In time, the majority of worth discovery shall be centred in Asia, however that’s a long-term transition.

The American worry commerce nonetheless performs a giant position in gold pricing, and this week options the employment report, US , a meet, the report, the federal government , and a giant tariff tax announcement.

It’s most likely the most important experiences/occasions week of the yr, and the motion begins early Wednesday morning with the ADP report!

Ought to charges be minimize, given the swoon in personal sector employment? A persuasive case could be made to try this.

The QQQ Nasdaq ETF (NASDAQ:) chart. The Fed goes to be reluctant to chop charges with the inventory market hovering.

Foundation the Shiller/CAPE ratio, the SP500 is now the second most overvalued in historical past.

Given the near-insane quantity of institutional hypothesis out there, a case could be made that charges must be hiked fairly than minimize.

So as to add to the chaos, the federal government is demanding cuts whereas including inflationary tariff taxes. How will the Fed act tomorrow… and what does it imply for gold?

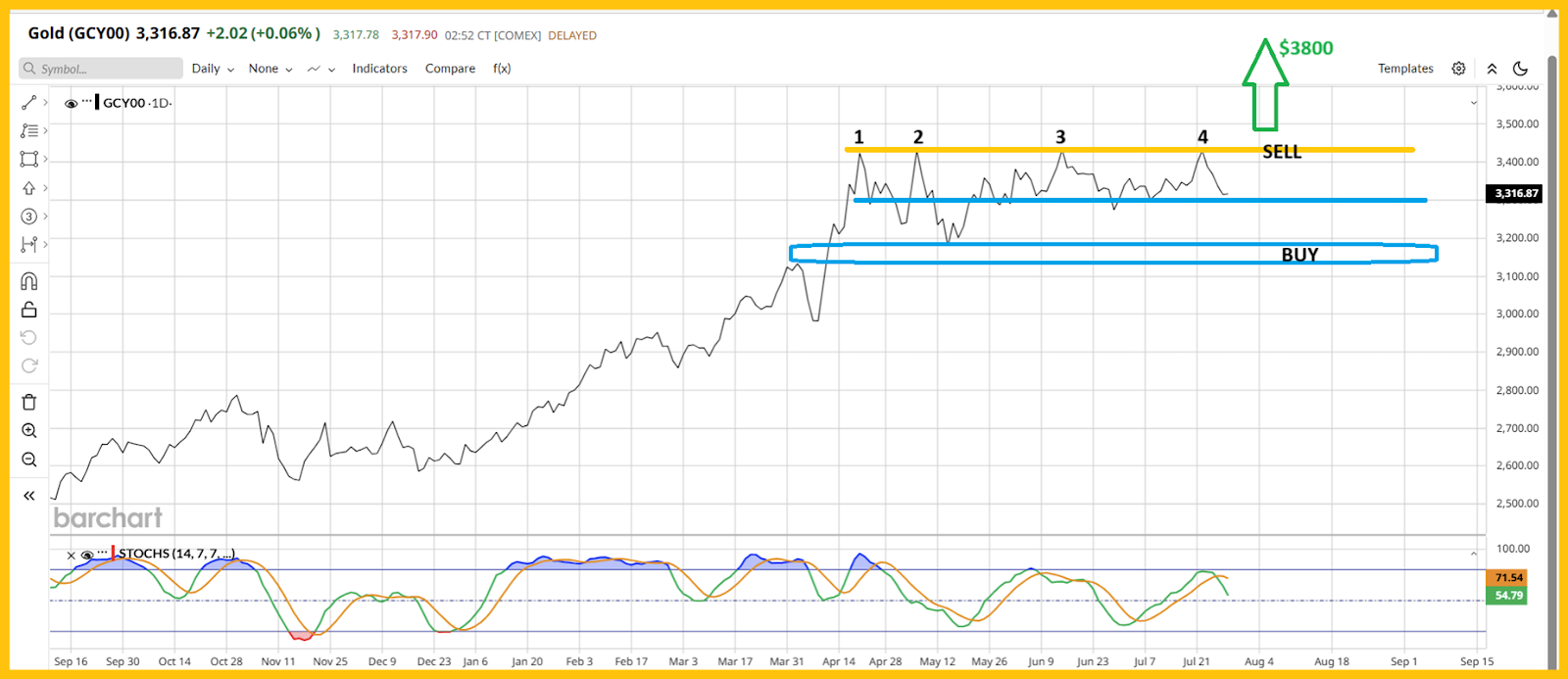

If the Fed cuts and/or Jay offers dovish commentary, gold may rally and break above the important thing $3440 zone.

If there isn’t a minimize and no dovish discuss, there could possibly be a bit extra softness within the worth.

If gold have been to commerce at $3170-$3130 after which rally from there to the $3800 goal zone, traders who purchased gold, silver, and miners into the dip can be handsomely rewarded.

The $3300 space can also be a purchase zone, however it’s best fitted to gamblers and “nibblers”.

The weekly chart. The $3800 goal zone is identical as for the each day chart, and the inverse H&S sample on the Stochastics oscillator (14,5,5 sequence) is “bullishly intriguing”.

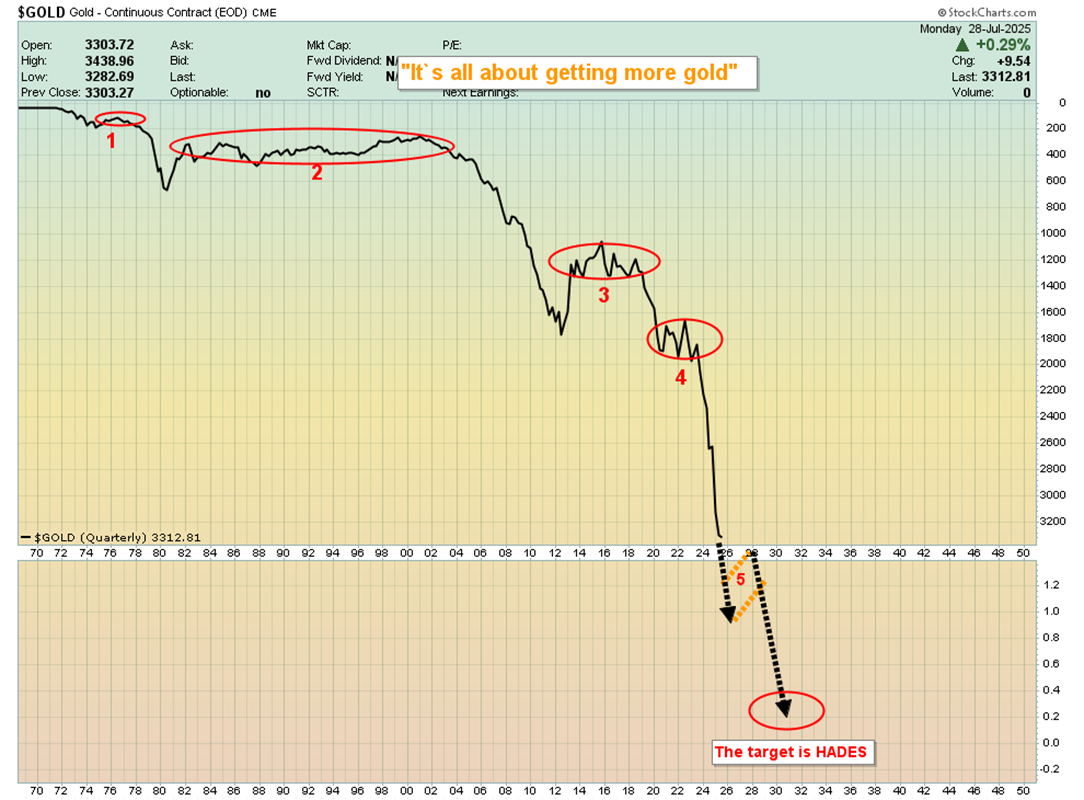

Gold isn’t a inventory, not to mention a “whipping boy” that traders purchase to make “huge fiat earnings”. It’s the world’s best foreign money. In a nutshell, it’s an finish, not a way.

Within the huge supreme foreign money image, it doesn’t matter whether or not gold will backside round $3170 or whether or not yesterday’s low marks the top of the consolidation.

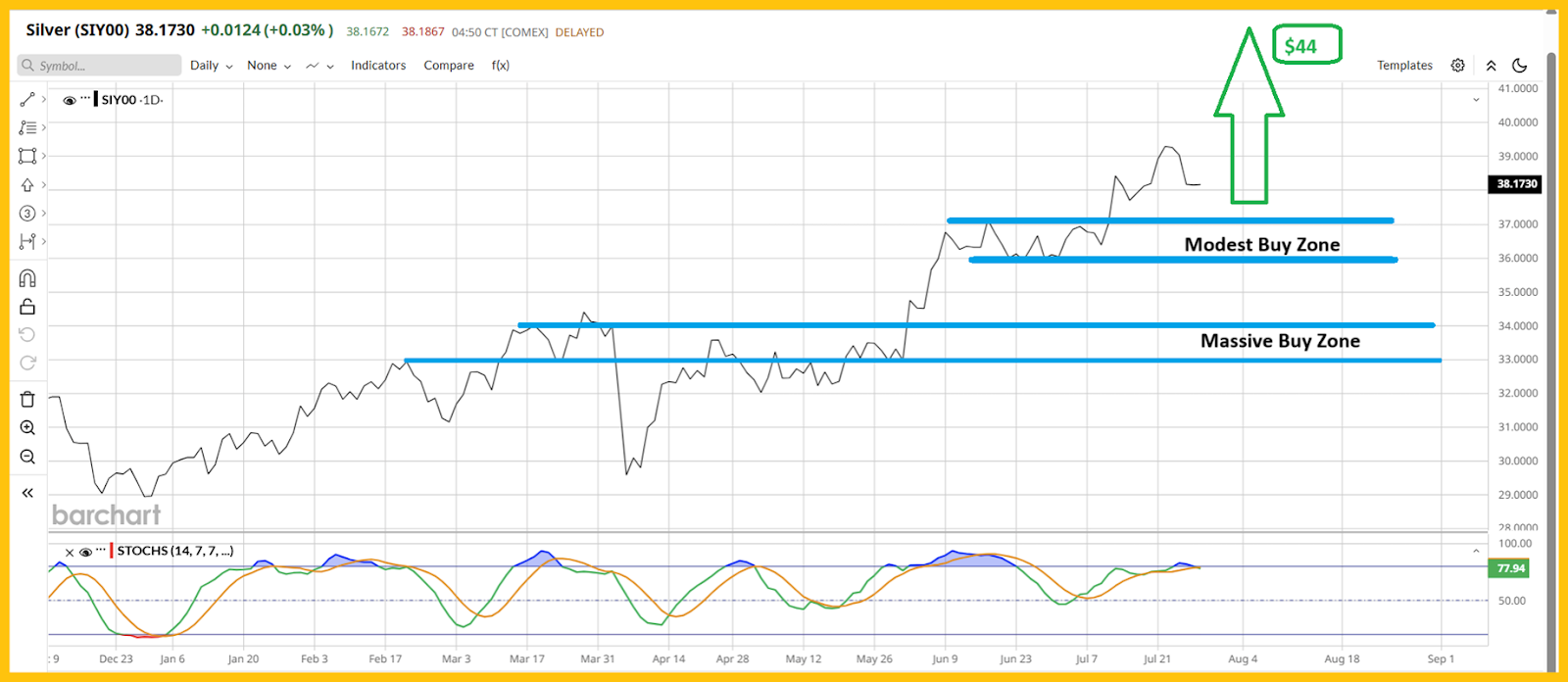

Buyers must give attention to getting extra gold and excitingly, silver and mining shares are two of one of the best methods to try this. A take a look at silver. Silver appears “keen” to surge in the direction of $44. This week’s slew of experiences might give traders a remaining likelihood to get in at $37 and even $36… earlier than the massive rally begins.

The attractive chart. The present rally is a bit prolonged; observe the positioning of Stochastics and RSI.

Many high-quality CDNX shares are already ten baggers and twenty baggers… in simply the previous few months! A relaxation is well-deserved and wholesome.

Having mentioned that, any pullback within the CDNX from right here is arguably the best shopping for alternative for gold and silver shares because the early Nineteen Seventies… and maybe in your entire historical past of markets.

The GDX (NYSE:) each day chart. Whereas the motion over the previous few weeks could be seen as irritating… there’s no technical harm to the chart.

In actual fact, there’s some first rate bull flag motion now in play. GDX is beginning to act because it ought to… as a mechanism to leverage the value motion of gold!

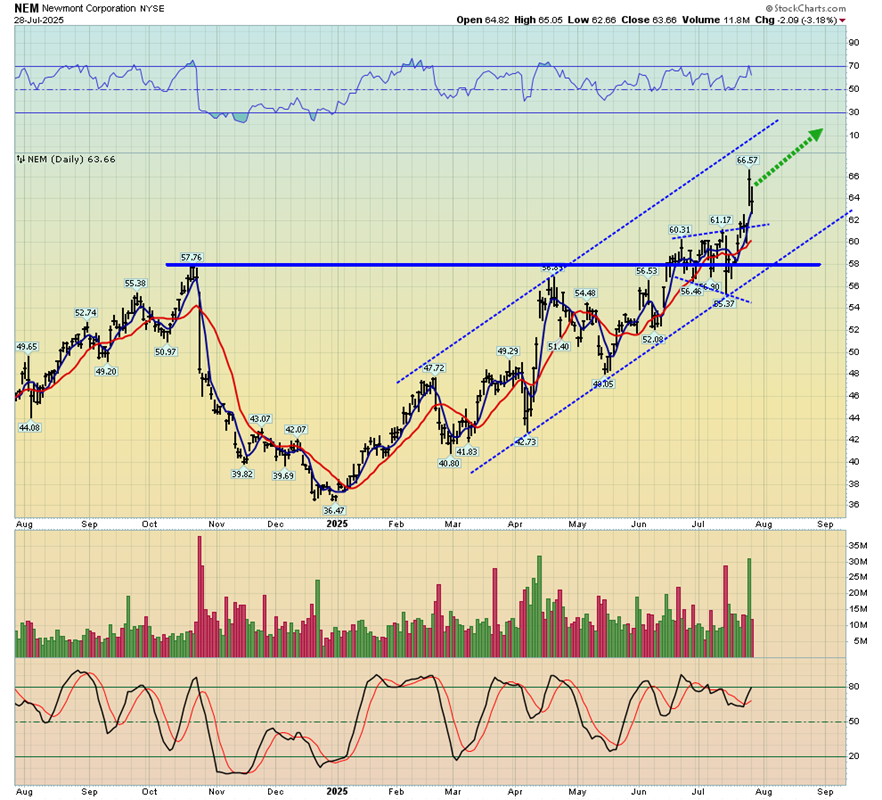

The weekly “chief of the pack” Newmont chart. A large inverse H&S sample breakout is in play. The goal of the sample is not less than $90.

A take a look at the each day chart. In time, I anticipate most intermediate and senior producers will look nearly as good as Newmont does now. A gold worth of $3000+ turns most of those firms into money cows and at $3800 gold, traders can anticipate to see the , XAU, and GDX soar collectively… to superb all-time highs!