irregular trend.

Furthermore, in rising nations the place shoppers have rising disposable incomes, Apple ought to have the ability to enhance the variety of smartphones it’s promoting within the coming years.

As well as, Apple’s Companies unit, which consists of iTunes, Apple Music, the App Retailer, iCloud, Apple Pay, and many others., has recorded a major income progress price in recent times. Companies revenues develop at a quick price and produce high-margin, recurring revenues.

Click on right here to obtain our most up-to-date Positive Evaluation report on AAPL (preview of web page 1 of three proven beneath):

#2: American Categorical Firm (AXP)

Dividend Yield: 1.0percent% of Warren Buffett’s Portfolio: 18.78%

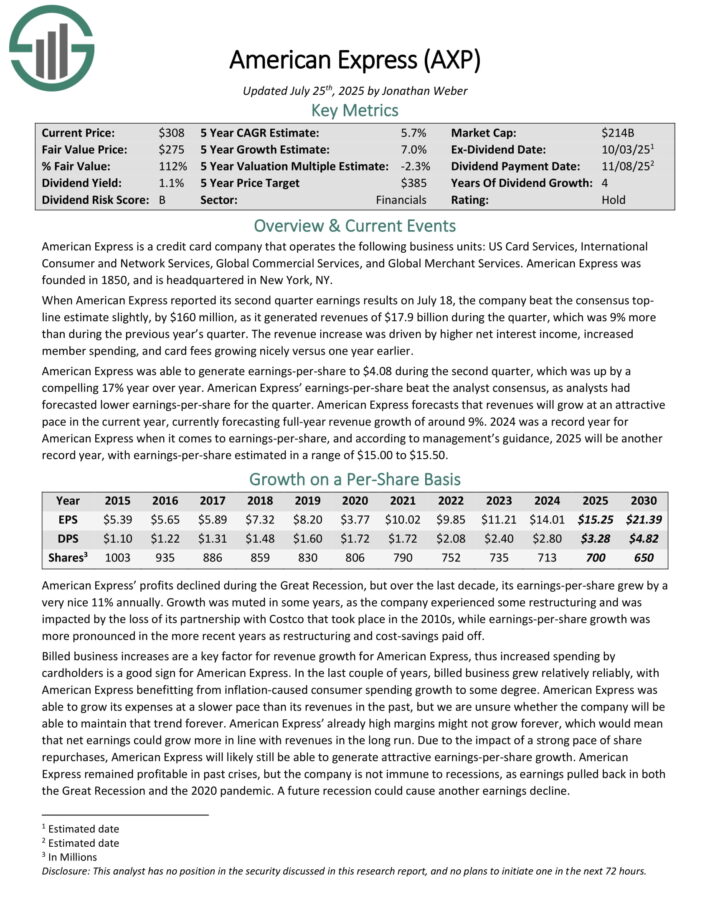

American Categorical is one in all Berkshire’s longest-held shares. American Categorical is a bank card firm that operates the next enterprise models: US Card Companies, Worldwide Client and Community Companies, International Business Companies, and International Service provider Companies. American Categorical was based in 1850.

When American Categorical reported its second quarter earnings outcomes on July 18, the corporate beat the consensus topline estimate barely, by $160 million, because it generated revenues of $17.9 billion in the course of the quarter, which was 9% greater than in the course of the earlier 12 months’s quarter. The income enhance was pushed by greater internet curiosity earnings, elevated member spending, and card charges rising properly versus one 12 months earlier.

American Categorical was capable of generate earnings-per-share to $4.08 in the course of the second quarter, which was up by a compelling 17% 12 months over 12 months. American Categorical’ earnings-per-share beat the analyst consensus, as analysts had forecasted decrease earnings-per-share for the quarter.

American Categorical forecasts that revenues will develop at a sexy tempo within the present 12 months, at the moment forecasting full-year income progress of round 9%. 2024 was a document 12 months for American Categorical relating to earnings-per-share, and in line with administration’s steerage, 2025 can be one other document 12 months, with earnings-per-share estimated in a spread of $15.00 to $15.50

Click on right here to obtain our most up-to-date Positive Evaluation report on American Categorical (preview of web page 1 of three proven beneath):

#3: Financial institution of America Company (BAC)

Dividend Yield: 2.2percent% of Warren Buffett’s Portfolio: 11.12%

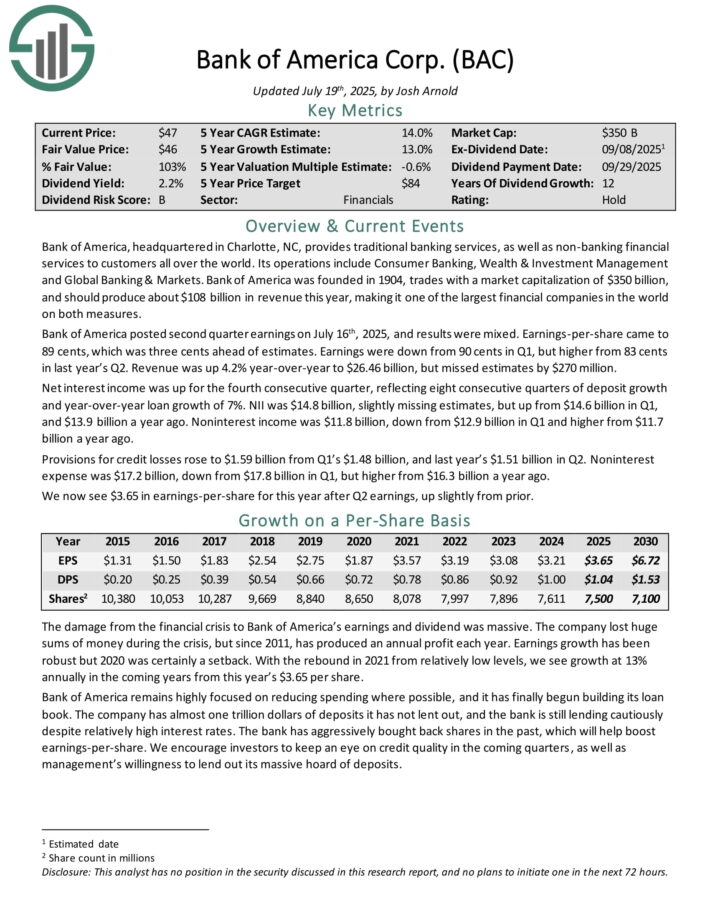

Financial institution of America, headquartered in Charlotte, NC, offers conventional banking providers, in addition to non–banking monetary providers to clients throughout the world. Its operations embody Client Banking, Wealth & Funding Administration and International Banking & Markets.

Financial institution of America posted second quarter earnings on July sixteenth, 2025, and outcomes have been combined. Earnings-per-share got here to 89 cents, which was three cents forward of estimates. Earnings have been down from 90 cents in Q1, however greater from 83 cents in final 12 months’s Q2. Income was up 4.2% year-over-year to $26.46 billion, however missed estimates by $270 million.

Internet curiosity earnings was up for the fourth consecutive quarter, reflecting eight consecutive quarters of deposit progress and year-over-year mortgage progress of seven%. NII was $14.8 billion, barely lacking estimates, however up from $14.6 billion in Q1, and $13.9 billion a 12 months in the past. Noninterest earnings was $11.8 billion, down from $12.9 billion in Q1 and better from $11.7 billion a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on Financial institution of America (preview of web page 1 of three proven beneath):

#4: The Coca-Cola Firm (KO)

Dividend Yield: 3.0percent% of Warren Buffett’s Portfolio: 10.99%

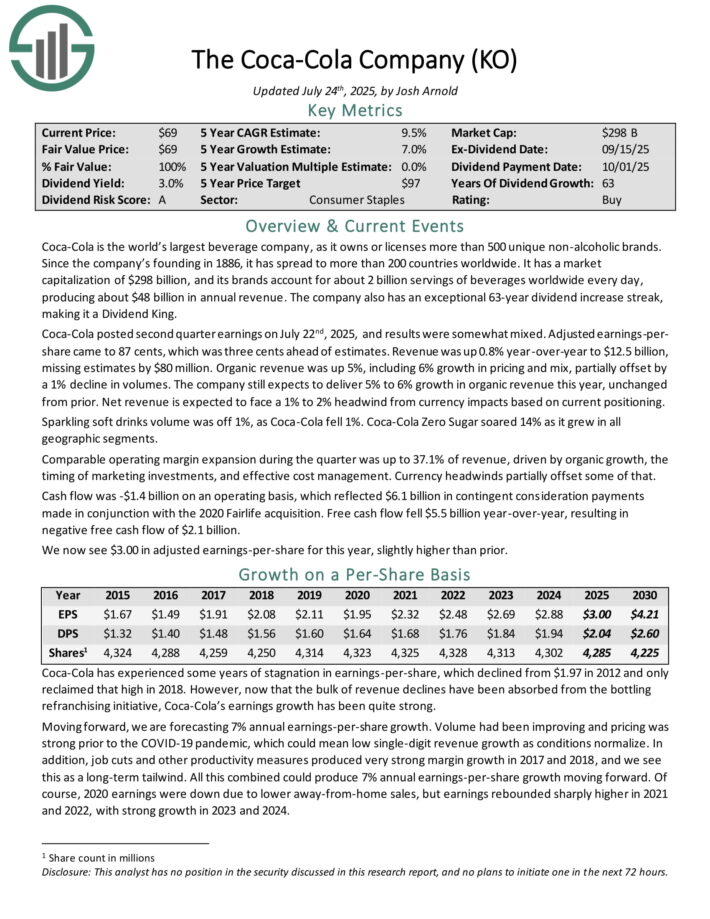

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. For the reason that firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

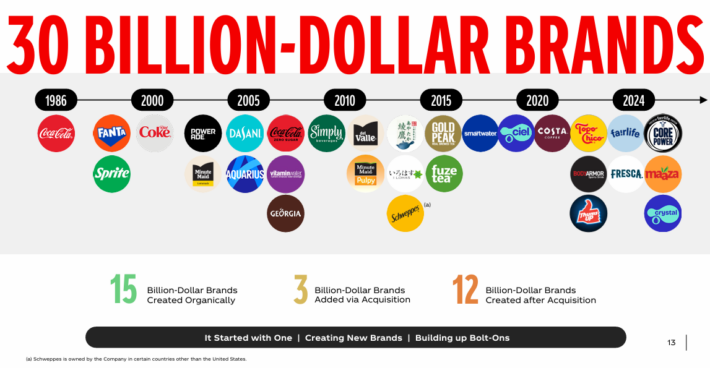

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate not less than $1 billion in annual gross sales.

Supply: Investor Presentation

Coca-Cola posted second quarter earnings on July twenty second, 2025, and outcomes have been considerably combined. Adjusted earnings-per-share got here to 87 cents, which was three cents forward of estimates. Income was up 0.8% year-over-year to $12.5 billion, lacking estimates by $80 million.

Natural income was up 5%, together with 6% progress in pricing and blend, partially offset by a 1% decline in volumes. The corporate nonetheless expects to ship 5% to six% progress in natural income this 12 months, unchanged from prior. Internet income is anticipated to face a 1% to 2% headwind from forex impacts primarily based on present positioning.

Glowing comfortable drinks quantity was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% because it grew in all geographic segments. Comparable working margin growth in the course of the quarter was as much as 37.1% of income, pushed by natural progress, the timing of promoting investments, and efficient price administration. Forex headwinds partially offset a few of that..

Click on right here to obtain our most up-to-date Positive Evaluation report on KO (preview of web page 1 of three proven beneath):

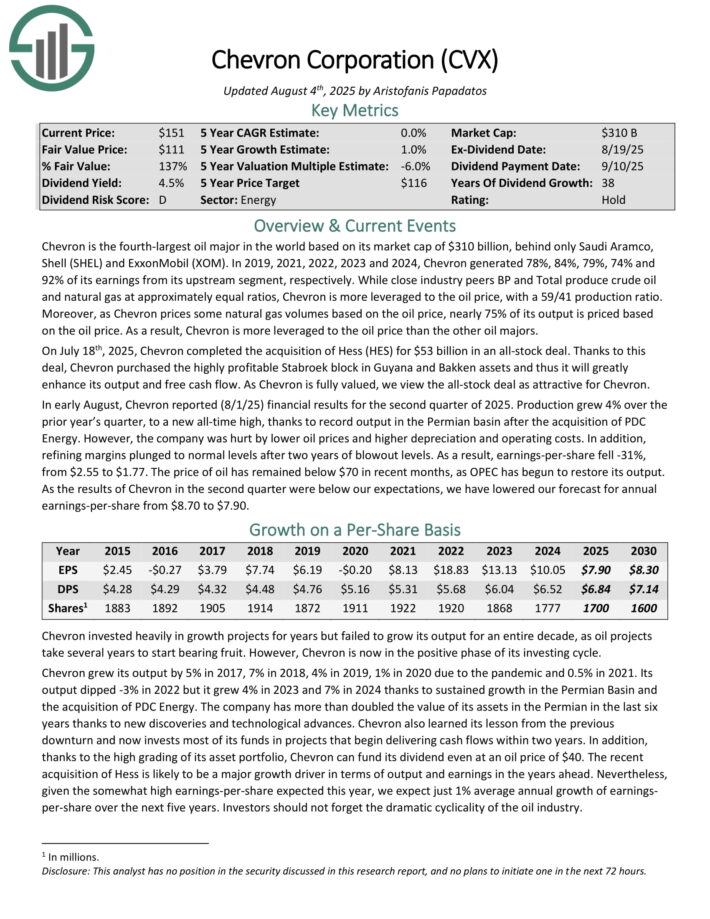

#5: Chevron Company (CVX)

Dividend Yield: 4.3percent% of Warren Buffett’s Portfolio: 6.79%

Chevron is the fourth-largest oil main on the earth primarily based on market cap. Chevron costs some pure fuel volumes primarily based on the oil value, which means practically 75% of its output is priced primarily based on the oil value. In consequence, Chevron is extra leveraged to the oil value than the opposite oil majors.

Chevron has elevated its dividend for 38 consecutive years, inserting it on the Dividend Aristocrats listing.

In early August, Chevron reported (8/1/25) monetary outcomes for the second quarter of 2025. Manufacturing grew 4% over the prior 12 months’s quarter, to a brand new all-time excessive, because of document output within the Permian basin after the acquisition of PDC Power. Nonetheless, the corporate was damage by decrease oil costs and better depreciation and working prices.

As well as, refining margins plunged to regular ranges after two years of blowout ranges. In consequence, earnings-per-share fell -31%, from $2.55 to $1.77.

The value of oil has remained beneath $70 in current months, as OPEC has begun to revive its output.

Chevron’s output dipped -3% in 2022 but it surely grew 4% in 2023 and seven% in 2024 because of sustained progress within the Permian Basin and the acquisition of PDC Power. The corporate has greater than doubled the worth of its property within the Permian within the final six years because of new discoveries and technological advances.

Click on right here to obtain our most up-to-date Positive Evaluation report on Chevron Company (CVX) (preview of web page 1 of three proven beneath):

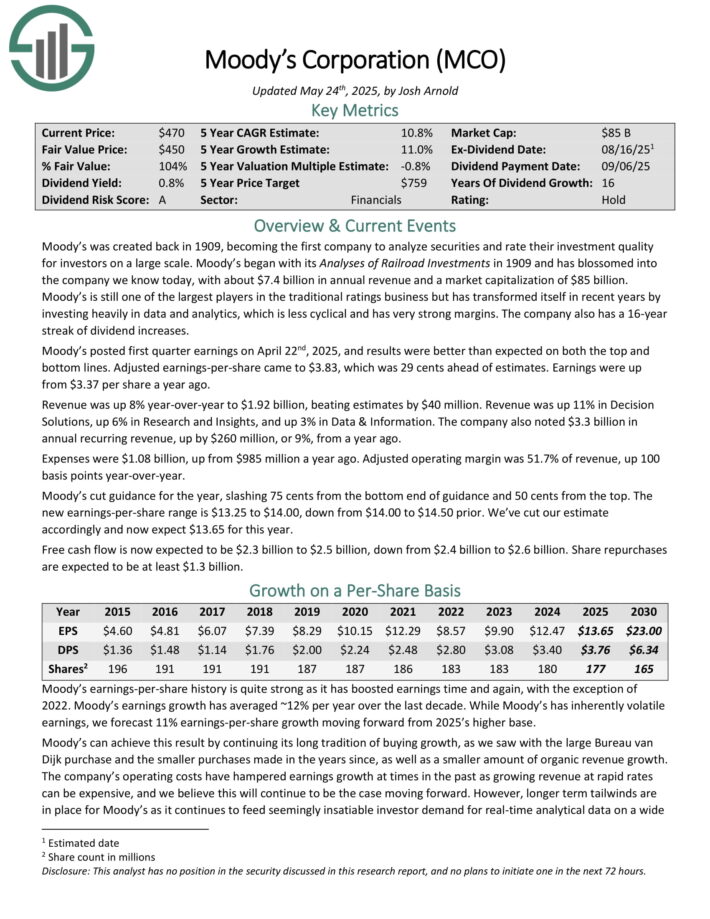

#6: Moody’s Company (MCO)

Dividend Yield: 0.7percent% of Warren Buffett’s Portfolio: 4.81%

Moody’s was created again in 1909, turning into the primary firm to investigate securities and price their funding high quality for traders on a big scale. Moody’s started with its Analyses of Railroad Investments in 1909 and has blossomed into the corporate we all know at this time, with over $6 billion in annual income.

Moody’s posted first quarter earnings on April twenty second, 2025, and outcomes have been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $3.83, which was 29 cents forward of estimates. Earnings have been up from $3.37 per share a 12 months in the past.

Income was up 8% year-over-year to $1.92 billion, beating estimates by $40 million. Income was up 11% in Determination Options, up 6% in Analysis and Insights, and up 3% in Knowledge & Info. The corporate additionally famous $3.3 billion in annual recurring income, up by $260 million, or 9%, from a 12 months in the past.

Bills have been $1.08 billion, up from $985 million a 12 months in the past. Adjusted working margin was 51.7% of income, up 100 foundation factors year-over-year.Moody’s minimize steerage for the 12 months, slashing 75 cents from the underside finish of steerage and 50 cents from the highest. The brand new earnings-per-share vary is $13.25 to $14.00, down from $14.00 to $14.50 prior. We’ve minimize our estimate accordingly and now anticipate $13.65 for this 12 months.

Free money movement is now anticipated to be $2.3 billion to $2.5 billion, down from $2.4 billion to $2.6 billion. Share repurchases are anticipated to be not less than $1.3 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on Moody’s (preview of web page 1 of three proven beneath):

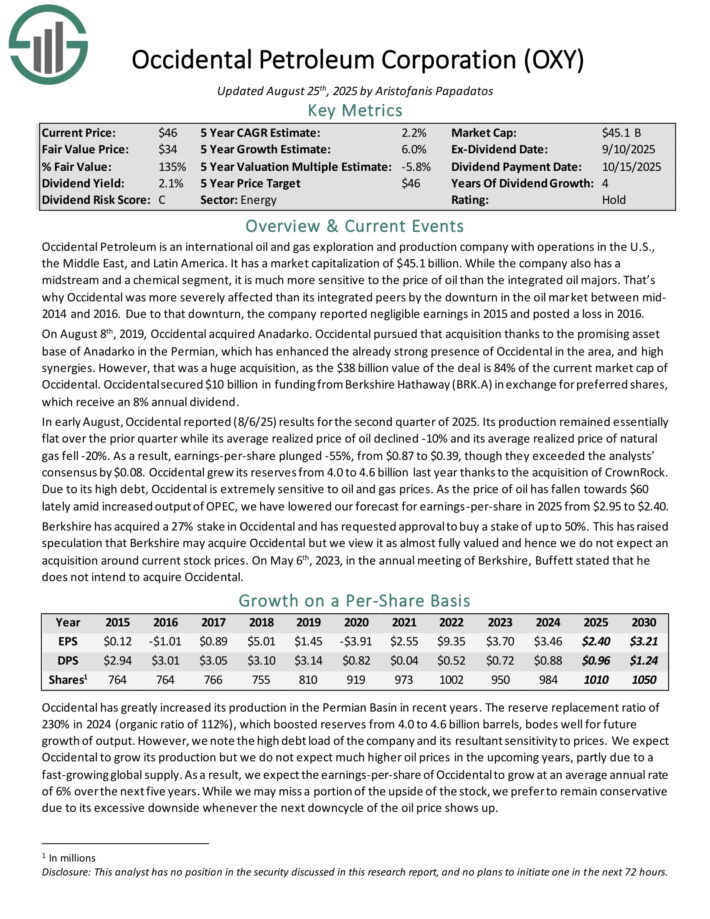

#7: Occidental Petroleum (OXY)

Dividend Yield: 2.1percent% of Warren Buffett’s Portfolio: 4.32%

Occidental Petroleum is a world oil and fuel exploration and manufacturing firm with operations within the U.S., the Center East, and Latin America. Whereas the corporate additionally has a midstream and a chemical section, it’s rather more delicate to the value of oil than the built-in oil majors.

In early August, Occidental reported (8/6/25) outcomes for the second quarter of 2025. Its manufacturing remained basically flat over the prior quarter whereas its common realized value of oil declined -10% and its common realized value of pure fuel fell -20%.

In consequence, earnings-per-share plunged -55%, from $0.87 to $0.39, although they exceeded the analysts’ consensus by $0.08. Occidental grew its reserves from 4.0 to 4.6 billion final 12 months because of the acquisition of CrownRock.

Because of its excessive debt, Occidental is extraordinarily delicate to grease and fuel costs. As the value of oil has fallen in direction of $60 these days amid elevated output of OPEC, we’ve lowered our forecast for earnings-per-share in 2025 from $2.95 to $2.40.

Click on right here to obtain our most up-to-date Positive Evaluation report on OXY (preview of web page 1 of three proven beneath):

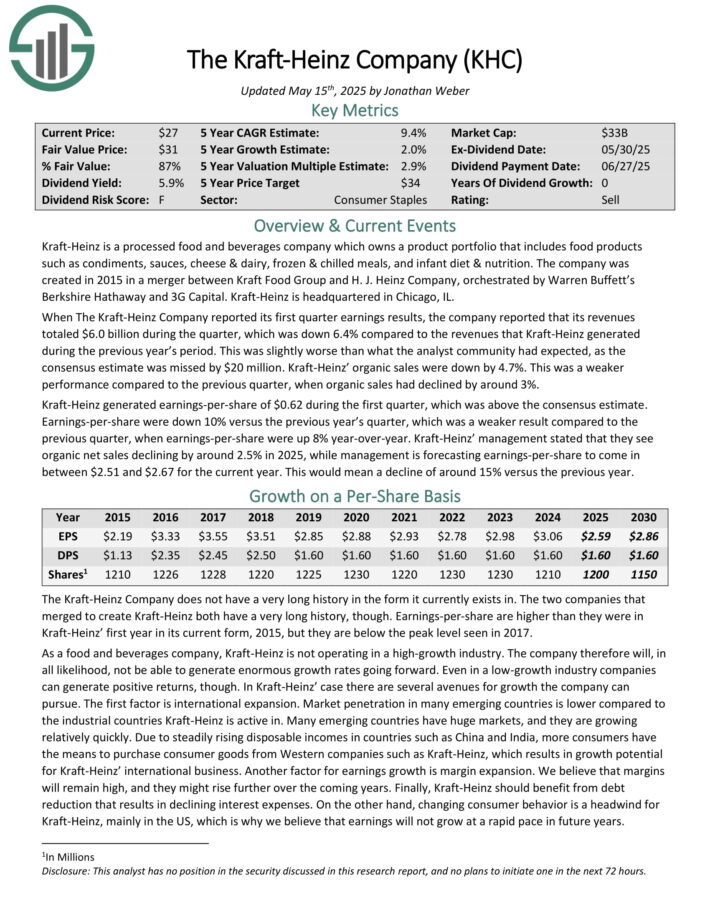

#8: The Kraft-Heinz Firm (KHC)

Dividend Yield: 5.7percent% of Warren Buffett’s Portfolio: 3.26%

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise comparable to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler weight loss program & vitamin.

When The Kraft-Heinz Firm reported its first quarter earnings outcomes, the corporate reported that its revenues totaled $6.0 billion in the course of the quarter, which was down 6.4% in comparison with the revenues that Kraft-Heinz generated in the course of the earlier 12 months’s interval.

This was barely worse than what the analyst group had anticipated, because the consensus estimate was missed by $20 million. Kraft-Heinz’ natural gross sales have been down by 4.7%.

Kraft-Heinz generated earnings-per-share of $0.62 in the course of the first quarter, which was above the consensus estimate. Earnings-per-share have been down 10% versus the earlier 12 months’s quarter, which was a weaker outcome in comparison with the earlier quarter, when earnings-per-share have been up 8% year-over-year.

Kraft-Heinz’ administration said that they see natural internet gross sales declining by round 2.5% in 2025, whereas administration is forecasting earnings-per-share to come back in between $2.51 and $2.67 for the present 12 months. This may imply a decline of round 15% versus the earlier 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on KHC (preview of web page 1 of three proven beneath):

#9: Chubb Restricted (CB)

Dividend Yield: 1.4percent% of Warren Buffett’s Portfolio: 3.04%

Chubb Ltd is a worldwide supplier of insurance coverage and reinsurance providers headquartered in Zurich, Switzerland. The corporate offers insurance coverage providers together with property & casualty insurance coverage, accident & medical health insurance, life insurance coverage, and reinsurance.

FFor its fiscal second quarter, Chubb Ltd reported internet earned premiums of $13.1 billion, which was 7% greater than the online earned premiums that Chubb generated in the course of the earlier 12 months’s quarter. Internet written premiums have been up 6% yearover-year within the firm’s International P&C enterprise unit, whereas different enterprise models comparable to Life noticed stable progress as effectively.

Chubb was capable of generate internet funding earnings of $1.57 billion in the course of the quarter, or $1.69 billion after changes, which was up by a pleasant 8% in comparison with the earlier 12 months’s interval.Chubb generated earnings-per-share of $6.14 in the course of the second quarter, which was above the earlier 12 months’s quarter’s stage.

Chubb’s above-average profitability in the course of the quarter might be defined by sturdy premium progress and reasonable disaster losses that didn’t trigger above-average prices in comparison with different quarters.

Because of written premium progress and tailwinds from share repurchases, Chubb’s earnings could possibly be sturdy within the coming quarters, until the corporate feels an affect from above-average disaster losses, which usually aren’t predictable. Chubb’s guide worth was up barely in the course of the interval, ending the quarter at $174.07.

Click on right here to obtain our most up-to-date Positive Evaluation report on Chubb (preview of web page 1 of three proven beneath):

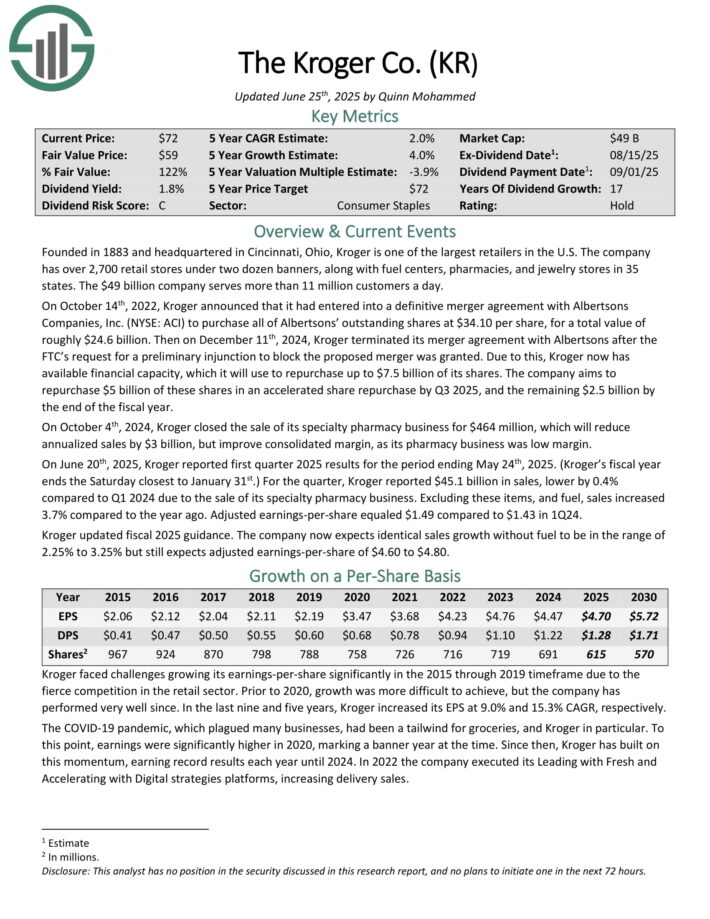

#10: The Kroger Co. (KR)

Dividend Yield: 2.1percent% of Warren Buffett’s Portfolio: 1.39%

Based in 1883 and headquartered in Cincinnati, Ohio, Kroger is one of many largest retailers within the U.S. The corporate has practically 2,800 retail shops below two dozen banners, together with gas facilities, pharmacies and jewellery shops in 35 states.

On June twentieth, 2025, Kroger reported first quarter 2025 outcomes for the interval ending Might twenty fourth, 2025. (Kroger’s fiscal 12 months ends the Saturday closest to January thirty first.) For the quarter, Kroger reported $45.1 billion in gross sales, decrease by 0.4% in comparison with Q1 2024 because of the sale of its specialty pharmacy enterprise.

Excluding these things, and gas, gross sales elevated 3.7% in comparison with the 12 months in the past. Adjusted earnings-per-share equaled $1.49 in comparison with $1.43 in 1Q24.

Kroger up to date fiscal 2025 steerage. The corporate now expects an identical gross sales progress with out gas to be within the vary of two.25% to three.25% however nonetheless expects adjusted earnings-per-share of $4.60 to $4.80.

Click on right here to obtain our most up-to-date Positive Evaluation report on Kroger (preview of web page 1 of three proven beneath):

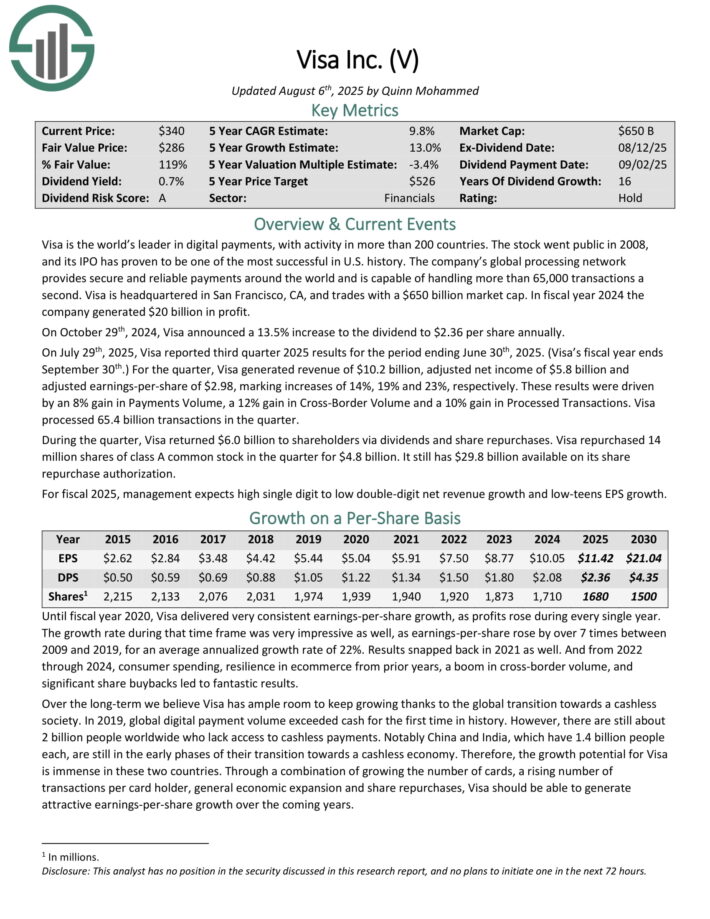

#11: Visa Inc. (V)

Dividend Yield: 0.67percent% of Warren Buffett’s Portfolio: 1.14%

Visa is the world’s chief in digital funds, with exercise in additional than 200 nations. The corporate’s world processing community offers safe and reliable funds around the globe and is able to dealing with greater than 65,000 transactions a second.

On July twenty ninth, 2025, Visa reported third quarter 2025 outcomes for the interval ending June thirtieth, 2025. (Visa’s fiscal 12 months ends September thirtieth.) For the quarter, Visa generated income of $10.2 billion, adjusted internet earnings of $5.8 billion and adjusted earnings-per-share of $2.98, marking will increase of 14%, 19% and 23%, respectively.

These outcomes have been pushed by an 8% achieve in Funds Quantity, a 12% achieve in Cross-Border Quantity and a ten% achieve in Processed Transactions. Visa processed 65.4 billion transactions within the quarter.

Throughout the quarter, Visa returned $6.0 billion to shareholders by way of dividends and share repurchases. Visa repurchased 14 million shares of sophistication A typical inventory within the quarter for $4.8 billion. It nonetheless has $29.8 billion out there on its share repurchase authorization. For fiscal 2025, administration expects excessive single digit to low double-digit internet income progress and low-teens EPS progress.

Click on right here to obtain our most up-to-date Positive Evaluation report on Visa (preview of web page 1 of three proven beneath):

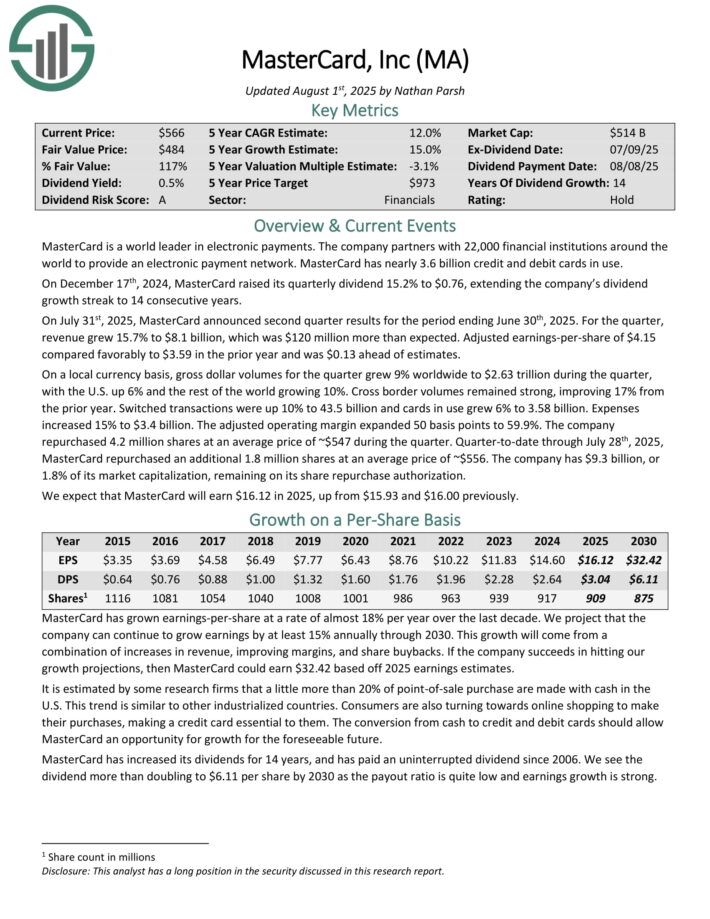

#12: Mastercard Inc. (MA)

Dividend Yield: 0.51percent% of Warren Buffett’s Portfolio: 0.87%

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments around the globe to supply an digital fee community. MasterCard has greater than 3.1 billion credit score and debit playing cards in use.

On July thirty first, 2025, MasterCard introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 15.7% to $8.1 billion, which was $120 million greater than anticipated. Adjusted earnings-per-share of $4.15 in contrast favorably to $3.59 within the prior 12 months and was $0.13 forward of estimates.

On a neighborhood forex foundation, gross greenback volumes for the quarter grew 9% worldwide to $2.63 trillion in the course of the quarter, with the U.S. up 6% and the remainder of the world rising 10%. Cross border volumes remained sturdy, bettering 17% from the prior 12 months.

Switched transactions have been up 10% to 43.5 billion and playing cards in use grew 6% to three.58 billion. Bills elevated 15% to $3.4 billion. The adjusted working margin expanded 50 foundation factors to 59.9%.

The corporate repurchased 4.2 million shares at a mean value of ~$547 in the course of the quarter. Quarter-to-date by way of July twenty eighth, 2025, MasterCard repurchased a further 1.8 million shares at a mean value of ~$556.

Click on right here to obtain our most up-to-date Positive Evaluation report on Mastercard (preview of web page 1 of three proven beneath):

#13: Amazon Inc. (AMZN)

Dividend Yield: N/APercent of Warren Buffett’s Portfolio: 0.85%

Amazon is an enormous tech firm. It’s a web-based retailer that operates an enormous e-commerce platform the place shoppers should buy just about something with their computer systems or smartphones. Amazon is a mega-cap inventory with a market cap above $2 trillion. It operates by way of the next segments:

North America

Worldwide

Amazon Internet Companies

The North America and Worldwide segments embody the worldwide retail platform of client merchandise by way of the corporate’s web sites. The Amazon Internet Companies section sells subscriptions for cloud computing and storage providers to shoppers, start-ups, enterprises, authorities companies, and educational establishments.

Amazon’s e-commerce operations fueled its huge income progress over the previous decade.

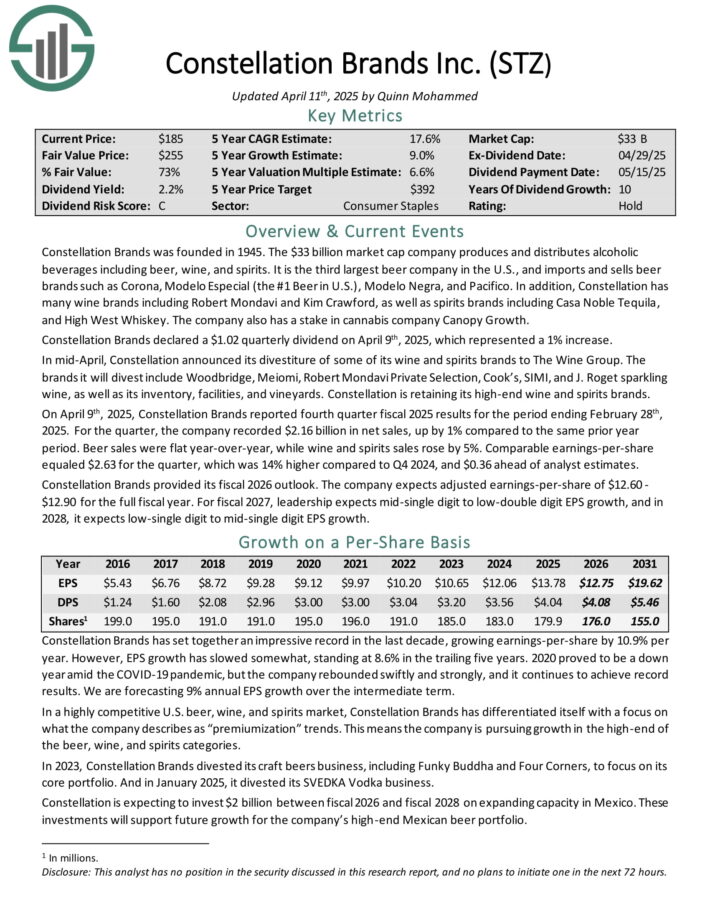

#14: Constellation Manufacturers (STZ)

Dividend Yield: 2.5percent% of Warren Buffett’s Portfolio: 0.85%

Constellation Manufacturers was based in 1945. The $33 billion market cap firm produces and distributes alcoholic drinks together with beer, wine, and spirits. It’s the third largest beer firm within the U.S., and imports and sells beer manufacturers comparable to Corona, Modelo Especial (the #1 Beer in U.S.), Modelo Negra, and Pacifico.

As well as, Constellation has many wine manufacturers together with Robert Mondavi and Kim Crawford, in addition to spirits manufacturers together with Casa Noble Tequila, and Excessive West Whiskey. The corporate additionally has a stake in hashish firm Cover Development.

On April ninth, 2025, Constellation Manufacturers reported fourth quarter fiscal 2025 outcomes for the interval ending February twenty eighth, 2025. For the quarter, the corporate recorded $2.16 billion in internet gross sales, up by 1% in comparison with the identical prior 12 months interval. Beer gross sales have been flat year-over-year, whereas wine and spirits gross sales rose by 5%.

Comparable earnings-per-share equaled $2.63 for the quarter, which was 14% greater in comparison with This autumn 2024, and $0.36 forward of analyst estimates.

Constellation Manufacturers supplied its fiscal 2026 outlook. The corporate expects adjusted earnings-per-share of $12.60 to $12.90 for the total fiscal 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on STZ (preview of web page 1 of three proven beneath):

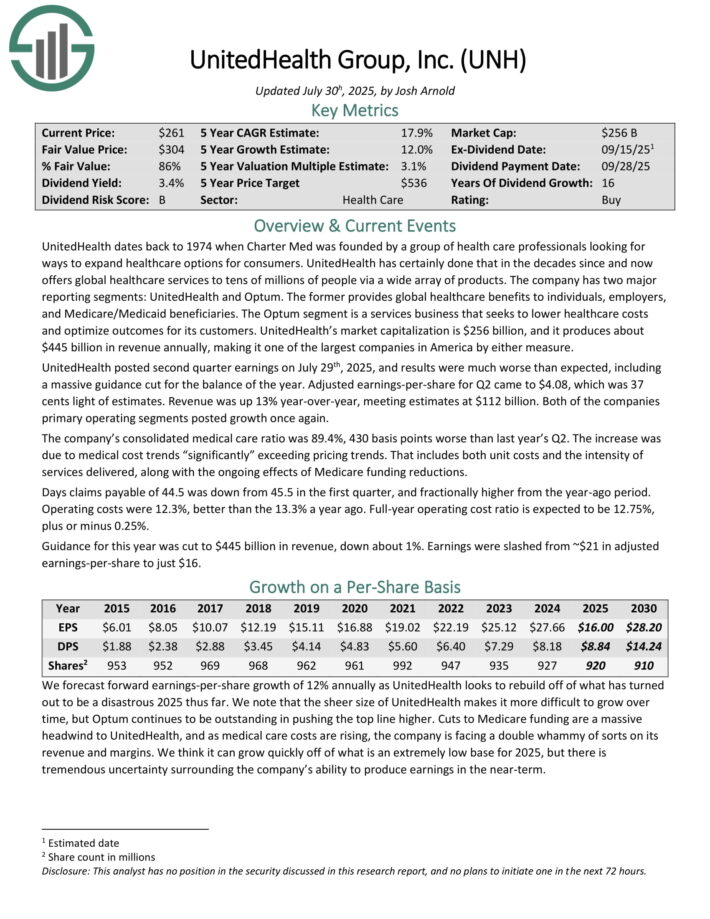

#15: UnitedHealth Group (UNH)

Dividend Yield: 2.9percent% of Warren Buffett’s Portfolio: 0.61%

UnitedHealth dates again to 1974 when Constitution Med was based by a gaggle of well being care professionals in search of methods to increase healthcare choices for shoppers. It produces about $445 billion in income yearly.

The corporate has two main reporting segments: UnitedHealth and Optum. The previous offers world healthcare advantages to people, employers, and Medicare/Medicaid beneficiaries.

The Optum section is a providers enterprise that seeks to decrease healthcare prices and optimize outcomes for its clients.

UnitedHealth posted second quarter earnings on July twenty ninth, 2025, and outcomes have been a lot worse than anticipated, together with an enormous steerage minimize for the stability of the 12 months. Adjusted earnings-per-share for Q2 got here to $4.08, which was 37 cents mild of estimates. Income was up 13% year-over-year, assembly estimates at $112 billion. Each of the businesses main working segments posted progress as soon as once more.

The corporate’s consolidated medical care ratio was 89.4%, 430 foundation factors worse than final 12 months’s Q2. The rise was resulting from medical price traits “considerably” exceeding pricing traits. That features each unit prices and the depth of providers delivered, together with the continued results of Medicare funding reductions.

Days claims payable of 44.5 was down from 45.5 within the first quarter, and fractionally greater from the year-ago interval. Working prices have been 12.3%, higher than the 13.3% a 12 months in the past.

Full-year working price ratio is anticipated to be 12.75%, plus or minus 0.25%. Steering for this 12 months was minimize to $445 billion in income, down about 1%. Earnings have been slashed from ~$21 in adjusted earnings-per-share to only $16.

Click on right here to obtain our most up-to-date Positive Evaluation report on UNH (preview of web page 1 of three proven beneath):

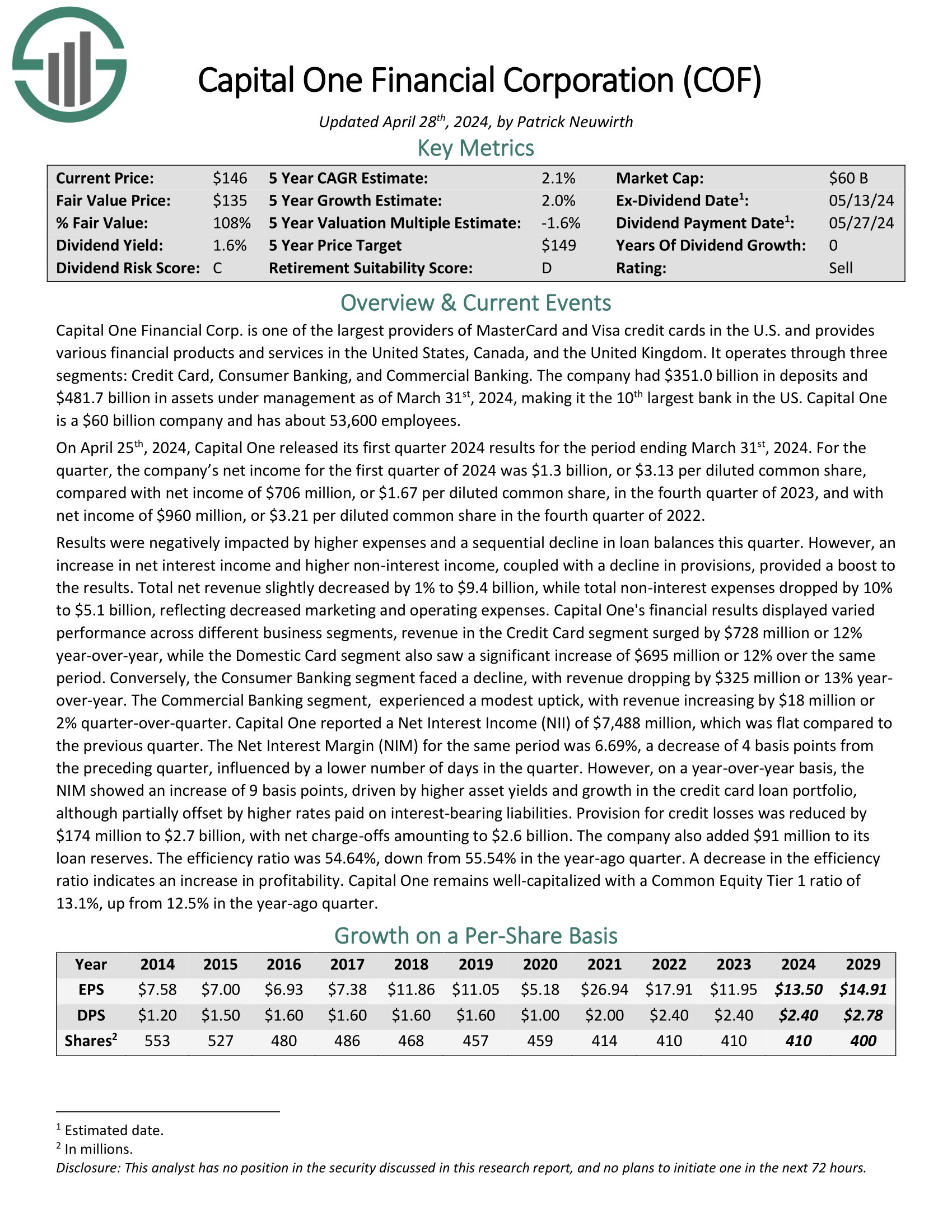

#16: Capital One Monetary (COF)

Dividend Yield: 1.1percent% of Warren Buffett’s Portfolio: 0.59%

Capital One Monetary Corp. is without doubt one of the largest suppliers of MasterCard and Visa bank cards within the U.S. and offers numerous monetary services in the USA, Canada, and the UK. It operates by way of three segments: Credit score Card, Client Banking, and Business Banking.

The corporate had $348.0 billion in deposits and $478 billion in property below administration as of the top of 2023, making it the tenth largest financial institution within the US.

On April twenty fifth, 2024, Capital One launched its first quarter 2024 outcomes for the interval ending March thirty first, 2024. For the quarter, internet earnings was $1.3 billion, or $3.13 per diluted widespread share, in contrast with $1.67 per diluted widespread share, within the fourth quarter of 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on COF (preview of web page 1 of three proven beneath):

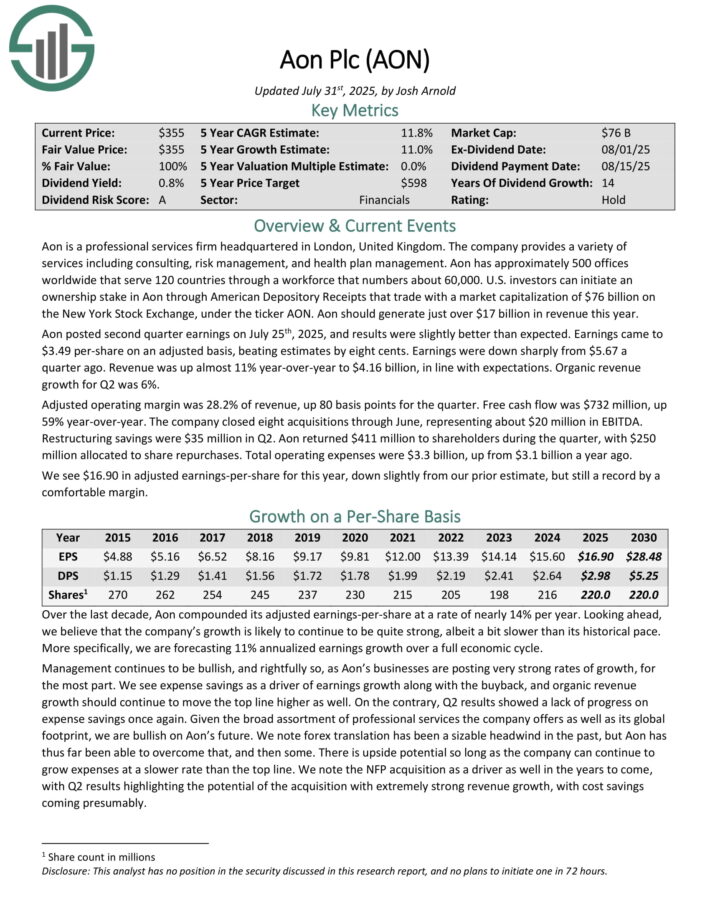

#17: Aon plc (AON)

Dividend Yield: 0.81percent% of Warren Buffett’s Portfolio: 0.57%

Aon is knowledgeable providers agency headquartered in London, United Kingdom. The corporate offers quite a lot of providers together with consulting, danger administration, and well being plan administration.

Aon has roughly 500 places of work worldwide that serve 120 nations by way of a workforce that numbers about 50,000.

Aon posted second quarter earnings on July twenty fifth, 2025, and outcomes have been barely higher than anticipated. Earnings got here to $3.49 per-share on an adjusted foundation, beating estimates by eight cents. Earnings have been down sharply from $5.67 1 / 4 in the past. Income was up virtually 11% year-over-year to $4.16 billion, consistent with expectations. Natural income progress for Q2 was 6%.

Adjusted working margin was 28.2% of income, up 80 foundation factors for the quarter. Free money movement was $732 million, up 59% year-over-year. The corporate closed eight acquisitions by way of June, representing about $20 million in EBITDA.

Restructuring financial savings have been $35 million in Q2. Aon returned $411 million to shareholders in the course of the quarter, with $250 million allotted to share repurchases. Whole working bills have been $3.3 billion, up from $3.1 billion a 12 months in the past. .

Click on right here to obtain our most up-to-date Positive Evaluation report on Aon (preview of web page 1 of three proven beneath):

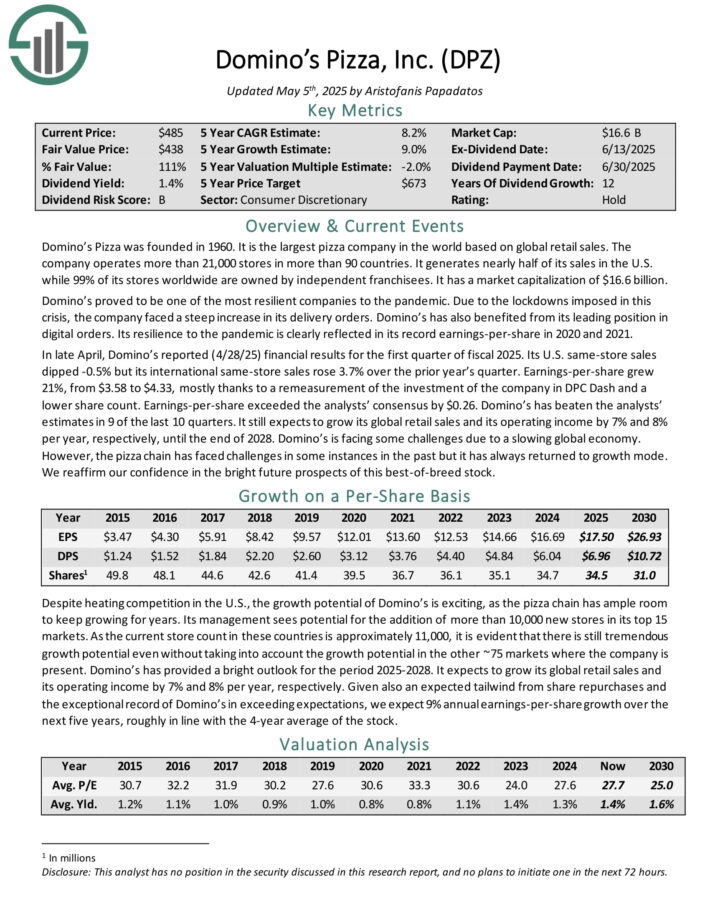

#18: Domino’s Pizza (DPZ)

Dividend Yield: 1.5percent% of Warren Buffett’s Portfolio: 0.46%

Domino’s Pizza was based in 1960. It’s the largest pizza firm on the earth primarily based on world retail gross sales. The corporate operates greater than 21,000 shops in additional than 90 nations.

It generates practically half of its gross sales within the U.S. whereas 99% of its shops worldwide are owned by unbiased franchisees.

In late April, Domino’s reported (4/28/25) monetary outcomes for the primary quarter of fiscal 2025. Its U.S. same-store gross sales dipped -0.5% however its worldwide same-store gross sales rose 3.7% over the prior 12 months’s quarter. Earnings-per-share grew 21%, from $3.58 to $4.33, largely because of a re-measurement of the funding of the corporate in DPC Sprint and a decrease share depend.

Earnings-per-share exceeded the analysts’ consensus by $0.26. Domino’s has crushed the analysts’ estimates in 9 of the final 10 quarters. It nonetheless expects to develop its world retail gross sales and its working earnings by 7% and eight% per 12 months, respectively, till the top of 2028.

Click on right here to obtain our most up-to-date Positive Evaluation report on DPZ (preview of web page 1 of three proven beneath):

.

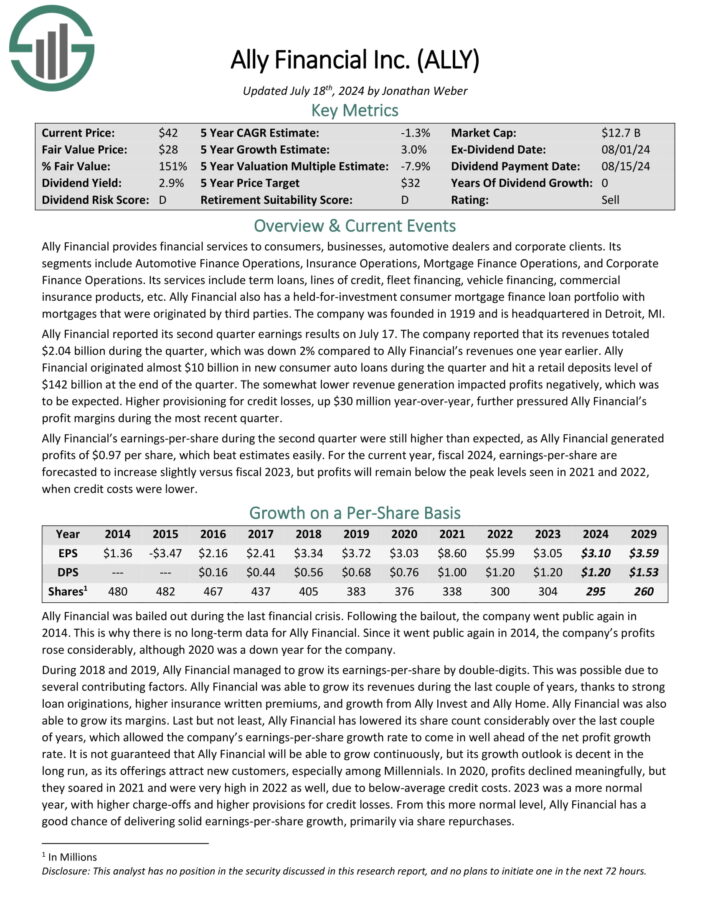

#19: Ally Monetary (ALLY)

Dividend Yield: 2.9percent% of Warren Buffett’s Portfolio: 0.44%

Ally Monetary offers monetary providers to shoppers, companies, automotive sellers and company purchasers. Its segments embody Automotive Finance Operations, Insurance coverage Operations, Mortgage Finance Operations, and Company Finance Operations.

Its providers embody time period loans, traces of credit score, fleet financing, car financing, business insurance coverage merchandise, and many others. Ally Monetary additionally has a held-for-investment client mortgage finance mortgage portfolio with mortgages that have been originated by third events. The corporate was based in 1919 and is headquartered in Detroit, MI.

Ally Monetary reported its second quarter earnings outcomes on July 17. The corporate reported that its revenues totaled $2.04 billion in the course of the quarter, which was down 2% in comparison with Ally Monetary’s revenues one 12 months earlier.

Ally Monetary originated virtually $10 billion in new client auto loans in the course of the quarter and hit a retail deposits stage of $142 billion on the finish of the quarter. The considerably decrease income technology impacted earnings negatively, which was to be anticipated. Larger provisioning for credit score losses, up $30 million year-over-year, additional pressured Ally Monetary’s revenue margins throughout the newest quarter.

Ally Monetary’s earnings-per-share in the course of the second quarter have been nonetheless greater than anticipated, as Ally Monetary generated earnings of $0.97 per share, which beat estimates simply. For the present 12 months, fiscal 2024, earnings-per-share are forecasted to extend barely versus fiscal 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on ALLY (preview of web page 1 of three proven beneath):

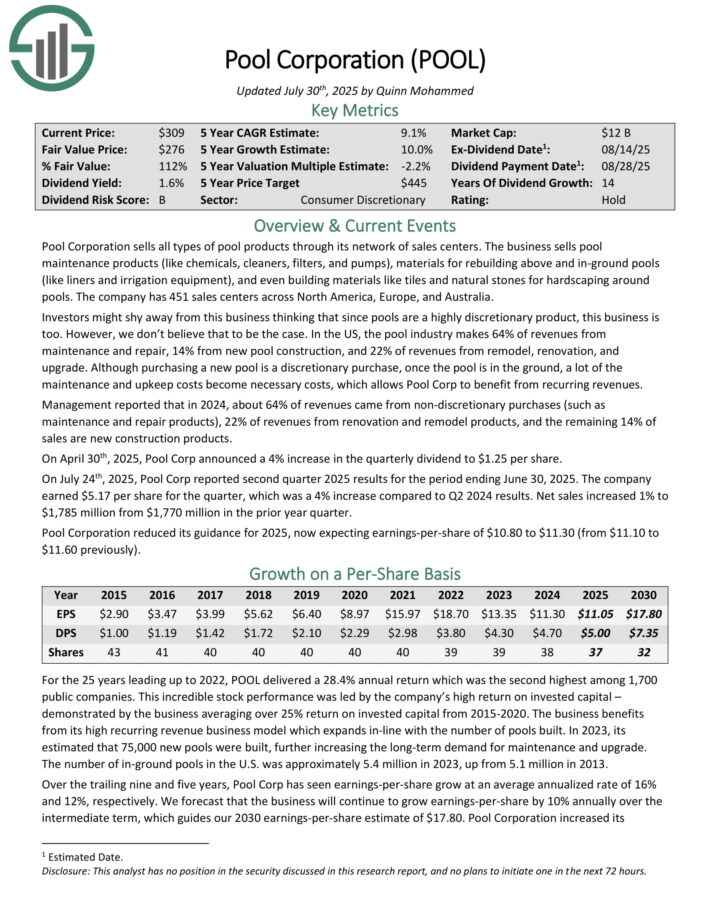

#20: Pool Company (POOL)

Dividend Yield: 1.57percent% of Warren Buffett’s Portfolio: 0.39%

Pool Company sells all forms of pool merchandise by way of its community of gross sales facilities. The enterprise sells pool upkeep merchandise (like chemical substances, cleaners, filters, and pumps), supplies for rebuilding above and in-ground swimming pools (like liners and irrigation gear), and even constructing supplies like tiles and pure stones for hardscaping round swimming pools. The corporate has 451 gross sales facilities throughout North America, Europe, and Australia.

Traders may draw back from this enterprise considering that since swimming pools are a extremely discretionary product, this enterprise is just too. Nonetheless, we don’t consider that to be the case. Within the US, the pool trade makes 64% of revenues from upkeep and restore, 14% from new pool development, and 22% of revenues from rework, renovation, and improve. Though buying a brand new pool is a discretionary buy, as soon as the pool is within the floor, plenty of the upkeep and maintenance prices change into essential prices, which permits Pool Corp to learn from recurring revenues.

Administration reported that in 2024, about 64% of revenues got here from non-discretionary purchases (comparable to upkeep and restore merchandise), 22% of revenues from renovation and rework merchandise, and the remaining 14% of gross sales are new development merchandise.

On April thirtieth, 2025, Pool Corp introduced a 4% enhance within the quarterly dividend to $1.25 per share.

On July twenty fourth, 2025, Pool Corp reported second quarter 2025 outcomes for the interval ending June 30, 2025. The corporate earned $5.17 per share for the quarter, which was a 4% enhance in comparison with Q2 2024 outcomes. Internet gross sales elevated 1% to $1,785 million from $1,770 million within the prior 12 months quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on POOL (preview of web page 1 of three proven beneath):

Closing Ideas

You’ll be able to see the next extra articles concerning Warren Buffett:

Warren Buffett shares signify most of the strongest, most long-lived companies round. You’ll be able to see extra high-quality dividend shares within the following Positive Dividend databases:

You may also be seeking to create a extremely personalized dividend earnings stream to pay for all times’s bills.

The next two lists present helpful data on excessive dividend shares and shares that pay month-to-month dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.