Up to date on February twenty sixth, 2025 by Bob CiuraSpreadsheet knowledge up to date every day

Most firms distribute dividends on a quarterly or semi-annual fee schedule, however there are some that pay dividends month-to-month.

Nevertheless, the variety of firms that distribute month-to-month dividends is proscribed.

You’ll be able to see all of the month-to-month dividend shares right here.

It’s also possible to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

This text supplies an summary of month-to-month dividend shares, and features a prime 10 record of month-to-month dividend shares that the majority revenue buyers haven’t heard of.

Desk of Contents

Month-to-month Dividend Shares Overview

Month-to-month dividend funds are helpful for one group of buyers specifically; retirees who depend on dividend shares for revenue.

With that mentioned, month-to-month dividend shares are higher beneath all circumstances (all the pieces else being equal), as a result of they permit for returns to be compounded on a extra frequent foundation.

Extra frequent compounding ends in higher complete returns, notably over lengthy durations of time.

In fact, there are additionally potential danger components when investing in month-to-month dividend shares.

Traders ought to be aware many month-to-month dividend shares are extremely speculative. On common, month-to-month dividend shares are inclined to have elevated payout ratios.

An elevated payout ratio means there’s much less margin for error to proceed paying the dividend if enterprise outcomes endure a brief (or everlasting) decline.

Because of this, we’ve actual issues that many month-to-month dividend payers will be unable to proceed paying rising dividends within the occasion of a recession.

The next 10 dividend shares pay dividends every month, however have danger components and distinctive enterprise fashions that buyers ought to fastidiously contemplate earlier than shopping for.

The next record is comprised of 10 month-to-month dividend shares with market caps beneath $3 billion, which implies they’re smaller firms than the extra widely-followed month-to-month dividend shares.

The record excludes extraordinarily speculative month-to-month dividend shares equivalent to oil and gasoline royalty trusts. It additionally excludes mortgage REITs that are additionally high-risk securities.

The ten month-to-month dividend shares you’ve by no means heard of are sorted by dividend yield, from lowest to highest.

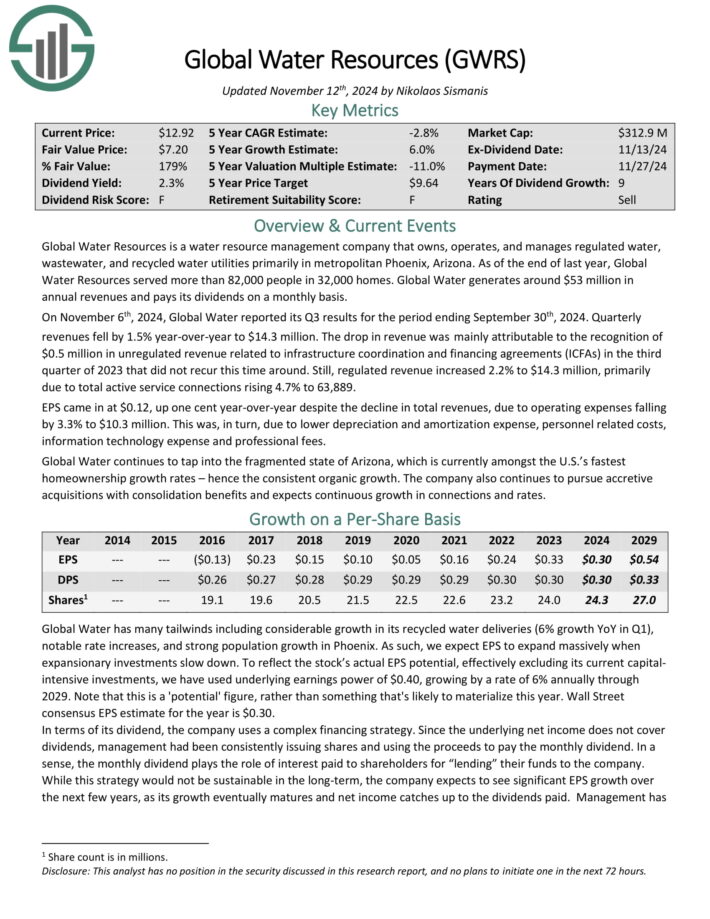

Month-to-month Dividend Inventory You’ve By no means Heard Of: International Water Assets (GWRS)

International Water Assets is a water useful resource administration firm. It owns, operates, and manages water, wastewater, and recycled water utilities in Phoenix, Arizona.

It owns 25 water and wastewater utilities in Phoenix and serves greater than 74,000 individuals. It additionally recycles greater than 1 billion gallons of water yearly.

The corporate believes it has the capability for tons of of 1000’s of service connections, however its present scale is kind of small.

Annual income is about $42 million, and the inventory trades with a market capitalization of ~$300 million.

Supply: Investor relations

Supply: Investor relations

On November sixth, 2024, International Water reported its Q3 outcomes for the interval ending September thirtieth, 2024. Quarterly revenues fell by 1.5% year-over-year to $14.3 million.

The drop in income was primarily attributable to the popularity of $0.5 million in unregulated income associated to infrastructure coordination and financing agreements (ICFAs) within the third quarter of 2023 that didn’t recur this time round.

Nonetheless, regulated income elevated 2.2% to $14.3 million, primarily as a consequence of complete energetic service connections rising 4.7% to 63,889.

Click on right here to obtain our most up-to-date Positive Evaluation report on GWRS (preview of web page 1 of three proven beneath):

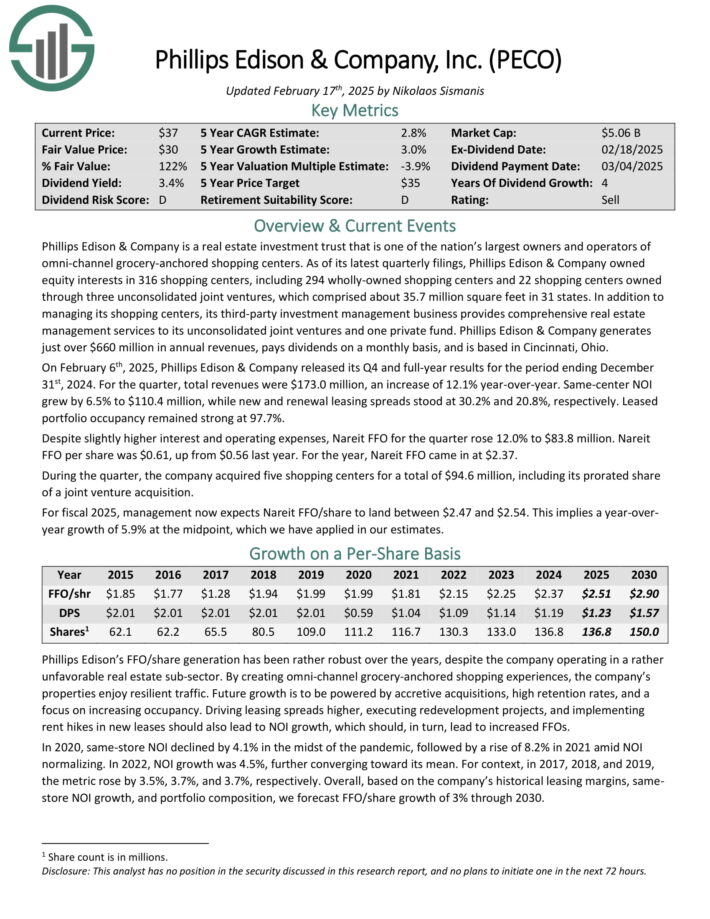

Month-to-month Dividend Inventory You’ve By no means Heard Of: Phillips Edison & Firm (PECO)

Phillips Edison & Firm is an actual property funding belief that is among the nation’s largest homeowners and operators of omni-channel grocery-anchored procuring facilities.

As of its newest quarterly filings, Phillips Edison & Firm owned fairness pursuits in 316 procuring facilities, together with 294 wholly-owned procuring facilities and 22 procuring facilities owned by three unconsolidated joint ventures, which comprised about 35.7 million sq. toes in 31 states.

Along with managing its procuring facilities, its third-party funding administration enterprise supplies complete actual property administration providers to its unconsolidated joint ventures and one personal fund.

Phillips Edison & Firm generates simply over $660 million in annual revenues, pays dividends on a month-to-month foundation, and relies in Cincinnati, Ohio.

On February sixth, 2025, Phillips Edison & Firm launched its This autumn and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, complete revenues had been $173.0 million, a rise of 12.1% year-over-year.

Similar-center NOI grew by 6.5% to $110.4 million, whereas new and renewal leasing spreads stood at 30.2% and 20.8%, respectively. Leased portfolio occupancy remained sturdy at 97.7%.

Regardless of barely greater curiosity and working bills, Nareit FFO for the quarter rose 12.0% to $83.8 million. Nareit FFO per share was $0.61, up from $0.56 final yr. For the yr, Nareit FFO got here in at $2.37.

Click on right here to obtain our most up-to-date Positive Evaluation report on PECO (preview of web page 1 of three proven beneath):

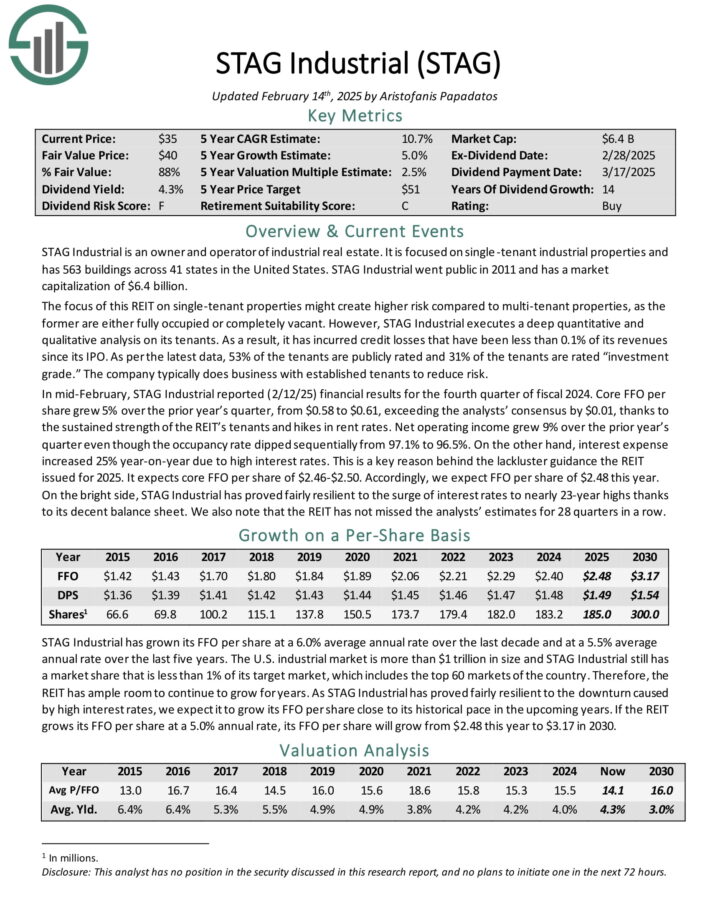

Month-to-month Dividend Inventory You’ve By no means Heard Of: STAG Industrial (STAG)

STAG Industrial is an proprietor and operator of business actual property. It’s targeted on single-tenant industrial properties and has ~560 buildings throughout 41 states in the US.

The main target of this REIT on single-tenant properties would possibly create greater danger in comparison with multi-tenant properties, as the previous are both totally occupied or fully vacant.

Supply: Investor Presentation

Nevertheless, STAG Industrial executes a deep quantitative and qualitative evaluation on its tenants. Because of this, it has incurred credit score losses which have been lower than 0.1% of its revenues since its IPO.

In mid-February, STAG Industrial reported (2/12/25) monetary outcomes for the fourth quarter of fiscal 2024. Core FFO-per-share grew 5% over the prior yr’s quarter, from $0.58 to $0.61, exceeding the analysts’ consensus by $0.01, because of hikes in hire charges.

Internet working revenue grew 9% over the prior yr’s quarter although the occupancy fee dipped sequentially from 97.1% to 96.5%. Then again, curiosity expense elevated 25% year-on-year as a consequence of excessive rates of interest.

STAG expects core FFO per share of $2.46-$2.50 for 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on STAG Industrial Inc. (STAG) (preview of web page 1 of three proven beneath):

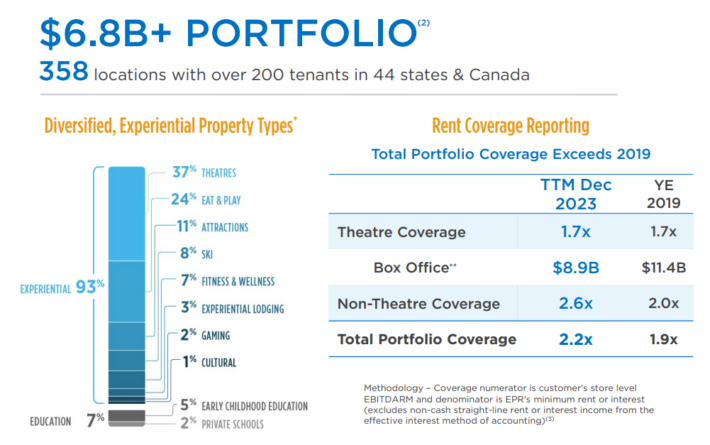

Month-to-month Dividend Inventory You’ve By no means Heard Of: EPR Properties (EPR)

EPR Properties is a specialty actual property funding belief, or REIT, that invests in properties in particular market segments that require trade data to function successfully.

It selects properties it believes have sturdy return potential in Leisure, Recreation, and Schooling. The portfolio consists of about $7 billion in investments throughout 350+ places in 44 states, together with over 200 tenants.

Supply: Investor Presentation

EPR posted third quarter earnings on October thirtieth, 2024, and outcomes had been higher than anticipated on each the highest and backside traces. Funds-from-operations got here to $1.29, which was two cents forward of estimates. FFO was down from $1.47 per share a yr in the past. On a greenback foundation, FFO fell from $113 million to only over $100 million.

Income was off nearly 5% year-over-year to $180.5 million, which was $21.5 million forward of expectations. For the 9 months, income was off from $534 million to $521 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPR (preview of web page 1 of three proven beneath):

Month-to-month Dividend Inventory You’ve By no means Heard Of: LTC Properties (LTC)

LTC Properties is a REIT that invests in senior housing and expert nursing properties. Its portfolio consists of roughly 50% senior housing and 50% expert nursing properties.

Similar to different healthcare REITs, LTC advantages from a powerful secular pattern, specifically the excessive development of the inhabitants that’s above 80 years previous. This development outcomes from the getting old of the infant boomers’ era and the regular rise of life expectancy because of sustained progress in medical sciences.

The REIT owns 194 investments in 26 states, with 31 working companions.

Supply: Investor Presentation

In late October, LTC reported (10/29/24) monetary outcomes for the third quarter of fiscal 2024. Funds from operations (FFO) per share grew 5% over the prior yr’s quarter, from $0.65 to $0.68, however missed the analysts’ consensus by $0.01.

The rise in FFO per share resulted primarily from greater revenue from beforehand transitioned properties and better revenue from mortgage originations. LTC drastically improved its leverage ratio (Internet Debt to EBITDA) from 5.3x to 4.2x thanks to numerous asset gross sales.

Click on right here to obtain our most up-to-date Positive Evaluation report on LTC (preview of web page 1 of three proven beneath):

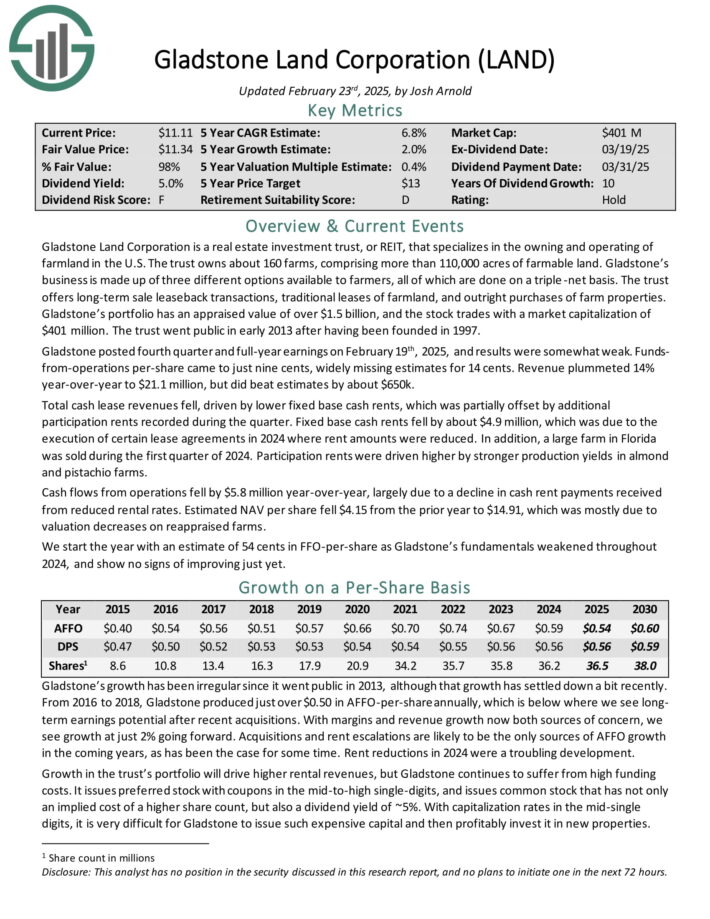

Month-to-month Dividend Inventory You’ve By no means Heard Of: Gladstone Land Corp. (LAND)

Gladstone Land Company is an actual property funding belief, or REIT, that makes a speciality of the proudly owning and working of farmland within the U.S.

The belief owns about 160 farms, comprising greater than 110,000 acres of farmable land. Gladstone’s enterprise is made up of three completely different choices out there to farmers, all of that are carried out on a triple-net foundation.

The belief provides long-term sale leaseback transactions, conventional leases of farmland, and outright purchases of farm properties.

Gladstone posted fourth quarter and full-year earnings on February nineteenth, 2025, and outcomes had been considerably weak. Funds-from-operations per-share got here to only 9 cents, broadly lacking estimates for 14 cents.

Income fell 14% year-over-year to $21.1 million, however did beat estimates by about $650k.

Complete money lease revenues fell, pushed by decrease mounted base money rents, which was partially offset by further participation rents recorded throughout the quarter.

Mounted base money rents fell by about $4.9 million, which was as a result of execution of sure lease agreements in 2024 the place hire quantities had been diminished.

As well as, a big farm in Florida was offered throughout the first quarter of 2024. Participation rents had been pushed greater by stronger manufacturing yields in almond and pistachio farms.

Click on right here to obtain our most up-to-date Positive Evaluation report on LAND (preview of web page 1 of three proven beneath):

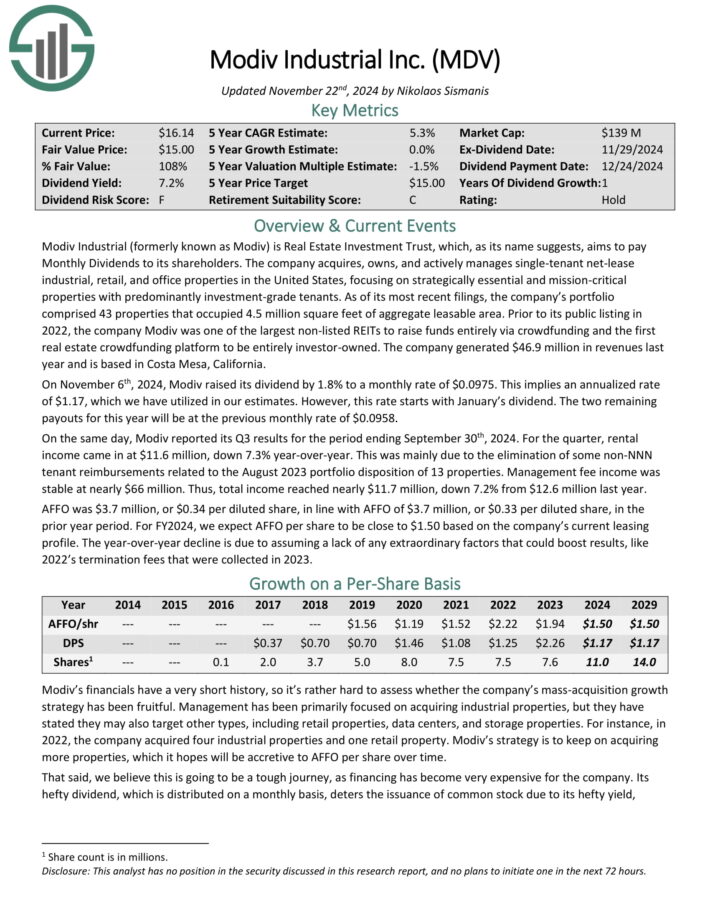

Month-to-month Dividend Inventory You’ve By no means Heard Of: Modiv Industrial REIT (MDV)

Modiv Industrial acquires, owns, and actively manages single-tenant net-lease industrial, retail, and workplace properties in the US, specializing in strategically important and mission-critical properties with predominantly investment-grade tenants.

As of its most up-to-date filings, the corporate’s portfolio comprised 44 properties that occupied 4.6 million sq. toes of combination leasable space.

Modiv has almost 43 properties in its portfolio that occupy 4.5 million sq. toes of combination leasable space.

Modiv reported its Q3 outcomes for the interval ending September thirtieth, 2024. For the quarter, rental revenue got here in at $11.6 million, down 7.3% year-over-year.

This was primarily as a result of elimination of some non-NNN tenant reimbursements associated to the August 2023 portfolio disposition of 13 properties.

Administration price revenue was steady at almost $66 million. Complete revenue reached almost $11.7 million, down 7.2% from $12.6 million final yr.

AFFO was $3.7 million, or $0.34 per diluted share, consistent with AFFO of $3.7 million, or $0.33 per diluted share, within the prior yr interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on MDV (preview of web page 1 of three proven beneath):

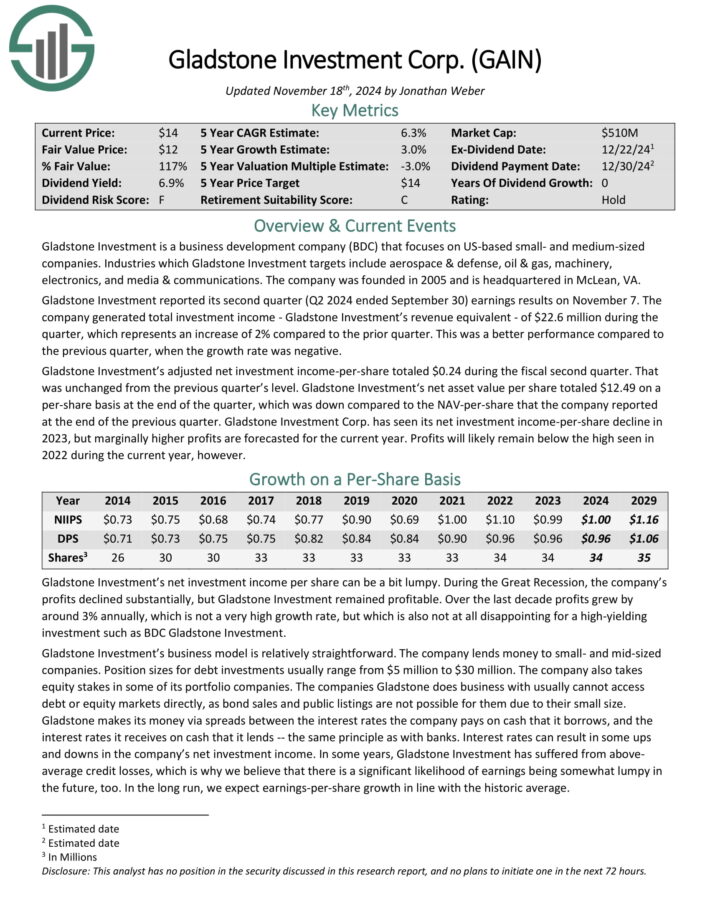

Month-to-month Dividend Inventory You’ve By no means Heard Of: Gladstone Funding Corp. (GAIN)

Gladstone Funding is a enterprise growth firm (BDC) that focuses on US-based small- and medium-sized firms.

Industries which Gladstone Funding targets embody aerospace & protection, oil & gasoline, equipment, electronics, and media & communications.

A rundown of GAIN’s funding course of might be seen within the picture beneath:

Supply: Investor Presentation

Gladstone Funding reported its second quarter (Q2 2024 ended September 30) earnings outcomes on November 7. The corporate generated complete funding revenue of $22.6 million throughout the quarter, which represents a rise of two% in comparison with the prior quarter.

This was a greater efficiency in comparison with the earlier quarter, when the expansion fee was detrimental.

Gladstone Funding’s adjusted web funding income-per-share totaled $0.24 throughout the fiscal second quarter. That was unchanged from the earlier quarter’s stage.

Gladstone Funding‘s web asset worth per share totaled $12.49 on a per-share foundation on the finish of the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on GAIN (preview of web page 1 of three proven beneath):

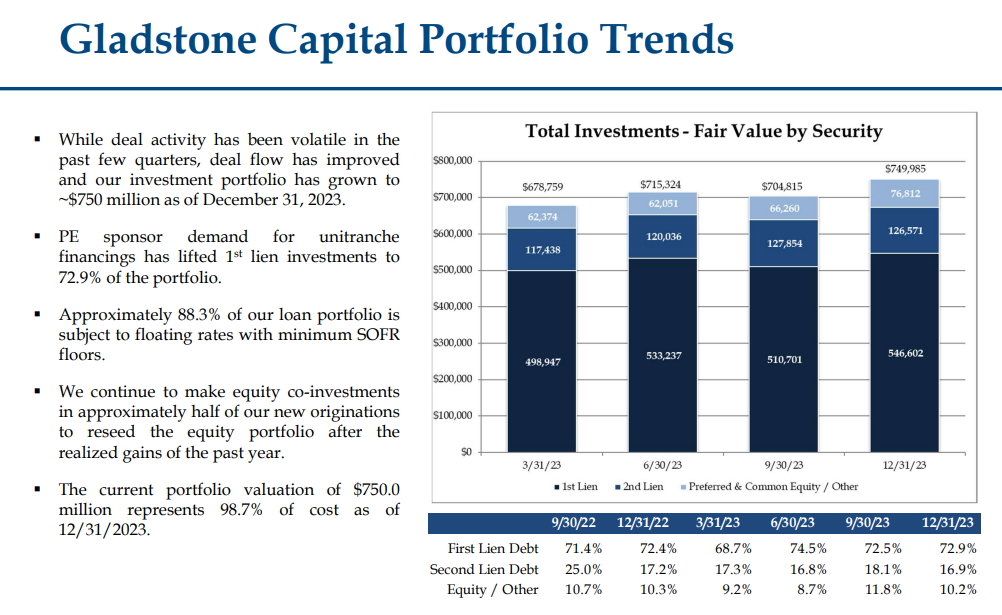

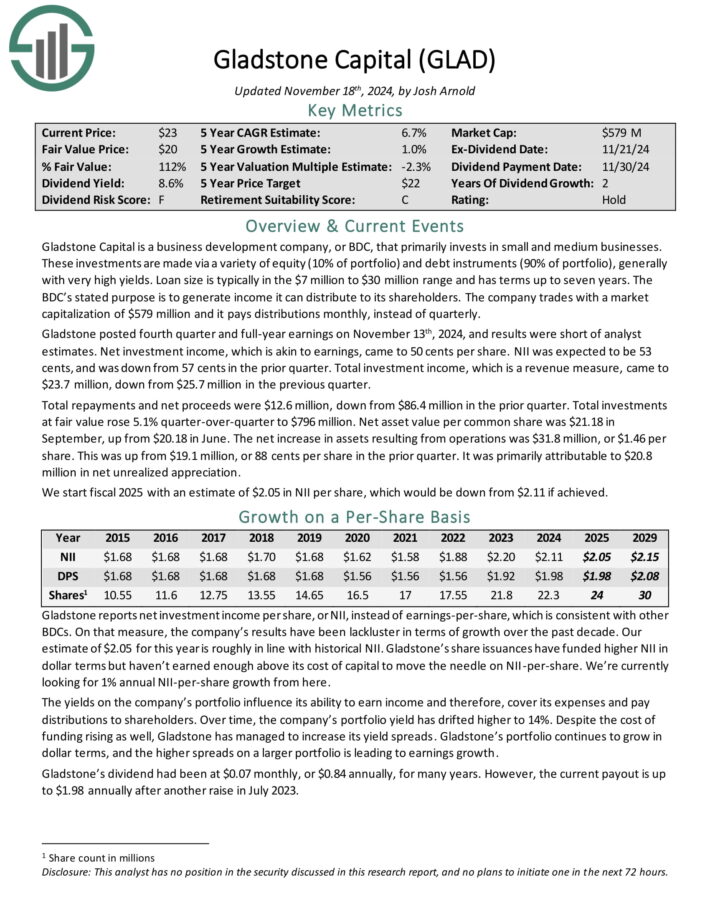

Month-to-month Dividend Inventory You’ve By no means Heard Of: Gladstone Capital Corp. (GLAD)

Gladstone Capital is a enterprise growth firm, or BDC, that primarily invests in small and medium companies. These investments are made through quite a lot of fairness (10% of portfolio) and debt devices (90% of portfolio), usually with very excessive yields.

Mortgage dimension is usually within the $7 million to $30 million vary and has phrases as much as seven years.

Supply: Investor Presentation

Gladstone posted fourth quarter and full-year earnings on November thirteenth, 2024, and outcomes had been in need of analyst estimates. Internet funding revenue, which is akin to earnings, got here to 50 cents per share.

NII was anticipated to be 53 cents, and was down from 57 cents within the prior quarter. Complete funding revenue, which is a income measure, got here to $23.7 million, down from $25.7 million within the earlier quarter.

Complete repayments and web proceeds had been $12.6 million, down from $86.4 million within the prior quarter. Complete investments at honest worth rose 5.1% quarter-over-quarter to $796 million. Internet asset worth per frequent share was $21.18 in September, up from $20.18 in June.

Click on right here to obtain our most up-to-date Positive Evaluation report on GLAD (preview of web page 1 of three proven beneath):

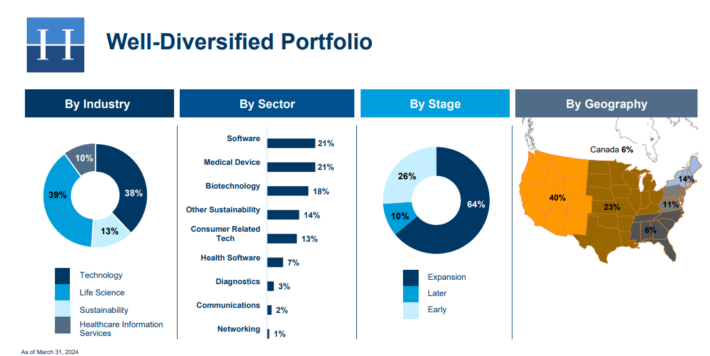

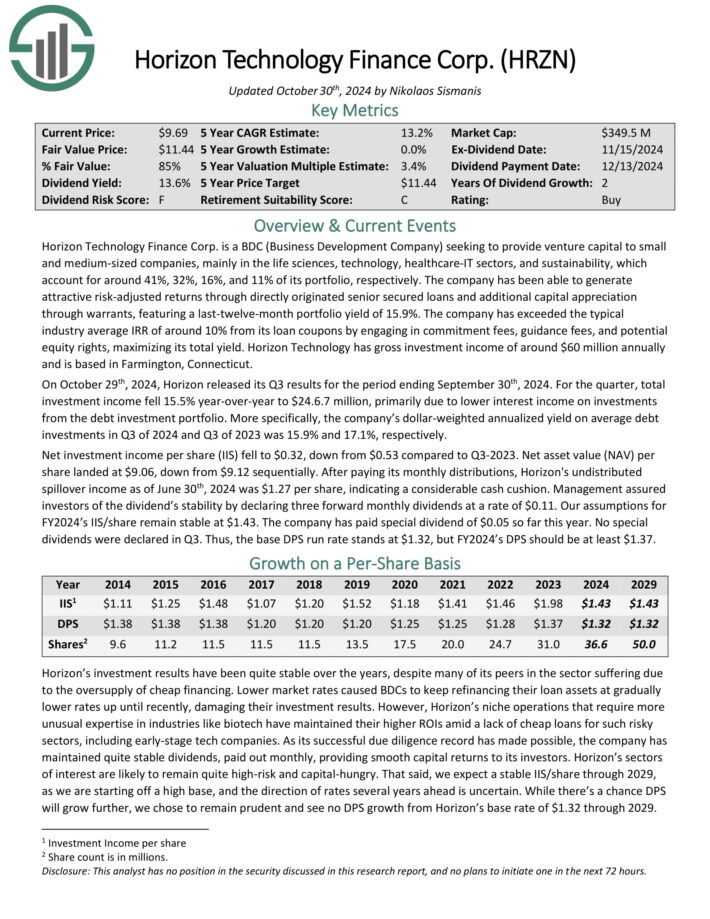

Month-to-month Dividend Inventory You’ve By no means Heard Of: Horizon Know-how Finance (HRZN)

Horizon Know-how Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the expertise, life sciences, and healthcare–IT sectors.

The corporate has generated enticing danger–adjusted returns by instantly originated senior secured loans and extra capital appreciation by warrants.

Supply: Investor Presentation

On October twenty ninth, 2024, Horizon launched its Q3 outcomes for the interval ending September thirtieth, 2024. For the quarter, complete funding revenue fell 15.5% year-over-year to $24.6.7 million, primarily as a consequence of decrease curiosity revenue on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in Q3 of 2024 and Q3 of 2023 was 15.9% and 17.1%, respectively.

Internet funding revenue per share (IIS) fell to $0.32, down from $0.53 in comparison with Q3-2023. Internet asset worth (NAV) per share landed at $9.06, down from $9.12 sequentially.

After paying its month-to-month distributions, Horizon’s undistributed spillover revenue as of June thirtieth, 2024 was $1.27 per share, indicating a substantial money cushion.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven beneath):

Further Studying

Month-to-month dividend shares could also be extra enticing for revenue buyers as a consequence of their frequent payouts.

Moreover, many month-to-month dividend payers supply buyers excessive yields. The mixture of a month-to-month dividend fee and a excessive yield could possibly be particularly interesting.

We’ve compiled a studying record for added dividend development inventory investing concepts:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.