Information up to date dailyArticle up to date on September twenty sixth, 2025 by Bob Ciura

The buyer staples sector is house to a few of the most well-known dividend progress shares on the earth.

There may be additionally a large physique of proof that implies that the buyer staples sector outperforms over lengthy intervals of time.

With that in thoughts, we’ve compiled a database of 61 shopper staples shares, which you’ll be able to entry under:

The listing of shares was derived from just a few main shopper staples ETFs:

Client Staples Choose Sector SPDR ETF (XLP)

Invesco S&P Small Cap Client Staples ETF (PSCC)

Maintain studying this text to be taught extra in regards to the deserves of investing in shopper staples shares.

Desk of Contents

This text gives our full listing of all shopper staples shares, a tutorial on the right way to use the spreadsheets to create screens of shopper staples shares, and the highest 7 shopper staples shares now.

The highest 7 listing was derived from the anticipated returns of every inventory. We calculate anticipated returns based mostly on a projection of earnings-per-share progress, dividend yields, and modifications within the valuation a number of.

The 7 shopper staples shares are ranked by 5-year anticipated returns, from lowest to highest.

The desk of contents under permits for simple navigation:

How To Use The Client Staples Shares Listing To Discover Funding Concepts

Having an Excel doc containing every dividend-paying shopper staples shares may be very helpful.

This instrument turns into much more potent when mixed with a stable, basic data of the right way to manipulate information with Microsoft Excel. Quantitative investing screeners permit traders to take away most of the cognitive biases that impair long-term investing returns.

With that in thoughts, this part will present a step-by-step rationalization of the right way to use the dividend-paying shopper staples shares listing to search out one of the best shopper staples funding concepts through the use of easy screening methods.

The primary display screen that we’ll implement is for shares with price-to-earnings ratios under 25,

Display screen 1: Avoiding Overvalued Shares

Step 1: Obtain your free spreadsheet of all 71 shopper staples shares right here.

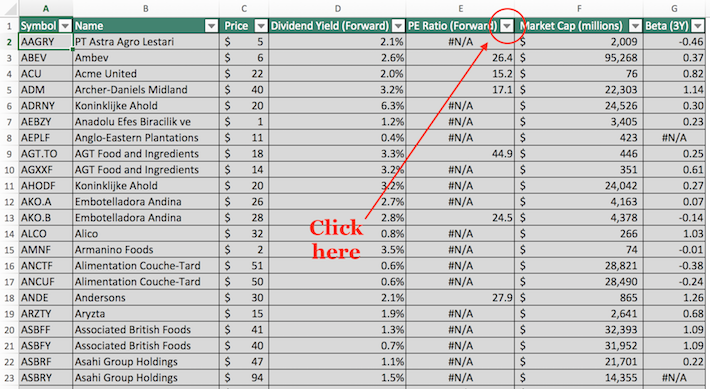

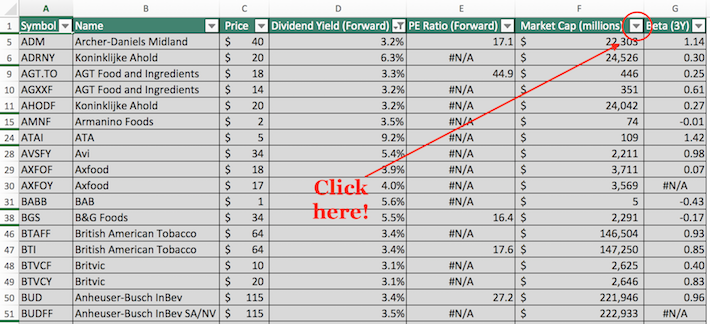

Step 2: Click on on the filter icon on the prime of the price-to-earnings ratio column, as proven under.

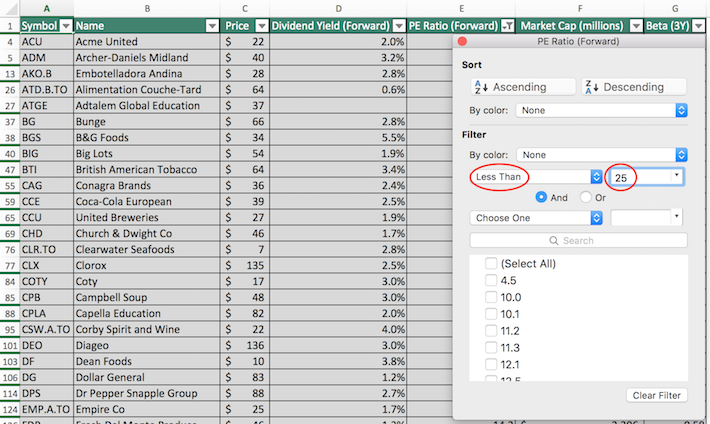

Step 3: Change the filter setting to “Much less Than” and enter 25 into the sector beside it, as proven under.

The remaining shares within the spreadsheet are shopper staples with price-to-earnings ratio lower than 25.

The subsequent display screen that we’ll implement is for ‘blue chip shares’ – these with dividend yields above 3% and market capitalizations above $10 billion.

Display screen 2: Blue Chip Shares

Step 1:Obtain your free spreadsheet of all 71 shopper staples shares right here.

Step 2: We’ll first filter by dividend yield after which by market capitalization. Importantly, order doesn’t matter – you may additionally filter by market capitalization after which dividend yield and the display screen would output the identical outcomes.

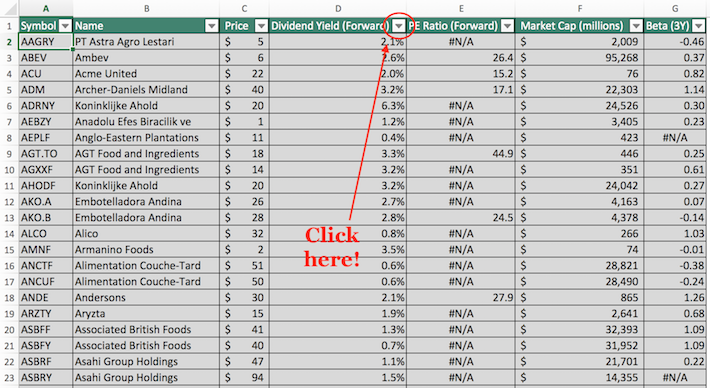

To filter by dividend yield, click on the filter icon on the prime of the dividend yield icon, as proven above.

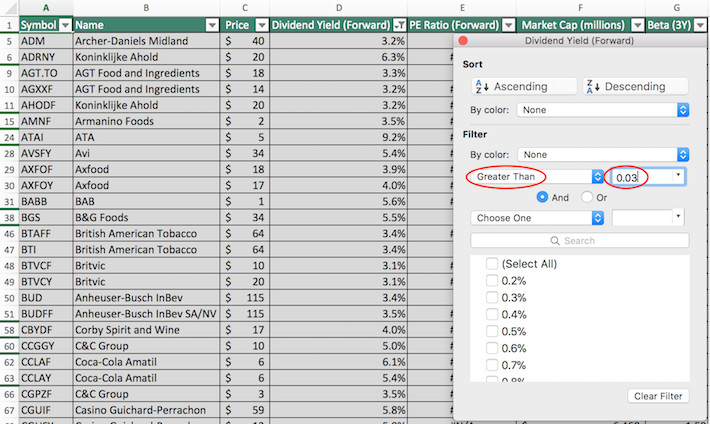

Step 3: To filter for dividend yields better than 3%, change the filter setting to ‘Better Than’, and enter 0.03 into the sector beside it.

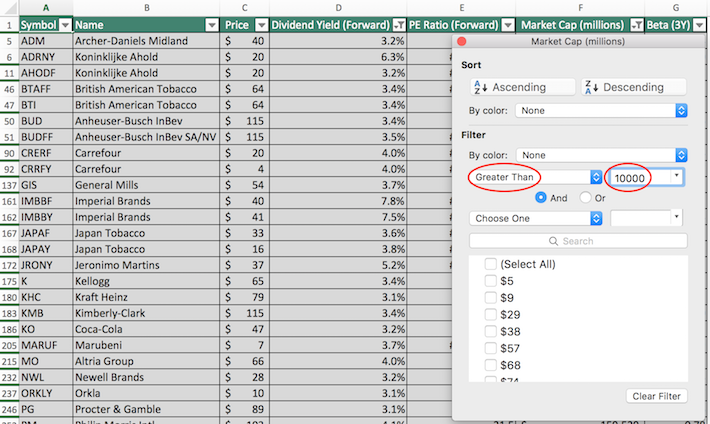

Step 4: Subsequent we’ll execute the display screen for market capitalization. Shut of out of the earlier window (by clicking exit, not by clicking ‘clear filter’ on the backside of the filter window). Then, click on the filter icon on the prime of the market capitalization column, as proven under.

Step 5: Change the filter setting to ‘Better Than’ and enter 10000 into the sector beside it. Discover that since market capitalization is measured in hundreds of thousands of {dollars} on this spreadsheet, then filtering for shares with market capitalizations above ‘$10,000 million’ is equal for screening for securities with market capitalizations above $10 billion.

The remaining shares on this spreadsheet are these with dividend yields above 3% and market capitalizations above $10 billion.

You now have a stable understanding of the right way to use the dividend-paying shopper staples shares spreadsheet to search out compelling funding concepts. The subsequent part will present a abstract of why the buyer staples sector deserves an allocation in your funding portfolio.

Why Make investments In Client Staples Shares?

Client staples shares are an interesting funding class for numerous causes.

To begin with, shopper staples shares are very recession-resistant by definition. Client staples corporations make merchandise or ship providers which are thought-about to be ‘staples’ – in different phrases, shoppers can’t do with out them.

Meals shares inside the shopper staples sector are a superb instance of this. Customers are seemingly to purchase extra meals merchandise throughout recessions as they reduce on eating out to preserve funds throughout tough financial occasions.

Alcohol shares are one other instance. Folks are inclined to drink at the very least the identical quantity (if no more) when occasions get powerful.

Because of this shopper staples shares have a tendency to carry up very nicely in periods of financial turmoil. This may be seen by learning the sector’s efficiency through the 2007-2009 monetary disaster.

Throughout 2008, for instance, the buyer staples sector returned -15%. Whereas this appears dangerous on the floor, it’s really excellent on a relative foundation. Right here’s the efficiency of another sectors throughout the identical calendar 12 months:

Financials: -55%

Supplies: -44%

Expertise: -41%

Clearly, the efficiency of the buyer staples sector beat these different industries by a large margin regardless of being damaging itself. Actually, shopper staples was the one finest performing sector throughout calendar 12 months 2008.

The buyer staples sector stands up nicely throughout occasions of recessions, implying that the sector presents much less danger than lots of its counterparts.

Amazingly, the sector’s long-term efficiency has additionally been among the best. The sector has demonstrated a exceptional skill to generate constantly excessive returns on invested capital, avoiding the imply reversion skilled by many different extremely worthwhile industries.

Whereas conventional tutorial concept tells us that traders should assume additional danger to generate incremental returns, the out-performance of the recession-resistant shopper staples sector tells us that this isn’t true in observe.

The sector’s mixture of excessive returns and low danger make it a uniquely interesting sector for conservative whole return traders.

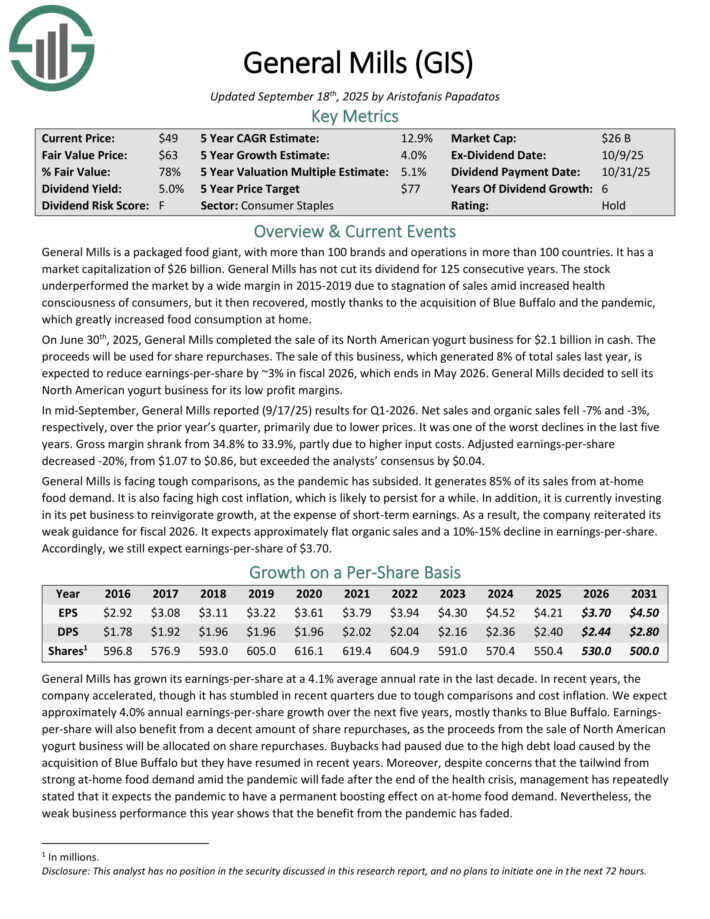

Client Staples Inventory #7: Basic Mills (GIS)

Anticipated Annual Returns: 12.7%

Basic Mills is a packaged meals large, with greater than 100 manufacturers and operations in additional than 100 nations. It has a market capitalization of $26 billion. Basic Mills has not minimize its dividend for 125 consecutive years.

On June thirtieth, 2025, Basic Mills accomplished the sale of its North American yogurt enterprise for $2.1 billion in money. The proceeds will likely be used for share repurchases.

The sale of this enterprise, which generated 8% of whole gross sales final 12 months, is anticipated to scale back earnings-per-share by ~3% in fiscal 2026, which ends in Could 2026. Basic Mills determined to promote its North American yogurt enterprise for its low revenue margins.

In mid-September, Basic Mills reported (9/17/25) outcomes for Q1-2026. Web gross sales and natural gross sales fell -7% and -3%, respectively, over the prior 12 months’s quarter, primarily as a result of decrease costs.

It was one of many worst declines within the final 5 years. Gross margin shrank from 34.8% to 33.9%, partly as a result of increased enter prices.

Adjusted earnings-per-share decreased -20%, from $1.07 to $0.86, however exceeded the analysts’ consensus by $0.04. Basic Mills is dealing with powerful comparisons, because the pandemic has subsided.

It generates 85% of its gross sales from at-home meals demand. Additionally it is dealing with excessive price inflation, which is prone to persist for some time.

As well as, it’s at present investing in its pet enterprise to reinvigorate progress, on the expense of short-term earnings. Because of this, the corporate reiterated its weak steerage for fiscal 2026.

It expects roughly flat natural gross sales and a ten%-15% decline in earnings-per-share.

Click on right here to obtain our most up-to-date Positive Evaluation report on GIS (preview of web page 1 of three proven under):

Client Staples Inventory #6: McCormick & Co. (MKC)

Anticipated Annual Returns: 13.0%

McCormick & Firm produces, markets, and distributes seasoning mixes, spices, condiments and different merchandise to clients within the meals business. McCormick was based in 1889 by Willoughby M. McCormick and controls ~20% of the worldwide seasoning and spice market.

On June twenty sixth, 2025, McCormick introduced second quarter outcomes for the interval ending Could thirty first, 2025. For the quarter, income improved 1.2% to $1.6. billion, which matched estimates. Adjusted earnings-per-share of $0.69 was unchanged from the prior 12 months, however was $0.04 higher than anticipated.

For the quarter, quantity and blend grew 1.3% whereas pricing was up 0.3%. The Client section was increased by 3.0% for the interval. Features in quantity and blend (+3.3) had been solely partially offset by weaker pricing (-0.3%).

Natural progress for the Americas, EMEA, and Asia/Pacific areas was 2.8%, 3.3%, and three.7%, respectively. All areas noticed quantity progress whereas pricing was solely down within the Americas.

McCormick offered up to date steerage for 2025 as nicely. The corporate nonetheless expects income to be in a variety of flat to up 2% in comparison with 2024.

Adjusted earnings-per-share are actually projected to be in a variety of $3.03 to $3.08, up from $2.99 to $3.04 beforehand.

Click on right here to obtain our most up-to-date Positive Evaluation report on MKC (preview of web page 1 of three proven under):

Client Staples Inventory #5: Conagra Manufacturers (CAG)

Anticipated Annual Returns: 13.3%

Conagra traces its roots again to Gilbert Van Camp’s new canned product – pork and beans – in 1861.

The corporate was integrated as Nebraska Consolidated Mills in 1919, modified to ConAgra in 1971, ConAgra Meals in 1993, and has now change into Conagra Manufacturers, shifting its headquarters from Omaha to Chicago and spinning off its Lamb Weston enterprise in 2016. In 2018 Conagra acquired Pinnacle Meals.

The corporate has well-known manufacturers like Slim Jim, Wholesome Selection, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

After paying the identical $0.2125 quarterly payout for 13 consecutive quarters, Conagra elevated its dividend 29.4% in 2020, 13.6% in 2021, 5.6% in 2022, and 6.1% in 2023 to $0.35 per quarter.

On July tenth, 2025, Conagra reported fourth quarter outcomes for the interval ending Could 25, 2025. (Conagra’s fiscal 12 months ends the final Sunday in Could). For the quarter, web gross sales declined 4.3% year-over-year to $2.8 billion, the results of a 3.5% discount in natural web gross sales, a 0.6% decline as a result of forex trade, and a damaging impression of -0.2% as a result of M&A.

Quantity declined 2.5%. Adjusted EPS decreased 8% to $0.56, lacking analyst estimates by $0.05. At fiscal year-end, the corporate had web debt of $8.0 billion, and a web leverage ratio of three.6x.

Conagra offered its fiscal 2026 steerage, anticipating natural web gross sales progress of (1)% to 1% in comparison with FY 2025. Adjusted working margin is prone to are available between 11.0% to 11.5%, and adjusted EPS is anticipated to say no sharply from FY 2025 to $1.70 to $1.85.

Capex is anticipated to be $450 million, and curiosity expense is anticipated to equal $400 million. Moreover, it expects its web leverage ratio to degrade additional to three.85x.

Click on right here to obtain our most up-to-date Positive Evaluation report on CAG (preview of web page 1 of three proven under):

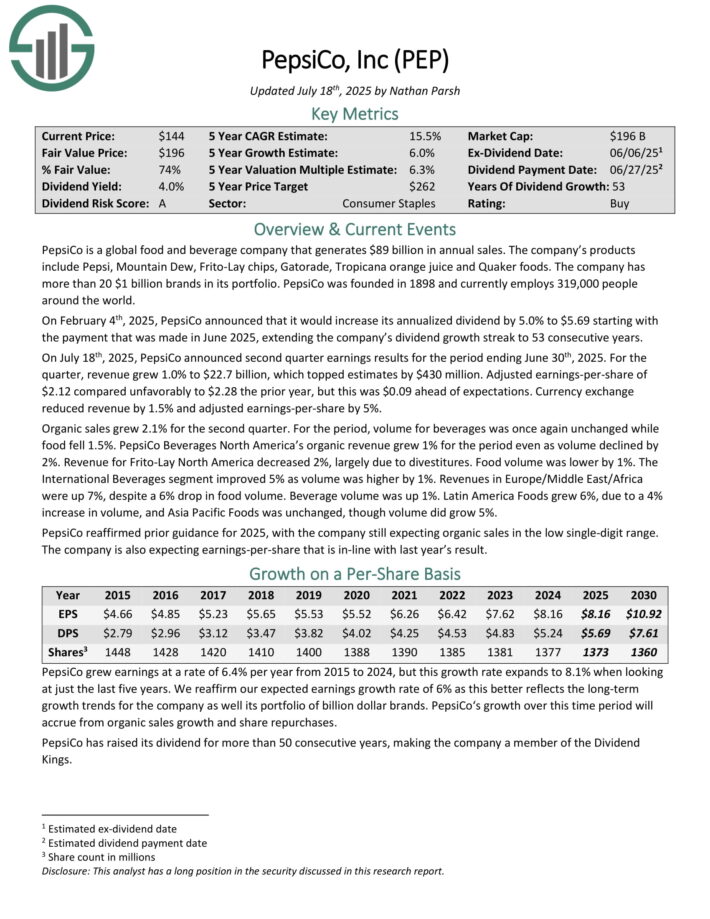

Client Staples Inventory #4: PepsiCo Inc. (PEP))

Anticipated Annual Returns: 16.1%

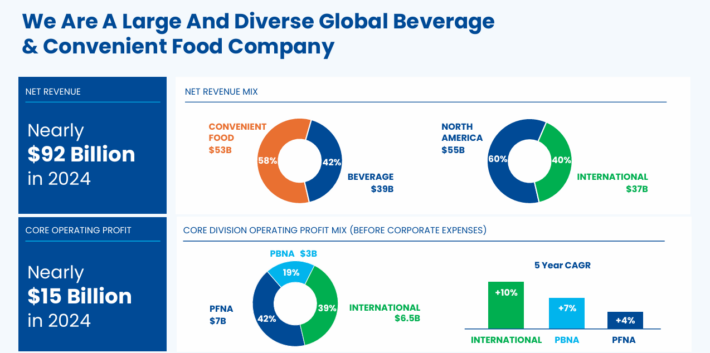

PepsiCo is a world meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 by way of meals and beverage income. Additionally it is balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July 18th, 2025, PepsiCo introduced second quarter earnings outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 in contrast unfavorably to $2.28 the prior 12 months, however this was $0.09 forward of expectations. Foreign money trade lowered income by 1.5% and adjusted earnings-per-share by 5%.

Natural gross sales grew 2.1% for the second quarter. For the interval, quantity for drinks was as soon as once more unchanged whereas meals fell 1.5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEP (preview of web page 1 of three proven under):

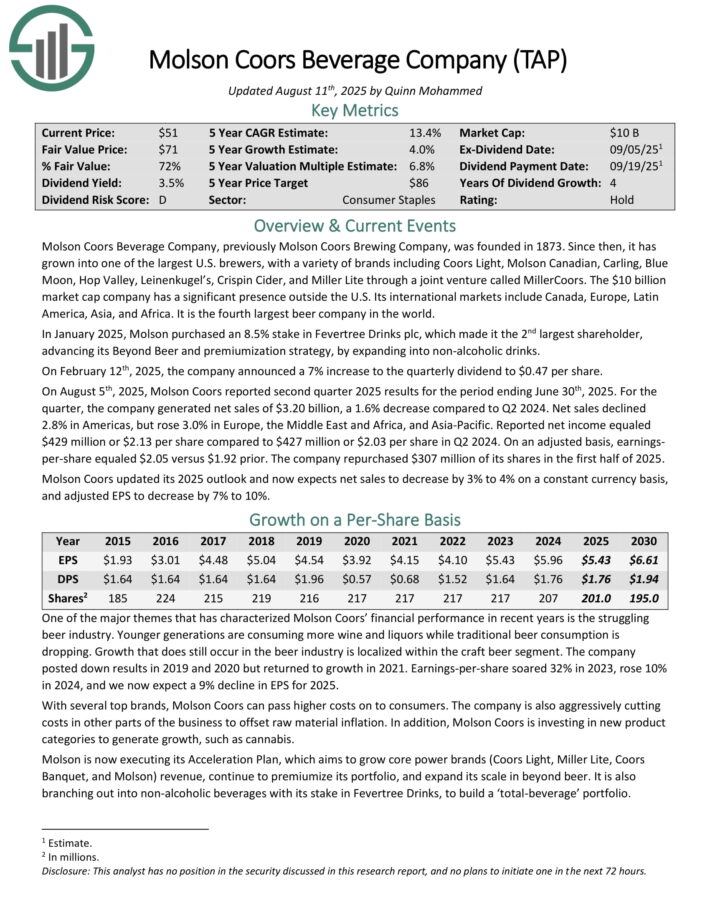

Client Staples Inventory #3: Molson Coors (TAP)

Anticipated Annual Returns: 16.5%

Molson Coors Beverage Firm was based in 1873. Since then, it has grown into one of many largest U.S. brewers, with a wide range of manufacturers together with Coors Gentle, Molson Canadian, Carling, Blue Moon, Hop Valley, Leinenkugel’s, Crispin Cider, and Miller Lite by a three way partnership referred to as MillerCoors.

The corporate has a big presence exterior the U.S. Its worldwide markets embody Canada, Europe, Latin America, Asia, and Africa. It’s the fourth largest beer firm on the earth.

In January 2025, Molson bought an 8.5% stake in Fevertree Drinks plc, which made it the 2nd largest shareholder, advancing its Past Beer and premiumization technique, by increasing into non-alcoholic drinks.

On February twelfth, 2025, the corporate introduced a 7% improve to the quarterly dividend to $0.47 per share.

On August fifth, 2025, Molson Coors reported second quarter 2025 outcomes for the interval ending June thirtieth, 2025. For the quarter, the corporate generated web gross sales of $3.20 billion, a 1.6% lower in comparison with Q2 2024.

Web gross sales declined 2.8% in Americas, however rose 3.0% in Europe, the Center East and Africa, and Asia-Pacific. Reported web earnings equaled $429 million or $2.13 per share in comparison with $427 million or $2.03 per share in Q2 2024.

On an adjusted foundation, earnings-per-share equaled $2.05 versus $1.92 prior. The corporate repurchased $307 million of its shares within the first half of 2025.

Molson Coors up to date its 2025 outlook and now expects web gross sales to lower by 3% to 4% on a continuing forex foundation, and adjusted EPS to lower by 7% to 10%.

Click on right here to obtain our most up-to-date Positive Evaluation report on TAP (preview of web page 1 of three proven under):

Client Staples Inventory #2: Keurig Dr. Pepper (KDP)

Anticipated Annual Returns: 19.6%

Keurig Dr. Pepper is the results of a ~$20B merger between Dr. Pepper Snapple and Keurig Inexperienced Mountain accomplished in mid-2018. The brand new firm began buying and selling on July 10, 2018.

KDP is now the third largest non-alcoholic beverage firm by way of income within the U.S. behind Coca-Cola (KO) and Pepsi (PEP). KDP now studies three enterprise segments: U.S. Refreshment Drinks, U.S. Espresso, and Worldwide.

Main manufacturers embody Core, Dr. Pepper, Sunkist, Canada Dry, Bai, 7UP, Snapple, and Keurig. JAB Holdings controls ~4.4% of the widespread inventory. Web gross sales had been about $15.35B in fiscal 2024. Keurig Dr. Pepper reported Q2 2025 outcomes on July twenty fifth, 2025.

Firm-wide adjusted web gross sales climbed 7.2% year-over-year. Adjusted diluted earnings per share elevated 11.1% to $0.49 within the quarter, in comparison with $0.45 within the year-ago interval. Gross sales rose 10.5% within the U.S.

Refreshment Beverage section on 1.0% increased costs and 9.5% better quantity/combine drive by the GHOST acquisition. The U.S. Espresso section noticed (-0.2%) decrease gross sales on 3.6% increased costs and -3.8% quantity/combine decline. Rising competitors and enter prices are affecting outcomes of this section.

Keurig Dr. Pepper continues to amass or accomplice with manufacturers to broaden its attain. The newest deal was a partnership with Grupo PiSA for Electrolit.

The agency acquired GHOST, an power drink with about 3% market share and $500M in gross sales. Keurig will purchase 60% now and the remaining 40% in 2028.

Click on right here to obtain our most up-to-date Positive Evaluation report on KDP (preview of web page 1 of three proven under):

Client Staples Inventory #1: Constellation Manufacturers Inc. (STZ)

Anticipated Annual Returns: 22.3%

Constellation Manufacturers was based in 1945. The corporate produces and distributes alcoholic drinks together with beer, wine, and spirits. It’s the third largest beer firm within the U.S., and imports and sells beer manufacturers resembling Corona, Modelo Especial (the #1 Beer in U.S.), Modelo Negra, and Pacifico.

As well as, Constellation has many wine manufacturers together with Robert Mondavi and Kim Crawford, in addition to spirits manufacturers together with Casa Noble Tequila, and Excessive West Whiskey. The corporate additionally has a stake in hashish firm Cover Development.

In June 2025, Constellation accomplished its divestiture of a few of its wine and spirits manufacturers to The Wine Group. The manufacturers divested embody Woodbridge, Meiomi, Robert Mondavi Non-public Choice, Prepare dinner’s, SIMI, and J. Roget glowing wine, in addition to its stock, services, and vineyards. Constellation retained its high-end wine and spirits manufacturers.

On July 1st, 2025, Constellation Manufacturers reported first quarter fiscal 2026 outcomes for the interval ending Could 31, 2025. For the quarter, the corporate recorded $2.52 billion in web gross sales, down 6% in comparison with the identical prior 12 months interval. Beer gross sales fell 2% year-over-year, whereas wine and spirits gross sales plunged 28%.

Comparable earnings-per-share equaled $3.22 for the quarter, which was 10% decrease in comparison with Q1 2025, and $0.07 behind analyst estimates.

Within the first quarter, Constellation Manufacturers repurchased $306 million of its shares and paid $182 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on STZ (preview of web page 1 of three proven under):

Closing Ideas

The buyer staples sector is an intriguing place to seems for high-quality dividend funding concepts.

Should you’re keen to look exterior of this sector whereas looking for funding alternatives, the next inventory databases are extremely helpful:

Investing is a novel craft as a result of we’ve the flexibility to ‘cheat’ off the strikes of the world’s biggest traders.

Massive, institutional funding managers with greater than $100 million in property below administration are required to reveal their portfolio holdings on a quarterly foundation by a regulatory submitting referred to as a 13F.

With this in thoughts, there isn’t any higher investor than Berkshire Hathaway’s Warren Buffett. We offer an in depth quarterly evaluation on Warren Buffett’s inventory portfolio, which you’ll be able to entry under:

Should you’re in search of different sector-specific dividend shares, the next Positive Dividend databases will likely be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.