Printed on September twenty third, 2025 by Bob Ciura

Dividend investing is in the end about changing your working earnings with a passive earnings stream for a safe retirement and monetary freedom.

The fact of inflation means your earnings stream can’t simply be static. It have to be perpetually rising.

To construct your perpetual dividend machine, you will need to spend money on a fairly diversified basket of earnings securities which have the next traits:

Pay dividends (create earnings), the upper the yield the higher

Are prone to develop their funds, the quicker the higher

Have secure dividends, so you’re prone to see steady or higher earnings throughout a recession

Dividend investments ought to be secure, rising earnings securities with at the very least respectable yields.

With this in thoughts, we created a downloadable checklist of over 130 Dividend Champions.

You possibly can obtain your free copy of the Dividend Champions checklist, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

The Dividend Champions have raised their dividends for over 25 years in a row.

It’s no small feat to spice up a dividend year-after-year for many years at a time, even via financial downturns.

Because of this, longer streaks are most popular as a result of they present an organization can enhance dividends over a variety of financial and aggressive environments. Additionally they present proof of a sturdy aggressive benefit.

The next 10 U.S.-based dividend shares have elevated their payouts for over 25 years, inserting them on the Dividend Champions checklist. Additionally they have excessive yields greater than double present S&P 500 common yield of 1.15%.

Lastly, they’ve our high Dividend Threat Scores of ‘A’ or ‘B’, to concentrate on the shares more than likely to take care of their dividends, even in a recession.

Because of this, they may very well be thought of to be high shares for constructing a perpetual earnings machine.

Desk of Contents

The ten shares beneath are ranked by present dividend yield, from lowest to highest.

Perpetual Revenue Inventory: Northwest Pure Holding (NWN)

NW Pure was based in 1859 and has grown from only a handful of consumers to serving greater than 760,000 at this time. The utility’s mission is to ship pure gasoline to its prospects within the Pacific Northwest.

The corporate’s areas served are proven within the picture beneath.

Supply: Investor Presentation

On August 7, 2025, Northwest Pure Holding Firm reported outcomes for the second quarter ended June 30, 2025, exhibiting regular progress in buyer base and price restoration regardless of seasonal weak point typical of hotter months.

The corporate recorded web earnings of $7.4 million, or $0.19 per diluted share, in contrast with $5.8 million, or $0.16 per share, in the identical quarter final yr. Working income totaled $219.6 million, barely down from $222.3 million within the prior yr, as decrease gasoline utilization from delicate climate offset the good thing about price will increase and buyer progress.

Working earnings was $28.9 million, up from $25.7 million, reflecting disciplined value management and contributions from utility margin enchancment. The gasoline distribution section added practically 11,000 new prospects year-over-year, sustaining annual progress of about 1.4%, whereas infrastructure companies contributed modestly to earnings.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWN (preview of web page 1 of three proven beneath):

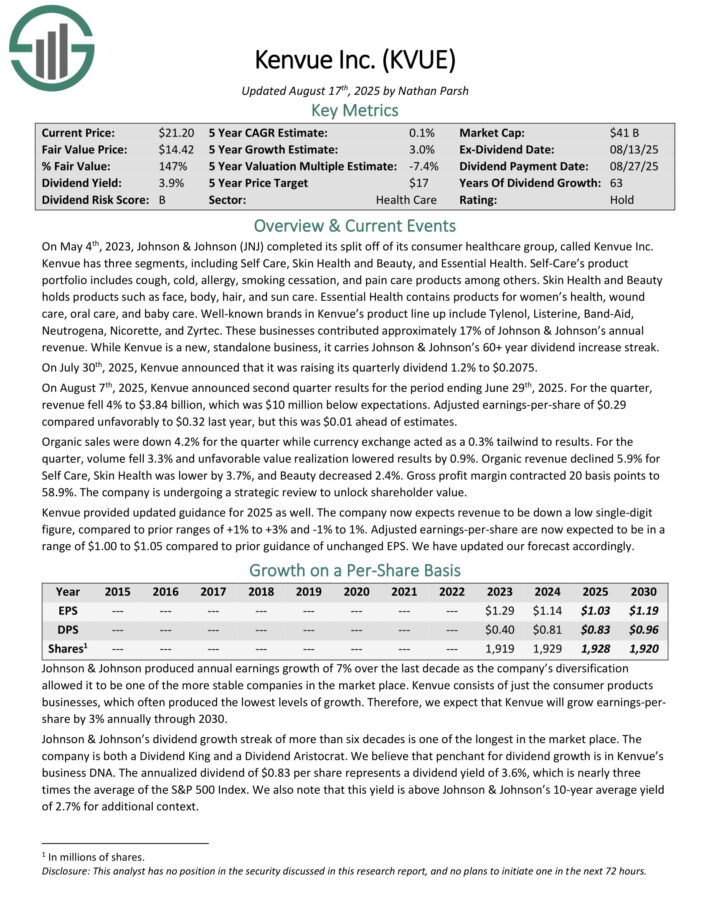

Perpetual Revenue Inventory: Kenvue Inc. (KVUE)

Kenvue was spun off from Johnson & Johnson (JNJ) in 2023. It has three segments, together with Self Care, Pores and skin Well being and Magnificence, and Important Well being.

Self-Care’s product portfolio contains cough, chilly, allergy, smoking cessation, and ache care merchandise amongst others. Pores and skin Well being and Magnificence holds merchandise resembling face, physique, hair, and solar care. Important Well being incorporates merchandise for girls’s well being, wound care, oral care, and child care.

Nicely-known manufacturers in Kenvue’s product line up embody Tylenol, Listerine, Band-Support, Neutrogena, Nicorette, and Zyrtec. These companies contributed roughly 17% of Johnson & Johnson’s annual income.

On August seventh, 2025, Kenvue introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income fell 4% to $3.84 billion, which was $10 million beneath expectations. Adjusted earnings-per-share of $0.29 in contrast unfavorably to $0.32 final yr, however this was $0.01 forward of estimates.

Natural gross sales have been down 4.2% for the quarter whereas forex alternate acted as a 0.3% tailwind to outcomes. For the quarter, quantity fell 3.3% and unfavorable worth realization lowered outcomes by 0.9%.

Natural income declined 5.9% for Self Care, Pores and skin Well being was decrease by 3.7%, and Magnificence decreased 2.4%. Gross revenue margin contracted 20 foundation factors to 58.9%. The corporate is present process a strategic evaluation to unlock shareholder worth.

Click on right here to obtain our most up-to-date Certain Evaluation report on KVUE (preview of web page 1 of three proven beneath):

Perpetual Revenue Inventory: Sonoco Merchandise (SON)

Sonoco Merchandise supplies packaging, industrial merchandise and provide chain companies to its prospects. The markets that use the corporate’s merchandise embody these within the home equipment, electronics, beverage, development and meals industries.

The corporate generates over $5 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Client Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

On April sixteenth, 2025, Sonoco Merchandise raised its quarterly dividend 1.9% to $0.53, extending the corporate’s dividend progress streak to 49 consecutive years.

On July twenty third, 2025, Sonoco Merchandise introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 in comparison with $1.28 within the prior yr, however was $0.08 lower than anticipated.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Client Packaging revenues surged 110% to $1.23 billion, principally on account of contributions from Eviosys.

Quantity progress was sturdy and favorable forex alternate charges additionally aided outcomes. Industrial Paper Packing gross sales fell 2% to $588 million as a result of affect of overseas forex alternate charges and decrease quantity following two plant divestitures in China final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

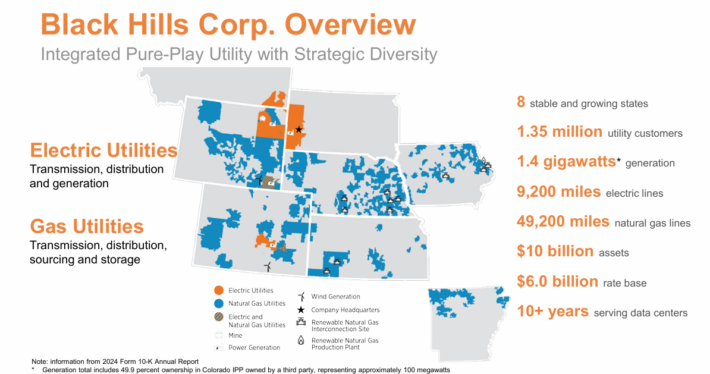

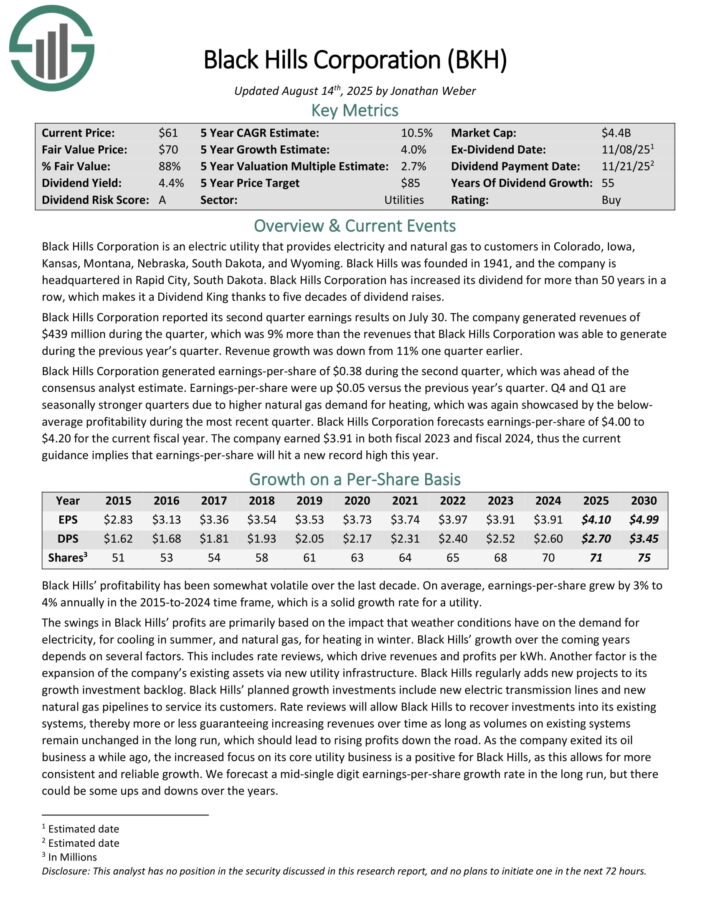

Perpetual Revenue Inventory: Black Hills Corp (BKH)

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to prospects in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility prospects in eight states. Its pure gasoline property embody 49,200 miles of pure gasoline traces. Individually, it has ~9,200 miles of electrical traces and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Black Hills Company reported its second quarter earnings outcomes on July 30. The corporate generated revenues of $439 million throughout the quarter, up 9% year-over-year.

Black Hills Company generated earnings-per-share of $0.38 throughout the second quarter, which was forward of the consensus analyst estimate.

Earnings-per-share have been up $0.05 versus the earlier yr’s quarter. This autumn and Q1 are seasonally stronger quarters on account of greater pure gasoline demand for heating.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven beneath):

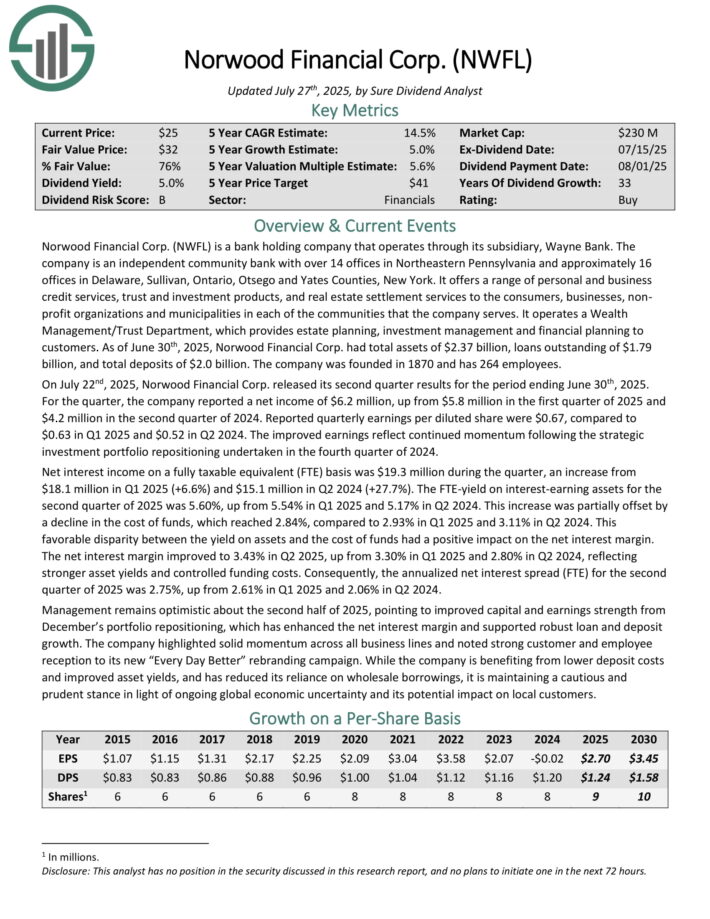

Perpetual Revenue Inventory: Norwood Monetary (NWL)

Norwood Monetary Corp. (NWFL) is a financial institution holding firm that operates via its subsidiary, Wayne Financial institution. The corporate is an impartial neighborhood financial institution with over 14 places of work in Northeastern Pennsylvania and roughly 16 places of work in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York.

It affords a spread of non-public and enterprise credit score companies, belief and funding merchandise, and actual property settlement companies to the shoppers, companies, nonprofit organizations and municipalities in every of the communities that the corporate serves. It operates a Wealth Administration/Belief Division, which supplies property planning, funding administration and monetary planning to prospects.

As of June thirtieth, 2025, Norwood Monetary Corp. had complete property of $2.37 billion, loans excellent of $1.79 billion, and complete deposits of $2.0 billion. The corporate was based in 1870 and has 264 workers.

On July twenty second, 2025, Norwood Monetary Corp. launched its second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, the corporate reported a web earnings of $6.2 million, up from $5.8 million within the first quarter of 2025 and $4.2 million within the second quarter of 2024.

Reported quarterly earnings per diluted share have been $0.67, in comparison with $0.63 in Q1 2025 and $0.52 in Q2 2024. The improved earnings mirror continued momentum following the strategic funding portfolio repositioning undertaken within the fourth quarter of 2024.

Internet curiosity earnings on a totally taxable equal (FTE) foundation was $19.3 million throughout the quarter, a rise from $18.1 million in Q1 2025 (+6.6%) and $15.1 million in Q2 2024 (+27.7%). The FTE-yield on interest-earning property for the second quarter of 2025 was 5.60%, up from 5.54% in Q1 2025 and 5.17% in Q2 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWFL (preview of web page 1 of three proven beneath):

Perpetual Revenue Inventory: Hormel Meals (HRL)

Hormel Meals was based in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with about $12 billion in annual income.

Hormel has saved its core competency as a processor of meat merchandise for nicely over 100 years however has additionally grown into different enterprise traces via acquisitions.

The corporate sells its merchandise in 80 international locations worldwide, and its manufacturers embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

Hormel posted third quarter earnings on August twenty eighth, 2025, and outcomes have been very weak, together with disappointing steering for the fourth quarter.

Adjusted earnings-per-share got here to 35 cents, which was six cents mild of estimates. Income was up 4.5% year-over-year to $3.03 billion, beating estimates by $50 million. Natural web gross sales have been up 6% year-over-year on quantity good points of 4%, with worth and blend comprising the opposite 2%.

The corporate additionally famous its value financial savings program is working and serving to save about $125 million yearly. Gross revenue was flat year-on-year, with inflationary headwinds offset by high line good points. The corporate famous 400 foundation factors of uncooked materials value inflation, an enormous headwind to margins.

Money stream from operations have been $157 million, whereas capex was $72 million, and dividends paid have been $159 million. Steering for This autumn was for web gross sales of ~$3.2 billion, about $50 million mild of consensus. Earnings are anticipated at ~39 cents.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven beneath):

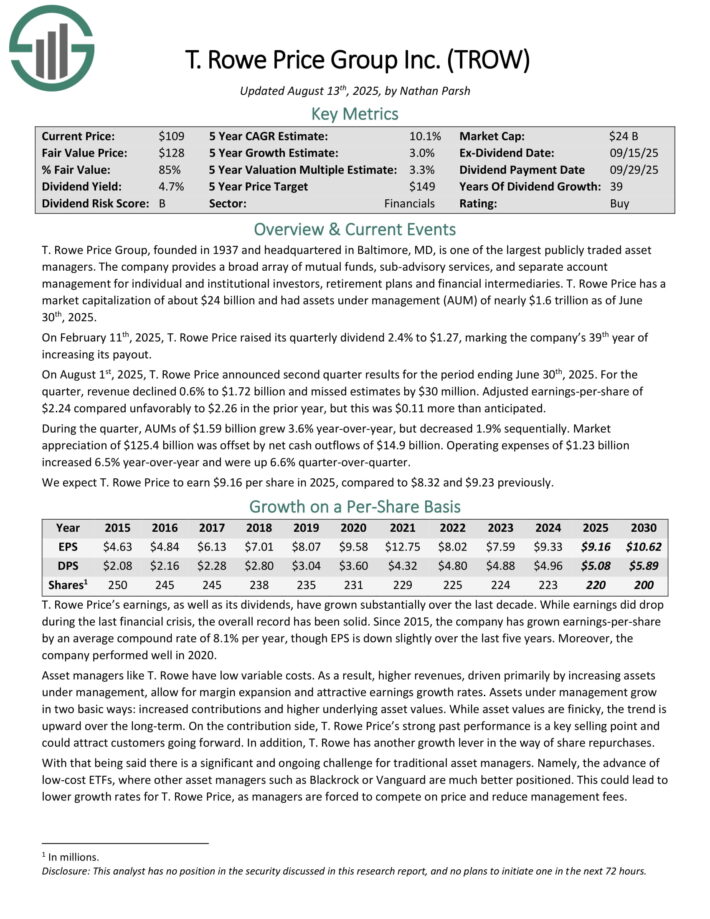

Perpetual Revenue Inventory: T. Rowe Worth Group (TROW)

T. Rowe Worth Group is among the largest publicly traded asset managers. The corporate supplies a broad array of mutual funds, sub-advisory companies, and separate account administration for particular person and institutional traders, retirement plans and monetary intermediaries.

T. Rowe Worth had property beneath administration (AUM) of practically $1.6 trillion as of June thirtieth, 2025.

On February eleventh, 2025, T. Rowe Worth raised its quarterly dividend 2.4% to $1.27, marking the corporate’s thirty ninth yr of accelerating its payout.

On August 1st, 2025, T. Rowe Worth introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income declined 0.6% to $1.72 billion and missed estimates by $30 million. Adjusted earnings-per-share of $2.24 in contrast unfavorably to $2.26 within the prior yr, however this was $0.11 greater than anticipated.

In the course of the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, however decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by web money outflows of $14.9 billion. Working bills of $1.23 billion elevated 6.5% year-over-year and have been up 6.6% quarter-over-quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on TROW (preview of web page 1 of three proven beneath):

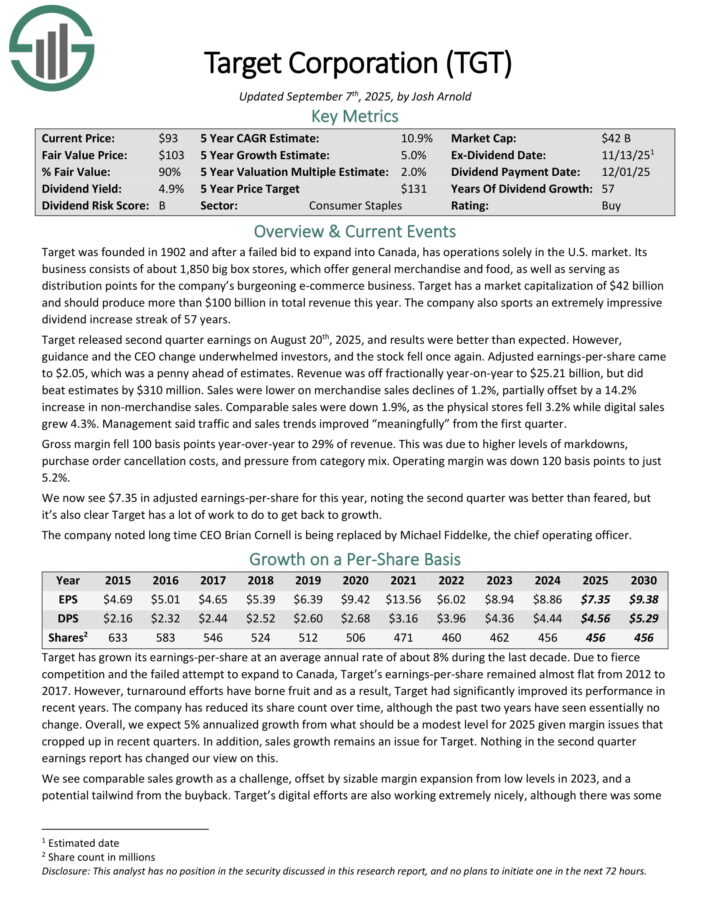

Perpetual Revenue Inventory: Goal Company (TGT)

Goal was based in 1902 and now operates about 1,850 huge field shops, which provide basic merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal launched second quarter earnings on August twentieth, 2025, and outcomes have been higher than anticipated. Nevertheless, steering and the CEO change underwhelmed traders, and the inventory fell as soon as once more.

Adjusted earnings-per-share got here to $2.05, which was a penny forward of estimates. Income was off fractionally year-on-year to $25.21 billion, however did beat estimates by $310 million. Gross sales have been decrease on merchandise gross sales declines of 1.2%, partially offset by a 14.2% enhance in non-merchandise gross sales.

Comparable gross sales have been down 1.9%, because the bodily shops fell 3.2% whereas digital gross sales grew 4.3%. Administration stated visitors and gross sales tendencies improved “meaningfully” from the primary quarter.

The corporate is investing closely in its enterprise with the intention to navigate via the altering panorama within the retail sector. The payout is now 62% of earnings for this yr, which is elevated from historic ranges, however the dividend stays well-covered.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

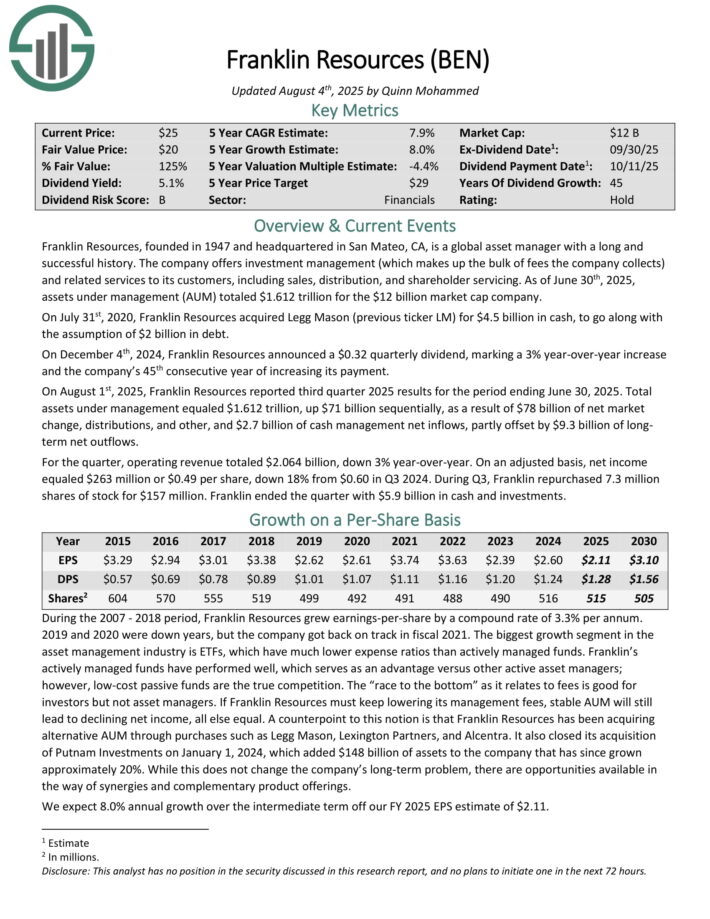

Perpetual Revenue Inventory: Franklin Assets (BEN)

Franklin Assets, based in 1947 and headquartered in San Mateo, CA, is a worldwide asset supervisor with an extended and profitable historical past. The corporate affords funding administration (which makes up the majority of charges the corporate collects) and associated companies to its prospects, together with gross sales, distribution, and shareholder servicing.

As of June thirtieth, 2025, property beneath administration (AUM) totaled $1.612 trillion for the $12 billion market cap firm.

On July thirty first, 2020, Franklin Assets acquired Legg Mason (earlier ticker LM) for $4.5 billion in money, to go together with the idea of $2 billion in debt.

On August 1st, 2025, Franklin Assets reported third-quarter 2025 outcomes for the interval ending June 30, 2025. Whole property beneath administration equaled $1.612 trillion, up $71 billion sequentially, because of $78 billion of web market change, distributions, and different, and $2.7 billion of money administration web inflows, partly offset by $9.3 billion of long-term web outflows.

For the quarter, working income totaled $2.064 billion, down 3% year-over-year. On an adjusted foundation, web earnings equaled $263 million or $0.49 per share, down 18% from $0.60 in Q3 2024. Throughout Q3, Franklin repurchased 7.3 million shares of inventory for $157 million. Franklin ended the quarter with $5.9 billion in money and investments.

Click on right here to obtain our most up-to-date Certain Evaluation report on BEN (preview of web page 1 of three proven beneath):

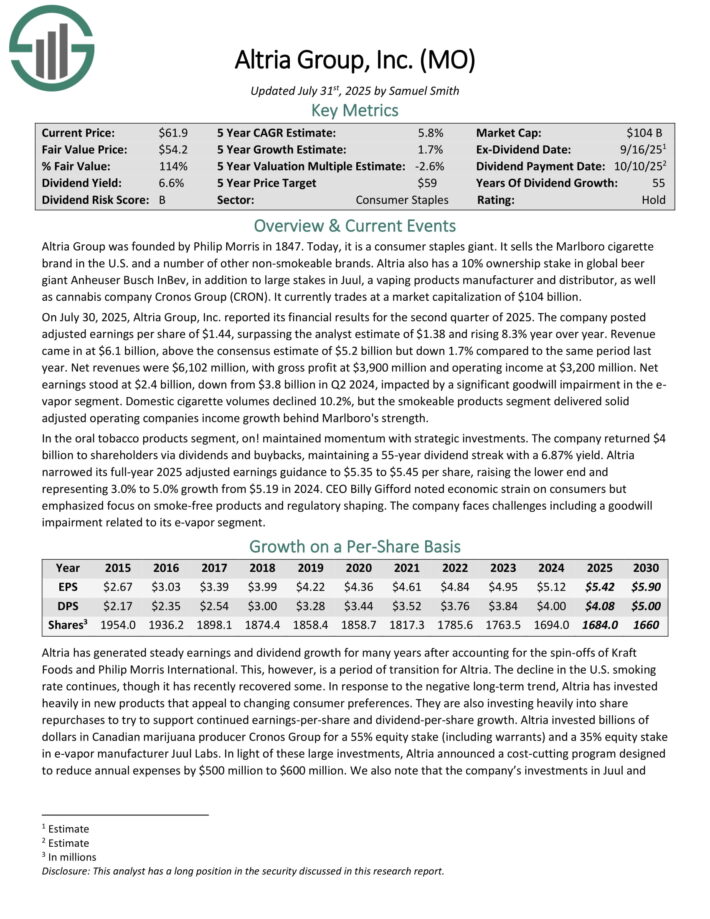

Perpetual Revenue Inventory: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath a wide range of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

This can be a interval of transition for Altria. The decline within the U.S. smoking price continues. In response, Altria has invested closely in new merchandise that attraction to altering client preferences, because the smoke-free class continues to develop.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% yr over yr.

Income got here in at $6.1 billion, above the consensus estimate of $5.2 billion however down 1.7% in comparison with the identical interval final yr. Internet revenues have been $6,102 million, with gross revenue at $3,900 million and working earnings at $3,200 million.

Internet earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a major goodwill impairment within the e-vapor section.

Home cigarette volumes declined 10.2%, however the smokeable merchandise section delivered strong adjusted working firms earnings progress behind Marlboro’s energy.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

Further Studying

The Dividend Champions checklist will not be the one option to rapidly display screen for shares that frequently pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.